LAB Group, Customer Onboarding Regulatory Technologist, Receives A $6.5 Million Financing From GCI

GCI's investment will support LAB Group to accelerate business and product development activities and international growth。

Australia-based customer onboarding solutions provider LAB Group announced it has successfully completed a round of private investment, raising up to $6.5 million in growth funding.。

New Investor Global Credit Investments (GCI) is a leading provider of professional private credit and customized financial products.。Founded in Sydney in 2015, GCI provides a flexible, low-dilution financing structure that enables investee companies to transform their businesses, and the funds have been used by businesses to help accelerate sales and marketing and fund international expansion strategies.。To date, GCI has raised and deployed around $1 billion in funding and is dedicated to supporting talented entrepreneurs and management teams looking to transform and expand their high-growth businesses.。

LAB Group was co-founded in 2010 by CEO Nick Boudrie and Chief Technology Officer Lyndon Webster, who still hold a majority stake in the company.。Since its inception, LAB Group has applied its technology to Australian and international financial services licensees and businesses in other industries, with offices in Melbourne, Sydney, Brisbane and Copenhagen.。The company works with a number of retail forex and CFD brokers, including IG Group.。

LAB Group works with some of the best-known and most respected institutions in Australia and the world, and its innovative onboarding and compliance platform addresses the key governance, risk and compliance challenges currently faced by regulated entities.。GCI's investment will support LAB Group to accelerate business and product development activities, providing working capital for domestic and international growth opportunities。

LAB Group CEO and co-founder Nick Boudrie said:

"We are delighted that GCI has become an investor in the LAB Group。An investor like GCI will provide LAB Group with the support it needs to further strengthen and expand our team and accelerate our growth strategy.。We are particularly pleased that we have found a capital investment solution that will help us take the business to the next stage of growth while minimizing dilution to shareholders.。

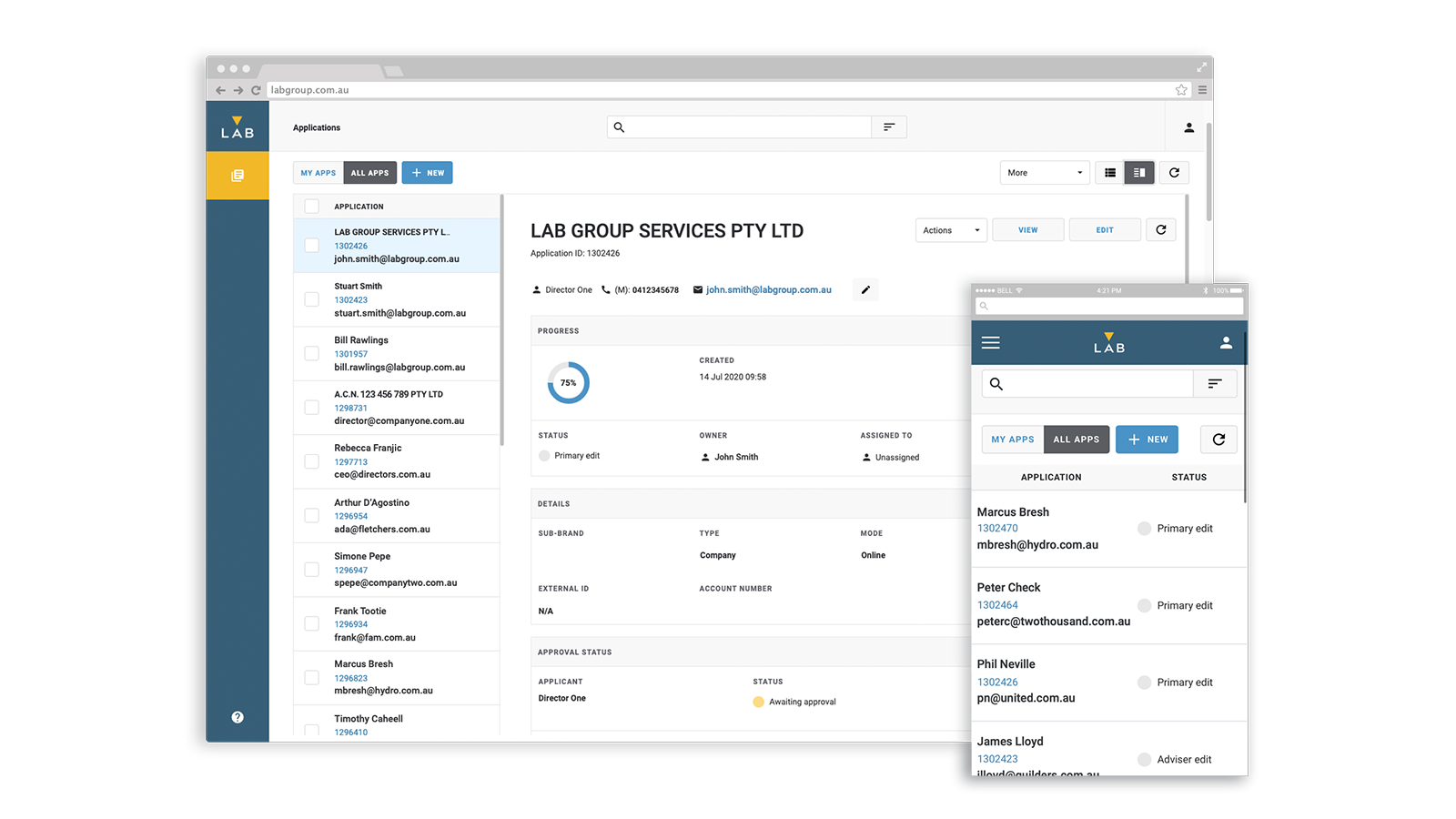

"The completion of GCI funding demonstrates the strong market position and unique capabilities of LAB Group after 12 years of development and innovation.。Our platform brings significant advantages to LAB Group customers, including a dynamic onboarding framework that provides end-to-end account opening and digital workflow management, anti-money laundering that can verify all entity types, KYC, KYB and PEP Sanctions Easy-to-integrate authentication solutions, and a global network of products and jurisdictions that can seamlessly move consumer data。

"We look forward to a fruitful partnership with GCI to create value for LAB Group customers, integration partners, employees and investors."。

GCI general manager and co-founder Gavin Solsky said:

"As LAB Group embarks on an exciting journey, we are pleased to announce our partnership with LAB Group。LAB Group embodies all the qualities we seek in emerging high-growth companies, from proven product-to-market fit to outstanding customer metrics。With a skilled founder management team driving their growth strategy and the huge market opportunities that come with structural growth, we are confident in their future success.。

Henslow Pty Ltd acts as corporate advisor to LAB Group and principal administrator of the transaction。

About LAB Group Services Pty Ltd

LAB is a regulatory technology company that provides an innovative KYC & Onboarding platform. The platform has revolutionized the customer service process from the first step. While meeting anti-money laundering / CTF regulatory needs, through the use of remedial measures and continuous Customer due diligence process, achieve a high degree of automation in account creation and customer lifecycle management, thereby saving time and resources。The LAB platform welcomes tens of thousands of people using hundreds of financial products across more than 15 industry verticals, matching applicants with a large number of market products.。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.