Amazon Q2 Net Profit Doubles, But Q3 Outlook Chills

Within Q2, Amazon's net profit was $13.5bn, up a whopping 100% year-on-year, but the third-quarter revenue outlook fell short of market expectations.

On August 2, Amazon released its financial report of FY2024Q2.

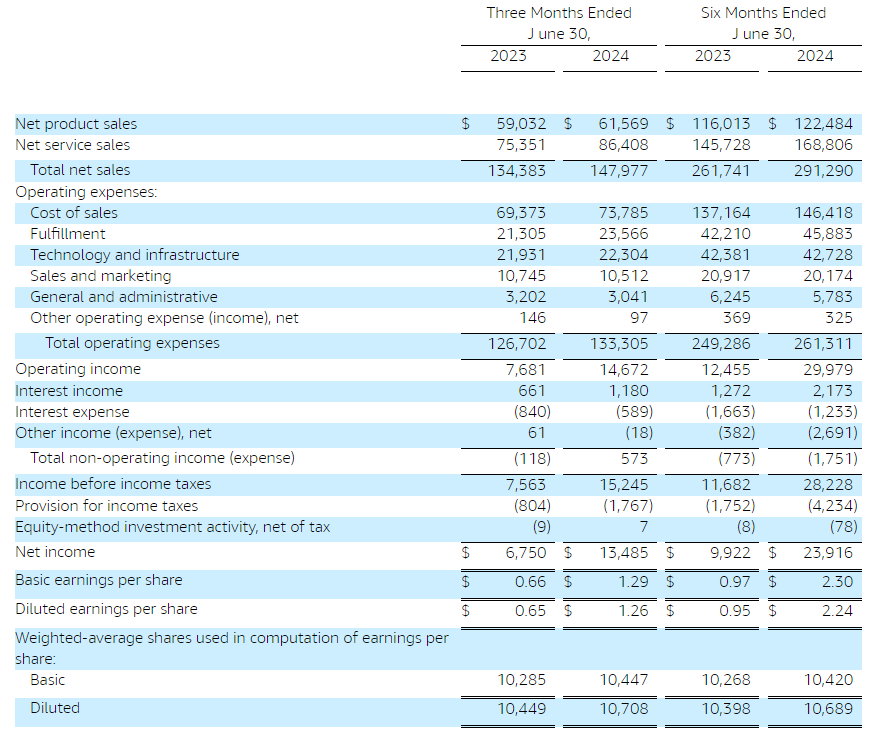

The data shows that in Q2, Amazon's operating income increased by approximately 48% year-over-year, reaching $14.7 billion, up from $7.7 billion last year. Net sales amounted to $148 billion, a 10% year-over-year increase, slightly below the market expectation of $148.78 billion. The net profit for the period was $13.5 billion, a significant 100% increase from the previous year. Diluted earnings per share were $1.26, surpassing the $0.65 from the same period last year and the market expectation of $1.04.

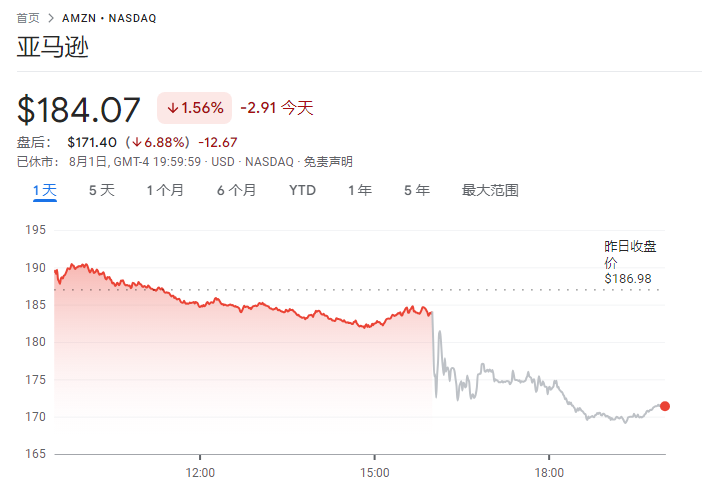

However, despite the strong Q2 performance, Amazon's revenue outlook for Q3 did not meet market expectations. The company forecasts operating profit between $11.5 billion and $15 billion, with analysts' average expectation at $15.7 billion. Revenue is expected to be between $154 billion and $158.5 billion, with analysts predicting $158.43 billion.

Following the earnings report, Amazon's stock price dropped more than 7% in after-hours trading.

Retailing: Consumers Prefer Low-Cost Products

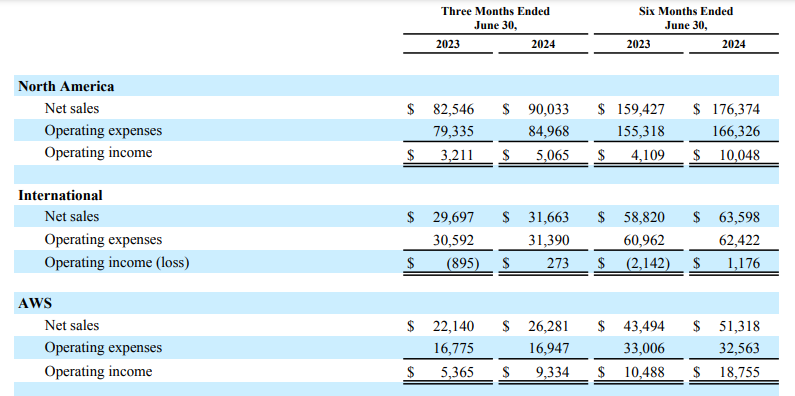

Thanks to its regional advantages, Amazon provided consumers with more convenient services and a wider range of products at lower costs in Q2. Regionally, Amazon's North American revenue was $90 billion with an operating profit of $5.1 billion, while international revenue was $31.7 billion with an operating profit of $300 million.

Despite this, Amazon continues to face challenges with slow growth in its core retail business due to increasing market competition.

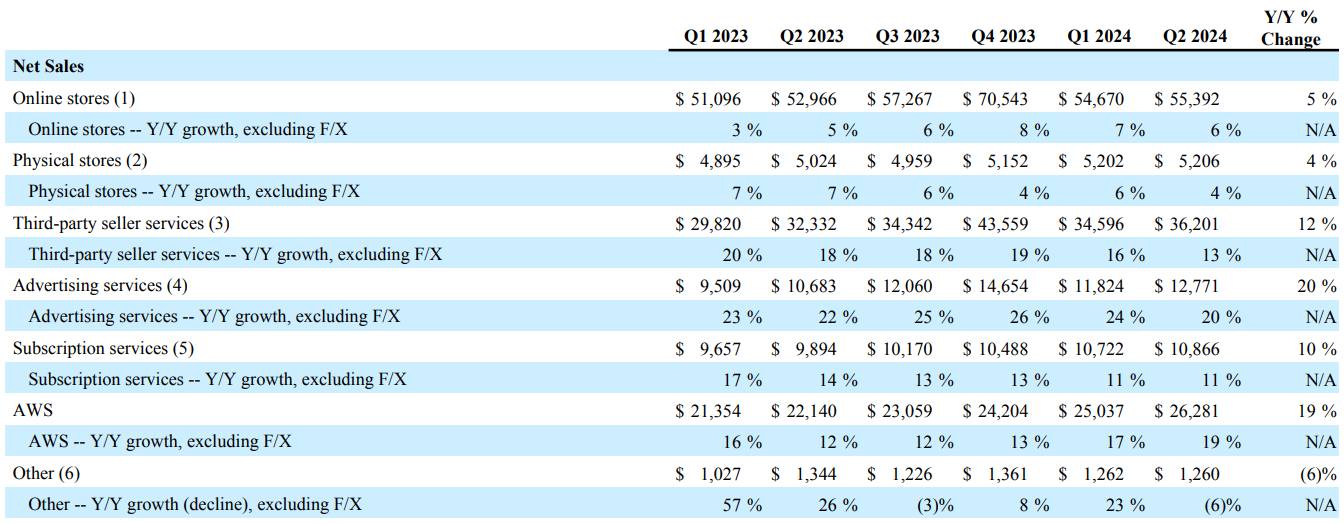

Competition primarily comes from discount websites like Temu and Shein, which allow Chinese merchants to sell low-cost goods directly to U.S. consumers. As a result, Amazon's online store sales grew only 5% year-over-year, while revenue from third-party seller services (including commissions, delivery fees, and shipping costs) saw a more significant 12% increase.

To address this, Amazon announced in April that starting May 15, it would offer discounts on sales commissions for low-cost clothing items in Europe, Japan, and Canada. In late June, Amazon planned to launch a discount store in China, focusing on selling unbranded items priced below $20, including clothing and home goods.

In the ongoing Q3, Amazon is also hosting its largest Prime Day sales event ever.

Amazon CFO Brian Olsavsky stated on a conference call, "Compared to previous internal forecasts, revenue growth in North America has been slightly below expectations. Consumer sentiment is more conservative, and shoppers are leaning toward cheaper products, leading to a decline in average selling price (ASP)." He added that recent major news events, such as the Olympics, have disrupted current quarter purchasing patterns, making forecasting more challenging.

Cloud Computing: Address Shortcomings with Investment

Specifically, AWS's net sales grew 19% year-over-year to $26.3 billion, exceeding analysts' expectations of $26.02 billion. Operating profit was $9.3 billion, up 74% from last year. Although AWS continues to dominate the cloud infrastructure market, Microsoft's Azure and Google Cloud have each recorded 29% growth driven by early AI models, making AWS slightly less competitive in comparison.

"We are making progress in many areas, but the most significant is the continued acceleration of AWS's growth," said Andy Jassy, Amazon's President and CEO. "As enterprises modernize their infrastructure and migrate to the cloud, with a focus on generative AI updates, AWS will remain the preferred choice due to its extensive functionality, superior security and operational performance, and its partner ecosystem and AI capabilities."

Statistics show that AWS currently accounts for 18% of the parent company's total revenue but is far more important in terms of profitability. According to the earnings report, AWS's quarterly operating profit was $9.3 billion, representing 63% of the company's total operating profit. CFO Brian Olsavsky indicated that AWS's annual revenue is expected to exceed $105 billion.

Deploying generative AI models through cloud services is an inevitable trend for all businesses. Like other cloud service providers, Amazon has announced a significant increase in capital expenditure for 2024, with a substantial portion allocated to the purchase of NVIDIA GPUs for training and running generative AI models.

Advertising: Profit's Biggest Contributor

In Q2, Amazon's advertising revenue surged 20% year-over-year to $12.77 billion, slightly below market expectations. This department has now become one of Amazon's largest sources of profit.

Although most of its advertising revenue still comes from sponsored product listings on its online store, the company has started placing ads in its Prime Video service, adding new products, and expanding its market share in digital advertising to compete with Meta and Google.

Among online advertising companies, Meta's quarterly performance was the strongest, with revenue growth of 22%. Google's advertising business grew 11% during the period, while Snap's advertising revenue increased by 16%.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.