How idle funds in securities earn interest?

The idle funds in the original securities account can also earn no less than the interest on time deposits, and the risk is equal to zero! This article analyzes the interest rates on idle funds of 13 U.S. stock brokerage firms, of which the interest rate on IB idle funds is close to 5%!

When making investments, we usually have a cash deposit in our securities account that is not in the market.。Compared to the interest generated by depositing money in a bank, or the potential return on making an investment。The idle cash in the securities account appears to be somewhat wasteful.。

In fact, the income from idle funds can also be no less than the interest on bank deposits!

This article will introduce the definition of idle funds in securities, the difference between the purchasing power of idle funds and cash, and the method of earning interest on idle funds, and compare the interest rate on idle funds with the interest rate on time deposits of banks in various countries.。At the end of the article, I attach a comparison of the interest rates on the idle funds of 13 brokerages, which will show you how to make good use of your cash balance to increase your capital!

What are idle funds?

Idle funds, also known as cash balances, are cash in securities accounts that are not traded in the market.。These cash balances often come from funds deposited by users, cash dividends, or cash received after the transaction is cleared.。

U.S. stock brokerage platforms often display idle funds as "Cash," refer to the following account screenshot of Interactive Brokers, the cash balance is in the form of "Cash," and the cash balance figures available for trading are displayed in different currencies.。

However, not all brokerage platforms will use the term "cash," and some may use "Uninvested Cash" or "Cash Available to Invest" to display cash balances.。Users of TD Ameritrade, an old U.S. stock brokerage, may be more familiar with "Cash & Sweep Vehicle," which is what thinkorswim says about account cash balances。

Idle funds vs purchasing power

It is worth noting that some investors often confuse the cash balance with purchasing power (Buying Power / Purchasing Power), thinking that purchasing power refers to the cash available to the account, and thus accidentally use the financing line to trade, must pay the related financing interest.。

In fact, purchasing power is equal to the maximum amount available for trading, meaning "ability to trade," not the true cash balance in a securities account.。

In the case of Interactive Brokers, for example, purchasing power is calculated differently depending on the type of account and the financial assets traded.

- Cash Account (Cash Account) Purchasing power: refers to the cash you have in each city, that is, your own funds that have been remitted to the brokerage firm)。Cash accounts are not eligible for financing transactions。For example, the purchasing power of an account holding a cash balance of USD 100,000 is USD 100,000。

- Reg.T account (Reg.T Margin Account) Purchasing power: Financing purchasing power is the maximum amount of money in an account that can be used to purchase financiable securities, usually the cash held in the account, plus the amount of financing (i.e., how much money can be borrowed from the brokerage firm), which adds up to the maximum amount that can be used for trading.。The initial financing margin requirement for the IB financing account is 50%, assuming a cash balance of USD 100,000 is held and the financing purchasing power is USD 200,000。

Therefore, when you see "purchasing power" in the account display, don't think it's your own cash balance, especially if the account can be financed, you must be careful to distinguish between the cash balance and the amount of financing to avoid accidentally using the financing transaction.。In other words, when you see a large amount of "cash" in your account, pay attention to whether you have deposited it for yourself, can apply for a withdrawal at any time, or your financing purchasing power.。

How to query idle fund balance on brokerage platform?(Take IB for example)

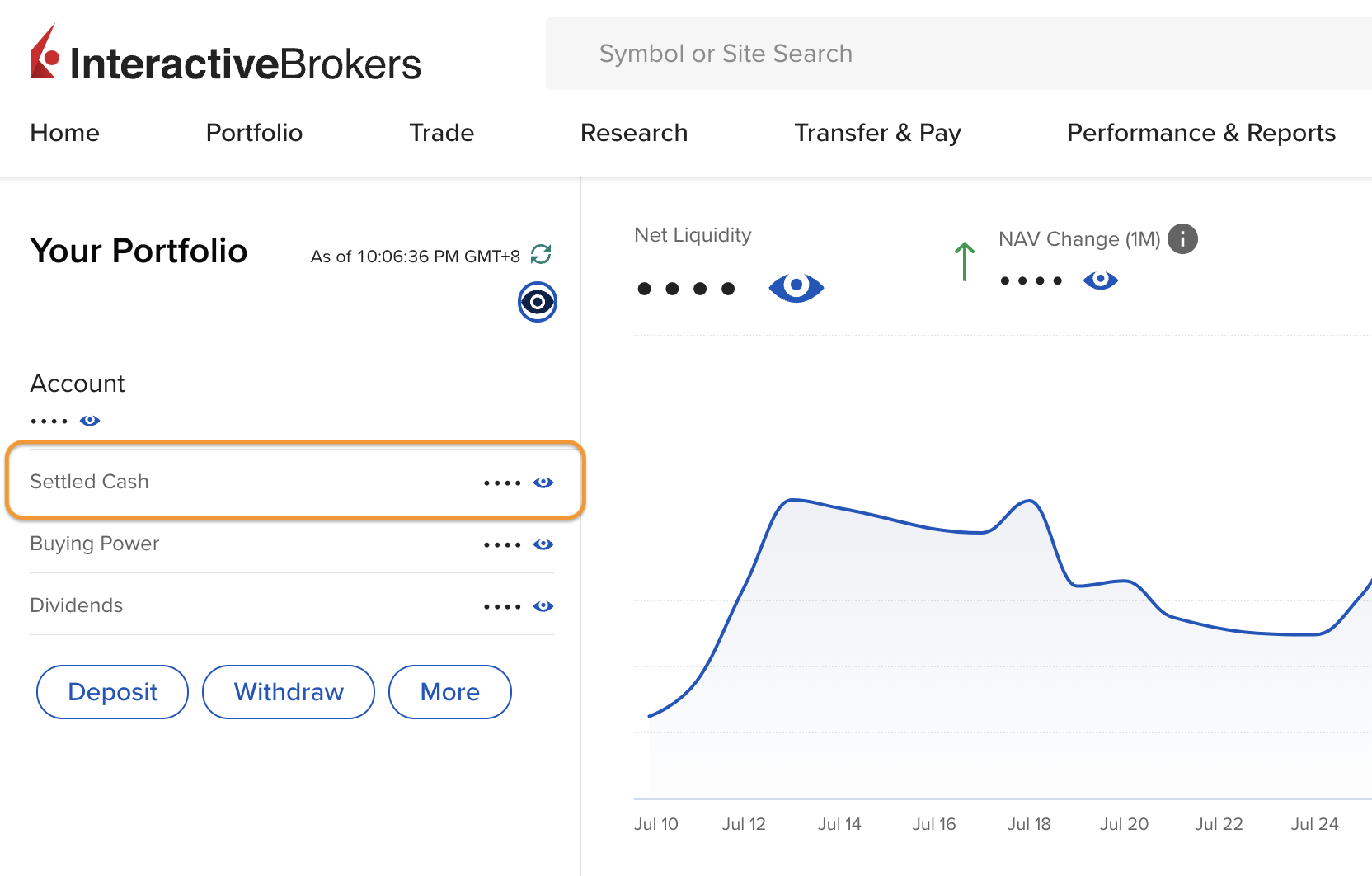

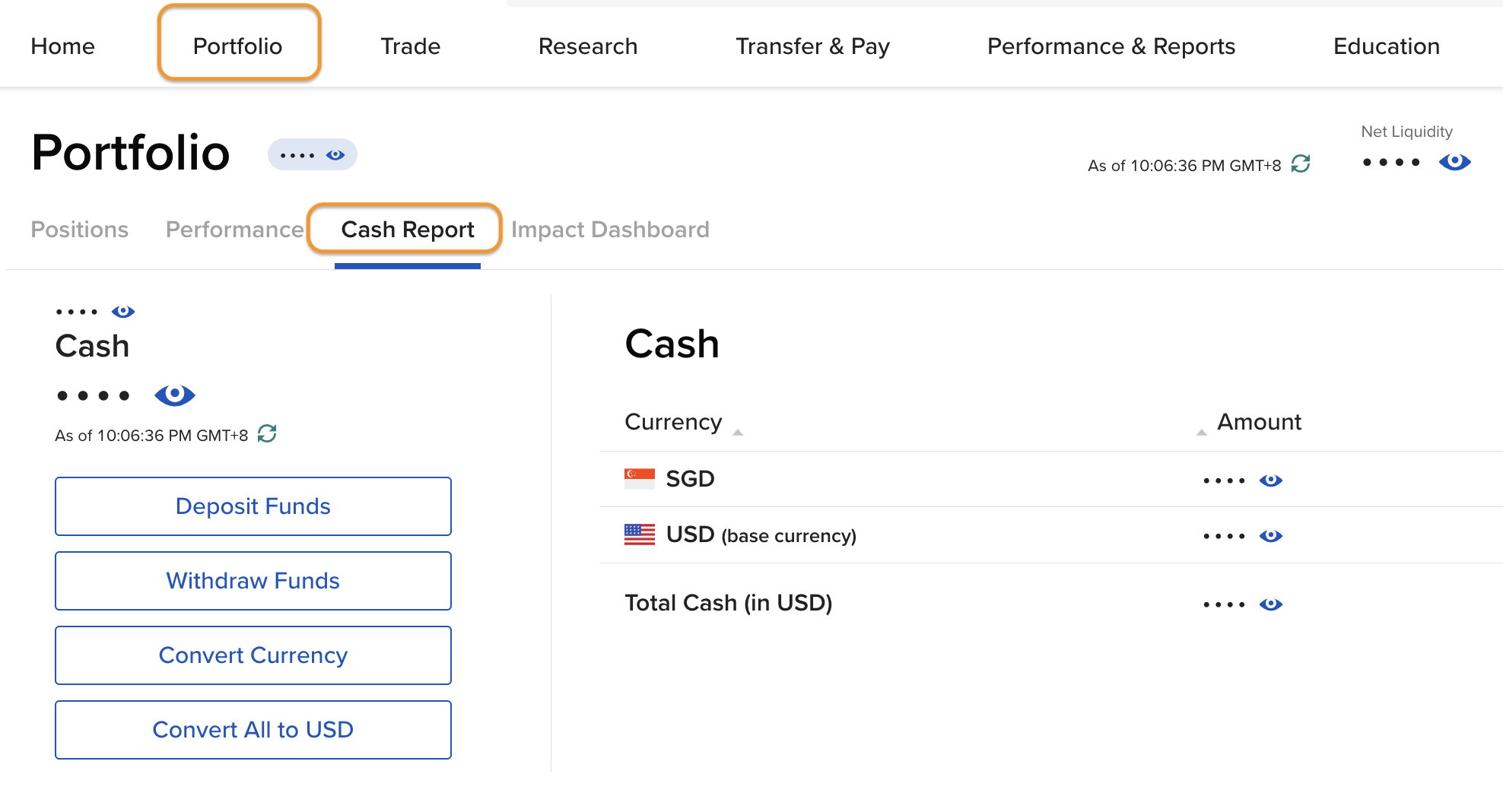

Computer version query

Log in to your Interactive Brokers account and check your cash balance in the message on the left side of the homepage。

- Settled Cash Cash Settled

- Buying Power

- Dividends Dividends

In addition, click "Portfolio" on the home page, select "Cash Report" and check "Cash" to find out how much cash the account currently holds.。

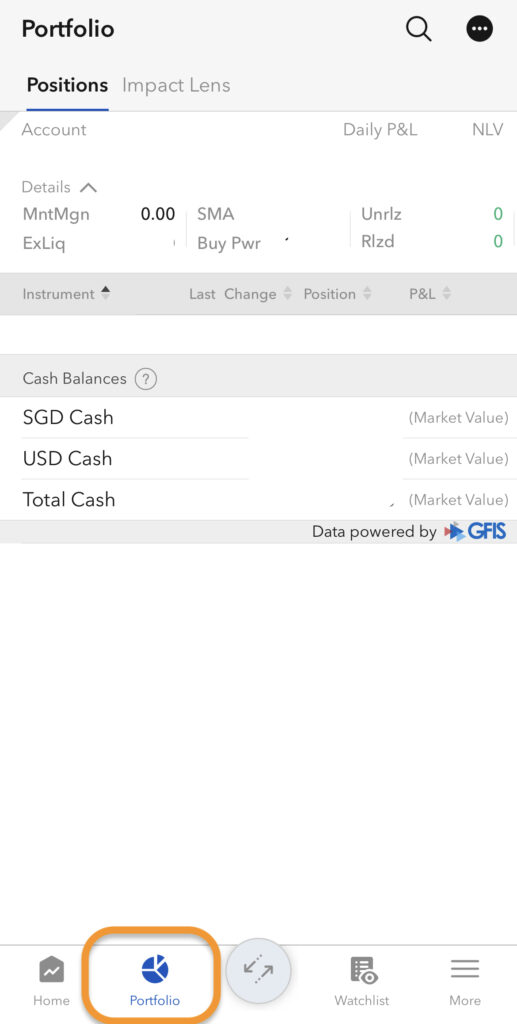

Mobile phone version query

First, log in to the Interactive Brokers APP, enter the account password, click "Portfolio" on the home page, and check that "Cash Balance" is the cash balance.。Open an IB account for free。

In general, how to deal with idle funds?

When cash is retained in a securities account, such as when a cash dividend is recorded, or when securities are sold to obtain cash, some investors will choose to withdraw funds to a bank account; some investors will choose to retain cash in a securities account to meet the need to cover their positions at any time, or have cash on hand to take advantage of investment opportunities in the market.。

Idle funds can also earn interest.?

This is where the problem comes in - generally we keep our money in the bank and receive interest on both demand and time deposits on a regular basis。Does interest also accrue if funds are deposited in a securities account??

The answer is yes。Many mainstream U.S. stock brokerages pay current interest on idle funds in their securities accounts, known as the "Cash Sweep Program."。This interest income does not come from the broker itself, but is automatically deposited by the broker with a third-party depository bank (typically an FDIC insured bank), so there will be interest income。In other words, even if the funds do not enter the market, there is money to collect, while retaining cash in the account flexible use.。The interest rate on such demand deposits is generally not high, and according to the rules of the brokerage firms from 0.01% to 4.83%。

It is worth noting that the major brokerages generally have provisions on idle funds need to be higher than a certain amount, will pay interest, it is recommended that you check with the brokerage details。

Of course, in order to improve the efficiency of cash balance income to a greater extent, most mainstream brokerage firms provide idle funds management tools, money market fund Money Market Fund as the underlying investment, the advantage is higher interest, low risk, strong liquidity, you can withdraw funds from the investment at any time, as a short-term parking tool is a good choice.。

Comparison of US Dollar Idle Funds Interest Rates of Major Securities Dealers

If you expect to keep a cash amount in your securities account, you may consider choosing a brokerage firm that offers higher interest rates。The following is a comparison of the U.S. dollar idle funds rates of 13 brokerages commonly used by the Chinese for your reference.。

| Brokers | US Dollar (USD) Idle Funds Rate | US Dollar (USD) Cash Balance to Threshold |

| Interactive Brokers (IBKR PRO) |

0% 4.83% |

0 ≤ $10,000 > $10,000 |

| Interactive Brokers (IBKR LITE) |

0% 3.83% |

0 ≤ $10,000 > $10,000 |

| TD Ameritrade | 0.35% | $0.01 |

| Firstrade | 0.45% | $0 |

| Charles Schwab | 0.45% | $0.01 |

| moomoo SG | 0% | $0 |

| Tiger Brokers | 0% | $0 |

| Webull | 0% | $0 |

| SAXO (Classic) | The interest rate is determined by the amount of cash, the higher the cash balance, the higher the interest rate。Classic account cash balance of at least $11,017 at 0.054% | > $11,000 |

| POEMS SG | 0% | $0 |

| Rakuten Trade | 0% | $0 |

| FSMOne | 0.50% | $0 |

| M+ Global | 0% | $0 |

| CGS-CIMB | 0% | $0 |

Through the above comparison, Interactive Brokers' dollar idle funds rate is the highest of many brokerages, at 4.83% and will be adjusted with U.S. interest rates。If you can put idle funds where you can earn interest, and the interest rate is comparable to the bank time deposit rate, it is indeed very attractive.。

The interest rates offered by Interactive Brokers are quite competitive compared to other lower-risk financial products。In addition, investors do not need to transfer idle funds into any financial instrument, and the investment risk is equal to zero (e.g. money market funds, although very low risk, still have to bear a certain degree of market volatility risk)。

And because the funds are always parked in the securities account, you can act immediately when investment opportunities arise, and there will be no time delay in the scheduling of funds.。For investors looking for high-interest cash securities accounts, Interactive Brokers is a good choice。Interactive Brokers account opening fast track

The interest rate of idle funds is compared with the interest rate of time deposits of banks in various countries.

Is it more cost-effective to put money in a securities account compared to the bank's foreign currency time deposit rate??Let's take a look at the following interest rate comparison, using Interactive Brokers' USD idle funds rate as a comparison。

| IBKR US Dollar Interest Rate | US dollar current interest rate (% per annum) | US Dollar Fixed Deposit Rate (% per annum) | |

| Bank of Taiwan | 4.83% ★★★ | 1.45% | 3.85% |

| Public Bank of Malaysia | 4.83% | 2.62 | 5.50% ★★★ |

| DBS Bank (Singapore) | 4.83% ★★★ | 0.030% | 4.63% |

As can be seen from the above list, the annual interest rate on US dollar fixed deposits of the Bank of Taiwan and Singapore Credit Suisse Bank is 3.85% and 4.63%, compared to Interactive Brokers' 4.83% US Dollar Idle Funds Interest Rate Better。Malaysia's Volkswagen Bank, on the other hand, has the highest dollar deposit rate of any of the comparator banks, at 5.50%

Note: After opening a bank foreign currency account, investors can choose to deposit their funds in the account to earn current interest, or transfer them to a US dollar time deposit account and bind them for a period of time to earn higher interest rates.。The advantage of foreign currency time deposits is that they benefit from exchange rate fluctuations, hold strong currencies such as the U.S. dollar and the Singapore dollar, and have the opportunity to earn foreign exchange differences.

However, time deposits are tied to fixed terms, and if you choose to unwind and withdraw money before they expire, you will lose interest (depending on the contract, interest rates will be reduced and interest rates will be discounted when some bank deposits are unwound early)。In contrast, keeping money in a securities account does not need to be tied up for a period of time and is very free and flexible in the movement of funds.

SUMMARY

So, should you continue to hold cash in a securities account or is it more cost-effective to transfer it to a bank for a fixed deposit in U.S. dollars??Investors have several ways of thinking, including trading habits and the amount of idle funds

If you are an investor active in the securities market, a deposit of a higher amount of funds, not only can take advantage of investment opportunities at any time, without the need to temporarily rush into the gold, but also lock in the exchange rate, such as when the dollar is lower against the ringgit, with the ringgit into the gold dollar, how much can save a little investment costs。And the interest on cash balances offered by securities accounts, which allows funds to add a little bit of income even if they don't enter the market, is an added advantage。Like Interactive Brokers idle funds rates up to 4.83%, the highest dollar rate in the industry today。Opening an IB Investment Account

If you don't have a high deposit at a time, or are not used to keeping large amounts of cash in a securities account, it's more cost-effective to deposit idle funds in a bank's foreign currency account。This is because there may not be interest on the cash left in the securities account and interest will only be paid if the minimum threshold set by the brokerage firm is met.。In the case of Interactive Brokers, for example, it is required that idle funds must be more than $10,000 to bear interest (approximately 45,549.99 ringgit)。The amount of cash deposited in a bank's foreign currency account is not too high, although there are also minimum deposit requirements, such as a minimum of RM10,000 for public bank foreign currency deposits.

Meet the Lowest Cost Brokers Interactive Brokers

Interactive Brokers, a world-renowned veteran U.S. brokerage firm, is the preferred brokerage firm for many investors to trade in overseas markets.。Interactive Brokers is a global trading account that can trade up to 150 international markets (the Taiwan stock market officially opened in July 2023), providing trading in financial commodities including stocks, ETFs, REITs, options, futures, foreign exchange, bonds, indices, CFD, funds, cryptocurrencies and more.

It has the reputation of "lowest cost broker," trading U.S. stocks and ETFs, IBKR Lite users enjoy zero commission;.$005, a minimum of $1 per transaction, and no platform fees, can greatly reduce the cost of investing in U.S. stocks.。Its professional investment platform provides many advanced analysis functions, real-time news, professional analyst reports, etc., suitable for novice to veteran investors

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.