Recently, China's artificial intelligence start-up DeepSeek released its new generation model R1, claiming that the model's performance is comparable to OpenAI's top models in multiple benchmark tests, but construction costs and computing power requirements are only a very small proportion of the latter.This technological breakthrough triggered violent shocks in the global technology sector. The Nasdaq index fell for a time, and the industry's market value evaporated by nearly US$1 trillion.

However, Meta Platforms CEO Mark Zuckerberg made it clear at an internal meeting on February 5 that the company's artificial intelligence infrastructure investment plan will not be adjusted due to external competition, and emphasized that 2025 will be "a decisive year for AI."

"Large-scale moat" is not a short-term replicable advantage

Zuckerberg pointed out that DeepSeek's innovation in computing power optimization and model efficiency is worthy of recognition, and its publicly published technical details provide a path for Meta to learn from.He said frankly: "The progress of our competitors has prompted us to remain vigilant, but Meta's core strengths lie in its open source ecosystem and large-scale infrastructure.Susan Li, Meta's chief financial officer, further added that because the company relies mainly on advertising rather than direct monetization of the open source model Llama, DeepSeek's impact on Meta is relatively limited.This statement echoes Meta's recent strong financial performance: in fiscal 2024, Meta's revenue increased 22% year-on-year to US$164.5 billion, and net profit soared 59% to US$62.36 billion, of which advertising revenue in the fourth quarter reached US$46.78 billion., user activity continues to rise.InvalidParameterValue

Despite the turbulent external environment, Meta stuck with its aggressive capital spending plan.Zuckerberg reiterated that the additional investment of US$60 - 65 billion in fiscal year 2024 will be mainly used for data center expansion and AI team expansion. It is expected that by the end of 2025, Meta will deploy more than 1.3 million GPUs (graphics processors) and build a super-large data center covering most areas of Manhattan with a computing power target of 2 GW.He particularly emphasized that although DeepSeek verified the possibility of low-cost AI research and development, Meta's long-term strategy relies on a "large-scale moat" of infrastructure-"Providing highly intelligent services to billions of users requires huge server capabilities, which is by no means a short-term replicable advantage."InvalidParameterValue

At the technical route level, Meta is accelerating the iteration of its open source model Llama.Zuckerberg revealed that the next generation of Llama 4 will integrate proxy functions and multimodal capabilities, with the goal of becoming the most competitive AI model in the world, even surpassing the closed system of ChatGPT.This ambition coincides with the long-term judgment of Meta's chief scientist Yann LeCun (Meta's chief AI scientist).Lequin has publicly stated that the current dominance of Large Language Models (LLMs) may be subverted within 3-5 years, and the new generation of AI architecture needs to break through the limitations of physical world understanding and complex reasoning capabilities.Meta is obviously trying to seize the right to speak on the future technology paradigm through a dual layout of open source ecosystem and hardware investment.InvalidParameterValue

Zuckerberg also responded to the social impact of AI.He admitted that AI may lead to the replacement of some positions, but it will also create demand for emerging professions such as "AI engineers", and that "the core of future projects lies in the efficiency of human-machine collaboration."This judgment contrasts with Meta's recent human resources strategy: Although the total number of employees will increase by 10% to 74,000 in 2024, the company plans to abolish 5% of "low-performance positions" and re-recruit talents focused on AI and hardware.InvalidParameterValue

It is noteworthy that Meta is simultaneously adjusting its policy framework to respond to regulatory changes.Zuckerberg announced that the company will restructure its Diversity, Fairness and Inclusion (DEI) policy to comply with increasingly stringent anti-discrimination regulations, while focusing on "resetting" relationships with global governments in 2025, especially seeking strategic cooperation with the U.S. government.Against this backdrop, Meta recently settled a US$25 million lawsuit dispute with former President Donald Trump, which was seen by outsiders as a measure to mitigate political risks.InvalidParameterValue

Looking at the overall situation, Meta's AI gamble stems from the urgency of technical competition and is also driven by geopolitical games.Zuckerberg has repeatedly mentioned that "open source standards must be dominated by the United States", implying that the rise of DeepSeek has strengthened Meta's determination to stick to the open source track.If its planned "1 billion user-level AI assistants" can be implemented as scheduled in 2025, Meta may reshape the global AI industry landscape.However, the annual capital expenditure of US$65 billion and the continued loss-making metaverse division (Reality Labs 'operating loss of US$4.97 billion in 2024) also show that this marathon investment still requires sufficient patience and confidence from the capital market.

Broadcom: The AI boom in big technology will last until the end of 2030

Zuckerberg's statement undoubtedly reassured the capital market.

Looking forward to 2025, artificial intelligence infrastructure will continue.For technology companies, from the training of deep learning models to complex reasoning tasks, strong computing power is needed as a support.For example, the number of parameters in OpenAI's GPT series models continues to increase, and the computing power required to train these models has also increased exponentially.This strong demand for computing power has promoted the continuous construction and upgrading of data centers, GPUs and other hardware facilities in AI infrastructure

Broadcom CEO said that its customers are formulating a three to five-year AI infrastructure investment plan, and it is expected that the investment boom in artificial intelligence by big technology companies will continue until the end of 2030.The popularity of GPUs, ASICs, DCI and other links in the reasoning stage will bring new opportunities.At the same time, although the reduction in training demand may put some pressure on areas such as Reinters and Light Modules, overall, the construction of AI infrastructure will continue to maintain strong growth.

So, in the face of this wave of artificial intelligence dividends, how should ordinary people participate?

Buying an ETF may be a good choice.

Since the stock price of the artificial intelligence concept is relatively high, taking Nvidia as an example, it costs US$140 to buy a share of Nvidia; the stock prices of Oracle and Google are both above US$150; Microsoft's stock price is around US$400; and Meta's stock price is as high as nearly US$600.For many people, buying a share of each of these companies will cost a lot of their savings.

In contrast, artificial intelligence-related ETFs have become a good choice, because buying an ETF is equivalent to buying a basket of stocks, which can achieve the above-mentioned "package and buy effect", but there is no such high buying threshold.

Generally speaking, the capital threshold of ETFs is between individual stocks and over-the-counter funds. Buying a lot (100 shares) may only cost more than 100 yuan, and the lower one is even less than 100 yuan, which is much lower than the threshold of individual stocks.

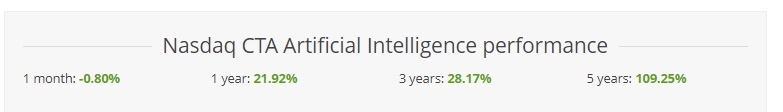

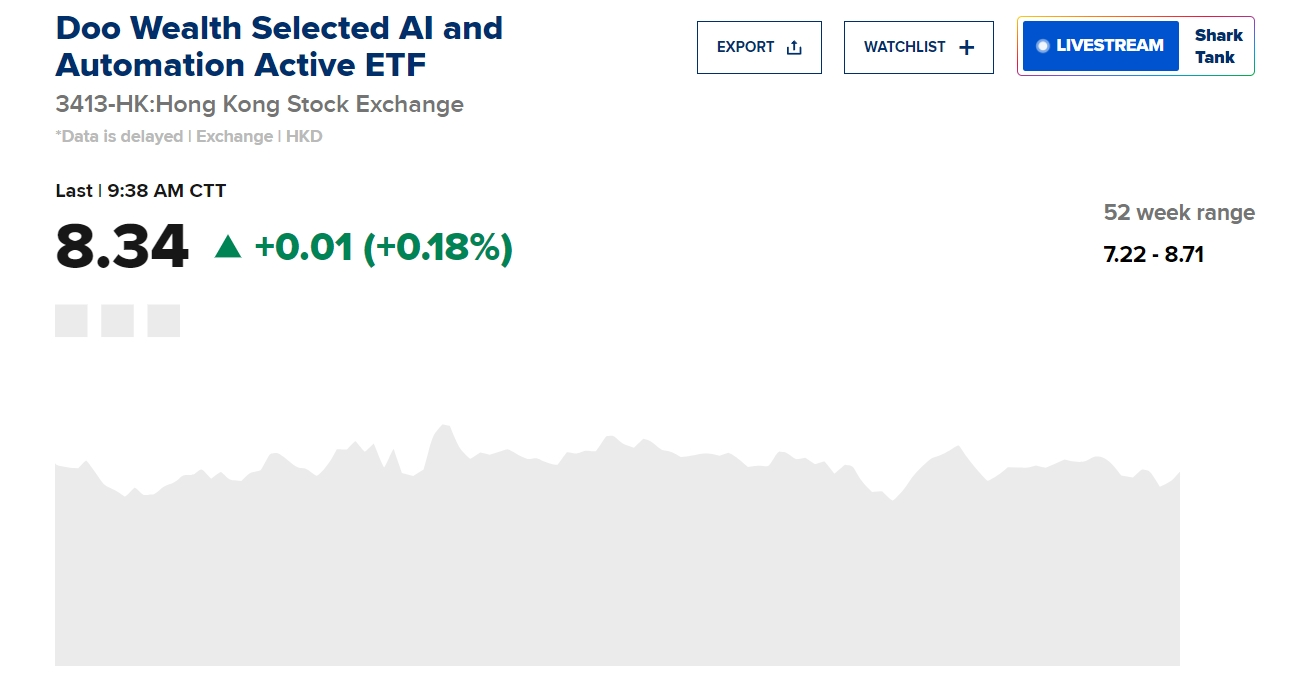

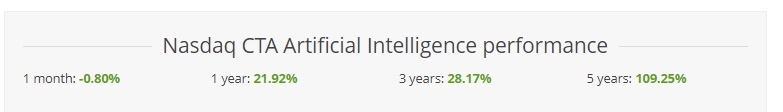

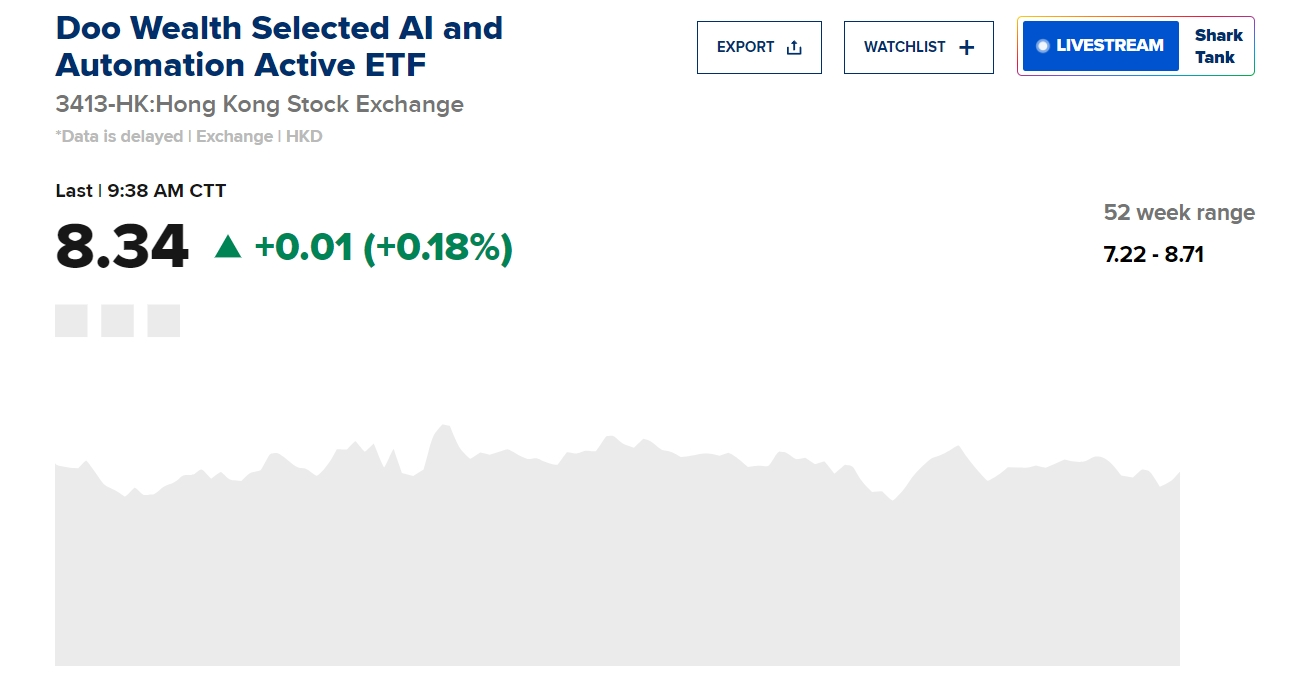

The following are some popular artificial intelligence ETF products on the market, for example only and no recommendations:

Moreover, ETFs have a rich selection of individual stocks.For investors unfamiliar with individual stock analysis, ETFs provide a simple way to invest without having to delve into each company.

There is also no risk of trading or delisting in ETFs.ETFs may fall sharply along with the industry or the broader market, but they will not be violent, so they can keep trading going normally in extreme bear markets, giving investors the opportunity to stop losses and exit.

With low thresholds, transparent transactions, rich options, no thunder, and support on-site trading, ETFs are the best choice for ordinary investors or novice investors to participate in the artificial intelligence market.