Australia's August Inflation Data Encouraging, But Market Reaction Muted

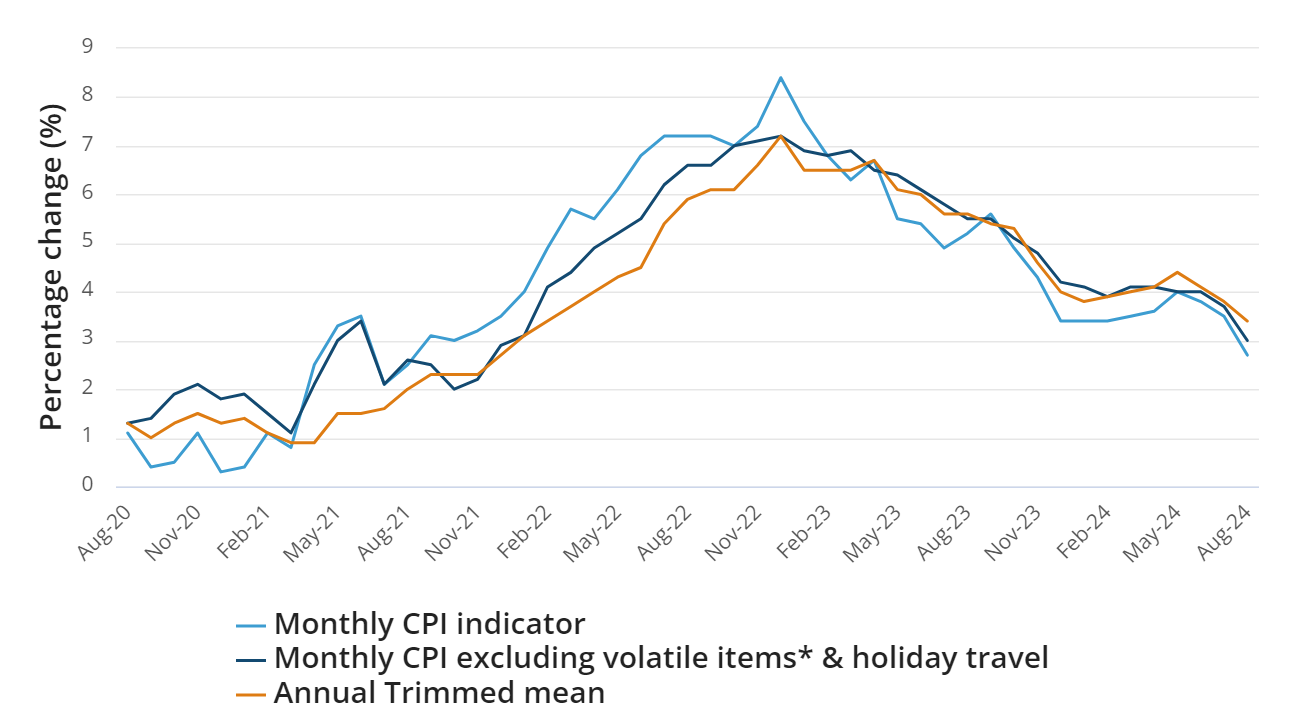

On Wednesday, data released by the Australian Bureau of Statistics showed that the country's monthly consumer price index (CPI) rose 2.7% year-on-year in August, down from 3.5% in July and in line with market expectations.

On Wednesday, data released by the Australian Bureau of Statistics showed that the country's monthly consumer price index (CPI) rose 2.7% year-on-year in August, down from 3.5% in July and in line with market expectations.

In August, the annualized rise in the monthly CPI gauge, which excludes volatile items and holiday travel, rushed down to 3% from 3.7% in July, coming to the upper end of the central bank's 2-3% target range.

Meanwhile, the core inflation gauge also slowed to 3.4% from 3.8% in July. The RBA expects the index to reach 3.5% by the end of this year.

The sharp drop in inflation was largely due to government measures such as energy subsidies. According to the Australian Bureau of Statistics, electricity costs fell 17.9 percent in August from a year earlier, the biggest drop on record. In addition, motor fuel also fell 7.6 percent from a year ago.

It's a good inflation spreadsheet for the Australian government. Headline inflation fell to its lowest level in three years and core inflation fell to its lowest level since early 2022.

Despite the good data, the market had a muted reaction to it. The Australian dollar retreated slightly against the U.S. dollar, last trading at $0.6882. Policy-sensitive three-year bond futures were little changed at 96.63.

The previous day, the Reserve of Australia (RBA) continued to leave its cash rate target unchanged at 4.35%, its sixth consecutive hold.

In its statement, the Australian Fed said that while headline inflation will decline for some time, underlying inflation is more reflective of inflationary momentum and remains too high for the time being. And it emphasized that “policy needs to be sufficiently tight until the Board is convinced that inflation is moving consistently towards the target range.”

The message from the Australian Fed was clear - the market still won't see the central bank cutting rates anytime soon.

After the inflation data came out, Australian Finance Minister Jim Chalmers expressed cautious optimism about the latest inflation figures. He said that “these data are encouraging, encouraging and welcome”, but still need to remain vigilant, and pointed out that the inflation trend may be unstable.

We're not going to get too excited because we know that monthly numbers can fluctuate,” Chalmers said at a news conference. Inflation doesn't always move in a straight line.”

“What really matters, as the RBA keeps reminding us, is whether underlying inflation can sustainably return to target.” Harry Murphy Cruise, an economist at Moody's Analytics, said, “That's still some way off, but the August data suggests that inflation momentum is moving in the right direction.”

Given the hawkish wording of the Australian Fed, the market generally believes that Australia's rate-cutting cycle will not start too soon. Economists generally expect the Australian Fed not to kick off a rate cut until February next year.

Tony Sycamore, an analyst at IG, said, “If the third quarter data also shows a downward trend in underlying inflation, we could see the RBA take a more moderate tone at its November meeting, potentially paving the way for a 25 basis point rate cut in December.”

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.