Australian inflation accelerates, central bank rate hike risk is increasing

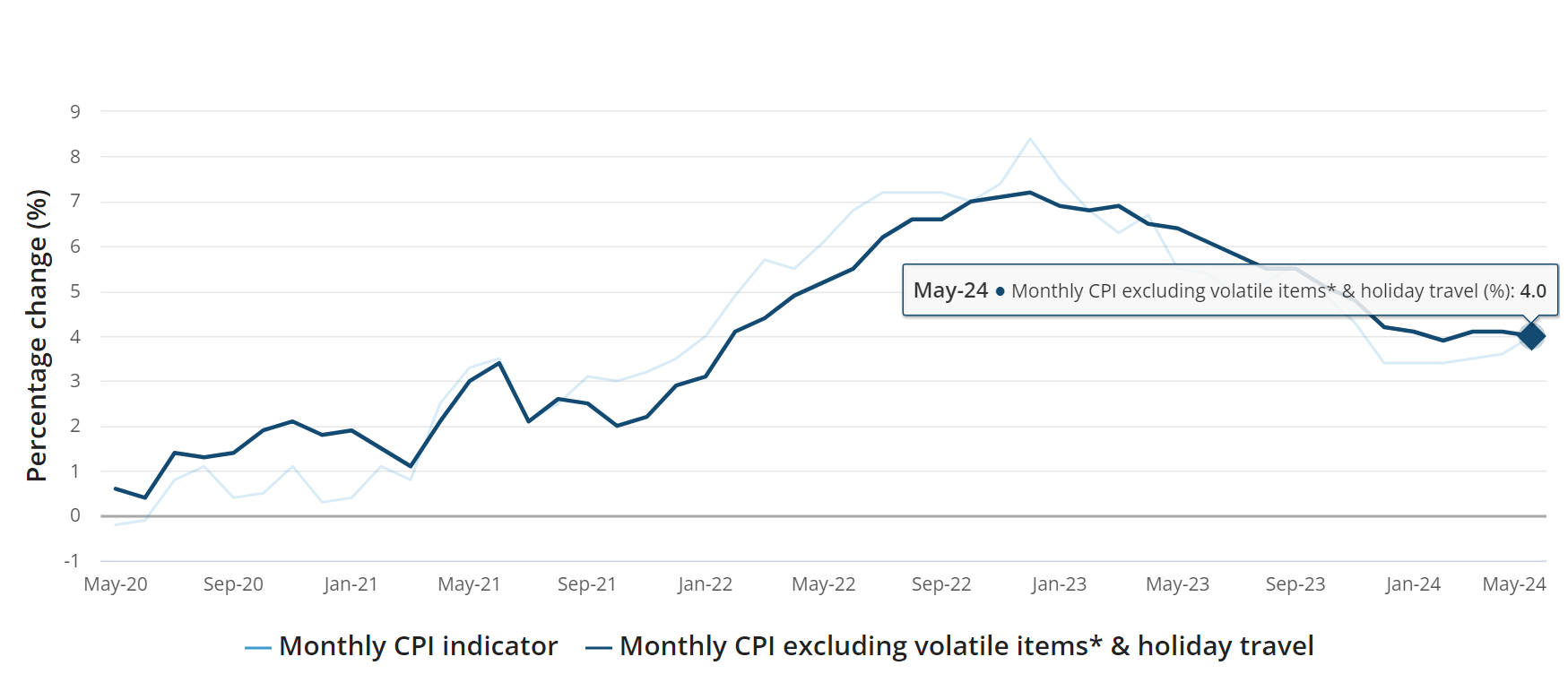

The data shows that Australia's CPI increased by 4% year-on-year in May, higher than expected by 3.8% and also higher than last month's 3.6%. This is the third consecutive month that inflation in Australia has exceeded expectations.

On Wednesday, June 26th, the Australian Bureau of Statistics (ABS) released the monthly CPI indicator for May.

The data shows that Australia's CPI increased by 4% year-on-year in May, higher than expected by 3.8% and also higher than last month's 3.6%. This is the third consecutive month that inflation in Australia has exceeded expectations.

Excluding volatile items such as fuel for cars, fruit and vegetables, , and holiday travel, the core CPI was 4%, higher than the expected 4% and slightly lower than April's 4.1%.

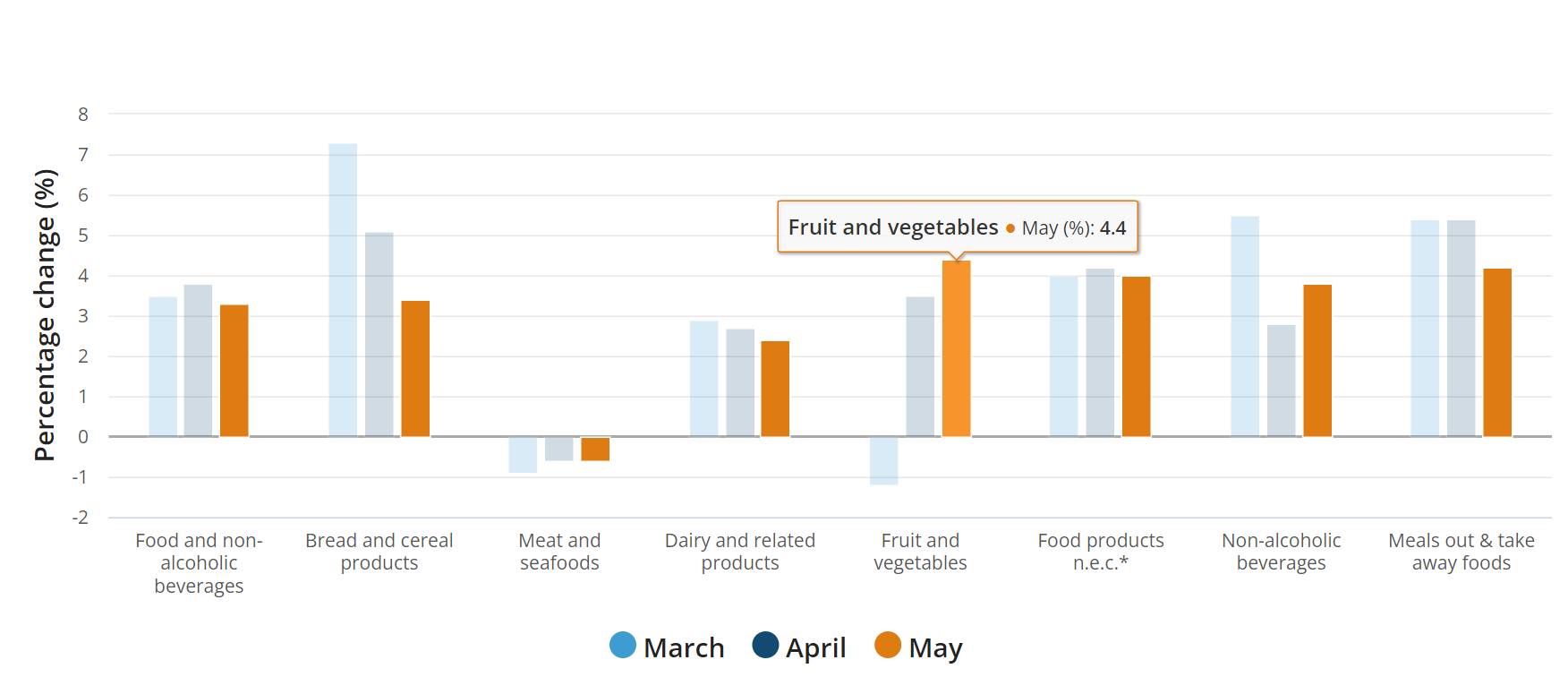

ABS stated that as of May, the largest contributors to the annual CPI increase were housing (+5.2%), food and non-alcoholic beverages (+3.3%), transportation (+4.9%), and alcohol and tobacco (+6.7%).

In the 12 months to May, housing prices have risen by 5.2%, higher than the 4.9% in April. The annual rent increased by 7.4%, reflecting the tension in the national rental market. During the same period, electricity prices increased by 6.5%, higher than April's 4.2%. As eligible households gradually use up the rebates from the energy bill relief fund, the out of pocket electricity costs are also gradually increasing.

Michelle Marquardt, the head of ABS price statistics, said that the energy bill relief fund tax refund implemented since July 2023 has largely offset the electricity price increase caused by the annual price review in the same month. If tax refunds are not included, the electricity price will increase by 14.5%.

In terms of automobile fuel prices, although they fell month on month in May, they still increased by 9.3% year-on-year, higher than the 7.4% in April.

Food prices fluctuate. The overall price has increased by 3.3% compared to May 2023, lower than the 3.8% in April. Among them, the prices of fruits and vegetables increased by 4.4% compared to May last year, after a 1.2% drop in prices in March.

The quarterly inflation data will not be released until July 31st. The official estimate is that the quarterly inflation rate from April to June will accelerate from 3.6% in the previous quarter to 3.8%.After the release of CPI data, the AUD/USD exchange rate rose by nearly 0.4%. The yield on policy sensitive three-year bonds rose 14 basis points to 4.07%, marking the largest daily increase since April.

Canstar executive Steve Mickenbecker stated that the monthly inflation rate increase is shocking and confirms that inflation is not on the downward trajectory sought by the Bank of Australia. Mikenbeck predicts that the central bank will "definitely raise interest rates" at its next meeting because "the risk of inflation expectations is too high."

David Bassanese, Chief Economist of Betashares, was also shocked by the monthly CPI data and believes that it will put enormous pressure on the Federal Reserve of Australia to raise interest rates in August.

"For the central bank, what is concerning is that the longer inflation remains high, the greater the risk of its integration into inflation expectations and sustained wage and price setting behavior - especially considering that despite weak economic growth, it is still operating at a high capacity level," said Basanese.

Last week, the Reserve Bank of Australia (RBA) kept interest rates unchanged as expected by the market, marking the fifth consecutive time the central bank has kept rates at 4.35%.

The next interest rate meeting of RBA will be held from August 5th to 6th. Before the August meeting, another inflation data will be released. Generally speaking, the next inflation data will have a greater impact on the August meeting. However, due to Australia's three consecutive months of inflation growth exceeding expectations, the outside world also has to worry that the high inflation rate may lead the central bank to take a more aggressive stance.

The RBA has previously stated that if it loses confidence in whether the inflation rate can fall back to the target range of 2% -3% by the end of next year, it will not hesitate to raise the benchmark interest rate. Australia raised interest rates 13 times between May 2022 and November 2023, which is at a relatively low level among global rate hikes.

After the release of CPI data in May, the market predicted that the likelihood of maintaining interest rates unchanged at the August meeting had decreased from 89% to 70%, while the likelihood of a rate hike at the September meeting had increased from around 12% to 35%.

Central Bank Governor Michele Bullock has expressed willingness to remain patient as she seeks to lower inflation rates without hindering economic growth.

The central bank predicts that CPI will not recover to its target level until 2025. Analysts generally expect that the Bank of Australia will not start cutting interest rates until 2025.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.