What is the annualized rate of return.?What is the difference with the return on investment??

Return on investment (ROI) is an indicator used to assess return on investment, investment performance or investment returns; annualized return is also an indicator used to assess return on investment, taking into account the time spent in the investment process。

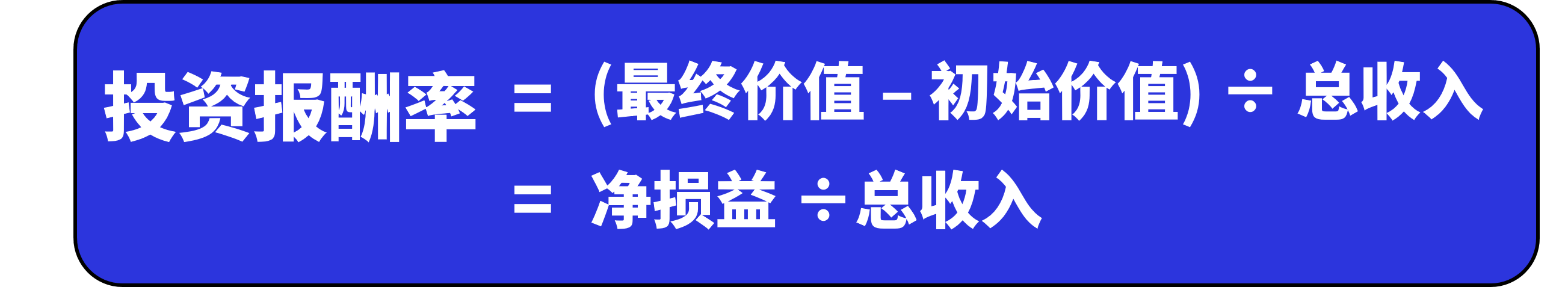

What is the return on investment.?

Return of investment (ROI) is a metric used to assess return on investment, investment performance or investment returns, usually used in personal financial planning, and the use of ROI on investments can help investors plan investment decisions.。

The return on investment is calculated as a percentage of the net gain or loss on the investment to the total capital invested, and when the return on investment is positive, it means that the investment is profitable; conversely, when the return on investment is negative, it means that the investment is losing money.

What is the annualized rate of return.?

Annualized Rate of Return (Annualized Rate of Return) is a metric used to assess return on investment, but this metric differs from ROI in that it is calculated taking into account the time spent in the investment process。

When used, it is often used to compare the performance of returns between different investment commodities, such as stocks, ETFs, funds, etc., and the difference in returns earned at the same time is generally expressed as a percentage。

Return on Investment vs Annualized Return

Since the return on investment (ROI) is calculated without taking time into account, it is not clear when comparing the returns between investment commodities, and the annualized rate of return can be used to compensate for this blind spot.。

Since the cycles of the two investment commodity investments are different, the annualized rate of return must be used to assess the review when comparing, and by looking at the rate of return on the investment in one year, it is possible to compare which of the two is more worth investing in.。

As we all know, high risk, high reward; low risk, low reward。However, a good rate of return depends on the investor's tolerance for risk, with some seeking a higher return on investment than a bank deposit, while others are willing to pursue high-paying products in a short period of time.。

Summary

The return on investment (ROI) is an indicator used to assess the return on investment, investment performance or investment income, and the data results are positive, indicating that the investment is profitable;。

Annualized rate of return is also a metric used to assess return on investment, taking into account the time spent in the investment process。In comparing the return on investment of two different investment commodities, the annualized rate of return should be used to examine how much investment return can be obtained in one year in order to compare the advantages and disadvantages of the two.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.