How to choose investment products?5 Common Investment Products Comparison

Investment commodities on the market are by no means limited to time deposits。Many people choose to increase their wealth by buying stocks, fund units, ETFs, etc.。

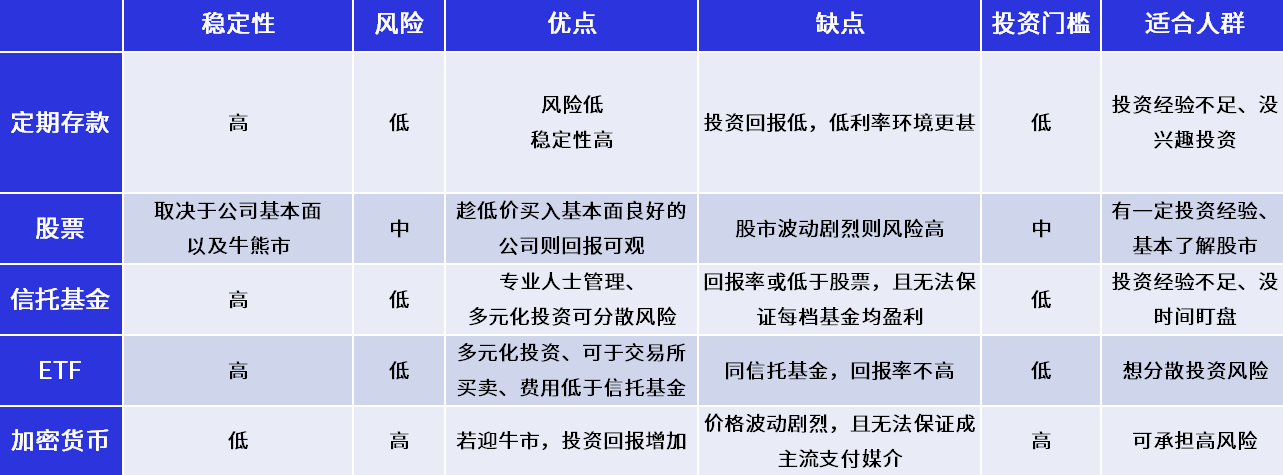

Time deposits

Time deposits are called "savings" and are the most basic, simple and safe way to invest.。As long as you open an account and deposit in the bank, you can receive interest from the bank every year.。

The interest paid by the bank is based on the deposit rate.。If the interest rate is 5% and the deposit is RM5,000, the bank will remit the interest on RM250 to the depositor's account。

The biggest advantage of time deposits is that they are safe enough。After the money is put into the bank, the depositor does not have to worry that they will be stolen or lost, the bank will lend the depositor's deposit and collect interest, and finally distribute the interest to the depositor at the agreed interest rate.。

However, the rate of profitability of this investment approach has never been ideal。Interest rates on time deposits are currently at around 3 per cent, and many depositors are concerned that their wealth will not increase as fast as inflation.

Stock

Shares are issued by companies in order to attract funds from all parties and then expand the business, or use them to pay off debt, etc.。And stockholders, who will become shareholders of the company, can attend general meetings and cast a vote for or against the company's plans。

There are two most common ways to make money in the stock market.。The first is "buy low and sell high," that is, take advantage of the stock price is low or undervalued to buy, the stock price rises and then sell to earn the difference.。Of course, buying and selling stocks also involves commissions (Brokerage Fee), clearing fees (Clearing Fee) and other fees.。Before an investor makes a buy or sell transaction, he or she must have a clear understanding of the billing format of individual brokerages.。

The second way to make money is to collect dividends.。Most consistently profitable, cash-rich companies pay regular dividends back to shareholders.。

From a wealth appreciation perspective, stock trading does have higher returns than time deposits。But in the world of investing, high returns mean high risk。The ability to make money in the stock market is a test of whether investors have done enough homework, inaccurate vision, luck, etc.。Therefore, before investing in a company, you must understand the company's business model, earnings history, cash position, etc., in order to minimize the risk.。

Trust Fund

The Trust Fund (Unit Trust Fund) pools the public's money and places it in the hands of professional fund managers to manage it and diversify its investments in different underlying financial commodities, such as stocks and bonds.。

The biggest benefit of investing in a trust is that the risk is relatively low because the fund managers are professional investors。Each sale is thoroughly studied before it is made in order to maximize the fund's net worth and return with minimal risk.。

In addition, the investment target of the trust fund is generally more diversified, the purpose is to spread the risk, the investor buys the fund unit, is equivalent to indirectly holding a number of shares of the company, or a variety of financial commodities.。

But the diversification of risk also limits the performance of investment returns.。Because the fund makes money from one part of the company, it may be diluted by another part of the company that loses money.。This investment strategy is also doomed investors will not be able to buy skyrocketing stocks, like the opportunity to get rich overnight.。

It is recommended that investors understand the investment style of the fund before buying it.。Some fund managers have more aggressive investment strategies or prefer to allocate most of their funds to a single area.。Different investment strategies can lead to different return performance and risk volatility。

In addition, behind the fund investment is a professional fund manager in the operation, the equivalent of investors hire professionals to help you take care of the investment, so you need to pay more costs and fees.。

Investors need to understand the sales fees, annual management fees, conversion fees, etc. of each tranche fund to avoid being muddled with high fees.。

Simply put, trusts are suitable for investors who tend to be stable, low-risk, and don't have time to keep an eye on the stock market every day.。Some newcomers to investing will also be more inclined to invest in trusts, which can save the hassle of stock selection and time for research homework。

ETF

ETF full name Exchange Traded Fund exchange-traded fund, also known as index equity funds, investment style and trust funds are similar.。The difference is that ETFs allow investors to buy and sell on an exchange; in the case of trusts, they need to be bought and sold through an agent.。In addition, ETFs involve lower fees than trusts。

ETFs track and replicate the index, and the underlying investment follows the index's passive decision to buy the index's constituents proportionally, so the price movement is essentially the same as the index being tracked.。Moreover, ETFs follow a diversification strategy with relatively low investment risk。

Due to the limited choice of domestic ETFs, many investors will prefer foreign, especially U.S. ETFs。However, no matter which country ETF you choose to invest in, you must understand who the ETF tracks and replicates, the size of the asset under management, the costs and expenses, and the tracking error of the ETF before making any decision in order to manage risk more effectively.

Cryptocurrency

Recently, a click on the financial news websites at home and abroad will see all kinds of news and news about cryptocurrency.。

Cryptocurrencies are digital, tradable currencies built on blockchain technology.。It is not like traditional currency with physical banknotes that can be seen and touched.。

The most famous types of cryptocurrencies include Bitcoin, Ethereum, Litecoin, Ripple, and DogeCoin.。

In addition, under the support of blockchain technology, cryptocurrencies are also wearing a "decentralized" technology aura.。When transferring and trading, bypass the bank, an intermediary, and distribute all transaction records to the block where each user is located.。Therefore, someone or agency can modify these records。

Currently, cryptocurrency trading platforms recognized by the Securities Commission of Malaysia include Luno, Tokenize, Sinegy and MX Global.。

Cryptocurrencies are so hot because some investors believe that they will replace traditional currencies as the mainstream payment medium in the future.。In addition, with central banks printing money to stimulate the economy during the epidemic, the world is worried about a sharp decline in the purchasing power of money。This has also led cryptocurrency fanatics to become more convinced that bitcoin, which is only 21 million in number, does not pose a serious inflation problem.。

However, no matter how good the ideal is, the current cryptocurrency has never been able to gain the trust of the whole people.。There are two reasons:

First, the price of cryptocurrencies is too volatile。In the case of Bitcoin, for example, the price soared to 63,346 on April 16, 2021, amid investor sentiment..A high of $79; but after Musk said on May 13, 2021, "Suspend Bitcoin payments for Tesla electric cars," the price of Bitcoin immediately fell below $50,000.。It has now risen back to around $39,000.。

This suggests that cryptocurrencies may still be speculative and look like the faces of global tycoons such as Musk。If investors enter the market blindly, it is easy to buy at the high point and burn it.。

Second, whether cryptocurrencies can beat traditional currencies and become mainstream payment media is still a mystery.。As time evolves, good money will eventually drive out bad money.。The remaining currency can gain the trust of the whole people.。

SUMMARY

The characteristics, risks, and returns of each investment commodity are different, and investors need to do their homework before making a decision, including thinking about their risk-taking capacity.。Don't see someone else making a lot of money and then rush into the arena to make a fortune.。After all, everyone's financial situation and risk appetite are different.。And the timing of the entry doomed investors to have a chance to get a piece of the investment market。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.