Bearish and Bullish Engaging Pattern-Trading Strategy Guide

Find out all about Bearish and Bullish Engaging Patterns and the best trading strategies to use them and profit.

In technical analysis, the engulfing pattern is a crucial reversal signal, divided into bullish engulfing and bearish engulfing patterns. These patterns play a vital role in signaling shifts in market trends, helping investors to seize the best entry and exit opportunities.

What is a Bearish Engulfing Pattern?

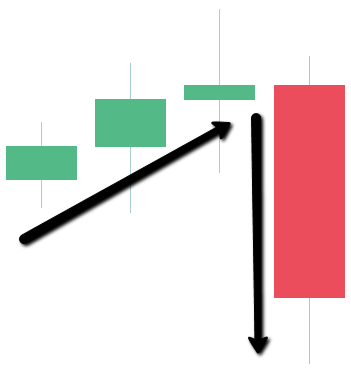

A bearish engulfing pattern is a trend reversal signal that typically indicates the beginning of a downward trend. This pattern is effective across any time frame, and investors can observe it at any stage of the market.

The main characteristic of a bearish engulfing pattern is that a large bearish candlestick completely engulfs the preceding one or more smaller bullish candlesticks, signaling a rapid increase in bearish strength. At this point, sellers have taken full control, usually indicating that the market is about to enter a downward trend.

How to Identify a Bearish Engulfing Pattern?

- Presence of Prior Small Bullish Candlesticks: This indicates that buyers had the upper hand in the short term.

- Subsequent Large Bearish Candlestick: A larger bearish candlestick engulfs all preceding smaller bullish candlesticks, with the bearish candlestick's closing price lower than the lowest point of the previous bullish candlestick.

- Ignoring Upper Wicks: When analyzing this pattern, you can disregard the upper wick of the bearish candlestick as it has little impact on the pattern’s assessment.

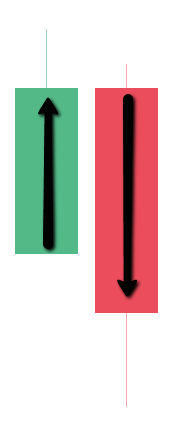

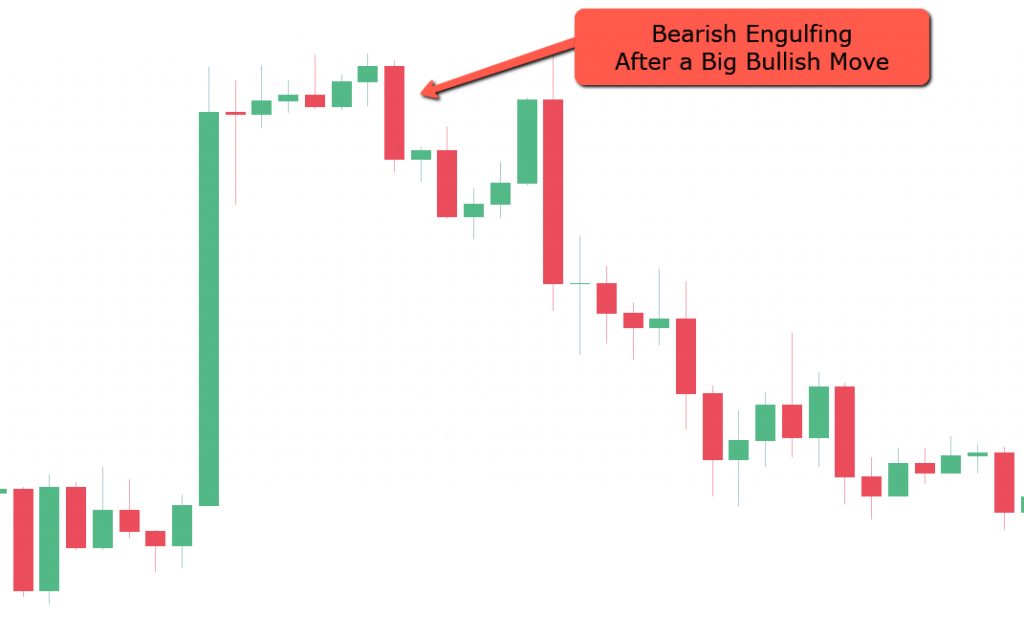

Besides this typical form, the bearish engulfing pattern can also appear after a single large bullish candlestick, followed by an even larger bearish candlestick. This scenario is also known as a 180-degree reversal pattern.

What is a Bullish Engulfing Pattern?

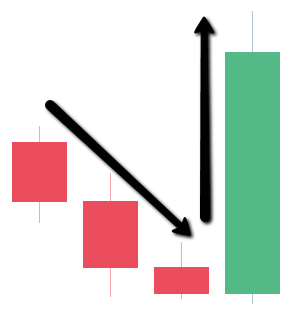

In contrast, the bullish engulfing pattern signals a potential reversal from a downtrend to an uptrend, serving as a buying signal. When this pattern appears in the market, it usually suggests a strong return of bullish strength, which may push prices further upward.

A bullish engulfing pattern typically consists of a large bullish candlestick completely engulfing one or more preceding smaller bearish candlesticks, indicating that bullish momentum is gradually gaining strength.

How to Identify a Bullish Engulfing Pattern?

- Presence of Prior Small Bearish Candlesticks: This indicates that sellers had the upper hand in the short term.

- Subsequent Large Bullish Candlestick: A larger bullish candlestick engulfs all preceding smaller bearish candlesticks, with the bullish candlestick’s closing price higher than the highest point of the previous bearish candlestick.

- Ignoring Lower Wicks: Similarly, when analyzing this pattern, you can disregard the lower wick of the bullish candlestick.

Another form of the bullish engulfing pattern consists of only two candlesticks: the first being a larger bearish candlestick, followed by a larger bullish candlestick that completely engulfs the former.

_401287517_994.png)

The Importance of Engulfing Patterns

Engulfing patterns display strong reversal signals in the market. They are applicable in both bullish and bearish markets, helping traders identify potential market turning points. Their main uses include:

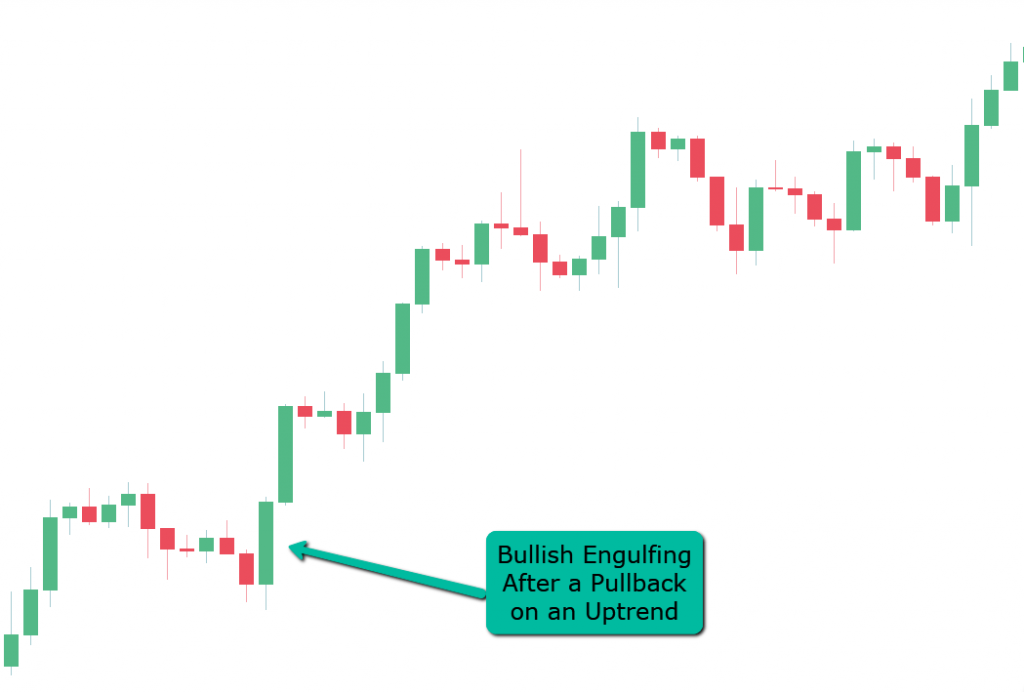

- Trend Continuation: After a trend retracement, an engulfing pattern can serve as an entry signal, especially when the pattern offers an opportunity to continue following the trend after the market retraces.

- Trend Reversal/Exit Trade: When an engulfing pattern appears, it may signal a trend reversal. Traders should consider exiting their current positions or considering a counter-trend trade.

Common Mistakes in Trading Engulfing Patterns

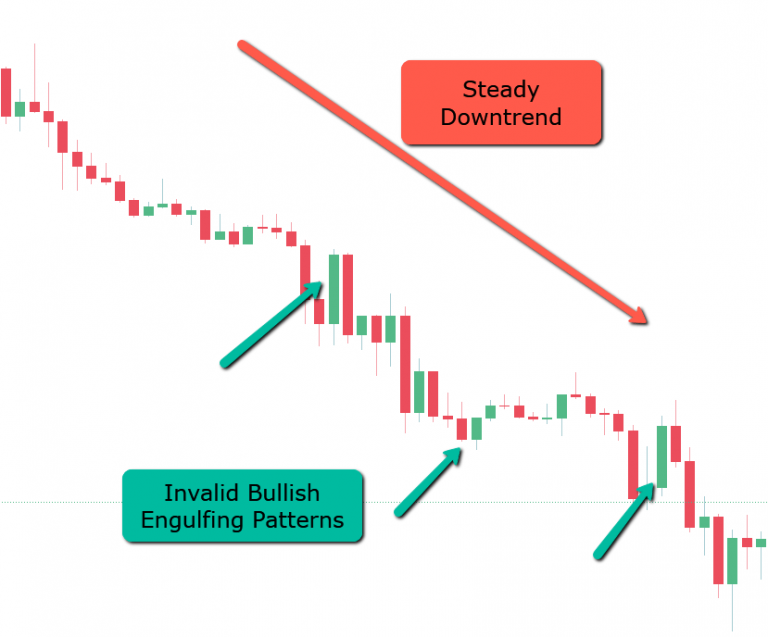

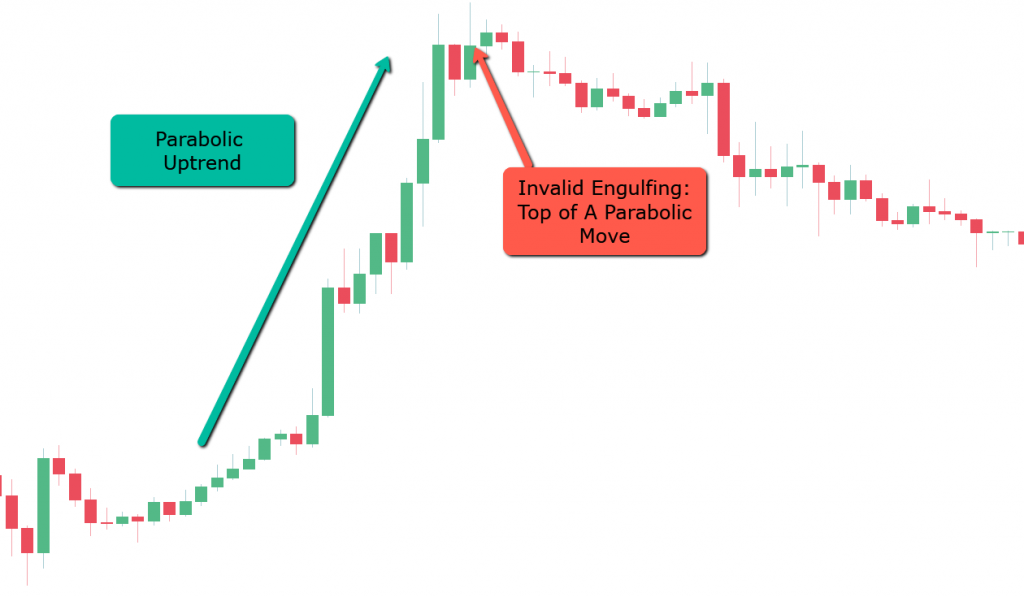

Most traders blindly go long or short when they see an engulfing pattern. To fully capitalize on this powerful pattern, it is essential to wait for the right market structure and position.

Situations to Avoid:

-

Counter-Trend Trading: If the price is in a steady downtrend (approximately a 45-degree angle), any counter-trend engulfing pattern may fail, and the price is likely to quickly resume its original trend.

-

Trading After a Parabolic Move: Parabolic moves attract many novice traders who use high leverage. These moves are often unstable and eventually reverse. Engulfing patterns that appear in this context are usually unreliable and should be avoided.

How to Trigger Engulfing Pattern Trades

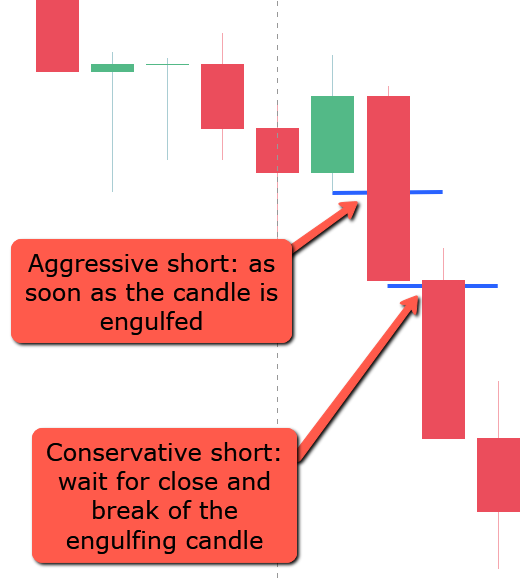

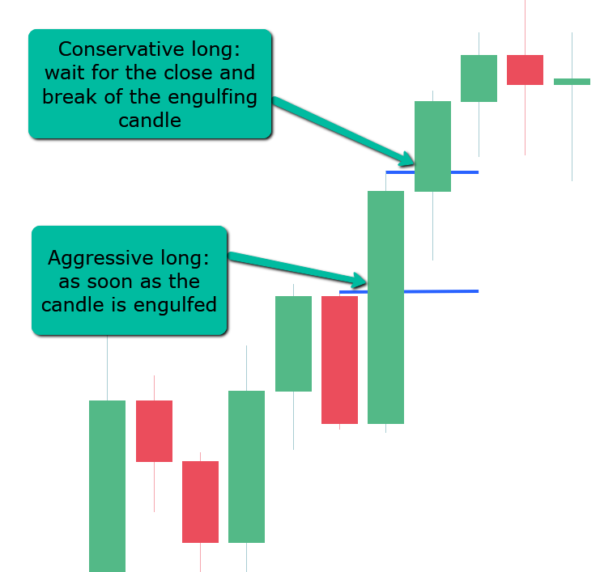

Are you a conservative or aggressive trader?

- Aggressive traders enter a trade immediately after the engulfing pattern appears.

- Conservative traders wait for confirmation of the engulfing pattern before trading.

Pros and Cons:

- Aggressive traders enter trades earlier, potentially reaching the profit zone faster, but they are also more likely to be shaken out by market fluctuations.

- Conservative traders wait for confirmation, entering later and requiring larger price movements to profit.

When the Bearish Engulfing Pattern is Triggered:

When the Bullish Engulfing Pattern is Triggered:

Trading Strategies

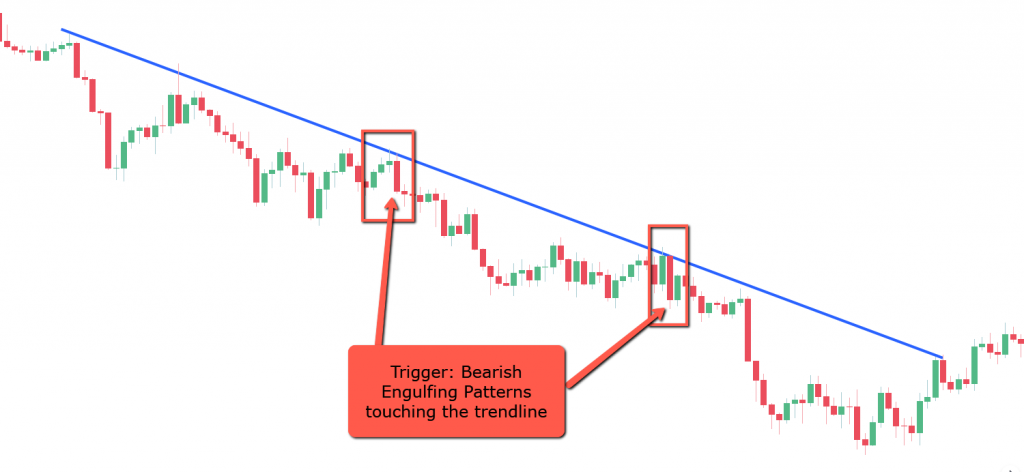

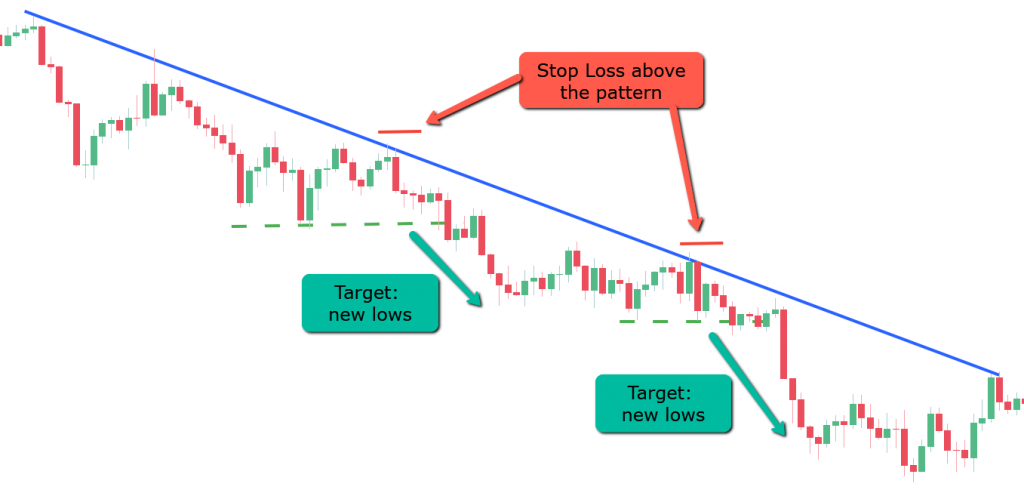

1.Using Trendline Strategy

- Market Structure: Identify market trendlines and look for engulfing patterns at trendline touchpoints.

- Key Area: Look for bearish or bullish engulfing patterns near the trendline.

- Trigger Point: After confirming the pattern, use a breakout of the pattern’s low (bearish) or high (bullish) as the entry signal.

- Target and Stop-Loss: Set reasonable stop-loss and targets, ensuring a favorable risk-reward ratio.

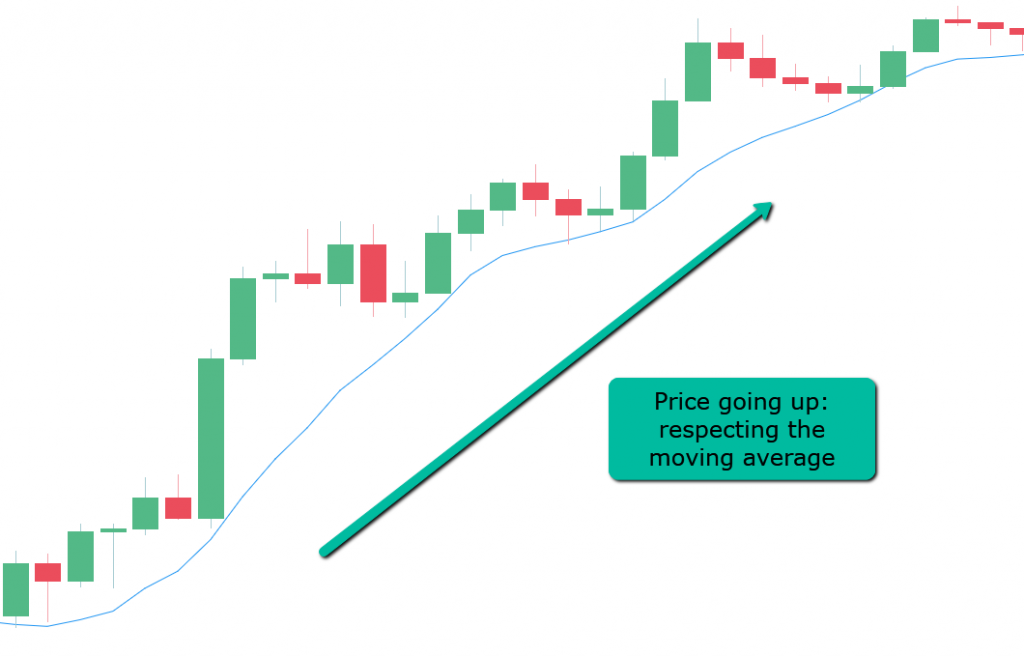

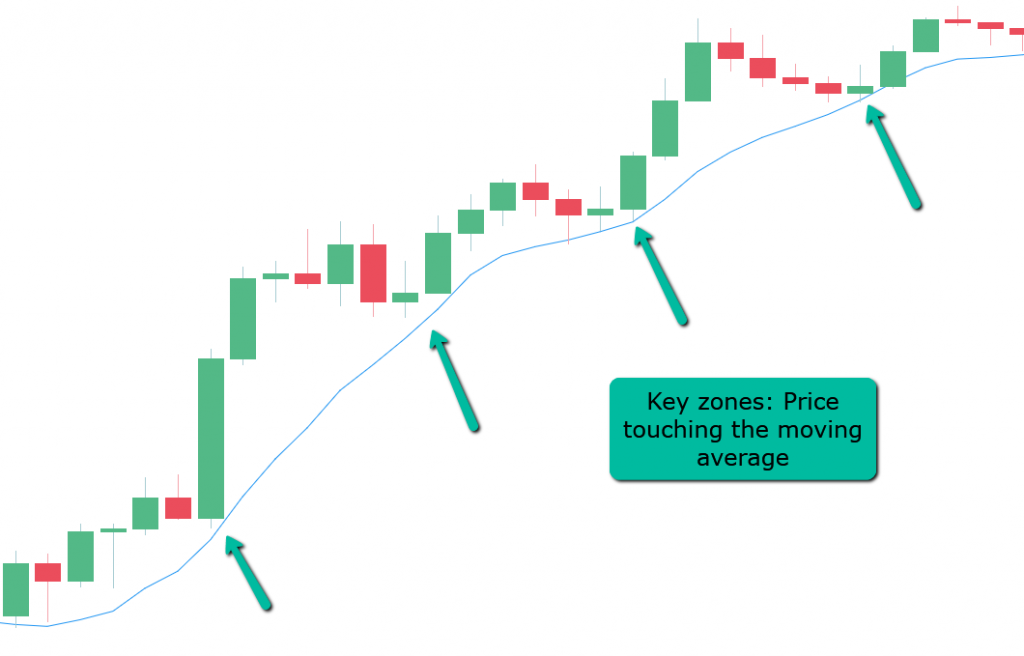

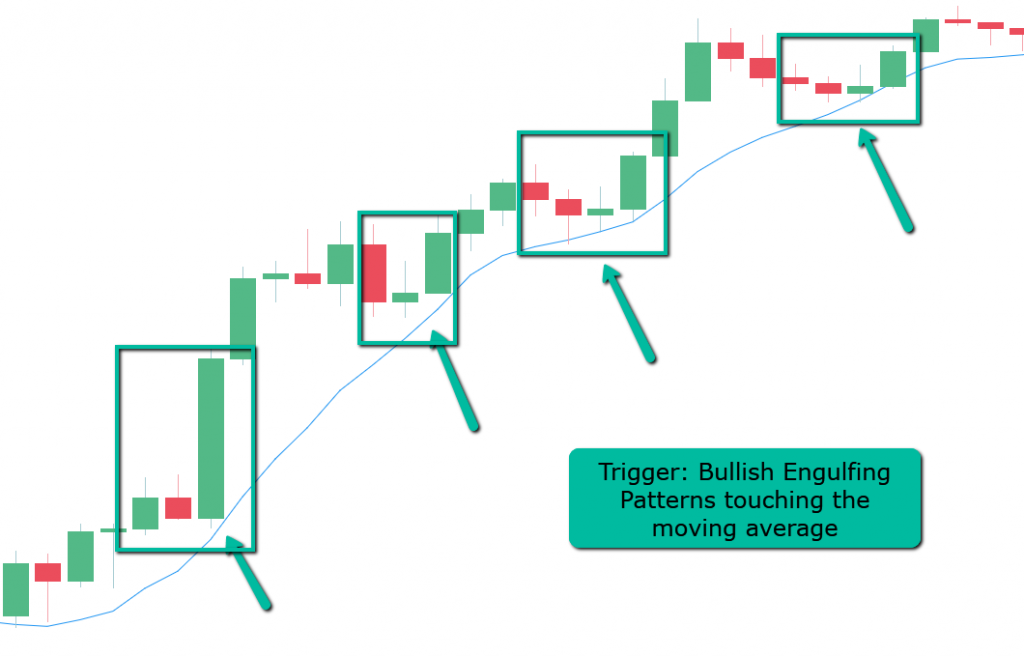

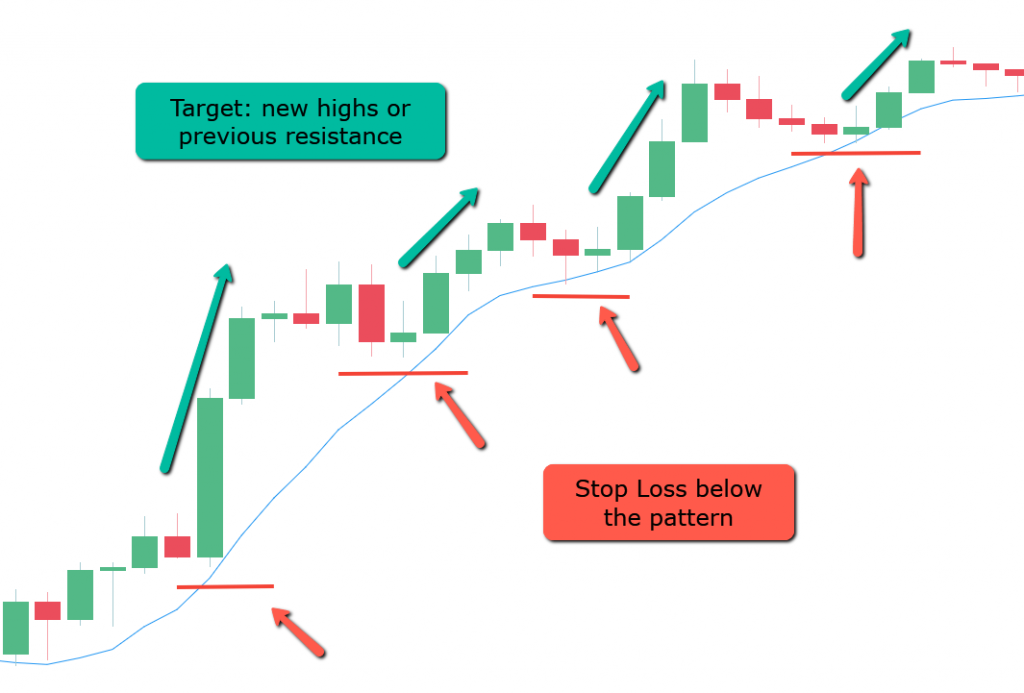

2.Using Moving Average Strategy

- Market Structure: Apply appropriate moving averages (e.g., 8, 20, 50, 200 periods) to determine trend direction.

- Key Area: Look for engulfing patterns when the price touches the moving average.

- Trigger Point: After confirming the pattern, use a breakout of the previous high or low as the entry signal.

- Target and Stop-Loss: Set the stop-loss below the engulfing pattern and determine a reasonable profit target.

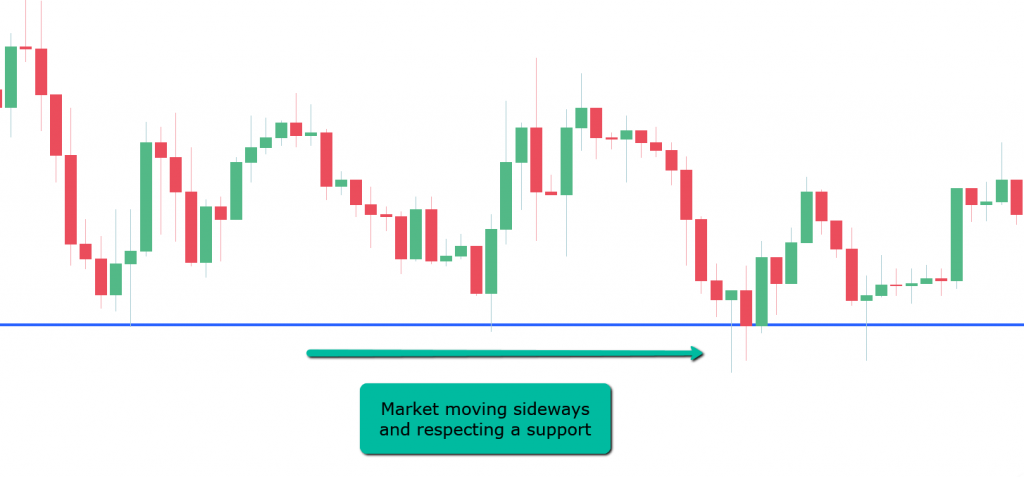

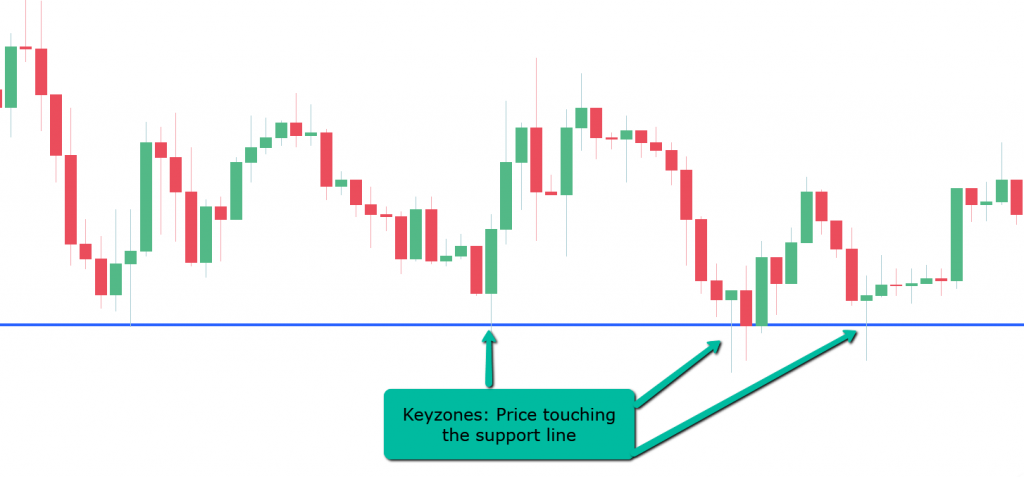

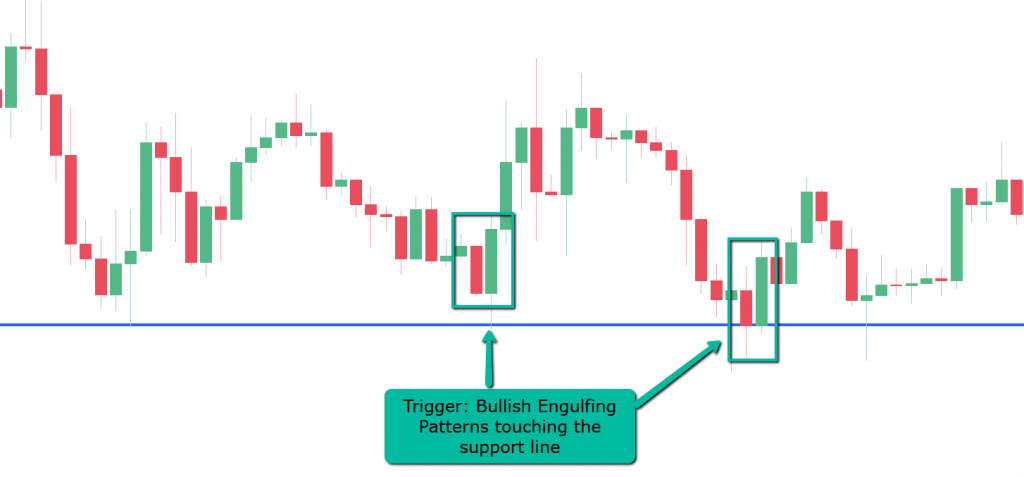

3.Using Support and Resistance Strategy

- Market Structure: In a ranging market, use support and resistance to trade.

- Key Area: Look for bullish engulfing patterns near support levels.

- Trigger Point: Enter a trade when a bullish engulfing pattern forms near the support level.

- Target and Stop-Loss: Set the stop-loss on the opposite side of the engulfing pattern and determine a target based on support and resistance levels.

Conclusion

With a success rate of 82% for bearish engulfing patterns and 62% for bullish engulfing patterns, engulfing patterns are powerful market signals that help traders make trading decisions at the right time. The key to successful trading is choosing the right position, reading the market structure correctly, and avoiding common trading mistakes.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.