U.S. Chip Act boosts Semiconductor Industry, Surpassing Asian Giants

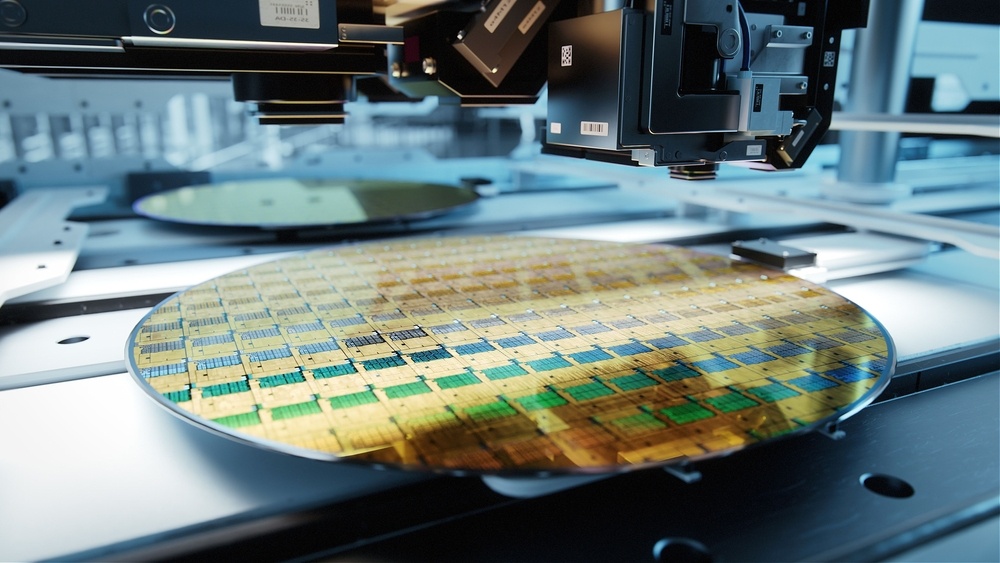

The United States is attempting to address the lagging situation in the global semiconductor supply chain through Chip Act, aiming to achieve a "reshoring" of 20% of the world's advanced chip manufacturing business by 2030.

Currently, the United States is attempting to address the lagging situation in the global semiconductor supply chain through the chip bill, aiming to achieve a "reshoring" of 20% of the world's advanced chip manufacturing business by 2030.

Over the past two years, the US government has begun implementing a $52.7 billion chip bill, with $3.9 billion earmarked for incentivizing manufacturing.

Recently, the Biden administration announced a $6.4 billion allocation to Samsung Electronics to expand its semiconductor production capacity, with the chips produced to be used in consumer goods, automotive industries, and other sectors. Additionally, Intel (INTC) received $8.5 billion in funding support for its new factory in Arizona.

So far, the chip bill has provided funding to Intel (INTC), Taiwan Semiconductor Manufacturing Company (TSM), GlobalFoundries (GFS), Microchip Technology (MCHP), and BAE Systems (BAESY).

It is expected that Micron Technology (MU) will receive funding support next week, but the construction of chip manufacturing facilities differs from conventional construction, requiring precise planning and lengthy construction periods. From establishing the basic structure to installing and debugging equipment, the entire process may take several years to complete. Moreover, rapid changes in market conditions and shortages of skilled workers have led companies like Taiwan Semiconductor Manufacturing Company (TSM) and Intel to announce delays in some projects.

Due to the volatility of the semiconductor market, production cannot be easily ramped up or scaled down. During market downturns, there may be issues of chip oversupply. However, even if it's impossible to perfectly time the market, strengthening the semiconductor supply chain in the United States is strategically correct and necessary.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.