Apple's new fiscal quarter is mixed: FY24Q1 revenue returns to growth Greater China falls more than expected

After hours Eastern Time on Thursday (February 1), Apple disclosed its first quarter results for fiscal 2024 ended December 30, 2023.。After the earnings announcement, Apple fell more than 2% after the market.。

After the U.S. stock market on Thursday (February 1), Apple disclosed its first-quarter results for fiscal 2024, which ended December 30, 2023, and revenue for the quarter returned to growth after four consecutive quarters of decline in 2023, with quarterly revenue in Greater China falling more than expected by 13% year-over-year.。

FY24Q1: Performance Data Overview

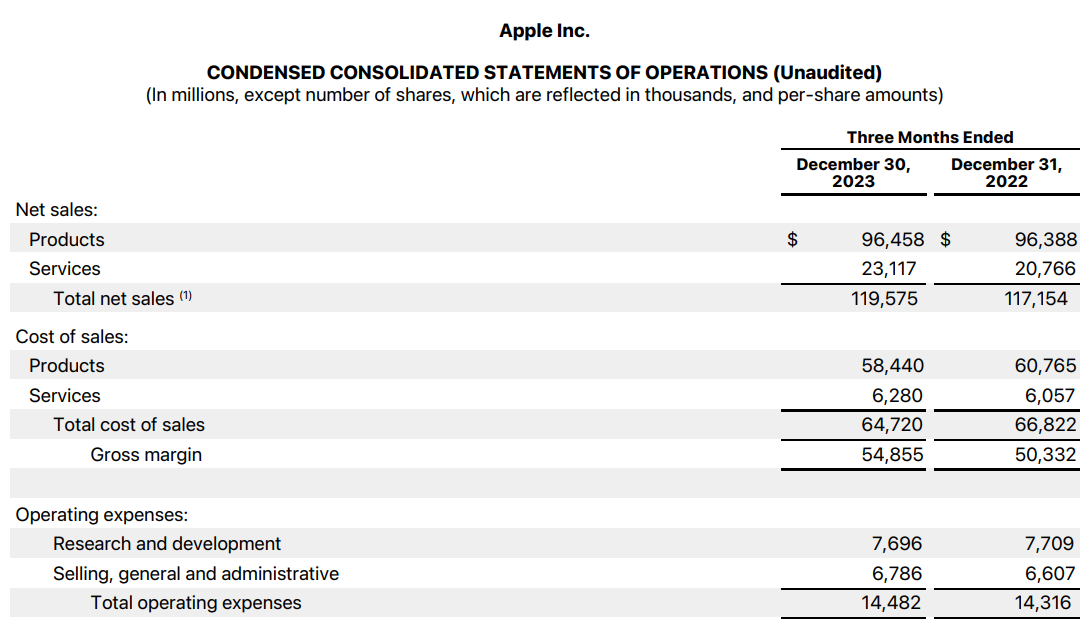

Apple's revenue for the period was $119.6 billion, up 2% year-over-year; net profit 339.$1.6 billion, compared with 299 in the same period last year.$9.8 billion, up 13% YoY; diluted EPS 2.$18, up 16% year-over-year, a record high; gross margin of 45.9%。The board of directors of the company announced that the distribution of 0 per share.$24 cash dividend。

Apple CEO Tim Cook (Tim Cook) said the company's December performance combined with margin expansion, quarter-on-quarter growth compared to the previous quarter is a huge acceleration, "due to the company's corporate calendar, the number of weeks in the December quarter this year is one week less than the first fiscal quarter last year, which had 14 weeks, compared to 13 weeks this year。"

Apple's performance in the quarter recorded its first increase since the fourth quarter of fiscal 2022, ending a year-over-year decline in 2023, the first year since 2001 in which Apple had four consecutive quarters of negative revenue growth.。At the same time as the revenue recovery, Apple's sales expenses for the quarter were 647.200 million U.S. dollars, up from 668 in the same period last year.$2.2 billion also reduced by more than $2 billion。

In addition, Apple said it spent nearly $27 billion on dividends and share buybacks during the quarter and generated nearly $40 billion in operating cash flow, returning about $27 billion to shareholders.。

iPhone SteadyService record high

By product, the iPhone contributed more than half of its revenue in the quarter, while the bright results of its services business also contributed to good growth in the quarter, while revenue from other series of hardware products did not grow significantly, and some declined significantly.。

Tim Cook said: "Apple's revenue growth in the fiscal quarter was mainly driven by iPhone sales, and revenue from the services business hit a record high.。"

In the first quarter, iPhone sales reached $69.7 billion, up nearly 6% year-over-year, with strong growth and the first full quarter in which Apple included iPhone 15 revenue.。Luca Maestri, Apple's chief financial officer, expects the iPhone business in the next quarter to be close to 513 in the same period last year..$300 million, as post-epidemic recovery will gradually bring benefits。

The Mac is 77..$800 million in revenue, up less than 1% year-over-year, but given the previous 34% decline, this performance is evidence that the product line is in a significant recovery.。iPad sales continued to decline in the quarter, down 25% year-over-year。And since Apple didn't release a new iPad model in 2023, Cook wasn't surprised by the performance。

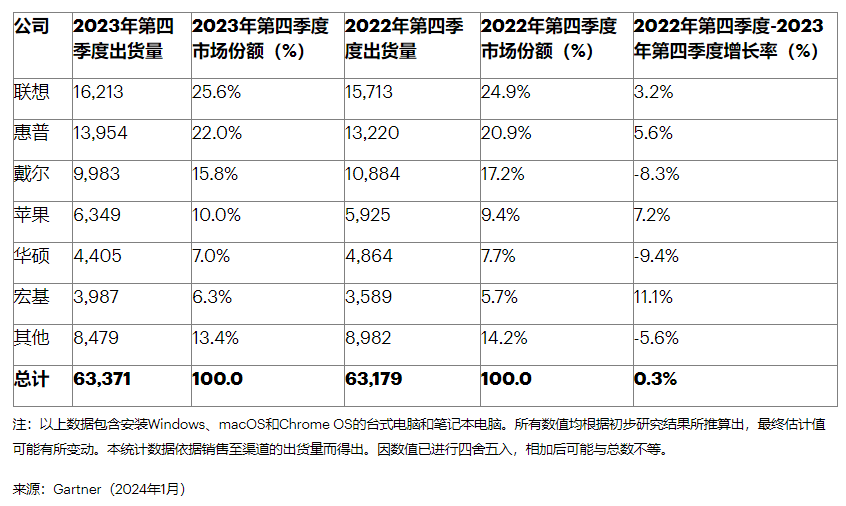

According to the news, Apple plans to release a new version of the iPad and Mac in March this year, or will increase the sales of these two product lines。Mac's return to growth also reflects a pick-up in global PC demand - Gartner released a report showing that Apple's global PC market share rose from 9% at the end of last year..4% to 10%。

Wearables (Airpods, Apple Watch) looked tough in the quarter, falling 11% year-over-year to 119.500 million dollars。Last December, the latest Apple Watch also went off the shelves in Apple stores for a few days due to a patent dispute with medical device company Masimo.。

On the eve of earnings release, Apple is about to launch Vision Pro headsets。This is the company's first foray into virtual and augmented reality, and some analysts say the $3,499 Vision Pro is unlikely to have a significant impact on profitability.。But as Apple's first new product category in nearly a decade, the device is also likely to boost market confidence and have a favorable impact on its stock price.。

Revenue from the services business also hit an all-time high, rising 11% year-over-year to 231.$100 million, mainly due to advertising, cloud services, payments and App Store。Apple TV + consumption doubled in 2023, with total viewership surging 42% year-over-year。

It is reported that Apple's services have more than 1 billion paid subscribers worldwide, and after the maturity of the iPhone product line has become the focus of Apple's business diversification, and can even reflect the trend of consumer demand in advance.。

However, Apple's service revenue is affected by policies and regulations around the world, and the EU market accounts for about 7% of Apple's global app store revenue.。Therefore, on January 26, Apple announced that it will open the App Store in the EU in March this year to allow third-party app store downloads and third-party payment channels to meet the requirements of the EU's Digital Market Act (DMA).。

Greater China share straight down Apple plays "discount card"

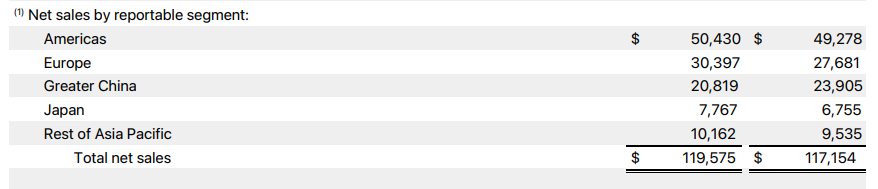

By market, Apple achieved sales growth in all regions except Greater China。

In Greater China, Apple's revenue fell 13 percent to $20.8 billion from $23.9 billion in the same period last year, which is Apple's weakest performance in the region since the first quarter of 2020.。Counterpoint Research reported that iPhone shipments in China declined in the quarter, mainly due to the release of novel models such as folding screens and the renewed competitive pressure from Huawei.。

Industry insiders say the decline in Greater China's performance is likely to be the beginning of a longer-term downward trend in the region。Luca Maestri believes that although the current performance in China has not met expectations, the company is still optimistic about the Chinese market in the long term.。

It is understood that Greater China is Apple's third largest sales market after North America and Europe, and the iPhone has become the core business in the region due to its sales volume, so its sales trends are widely watched.。In January 2024, Apple began offering rare discounts on the latest iPhone in the Chinese market in an attempt to offset the declining trend.。

However, in the United States (504.$300 million), Europe (303.$9.7 billion), day (77.$6.7 billion) and other markets in Asia-Pacific (101.$6.2 billion), Apple's sales performance remained good, with overall 2% growth and breaking the downward trend in annual revenue over the past four quarters。Among them, the American market was 492 in the same period last year..$7.8 billion, up more than $1 billion this time, and remains the company's number one source of revenue。

Cook said, "Apple's active device installations now exceed 2.2 billion units, a record high across all product and regional segments.。"

AIGC R & D has started Details to be announced later

For the rapid development of generative artificial intelligence (AIGC), although Apple has not yet specifically launched a specific AIGC product, but still focus on machine learning to improve the accuracy of its automatic completion function。

It was previously reported that Apple is working hard to integrate artificial intelligence technology into future products, and according to Cook, Apple has spent a lot of time and energy on the development of the field, and the details will be announced later this year。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.