Bull Traps in Financial Market:How to Profit?

Bull traps catch traders from all markets.Learn how to identify bull traps and how to trade them, profiting from the trapped trader ’ s loses.

In financial markets, various traps emerge continuously, making it difficult for traders to avoid them. Among these, the Bull Trap is one of the most common. Although it may seem simple and easy to identify, many traders still fall into it due to multiple influencing factors.

What is a Bull Trap?

A Bull Trap is a chart pattern that typically traps bullish traders. Bullish traders usually add to their positions during an uptrend and buy again when the price pulls back to a lower level, aiming to profit when the price makes a new high. However, when the price pullback fails and begins to decline, they become trapped. This pattern is particularly common when the "pump and dump" strategy starts to fail.

Key Locations for Bull Traps

Resistance Levels

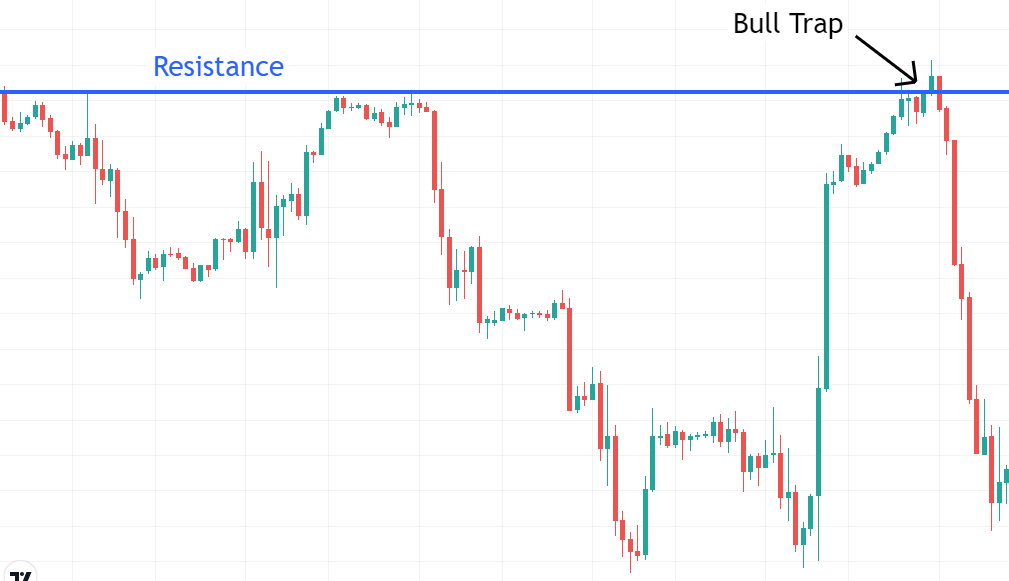

Resistance levels are classic points where price trends often change. When the price reaches a resistance level, selling pressure increases, making it difficult for the price to continue rising. In this situation, bullish traders expect the price to break through the resistance level and continue rising, but they often get trapped instead.

Example: The price of a stock repeatedly encounters resistance at a specific level. Each time the price reaches this level, selling pressure increases, causing the price to fall back.

After a Sharp Decline

Following a significant rise, a sharp decline indicates strong selling pressure in the market. It is crucial to follow the market's strength and weakness at this point. Typically, a large bearish candlestick or "ignition bar" shows immense selling pressure, and the next pullback usually does not become a buying opportunity.

Example: After a continuous rise, a stock suddenly experiences a sharp decline, forming a long bearish candlestick, indicating strong market selling pressure. The pullback afterward may lead to further decline.

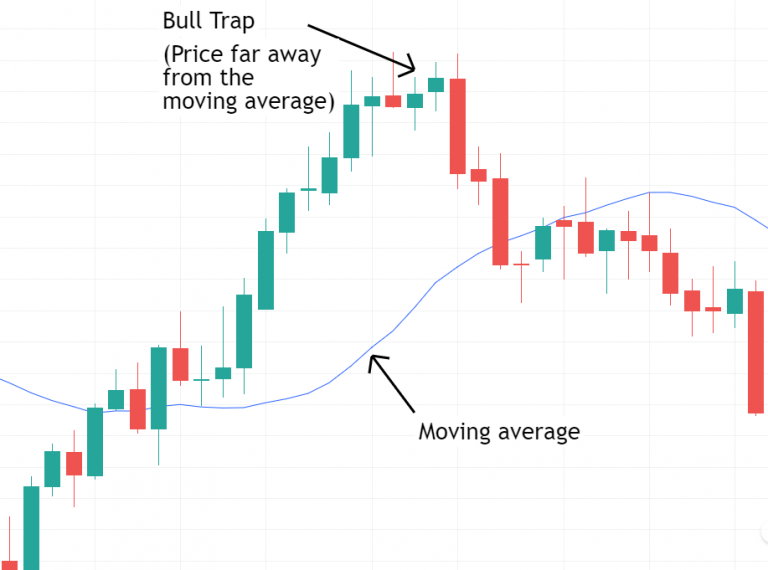

Price Far from Moving Averages

Moving averages are essential indicators for judging market trends. When the price is far from the moving average, it usually loses momentum and tends to return to the moving average. Therefore, the best trading opportunity is when the price approaches the moving average and is ready to rebound.

Example: The price of a stock is far from its 50-day moving average. The likelihood of a pullback increases, trapping traders who buy at this point.

Timeframes for Bull Traps

Bull Traps can appear in any timeframe, from weekly charts to 1-minute charts. Whether it's intraday trading, scalping, or swing trading, these traps repeatedly appear. The different timeframes only affect their scale but do not change their nature.

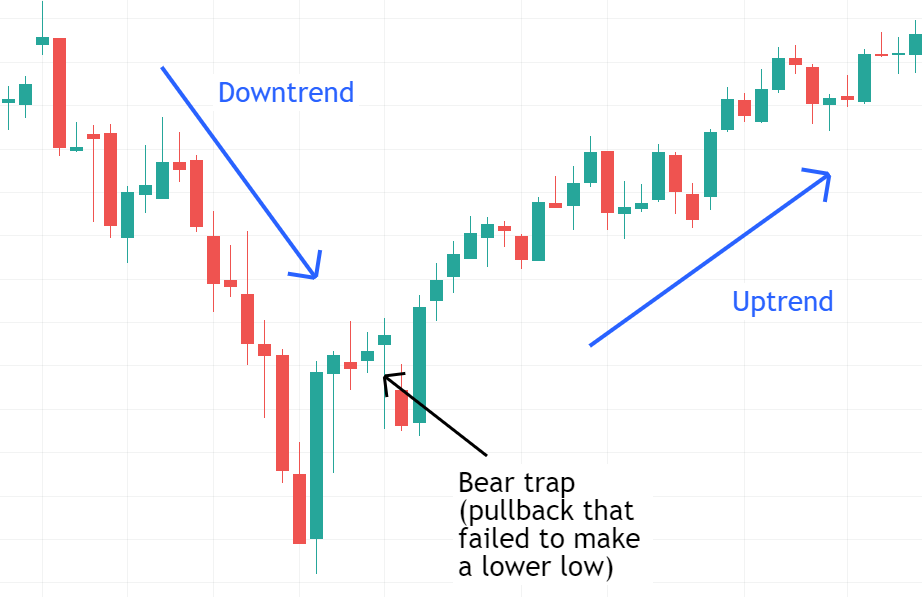

Bull Traps vs. Bear Traps

Bull Traps are similar to Bear Traps, but in opposite directions. Bull Traps appear during uptrends, while Bear Traps appear at the end of downtrends. The trading strategies for both are essentially the same, leveraging trend reversals for profit.

How to Trade Bull Traps?

Trading Bull Traps involves the following steps:

-

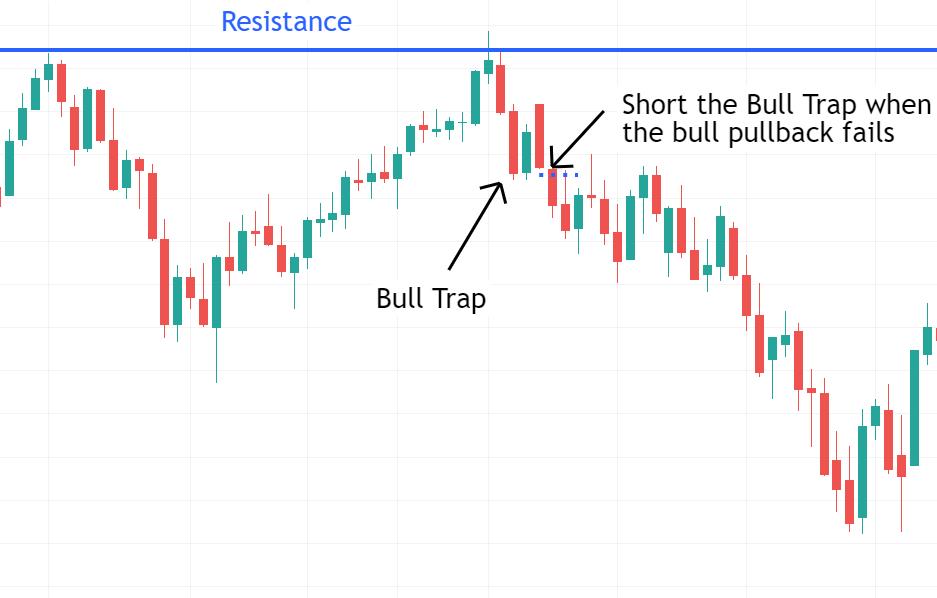

Wait for the Price to Meet Conditions Indicating a Possible Trend Change:These conditions include the price reaching resistance levels, moving far from moving averages, or showing strong counter-reactions. Head and shoulders patterns are also a variation of Bull Traps.

-

Wait for the Pullback to Form: Bullish traders usually enter during pullbacks, but we need to wait for them to get trapped and then look for shorting opportunities.

-

Wait for the Pullback to Fail or Start Failing: Aggressive traders can short immediately when the price stagnates and begins to fall after the pullback forms. Conservative traders can wait until the price breaks below the pullback before shorting.

Example: After a stock's pullback fails and the price starts to decline, aggressive traders can short immediately, while conservative traders can wait for the price to confirm the downtrend before entering.

Why Does the Price Fall After a Bull Trap?

-

A Large Number of Short Sellers Enter the Market:The selling pressure from short sellers pushes the price down, causing a sharp market reaction.

-

Bullish Traders Closing Positions:When the price moves unfavorably for bullish traders, their stop-loss orders get triggered, increasing market selling pressure. As more stop-loss orders trigger, the selling pressure further increases, causing the price to continue falling until the market selling pressure is exhausted.

Summary

Bull Traps are common chart patterns that signify the end of uptrends. They typically occur at resistance levels, far from moving averages, or after sharp declines. Bull Traps can be found in any timeframe and market, providing excellent shorting opportunities.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.