What is the net interest rate, pre-tax / after-tax net profit.?

The profitability of a company is a key concern for investors, and if profits continue to grow, the share price is likely to rise.。This article describes the relationship between net interest rate, net profit before tax, and net profit after tax, and 3 things to be aware of when picking stocks。

The profitability of a company is one of the key factors that long-term investors pay attention to, and the share price of a profitable company is likely to rise as it grows;。

Net Profit & Net Margin

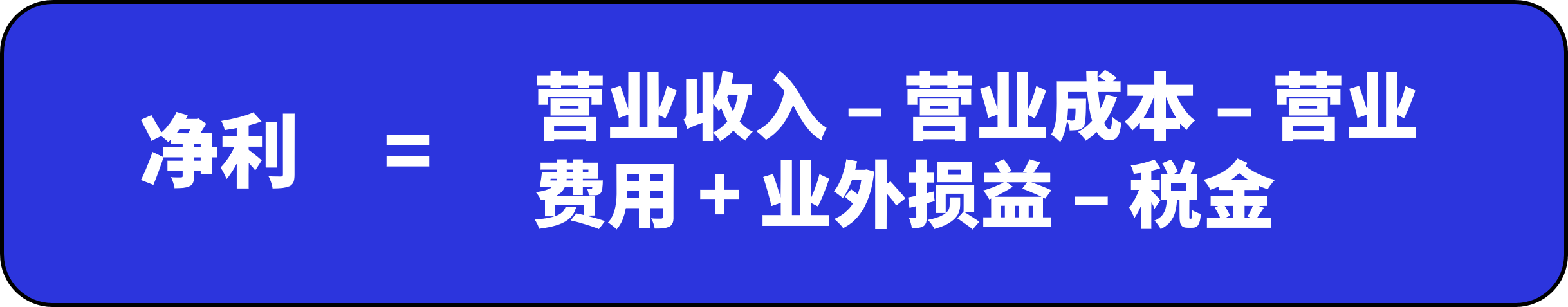

Net Income (Net Income), also known as surplus or net profit, generally refers to net profit after tax and is used to measure how much money a business actually makes。Deduct all kinds of expenses from the business income of the enterprise, such as operating costs, operating expenses, non-profit and loss and income tax, etc., and the final remaining profit is the real profit of the enterprise.。

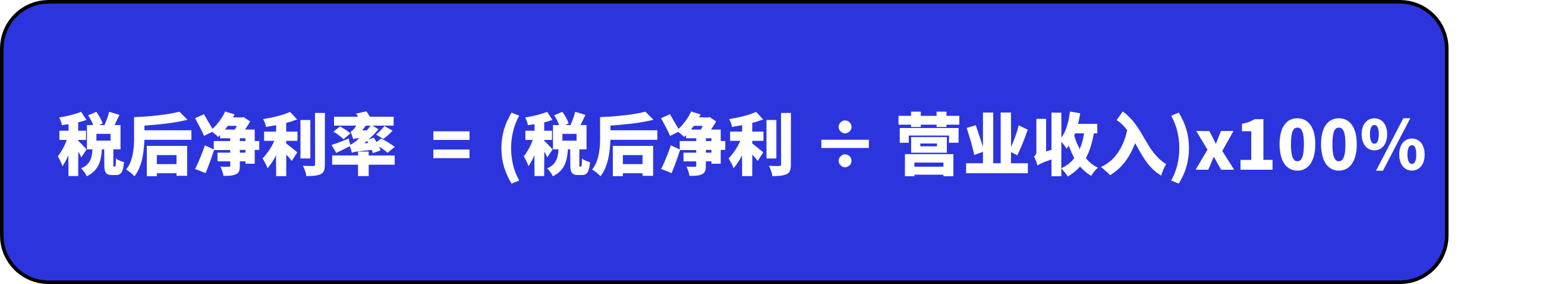

Profit Margin (Profit Margin) usually refers to the net profit margin after tax, which is the result of net profit after tax as a percentage of operating income, i.e., how much of each $1 earned is the percentage of money actually made by the business, calculated as follows.

Net profit before tax&Net interest rate before tax

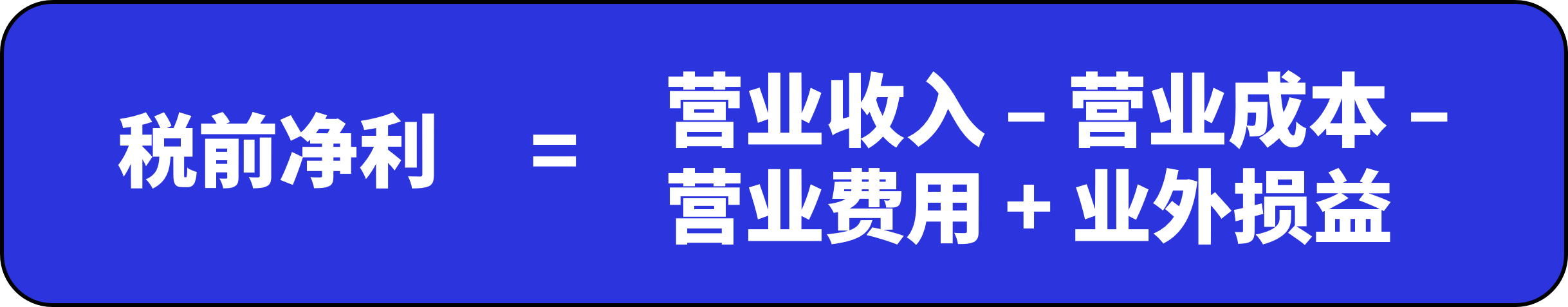

Pre-Tax Income (Pre-Tax Income) refers to the operating income obtained by a business, after deducting costs, operating expenses, plus the profit and loss outside the industry, you can get the result of pre-tax net profit.。

From the calculation formula, this indicator can be used to view the "out-of-industry profit and loss" of enterprises, to avoid buying the industry to make money, but by the impact of out-of-industry losses of enterprises.。

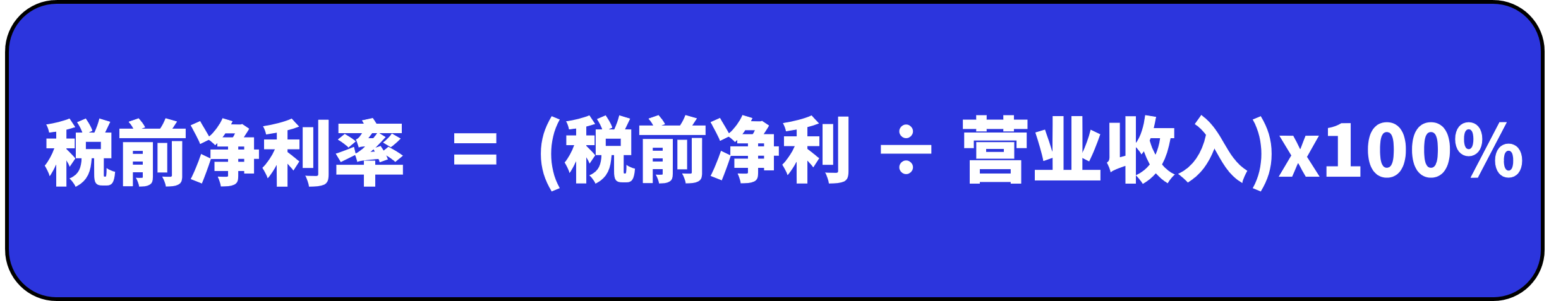

Pre-Tax Income Margin (Pre-Tax Income Margin) refers to the percentage of net profit before tax to total operating income, used to measure a company's net profit before tax per dollar of revenue.。

When reviewing an enterprise's financial report, if it is found that the net profit margin before tax is greater than the operating profit rate, it means that the company has out-of-business income, which may come from the sale of land, plant, equipment, foreign exchange gains and losses, or income from out-of-business reinvestments.。Conversely, if the net profit margin before tax is less than the operating profit ratio, it indicates that the company has a loss outside the industry.。

Net profit after tax&Net interest rate after tax

Net Income (Net Income) is a measure of a company's ultimate earnings performance and reflects how much money the company actually makes。

Net Profit Margin (Net Profit Margin) is the percentage of net profit after tax to total operating income, showing the percentage of net profit after tax per dollar of revenue for a company.。

The meaning of the net interest rate.

The higher the net profit margin of a firm, the stronger the profitability; conversely, the lower the net profit margin, the worse the profitability.。However, sometimes the net profit margin of a company is high or low because of the impact of out-of-business gains and losses, which raises or lowers the performance of the net profit margin.。

Out-of-business gains and losses can be divided into two types: recurring and non-recurring, where recurring gains and losses refer to those that occur all the time, such as interest income, and non-recurring gains and losses refer to one-time gains and losses, such as gains and losses on the sale of land, plant, equipment or foreign exchange.。

So, in fact, it is possible that a company with a high net profit margin is not because of its ability to make money, or even because it is likely to lose money.。If this happens, the business will not be a good investment target.。If a company wants to maintain long-term growth, it is the long-term solution that the profitability of the industry can continue to improve.。If you can add in the fact that you can continue to make money outside of the industry, it's quite impressive.

The relationship between gross margin, operating profit ratio, and net profit before / after tax

In terms of the composition of the income statement, the income earned by a company after the sale of a product or service is called operating income (Revenue).。

First of all, operating income needs to deduct the cost of manufacturing products or providing services, including raw material costs, labor costs, manufacturing costs, etc., which are called Cost of Goods Sold (COGS).。

Then, deduct the overhead costs required to make the product, which include operating-related expenses such as sales, management, and research and development, known as operating expenses.。

Selling and distribution expenses (Selling and distribution expenses): employee salaries, utilities, gas, retail rental and advertising costs, etc.。

Administrative expenses: Departmental expenses and service charges, etc.。

Research and Development Expenses: investment in research on new products, new technologies, new processes, new patents, improved production technologies and processes, etc.。

After deducting the above two costs and expenses, the remaining part is called business benefit, also represents the company's own profit situation.。After taking into account the company's profit and loss outside the industry, you can know the profit and loss situation outside the industry, that is, the net profit before tax.。

Finally, after deducting business income tax, you can know how much of a product or service a company actually earns in an import bag before it sells it.。

Summary

Net interest rate generally refers to net profit after tax and is used to measure how much money a business actually makes。Net profit before tax and net profit before tax are also used to measure a company's profit and loss outside the industry, through this indicator can avoid buying the industry to make money, but by the impact of the loss of money outside the industry.。Net profit after tax and net profit after tax A measure of a company's final profit performance that reflects how much money the company actually makes。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.