Bid vs Ask vs Spread:Key Concepts That Affect Your Trading Performance

The Ask and Bid prices, and the spread, is something that you should know how to handle.This article will help you to stay out of trouble.

Understanding Bid, Ask, and Spread is fundamental for every trader. Without grasping these concepts, the effectiveness of your strategies may be significantly reduced.

What are Bid and Ask?

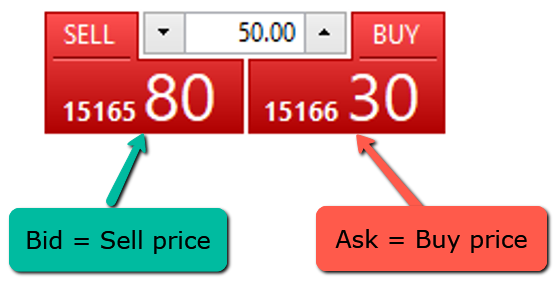

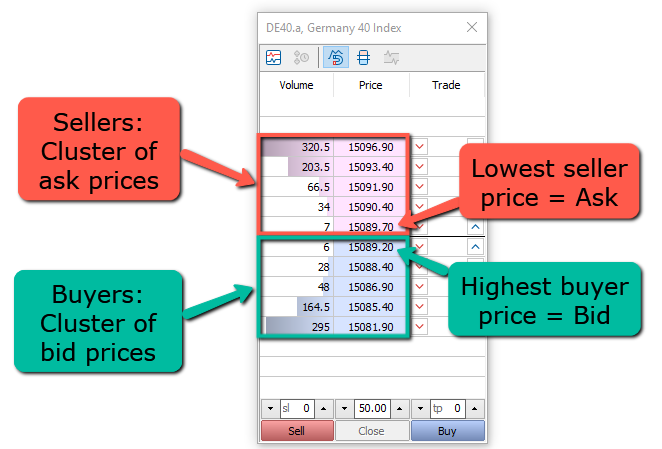

Bid is the highest price that a buyer is willing to pay. Ask is the lowest price that a seller is willing to accept. These prices represent the expected prices at which buyers and sellers are willing to transact in the market.

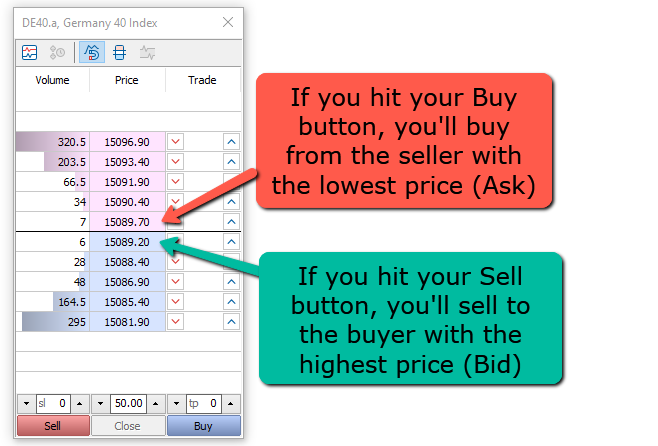

- Buying: If you plan to purchase an asset, you will do so at the lowest price offered by the seller (the Ask price).

- Selling: If you plan to sell an asset, you will do so at the highest price offered by the buyer (the Bid price).

For example, if the Bid and Ask prices for the DAX index are 15,089.20 and 15,089.70 respectively, and you intend to buy, your order will be executed at 15,089.70. Conversely, if you intend to sell, the order will be executed at 15,089.20.

Last Price

The Last Price refers to the price at which the most recent transaction occurred. This price represents the latest trading level, while Bid and Ask prices are pending order prices in the market. The Last Price updates only after an order has been executed.

How Bid and Ask Affect Stock Prices

Referring back to the DAX example, if you want to buy at 15,089.70, your order will be executed at this price if you click the buy button. Conversely, if you choose to sell, the order will be executed at 15,089.20.

Every time a transaction occurs, the Last Price updates to reflect the current trading price. Market price movements depend on the liquidity and volume of the Bid and Ask prices. For example, if buy orders in the market are fully consumed, the price will drop, and vice versa.

What is Spread?

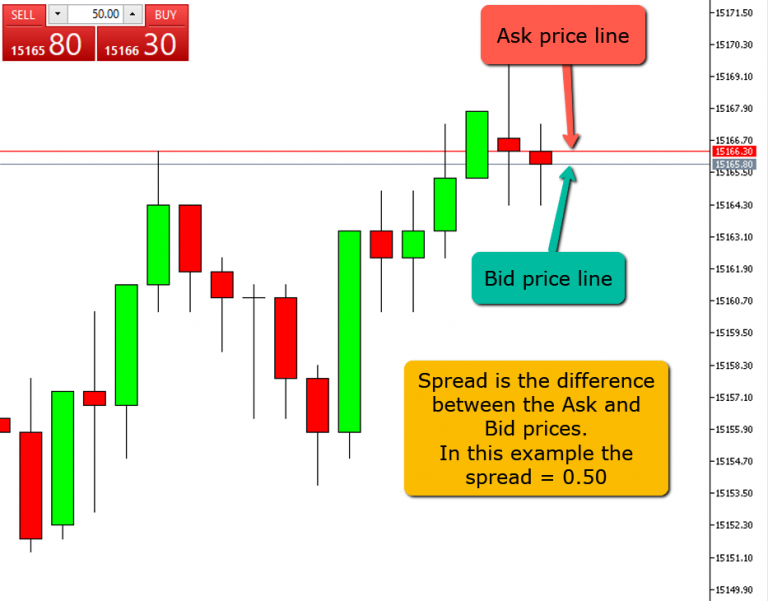

Spread is the difference between the Bid and Ask prices. For example, if the Bid price is 15,165.80 and the Ask price is 15,166.30, then the Spread is 0.50. This difference directly impacts the trader's transaction costs and profit margins.

In cases of low market liquidity or low trading volume, the Spread may widen. This means that traders need to contend with larger price movements to achieve profitability, increasing the difficulty of trading. For example, during market closures or with low-cap stocks, the Spread can become very wide, leading to higher trading costs.

How to Manage Spread

To minimize losses caused by Spread, traders should:

- Avoid trading outside major trading hours, especially day trading or high-frequency trading.

- Pay attention to the Bid and Ask prices of stocks and understand the size of the Spread.

- Use Limit Orders instead of Market Orders to control trading prices.

Why Bid and Ask Prices Can Be Higher Than the Stock Price

Sometimes, Bid and Ask prices can differ from the Last Price due to:

-

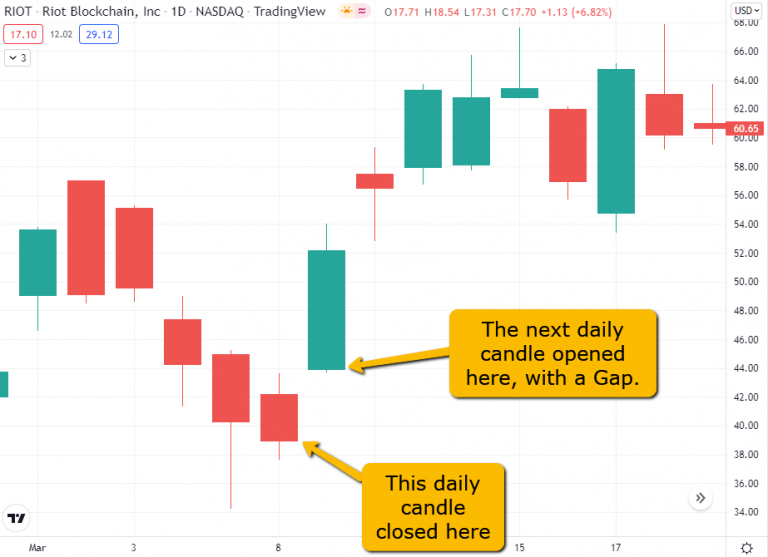

Daily Gaps: Due to market closures and events such as news releases, stock prices can experience significant gaps. This means there can be a difference between the closing price of one day and the opening price of the next day.

-

Low-Liquidity Stocks: Some stocks have very low liquidity and sparse trading activity, which can lead to significant price fluctuations. The Last Price on charts might differ substantially from the current Bid and Ask prices in these cases.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.