"Silicon Valley" in Malaysia: cradle of local chip start-ups

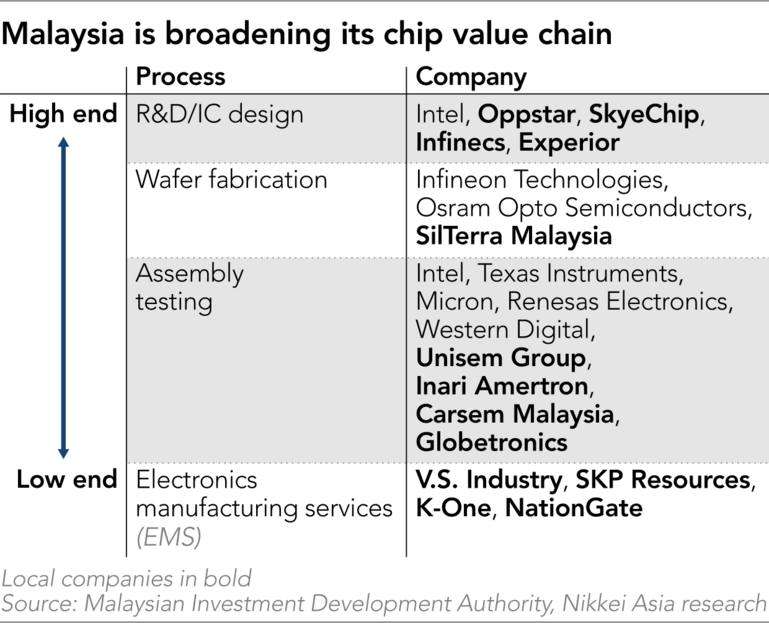

Malaysia has a history of about 50 years in the backend of the semiconductor industry supply chain. Currently, it is actively targeting high value-added sectors at the front end of this industry.

In recent years, the global semiconductor industry has been experiencing rapid growth, with Malaysia emerging as an important player in this technological battleground. As the competition between China and the US for global technological dominance intensifies, their differences over technology access have become increasingly tense. Consequently, many countries have imposed restrictions on the export of advanced chips and manufacturing equipment, leading numerous semiconductor companies to turn their attention to Southeast Asia, with Malaysia being one of the beneficiaries.

As the "backend" of the semiconductor industry (packaging, assembly, chip testing), Malaysia has a history of around 50 years. Since Intel established its first overseas assembly plant in Penang in 1972, Malaysia has played a significant role in the global chip industry. Today, it has become the world's sixth-largest exporter of semiconductors and one of the largest contributors to US semiconductor imports, accounting for approximately 23%.

According to a report by the Malaysian Investment Development Authority, Malaysia holds a 13% market share in chip packaging, assembly, and testing services globally. However, the disparity between domestic investment and foreign direct investment remains significant, indicating that Malaysia can still dedicate to enhance the value chain of semiconductor industry.

It is reported that Malaysia is actively targeting the high-value sectors of the global industry worth $520 billion, such as wafer fabrication and integrated circuit design. In 2023, Malaysia attracted approximately $41.061 billion in foreign direct investment, surpassing the total sum from 2013 to 2020.

Among them, Intel and Infineon each invested over $7 billion to establish chip packaging and testing facilities and wafer fabrication modules respectively. Nvidia is collaborating with Malaysia's YTL Group to build a $4.3 billion AI data center. Texas Instruments, Ericsson, Bosch, and Panasonic have also expanded their operations in Malaysia.

However, despite Malaysia's presence in the semiconductor industry, it still lags behind competitors like South Korea and Taiwan in the more technologically advanced chip manufacturing sector. Considering that around 90% of global semiconductor equipment spending is allocated to wafer fabrication processes, this reflects Malaysia's shortfall in the global semiconductor industry, as it has missed out on opportunities by not entering the "front-end market" of chip manufacturing.

Industry insiders emphasize that tapping into the front-end market is crucial for the development of Malaysia's semiconductor industry. However, the high costs involved in building cutting-edge chip factories make this goal even more challenging. Therefore, for newcomers, a lighter asset approach to chip design business may be a more feasible option.

In addition to penetrating the front-end market, Malaysia's semiconductor industry also faces the challenge of talent drain. Large multinational companies typically offer higher salaries than local companies, making it an urgent task to attract and retain engineers. Furthermore, an increasing number of locals are choosing to work in neighboring Singapore, adding pressure to Malaysia's semiconductor industry's talent pool.

Overall, Malaysia's chip industry is on a flourishing stage. With support from the national government and industry associations, last year, Malaysian chip design company Oppstar was officially listed on the Malaysian stock exchange. Despite sluggish global listing activities, investors flocked in, driving its stock price up by 286% on the first trading day.

Established in 2014, this chip design company specializes in developing custom chips for clients. Due to changes in the global geopolitical landscape affecting the chip supply chain, the company has secured large-scale projects from global clients, which are expected to elevate Malaysia's role in the global semiconductor industry.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.