What are the low-risk investments in Malaysia??

Low-risk investment refers to obtaining a certain rate of return under safe and controllable conditions.。This kind of investment performance is relatively stable, but also can have up to 6% of the return。

High Yield Savings Account

A high-yield savings account is a savings account with a higher interest rate than a savings account, but requires certain conditions, such as deposits, expenses and investments, to enjoy a higher interest rate。General savings accounts offer 0..2 to 1.5% annual interest rate。As long as you meet the conditions, you can open a high-yield savings account, enjoy a higher annual interest rate, so that the deposit is not only placed in a bank account, but also disguised as a stable and low-risk investment.。

Malaysia's major banks have launched high-yield savings accounts, and each bank offers different annual interest rate concessions and conditions for obtaining annual interest rates.。Different banks will offer different preferential high-yield savings accounts from time to time, simply choose a high-yield savings account that fits your current economic situation and your preferred preferential annual interest rate。

Advantages:

- Annual interest rates are higher than typical savings accounts.

- Guaranteed by Malaysian Deposit Insurance Corporation (PIDM) for amounts up to RM 250,000

- Zero risk

Disadvantages:

- There are minimum balance requirements

- Monthly deposit, payment, consumption and investment requirements set by the bank to earn an annual interest rate return

Time deposits

Among low-risk investments, time deposits are the least risky and most stable option.。As long as the funds are deposited within the period specified by the bank, the principal and interest will be recovered upon maturity.。Deposits can be as short as 1 month, 3 months, 6 months, 12 months, 24 months, 36 months to 48 months。In general, the longer the deposit term, the higher the interest you earn。

Time deposits have higher interest rates than savings accounts, but time deposits are less flexible and funds must be kept for a certain period of time.。If you withdraw your deposit in advance, you will lose interest.。

There are two ways to distribute interest on time deposits.

- Upon maturity, interest is automatically added to the principal (Credit to Principal) and the deposit continues。

- Upon maturity, interest and principal are transferred directly to the savings account (Credit into Account)。If automatic renewal is enabled, interest will be deposited into the savings account and the principal will automatically start a new time deposit contract。

When processing a time deposit, the bank will generally ask if the automatic renewal function is enabled.。Automatic renewal means that the bank will automatically renew the term deposit when it matures, allowing the principal and interest to continue to be deposited and you won't have to go to the bank to apply for a new term deposit.。You can choose whether to activate the automatic renewal function according to your personal situation.。

Advantages:

- Annual interest rates are higher than typical savings accounts.

- Guaranteed by Malaysian Deposit Insurance Corporation (PIDM) for amounts up to RM 250,000

- Zero risk

Disadvantages: Low flexibility

However, if you want to earn higher interest rates on time deposits, you can compare the rates of different banks and pick the one with the highest rate。

The longer time deposits are locked in, the higher the interest paid by the bank。However, it should be noted that the bank will bind this fixed deposit。If you withdraw early, you will lose interest, depending on the rules of the major banks.。

In addition, banks will hold time deposit concessions from time to time and will offer higher interest rates during the concession period。Before making a deposit, you need to pay attention to the conditions attached to the activity, some banks will ask you to transfer new funds from other banks and deposit them in a time deposit.。

Foreign currency time deposits

You can deposit the converted ringgit into foreign currency, such as US dollars, Singapore dollars, euros, RMB, etc., in a foreign currency account through a bank and be unable to withdraw money within a specific period of time, after which you can withdraw money and receive interest on foreign currency time deposits.。Deposits range from 1 month, 3 months, 6 months to 12 months。As with MA time deposits, the longer you deposit it, the higher the bank interest rate you get.。

Among the many foreign currency time deposits, the U.S. dollar, as the world's most mainstream currency, is one of the most popular foreign currency options, and U.S. dollar time deposits are very popular in the market.。When the term of the foreign currency time deposit expires, you can get the specified foreign currency time deposit interest。In general, the interest earned on foreign currency time deposits is the same as the foreign currency deposited in the deposit account.。For example, if you keep a dollar time deposit, then the interest is in dollars.。

In addition, some banks can also be exchanged for ringgit。

Advantages:

- Low risk compared to other investment vehicles such as equities

- Guaranteed by Malaysian Deposit Insurance Corporation (PIDM) for amounts up to RM 250,000

- Time deposit rates in strong currencies such as the US dollar, Singapore dollar and British pound are generally higher than those in the ringgit.

- Banks have a variety of options for the maturity of foreign currency time deposits.

- As a hedge against foreign exchange fluctuations, it can diversify the risk of a single currency and make asset allocation more diversified.

- Depositing a foreign currency time deposit means buying and holding foreign currency, which can lock in the exchange rate and earn the exchange rate difference.

Disadvantages:

- Risk of foreign exchange fluctuations, which affect the value of foreign currencies

- Need to bear the bid-ask spread of bank exchange.

- Inability to withdraw cash at any time and inflexibility of funds

Provident Fund

The company will automatically deduct the deposit from the salary to the provident fund (EPF) every month or the self-employed person can deposit to the provident fund account through i-Saraan.。

In fact, the provident fund is a very good investment and financial products, the annual interest rate of about 6%。Although dividends vary from year to year, they are very stable.。Under the Employees' Provident Fund Act 1991, the minimum dividend for EPF must be maintained at 2.5% annual interest rate, and in any case will not be lower than this level, for members of the provident fund account of the money preservation and continuous value-added.。

In addition, the investment fund can also be deducted from personal tax up to RM 4,000 per year.。

As of 2007, EPF members' CPF savings are divided into 2 accounts, each with different interest and receiving conditions.。

70% of the monthly EPF contributions are deposited into Account 1, which is basically immobile because its main purpose is to force savings to prepare for future retirement pensions.。However, in order to allow members to earn higher returns on their investments, the Provident Fund Board is open to members to take out some of the funds in Account 1 to invest。Alternatively, funds can be withdrawn from Account 1 when the member is over 55, disabled, out of the country, or dies。

The remaining 30% of the provident fund each month is deposited into a second account.。The money in Account 2 allows members to withdraw it for emergencies, such as down payments, loans, education and medical expenses.。

Advantages:

- Guarantee 2.Minimum dividend of 5%

- Can deduct personal tax

Disadvantages:

- Dividend rates are not fixed

- Lower liquidity than time deposits

ASNB Trust Fund

The Chinese name of Amanah Saham Nasional Berhad (ASNB) is the National Trust Fund Corporation, a trust provided by the Government of Malaysia for investments by Malaysians.。It is invested by several government-affiliated companies, such as National Investment Co..Ltd.or PNB (Permodalan Nasional Berhad)。raise money from investors and use that money to buy shares。

ASNB has 16 trust funds, which are divided into two main categories: Fixed Price funds and Variable Price funds.。As with general investment products, ASNB trusts are not protected by the Malaysian Deposit Insurance Corporation (PIDM).。While ASNBs are not guaranteed by PIDM, fixed-price ASNBs are as risk-free as time deposits because buying a fixed-price ASNB means that the ask price must be the same as the buy price。Also venture-free, but ASNB's dividend returns are several times higher than time deposits。

Floating price (variable price)

Floating price ASNB, like other investment instruments in the market, is a venture capital instrument with fluctuating and falling prices。

When the price of a trust fund's assets rises, so does the price of the trust fund's units; conversely, the price of the trust fund falls。

Ten ASNBs at floating prices including Amanah Saham Nasional, ASN Equity 2, ASN Equity 3, ASN Equity 5, ASN Equity Global, ASN Imbang 1, ASN Imbang 2, ASN Imbang 3 Global, ASN Sara 1 and ASN Sara 2。

Fixed Price (Fixed Price)

Fixed price ASNB trust funds are the same as our general bank time deposits。It's $1 when you buy it and $1 when you sell it, not a penny less。It's a true zero-risk investment.。

ASNB has six fixed-price trusts, three of which are open to indigenous Malaysians, the other three being Amanah Saham Malaysia (ASM), Amanah Saham Malaysia 2-Wawasan (ASM2) and Amanah Saham Malaysia 3 (ASM3).。

While three ASNBs are open to non-local buyers, these three funds have limited amounts。As long as the number of purchases reaches the limit, you'll need to wait for someone else to sell the fund before you can buy more。

Advantages:

- No handling fee

- Zero risk

- Payouts received higher than RMb time deposits

Disadvantages:

- Limited quantity, difficult to buy

- There is a limit on online withdrawals, up to RM 1,000

Education Savings Fund

SSPM Prime

SSPN Prime is a savings scheme launched by the Malaysian Higher Education Fund (PTPTN), which allows parents to save for their children's education fund savings account, which is also open to non-parents to apply.。It does not set any deposit and withdrawal conditions, you can deposit and withdraw any amount of funds at any time, but you must ensure that the account retains a deposit of at least RM 20 after withdrawal。After applying for a withdrawal, users must wait 14 working days to receive the money。

The deposit of SSPN Prime made by the user is guaranteed by the Malaysian government.。The National Higher Education Fund (PTPTN), under the supervision of the government, earns returns in the local market through short-term and long-term investments in line with Islamic teachings, rewarding users with dividends。

Users of SSPN Prime can receive interest allocated by the National Higher Education Fund of Malaysia each year, generally from 3% to 4%。Tax deductions of up to RM 8,000 are available to parents if opening an SSPN account for a child and not to non-parents。

In addition, as long as the amount of savings reaches RM 100 or more, you can enjoy free Muslim insurance coverage, including one-to-one death compensation, permanent disability compensation and death benefits, and eligible families can also apply for grants up to RM 10,000.。

SSPN Plus

SSPN Plus is an upgraded version of SSPN Prime Time Deposit Account with added insurance features。SSPN Plus has 6 different packages including: Intan, Delima, Topas, Zamrud, Nilam and Berlian。Depending on the package selected, the user's fixed minimum deposit varies from month to month, with a minimum of RM 30 and a maximum of RM 500。

SSPN Plus deposits will be divided into savings and insurance:

- Intan: RM 30 / Month (Savings RM 20 + Premium RM 10)

- Delima: RM 50 / month (savings RM 40 + premium RM 10)

- Topas: RM 100 / month (savings RM 90 + insurance premium RM10)

- Zamrud: RM 200 / Month (Savings RM 180 + Premium RM 20)

- Nilam: RM 300 / Month (Savings RM 270 + Premium RM 30)

- Berlian: RM 500 / month (savings RM 200 + premium RM 300)

The protection provided by SSPN Plus includes death and hospitalization benefits, 36 kinds of serious illness, permanent disability compensation, etc.。In addition to the same RM 8,000 tax relief as SSPN Prime, SSPN Plus has an additional Takaful tax relief of up to RM 3,000 and offers up to RM 11,000 tax relief。

It is important to note that the user must open an account for 3 years before withdrawing money and must retain at least RM 1,000 in the account after withdrawal.。After applying for a withdrawal, users must wait 14 working days to receive the money。

Advantages:

- Stable, low-risk, 3-4% payout per year

- Protected by the Malaysian Deposit Insurance Corporation (PIDM)

Disadvantages:

- After applying for a withdrawal, users must wait 14 working days to receive cash

- SSPN does not have detailed performance reports and investment project announcements.

- Limited withdrawal requirements, poor liquidity

Cash Management Platform

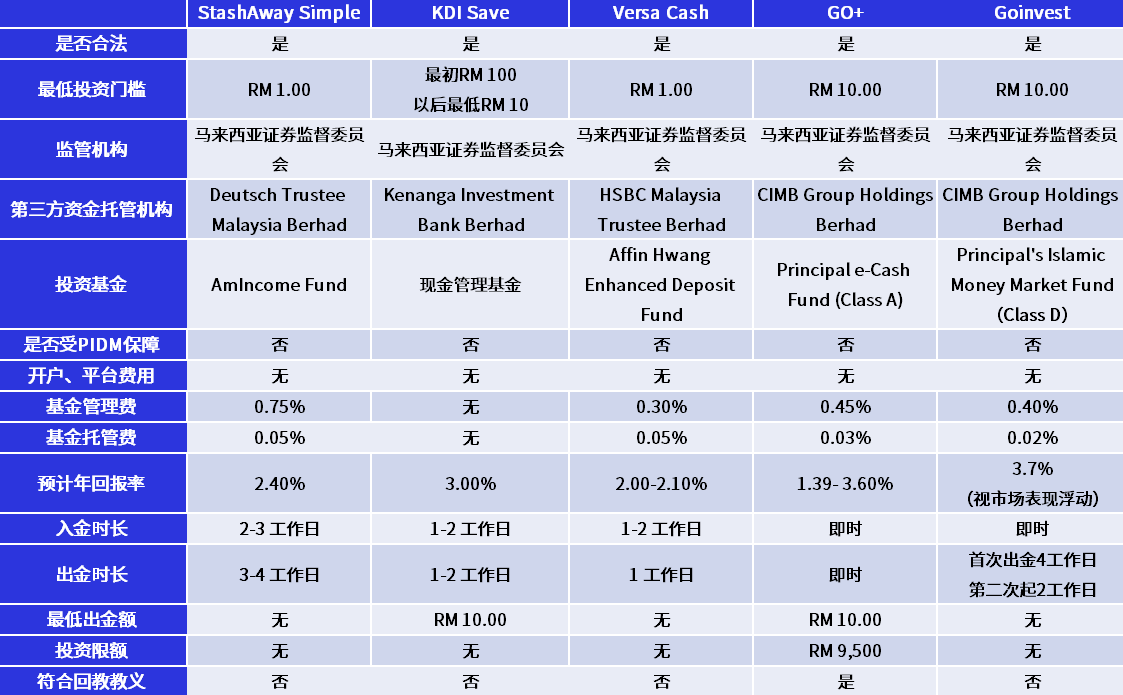

StashAway Simple

StashAway Simple is a money management tool launched in 2019 to invest your money in the Eastspring Investments Islamic Income Fund.。It doesn't have a lock-up period. You can save it as long as you want.。As long as you deposit at least RM1, you can get 2.4% expected fixed rate。

StashAway Simple is a money management platform regulated by the Securities Commission Malaysia.。StashAway Simple's money custody is Deutsch Trustee Malaysia Berhad, while the investment fund is AmIncome Fund。

KDI Save

KDI Save is an AI smart money management platform launched by Kenanga Investment Bank Bhd in Malaysia in February 2022。It uses AI artificial intelligence to provide the best return portfolio based on the user's investment objectives, financial situation, risk appetite and other information.。

KDI Save invests the money invested by investors in Fixed Deposits and money market instruments at the Kennag Investment Bank.。From a bank's perspective, money market instruments help them accumulate short-term cash reserves to cover the shortfall in daily reserves。These investment vehicles are highly liquid, have short maturities and are relatively low risk compared to other investment vehicles.。As a result, KDI Save is able to offer interest rates comparable to time deposits。

KDI Save earns interest at a daily rate of 3 per annum..00%, you only need to invest in RM 100 and you can start earning a return on your reserve amount through KDI Save without a fixed binding period and without paying management fees, conversion fees and upfront fees.。

Versa

Versa is a Malaysian fintech digital money management platform launched in 2021 in partnership with Affin Hwang Asset Management Bhd。Versa is a money management platform under the supervision of the Securities Commission Malaysia。Versa's escrow is HSBC (Malaysia) Trustee Berhad, while the investment fund is Affin Hwang Enhanced Deposit Fund。

Versa has no complicated procedures, lock-in periods and hidden fees and offers 2 per day.0-2.Expected annual interest rate of 1% (after deducting money management and custody costs)。The minimum investment threshold is RM1。

GO +

GO + is a small investment project launched by Touch'n Go and Principal Asset Management Berhad in Malaysia in 2021.。As long as you have RM 10 in Touch'n Go eWallet or in the bank, you can transfer your e-wallet balance or bank deposit to GO +, start investing in money market funds through GO +, earn interest every day, and get a higher interest rate than a bank savings account!

GO + is the second largest bank in Malaysia, CIMB Group Holdings Berhad, and the investment fund is Principal e-Cash Fund (Class A).。

The interest on GO + is calculated daily and will be deposited into the GO + account in the early hours of the second day, with the return based primarily on the return on Principal e-Cash Fund (Class A)。The annual interest rate of the Principal e-Cash Fund (Class A) is adjusted according to the performance of the market and the fund。Simply put, the interest you earn will vary from day to day。

GO + as an additional investment function of e-wallet, suitable for novices who don't have much money and want to enter the market but don't know anything about investment.。As long as the network, the use of mobile phones, put at least RM 10, you can invest anytime, anywhere, but also at any time to withdraw cash from the GO + account, very flexible and convenient, will not affect the liquidity of funds。

It is important to note that GO + has a maximum placement limit, you can only place up to RM9,500 in GO +。Funds invested in GO + are also not covered by the Malaysian Deposit Insurance Corporation (PIDM).。In other words, if there is a problem or sudden failure of the money market fund, GO + users will not be able to get their principal back.

GOinvest

GOinvest is an investment project jointly launched by Malaysia's Touch'n Go Group and Principal Asset Management Berhad in 2022.。You only need to invest in GOinvest at least RM 10 through the Touch'n Go e-wallet (eWallet app) to get an annual return of up to 3.7% return (non-guaranteed return, which will fluctuate with market performance)。

GOinvest's money custody is Malaysia's second largest bank, CIMB Group Holdings Berhad, while the investment fund is Principal's Islamic Money Market Fund (Class D).。

Principal's Islamic Money Market Fund (Class D) invests 90% of its funds in Islamic money market instruments and 10% in Islamic fixed income instruments, such as Islamic time deposits, Islamic acceptance bills, Islamic negotiable deposit notes, etc.。

GOinvest is regulated by the Securities Commission Malaysia.。There is no lock-up period for funds placed in GOinvest, you can withdraw them at any time.。Therefore, GOinvest can be said to be a financial investment vehicle that is in line with the dogmatic law and has high investment value, liquidity and safety.。

Another feature of GOinvest compared to Go + is the targeted investment。You can choose your personal financial goals, such as: wedding preparation, purchase of real estate, education fund, travel fund, retirement planning, etc.。GOinvest will make monthly recommendations on the amount of money to invest (cash in) based on different needs, target years, etc.。

Advantages:

- No funds tied to regular, high flexibility

- Platform interface is simple, registration, account opening process only a few minutes

- Low investment threshold

- Potential rate of return is higher than that of ringgit time deposits.

Disadvantages:

- Need to pay fund management fees and custody fees

- Time-consuming, need to wait at least one working day

- Passive investment, only the platform has the right to make investment decisions

- Funds are not covered by the Malaysian Deposit Insurance Agency (PIDM)

Bonds

When a company or government in a country borrows money from the public, institutions, or other countries instead of banks, it is called a bond issue。

A bond is a certificate, usually the issuer of the bond (government or company) will agree with the investor on the payment of interest and the amount to be returned at maturity.。Generally, bonds will clearly indicate the coupon amount, coupon rate, interest payment period and maturity date。

It should be noted that since the bonds are issued and then circulated in the market to raise funds from the public, as long as they buy their bonds, they indirectly lend the money to the bond issuer, rather than borrowing money from the other party privately.。As a result, bond prices are also affected by market supply and demand linkages。

interest-bearing bonds

The investor holding the bond will receive the proceeds through the periodic interest payments promised by the bond issue and the coupon amount (remaining arrears) at maturity。

zero coupon bonds

Investors holding bonds will not receive any periodic interest, but will receive the coupon amount (arrears and interest) directly at maturity.。

Bond interest is calculated based on the interest rate calculation method used by the bond issuer and is divided into fixed and floating rates.。The fixed rate is the rate set at the beginning of the repayment, and the floating rate is based on changes in market interest rates.。

investment mode

For investors with less capital, the likelihood of investing directly in bonds is lower, as most bonds have a minimum investment of hundreds of thousands, millions, or even tens of millions。If you really have large sums of money to invest directly in bonds, you can offer bond trading services to local private banks or bond dealers to buy。

You can also invest in bonds indirectly by investing in bond funds or bond ETFs.。Compared to buying bonds outright, bond funds not only allow investors with less money to participate in bond investments, but also help investors diversify their risk, as buying a bond fund is equivalent to buying a lot of different small portions of bonds and not having to worry about the entire loss of the fund due to a default by the bond issuer.。

In Malaysia, fund companies or banks such as FSMONE, Volkswagen Trust, Manulife Insurance, etc. provide bond fund sales services.。As long as you log on to the platform, you can choose your favorite bond fund。

Precautions

Before issuing bonds, the issuing company has to go through a credit rating agency (CRA) to evaluate the company's ability to repay loans and the company's own loan credit, and convert the score into bonds.。Before investing in a bond, an investor can see the grade of the bond, from high to low, e.g., AAA, BB, C。The higher the rating, the lower the probability that the company will default on its debt。If the issuer's credit profile or market conditions change, the bond price will change。

Bonds are one of the investment vehicles in the market, and the way investors make a profit is through the interest rate on the bonds.。If the credit of the issuing company deteriorates, it will indirectly cause investors to lose confidence in the bonds and thus divest from selling them。According to the principle of market supply and demand, when selling is higher than buying, bond prices fall。

In addition to bonds as an investment vehicle, there are also stocks and funds in the market.。When the market performs well and the market interest rate is higher than the bond coupon rate, most investors will pour their money into other projects one by one, rather than buying bonds, and bond prices will fall.。

Islamic Bond ETBS

An ETBS is a fixed income security that is traded in the stock market, also known as a bond or sukuk。ETBS is issued by a company or government to raise funds。It has different structures such as fixed rate, floating rate and mixed rate.。

ETBS is flexible and simple to trade on Bursa Malaysia。Investors can get real-time prices and quantities through the stock exchange, be able to follow up on investments and get the latest information。Investors can get regular income through regular coupons.。

It is important to note that credit risk will increase if the ETBS issuer fails to pay the coupon on time or fails to repay the principal to the investor at the end of the term。Government bonds and sukuk have lower credit risk because they are backed by the central government。

The price fluctuations of ETBS are also influenced by market supply and demand.。In addition, the assessment of ETBS may be affected by changes in interest rates。For example, when interest rates rise, the price of ETBS will fall as investors move to invest in other financial instruments (such as bank deposits)。

ETBS minimum trading volume of 10 units。At par per unit RM 100.00 calculation, RM 1,000 per transaction unit, excluding transaction costs。ETBS is traded in the same way as shares, using the same (T + 3) payment and liquidation rules。

Advantages:

- Interest rates higher than time deposits

- The rate of return is quite stable

Disadvantages:

- Long investment period

- Higher investment costs

paper gold

Paper gold is a paper trade in gold and does not involve physical gold trading.。After the investor opens a gold passbook account, he can trade paper gold.。Investors can check the paper gold transactions and balances in the gold passbook.。

Investors who buy and sell paper gold according to bank quotes can earn the difference in gold price fluctuations by grasping international gold price trends.。Paper gold, like foreign exchange, has Buying Price and Selling Price.。

There is a minimum amount for each paper gold transaction, some require at least 1 gram and some require at least 5 grams。If the price of 1 gram of gold is RM 250, in other words, the minimum transaction amount also requires RM 1,250。

Selling Price refers to the price at which banks sell gold and Buying Price is the price at which banks buy gold from you.。

In Malaysia, not all banks will sell paper gold, as of February 2023, only six banks provide paper gold investment services, each bank to sell paper gold treaty is not the same, Selling Price and Buying Price is updated daily.。These include:

- Public Bank Gold Investment

- Maybank Gold Investment Account

- CIMB e-Gold Investment Account (eGIA)

- UOB Gold Investment Account

- Kuwait Finance Junior Gold Account-i

- Kuwait Finance Gold Account-i

Advantages: low investment threshold, can use a small amount of money to invest

Disadvantages: medium and long term investment, short time can not make a lot of money

blue chip stocks

Blue chips refer to large capital stocks, i.e., they have to have a certain market capitalization to qualify as blue chips.。In general, blue chips are compared to the most representative local composite indices, such as Malaysia's FBM KLCI Index, Singapore's FTSE Straits Index, Hong Kong's Hang Seng Index, and more.。

In general, blue-chip companies have a very mature business scale, covering multiple regions and occupying a large market share and market capitalization of huge companies.。In Malaysia, the top 30 listed companies with many years of history, stable financial performance and market capitalization are known as blue chips, e.g. Volkswagen Bank, Malaya Bank, Genting, etc.。All of these companies have one thing in common, and that is that they are more than 50 years old from the time they were founded.。

Blue-chip companies are very large and their brands are trusted to deliver good financial results, so financial performance remains stable or continues to grow。Blue chips are also more mature companies that do not need to actively continue to invest in expanding their business and will distribute some of their profits to shareholders as dividends, so the payout ratio will be higher。

However, not all blue chips pay high dividends。After all, every company has its own dividend policy, but most blue chips pay good dividends。Blue-chip stocks have a large number of outstanding shares, are highly liquid and share price volatility is relatively small, so they are often traded by investment institutions and ordinary investors.。

Simply put, you can analyze whether a company can be considered a blue chip in terms of the three most important indicators:

- Awareness: The company name is a household name

- Authority: the company has a long history

- Safety: The company's financial position is stable during booms and busts

Precautions

Many people think that investing in blue chips is a sure way to make money, but that's not necessarily the case.。

First, there are systemic risks in the stock market.。Systemic risks are risks that cause global stock markets to plunge and cannot be avoided by diversifying their portfolios, including: the 2008 financial turmoil, the new coronary pneumonia epidemic in 2020, and the war between Russia and Ukraine in 2022.。

Second, if the outlook for blue chips is no longer bright, it is likely to make less and less money in the future, and blue chip share prices and dividends will fall。Regardless of the stock, the core reason for the rise in share prices is the continued rise in earnings。

Before investing in blue chips, we need to know the characteristics of quality blue chips.

- The company has a large competitive advantage in the industry.

- Company business remains stable, or continues to grow

- High dividend yield (above 3%)

- Low debt

- high return on assets

No matter how good a blue chip is, it's not a good investment to buy at the wrong price。After finding a good blue chip, you also need to analyze whether the blue chip's share price is reasonable.。

Advantages:

- Low risk, the company's business is mature and stable, and the share price will not fluctuate significantly in a short period of time.

- Stable dividend compensation

Disadvantages:

- Limited upside to share price due to mature business, modest gains, smaller capital gains

- High stock price, not suitable for small investment

How to invest in blue chips?

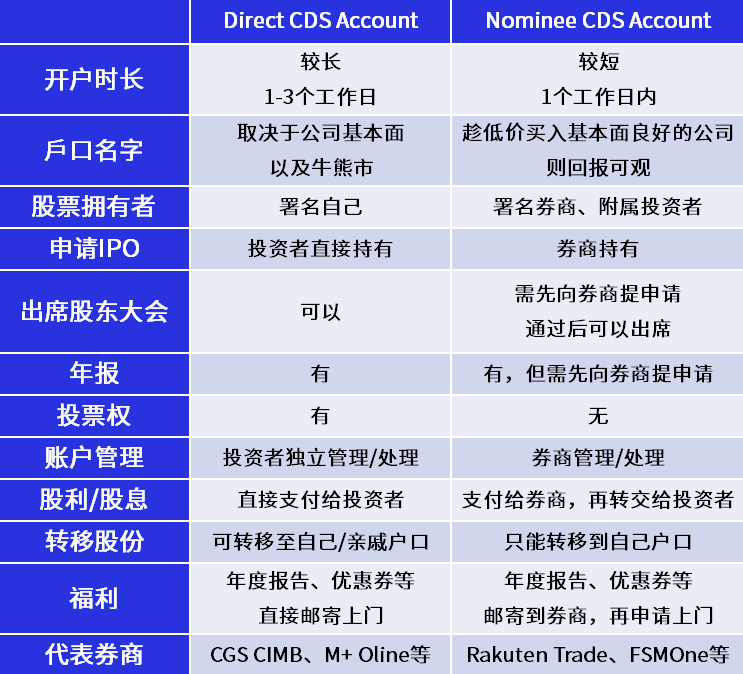

If you do not have an investment account but want to invest in Malaysian blue chips, you must open an investment account.。In Malaysia, investment accounts can be divided into: Direct CDS Account and Nominee CDS Account。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.