Stop Loss - Top 4 Best Ways to Use It

Stop loss orders can only save you if you place them correctly.Here are the best ways to do it.

What is Stop Loss?

A stop loss is a risk management tool designed to prevent traders from incurring losses beyond their acceptable level. It is a pending order that turns into a market order when the price reaches the predefined stop loss level. The primary purpose of a stop loss is to protect the trader's capital, ensuring that even if the market moves unfavorably, losses can be kept within an acceptable range.

Risks and Limitations of Stop Loss

Stop loss is not a guaranteed tool. In cases of extreme price volatility or gaps, the stop loss may not execute at the exact price level set. For instance, during high volatility periods, slippage can occur, causing the stop loss to be executed at different price levels. While stop loss is effective in limiting losses, its efficacy can be compromised under extreme market conditions.

Hard Stop Loss vs. Mental Stop Loss

1.Hard Stop Loss

- Definition: A hard stop loss is an automatic order set on the trading platform of the broker. When the market price hits the stop loss level, the system will automatically close the position.

- Advantages: It does not require real-time monitoring of the market, making it suitable for traders who cannot constantly track market movements.

- Disadvantages: If the broker does not provide a stop loss option, or if there is a technical failure, it may not execute as intended.

2.Mental Stop Loss

- Definition: A mental stop loss is a manually set level that requires the trader to actively monitor the market and close the position when the price reaches the predetermined level.

- Advantages: Provides flexibility in responding to market dynamics, especially with brokers that lack a stop loss feature.

- Disadvantages: Can be affected by emotional factors, potentially leading to delayed or missed stop loss actions.

Stop Loss Placement Strategies

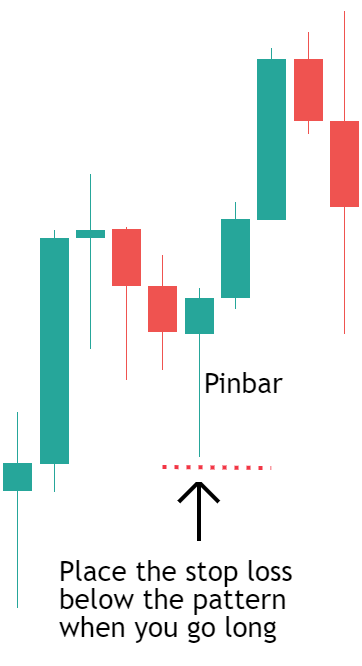

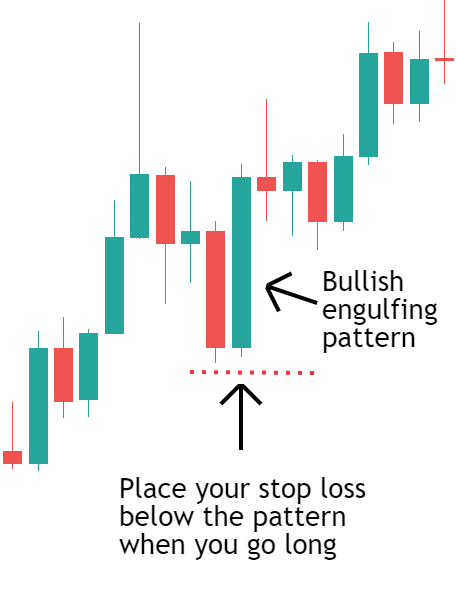

1.Entry Pattern Stop Loss:

Definition: This involves setting a stop loss based on chart patterns (e.g., pin bars, engulfing candles). When the price breaks the entry pattern, the stop loss triggers.

Application:

- Pin Bar: Set the stop loss on the opposite side of the pin bar's low point.

- Engulfing Pattern: Place the stop loss on the other side of the engulfing pattern's high or low point.

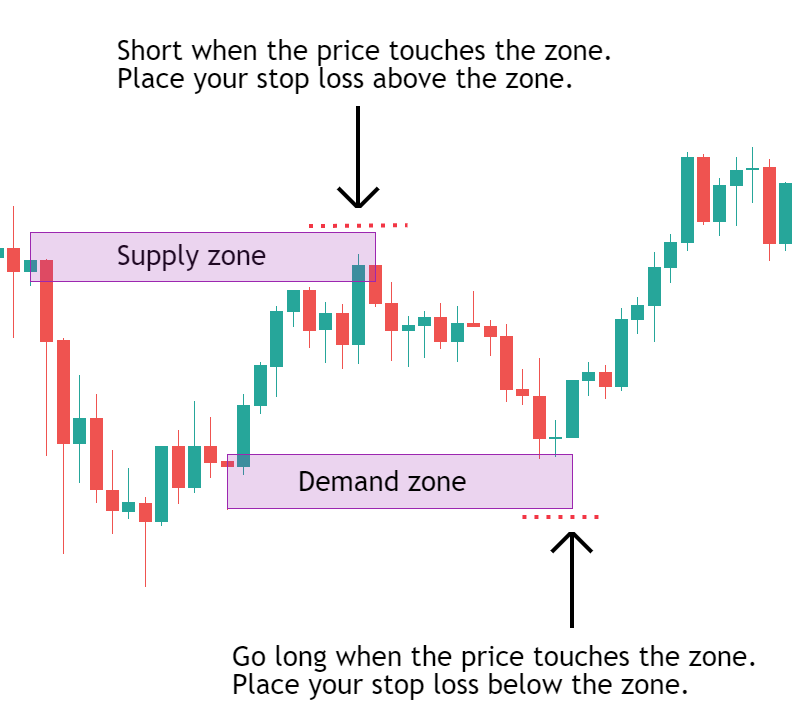

2.Supply/Demand Zone Stop Loss

Definition: This strategy uses historical levels of strong price movements (supply/demand zones) to set stop losses. When the price reaches these levels again, the stop loss is placed to protect the trade.

Application:

- Support Zone: Set the stop loss below the support zone if the price breaks it.

- Resistance Zone: Set the stop loss above the resistance zone if the price breaks it.

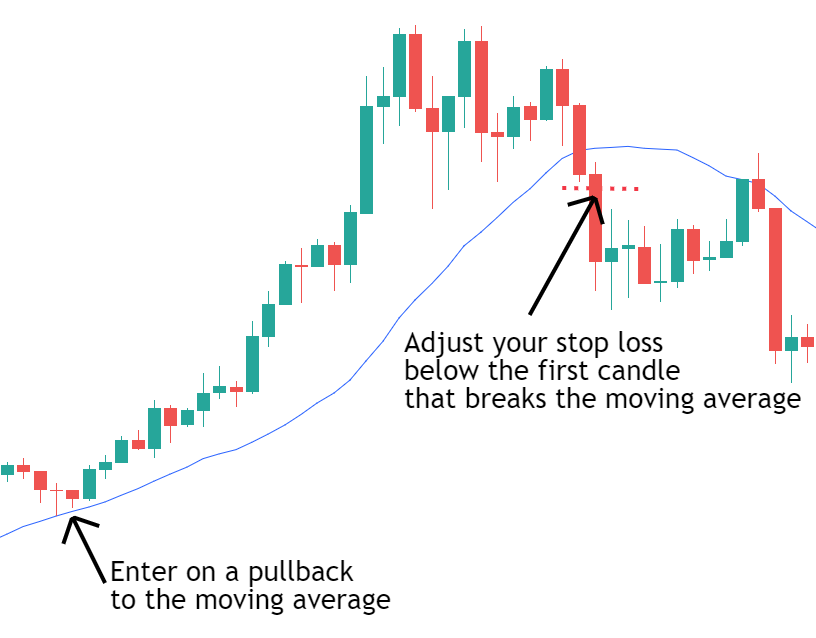

3.Moving Average Stop Loss

Definition: Utilizes moving averages to determine stop loss levels. When the price moves below the moving average during an uptrend (or above in a downtrend), the stop loss is adjusted accordingly.

Application:

- Uptrend: Set the stop loss just below the moving average. If the price breaks below the moving average, the stop loss triggers.

- Downtrend: Set the stop loss just above the moving average.

4.Maximum Loss Stop Loss in $:

Definition: This method involves gradually building a position and closing it if the total loss exceeds a predefined amount.

Application:

- Incremental Positioning: Add to positions on declines and adjust as the price moves. If losses exceed the maximum allowed, close the position.

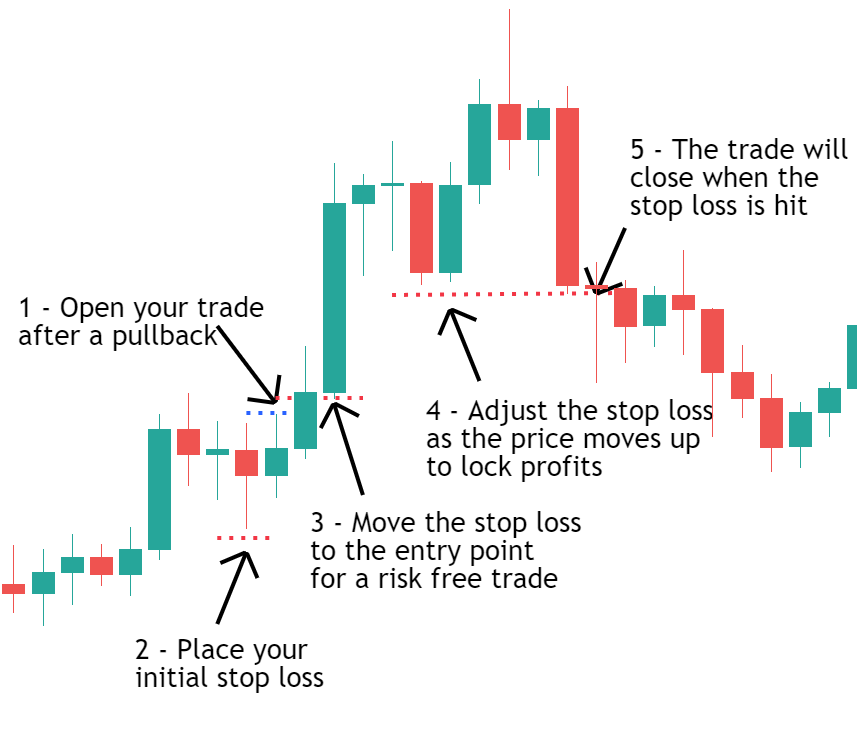

Locking in Profits with Stop Loss

Stop loss is not only for preventing losses but also for securing profits. Initially, a stop loss is set to limit losses. As the price moves favorably, the stop loss can be adjusted to lock in profits. This method is known as a "trailing stop."

Procedure:

- Initial Stop Loss: Set to limit losses upon trade initiation.

- Adjusting Stop Loss: As the trade becomes profitable, move the stop loss to the entry point or beyond to secure profits.

Trading Without Stop Loss: Risks and Alternatives

Although trading without a stop loss is possible, it significantly increases the risk of long-term losses. Particularly when using leverage, even small price moves can result in substantial losses. For leveraged trading, it is highly recommended to use stop losses. However, for non-leveraged trading, such as stock trading or using a cash account for cryptocurrencies, managing position sizes and avoiding leverage can mitigate risks associated with not using stop losses.

Summary

A stop loss is a critical risk management tool used to limit maximum losses and protect profits. Depending on market conditions and individual trading styles, various stop loss strategies can be employed, including entry pattern stop loss, supply/demand zone stop loss, moving average stop loss, and maximum loss stop loss in $ terms.

While stop loss may not be perfect in extreme market conditions, it remains essential for managing risk and protecting capital.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.