World Bank: Cross-border remittances hit record high for third consecutive year in 2023

Cross-border remittances hit a record high for the third year in a row, with employees from South Asia, East Asia and the Pacific driving growth, according to data released by the World Bank。

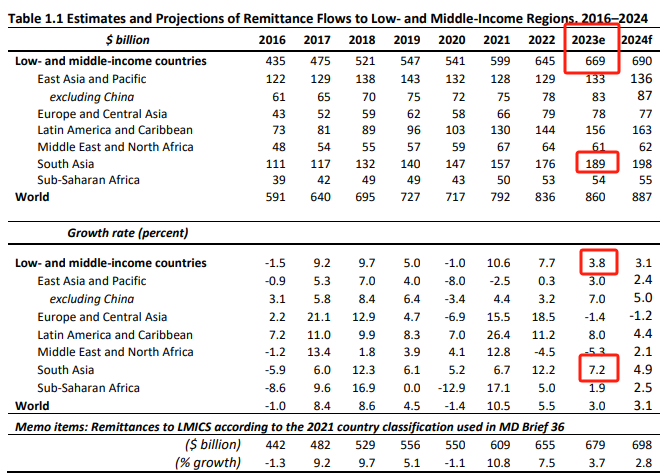

According to the latest data released by the World Bank, international remittances are expected to grow by 3% from the previous year to around $860 billion in 2023, a record high for the third consecutive year.。

According to the World Bank's latest Migration and Development Brief, remittances from the United States and European countries to South Asian countries such as India and Bangladesh are expected to be robust.。Remittances to low- and middle-income countries to grow in 2023.8%, to approximately $669 billion, and remittances will continue to grow in 2024。

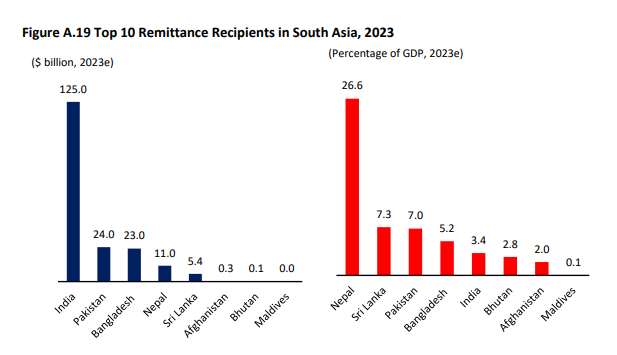

The overall increase was mainly driven by remittances to South Asian countries such as India, Pakistan, Bangladesh, Sri Lanka and Nepal.。Remittances to these countries accounted for nearly 30 per cent of total remittances from low- and middle-income countries, up 7 per cent year-on-year..2%, to about $189 billion。

Remittances to India were the largest, totaling about $125 billion, slightly more than 60 per cent of total remittances from South Asia, which the report attributed to "an increase in remittances from Indian skilled workers to India from the United States, the United Kingdom and Singapore," while IT engineers and programmers did send large amounts of money.。

And in remittances destined for India, the amount from the Persian Gulf countries is also stable。In August 2023, when Indian Prime Minister Narendra Modi visited the UAE, he agreed with UAE officials to change the currency for trade settlement between the two countries from the US dollar to the UAE dirham, a move that is helping to increase the dirham remittances India receives.。

Sri Lanka's economy is showing signs of stabilizing after receiving support from the International Monetary Fund (IMF), and remittances into the country may rebound sharply; while remittances to Nepal are expected to account for about 26% of the country's gross domestic product (GDP)..6%, mainly from the Middle East and Japan and other places。

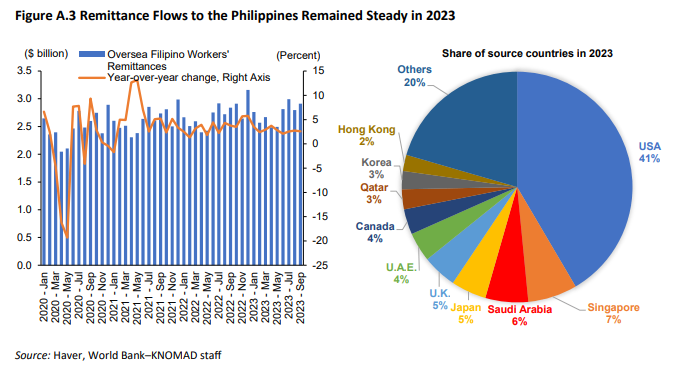

The report estimates that, excluding China, remittances to East Asian and Pacific countries will grow 7.0%。It is worth noting that remittances to the Philippines, while declining in the 2020 epidemic, have maintained a solid recovery since 2021, with an increase of 5% in 2023 or comparable to the previous year..1%。

As shown in the chart above, remittances from the United States are expected to account for the largest share of remittances to the Philippines, slightly more than 40%, followed by Singapore, Saudi Arabia, Japan and the United Kingdom。The Philippine government, led by President Ferdinand Marcos Jr., has been active in protecting Filipinos working overseas and has had a positive impact on the country's remittances.。

Among destinations other than Asia, remittances to Latin America and the Caribbean are expected to be 8 percent higher than a year ago..0%。In contrast, remittances to the Middle East and North Africa and Europe and Central Asia will decline as a result of the Russian-Ukrainian war and the political instability in some Middle East and African countries.。

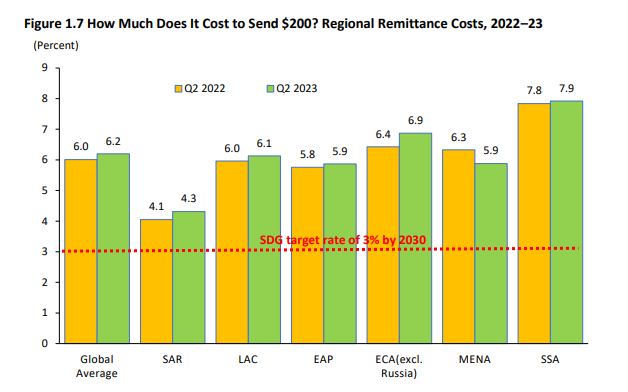

Reducing the cost of remittances is now a major policy issue in emerging and developing countries.。At a similar level, the United Nations Sustainable Development Goals set a sub-goal of reducing the transaction costs of migrant remittances to less than 3 per cent by 2030.。

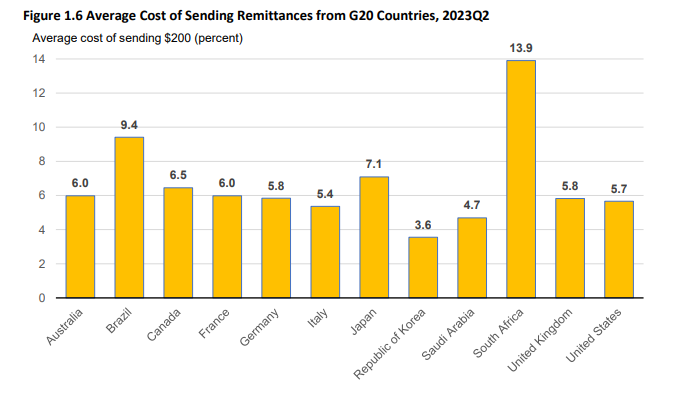

However, the facts are not satisfactory。According to the World Bank, the average cost of sending $200 globally in the three months to June 2023 was 6.2%, up slightly from 6% a year ago。

Over the same period, the average cost of sending $200 overseas from Japan was 7.1%, the highest level among the Group of Seven (G7) leading industrial countries; the Group of Twenty (G20) target is to reduce this rate to 5%, but only South Korea and Saudi Arabia have so far achieved this target, 3.6% and 4.7%。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.