What is ADR??What's the difference with stocks??

The shares of foreign companies listed in the United States are called ADRs.。

What is ADR??

ADRs are American Depositary Receipts (ADRs), through which ADR investors trade shares issued by companies outside the United States in U.S. dollars on U.S. exchanges.。

Why should companies issue ADRs??

Greater mobility

The New York Stock Exchange (NYSE) and the Nasdaq Exchange (NASDAQ) are the exchanges with the largest liquidity in the world, and the U.S. dollar is also the internationally used trading currency.。Listing in the U.S. also means a larger market, more capital, and a stronger ability to raise capital。

Lower cost of listing

Compared to listing a company in the U.S., issuing ADRs simply hands over the shares to a custodian bank for a secondary offering.。Issuing ADRs can save more time and reduce taxes than other listing methods。In addition, issuing ADRs requires simpler requirements than listing。

Higher exposure

For a company, a U.S. listing is the best exposure, and with the endorsement of the Securities and Exchange Commission (SEC), investors can trust the company more and indirectly improve its reputation。

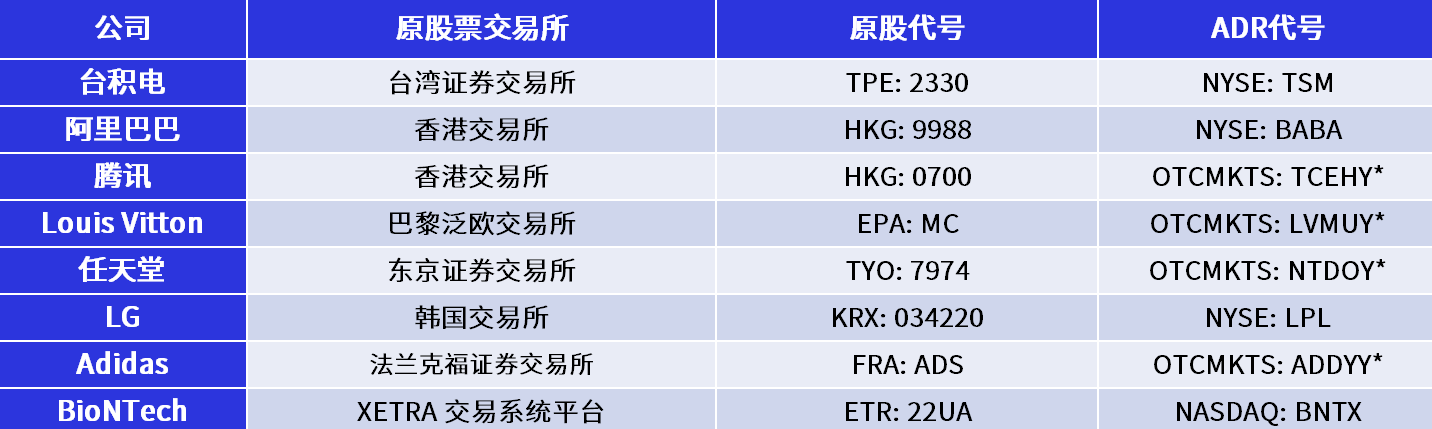

Which ADR companies are listed in the United States?

Are all U.S. foreign stocks ADRs??

No, some foreign companies such as Grab (GRAB) have merged with a special purpose acquisition company (SPAC) and listed on the Nasdaq Stock Exchange in the form of an initial public offering (IPO).。SPAC is also one of the ways for foreign companies to list in the United States.。

Difference between ADR and Common Stock

Transaction Currency

ADRs are traded in U.S. dollars, and the country from which the stock originates trades in the local currency of that country.。In addition, each different stock will have a different ratio of conversion to ADR。

Conversion ratio

Each company will disclose the ratio of the original stock to the ADR before issuing the ADR, and some will adjust the ratio to make the unit price of the U.S. stock lower.。

Premium and discount

Because ADRs are not traded in the same currency as the local exchange, fluctuations in the currency exchange rate can cause a difference in the price of both ADRs and stocks, a difference known as a discount or premium to ADRs。

- ADR - Original Stock > 0 (Premium)

- ADR - Original stock < 0 (discount)

Benefits of investing in ADRs

Higher efficiency of buying and selling

The United States has the most mature economic market and the most liquid stock market in the world.。High liquidity also means that stocks are bought and sold more efficiently and at more affordable prices for investors.。

Stability of the dollar

As an international currency, the U.S. dollar has risen relatively steadily, and investors do not need to exchange local exchange rates multiple times to raise costs.。If the company pays a dividend, the custodian will also convert the dividend into U.S. dollars to the ADR investor.。

SEC Guarantee

The SEC is the principal federal regulator of the U.S. securities industry, responsible for promoting disclosure, protecting investors, and combating fraud and manipulation in the securities markets, with five members appointed by the President of the United States.。

Shares traded in the U.S., whether common stock or ADR, are subject to SEC approval before they can be listed or issued, a move that helps protect investors' interests。

The disadvantages of investing in ADR

Additional custody fees are required to increase investment costs

Many people ignore the escrow fee for ADRs when considering investing in ADRs.。

ADR custody fees are settled in U.S. stocks and typically range from $0 per share..01 to $0.03 USD, different ADRs will have different fees for different custodians。

Custody fees are calculated on a per share basis, so the more you buy, the higher the cost of custody will be。

Risk of delisting due to political factors

SEC regulation can also be a double-edged sword。While raising shareholders' equity, it also faces political implications。

- Delisting Event

- Three major telecommunications delisting

In January 2021, China's three major telecom operators were suspended from the New York Stock Exchange and delisted in May of the same year.。

The three companies were originally China Mobile Ltd. (China Mobile Ltd..CHL), China Telecom Co., Ltd. (China Telecom Co.., CHA) and China United Network Communications (Hong Kong) Co., Ltd. (China Unicom (Hong Kong) Ltd..CHU)。The reason is that the US government claims that the company has security risks, providing support to China's military intelligence and security services.。

Regulatory Bill Introduced

Former U.S. President Donald Trump also signed a bill during his tenure, the Foreign Corporate Accountability Act, which requires U.S. regulators to successfully review audits of Chinese companies within three years or the Chinese company will be forced to delist and exit the U.S. securities market.。

For a variety of political reasons, these medium-sized ADRs are also much more risky in the U.S. market。Affects investor confidence in the general, delisting risk is a must know before investing in ADRs。

Risk List

The SEC also updated a batch of 88 U.S.-listed Chinese (Chinese) companies in May 2022 to include a total of 188 companies on the delisting risk list.。

Among them, 23 companies that are familiar to everyone, such as Weibo, iQiyi, Baidu, Futu and Northra, have been included in the confirmation list.。The SEC's big move has also led to a lot of panic selling, and the Hong Kong and A-share markets have experienced major turmoil.。

If you think there is a high risk of investing in Chinese companies / ADRs listed in the US, you can choose to invest directly in Chinese A-shares to avoid the risk caused by US-China politics.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.