What about Oanda's day trading??

Day trading is a strategy favored by many retail traders, with multiple opportunities to make a profit in one day, OANDA is a good choice for day traders。

Day trading is quite popular among retail forex traders。They are very cautious when choosing a broker because if the broker cannot provide trading tools and a high-quality platform that supports day trading, it is not suitable for day trading。

Ideally, brokers suitable for day trading should provide trading tools and reliable market execution, ensuring that traders can well find potential entry and exit points for their trades, thereby increasing their chances of profit。

The ideal broker should also be well regulated and fully authorized to operate in any country where it is located.。

Benefits of using OANDA for day trading

Intraday trading at OANDA offers multiple benefits to traders。First, they are authorized and regulated by well-known regulatory bodies such as FCA, ASIC and IIROC.。

Second, OANDA offers three platforms: fxTrade, MT4, and MT5, each with Android, iOS, and desktop versions.。Using these platforms, traders can access real-time market data, execute trades quickly and efficiently, and monitor positions in real time。

Moreover, OANDA offers a variety of tradable instruments。Start with 45 currency pairs, including major and minor currency pairs, 7 indices, 8 commodities, 2 precious metals (gold and silver), 27 stocks and 13 popular cryptocurrencies。

Finally, Oanda is known for providing competitive spreads and transparent pricing.。The broker operates on a commission-free model with spreads that vary according to market conditions.。For example, the spread of EUR / USD is only from 0.From 8 o'clock, the spread of the currency pair is only from 1.From 1: 00。This is very beneficial for Forex day traders who aim to capture small price fluctuations and require strict spreads to minimize transaction costs.。

OANDA Day Trading Platform

OANDA offers two ways to trade on the same day: mobile and desktop.。The mobile app allows traders to access their trading accounts and trade anywhere, anytime; the desktop version offers advanced algorithmic trading and customization features for professional traders。

OANDA Mobile App

The mobile app provides a user-friendly interface for seamless navigation and easy access to account information and transaction functions。

The app provides live streaming market data including live quotes, charts and market news。Traders can place market orders, limit orders, stop loss orders and take profit orders simply by using their mobile phones.。

Traders can also set up price alerts to receive notifications when specific price levels are reached。This feature allows traders to keep abreast of market movements and potential trading opportunities even without actively monitoring the application。

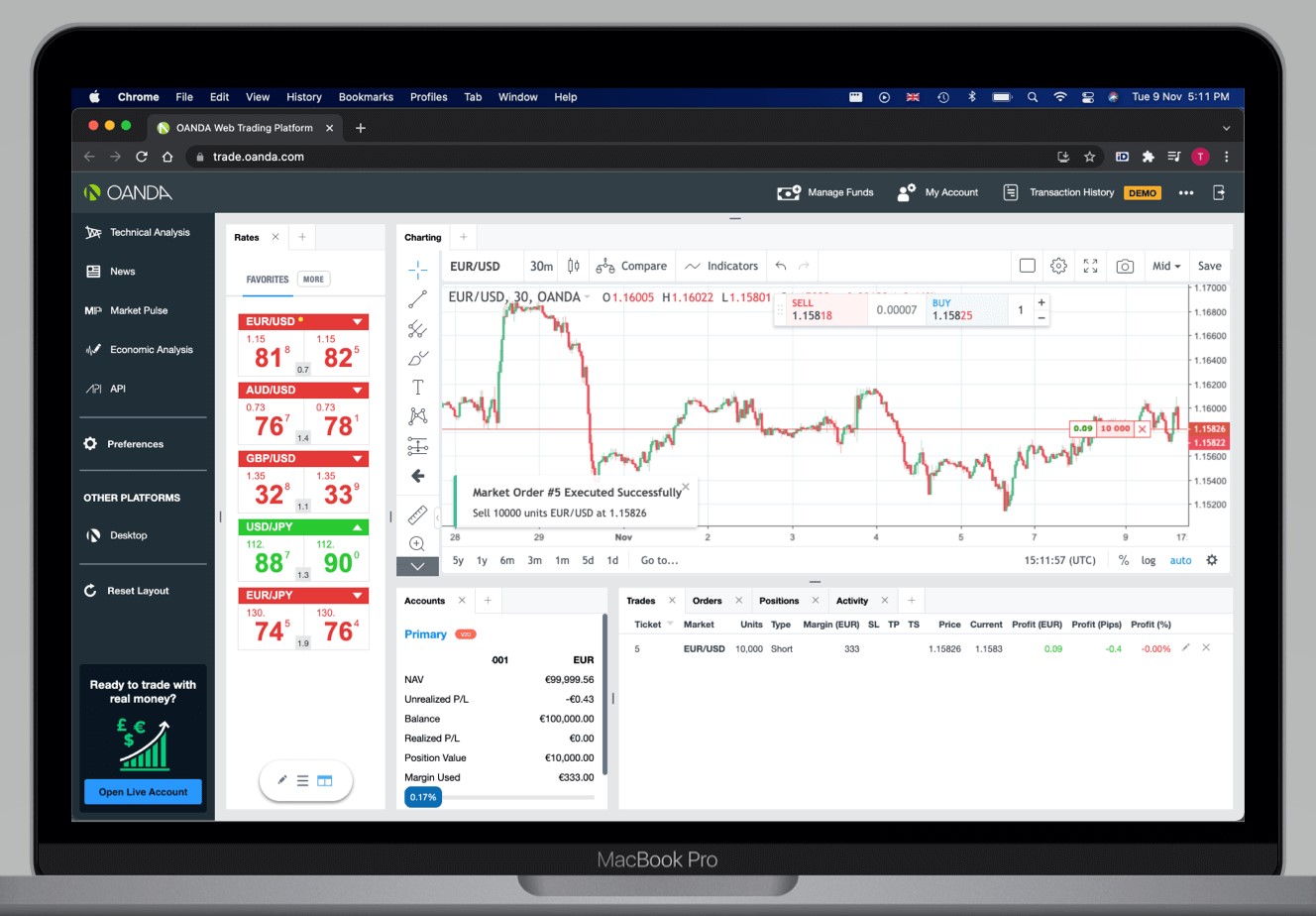

OANDA Desktop Edition

The desktop version allows traders to customize the workspace and layout according to their preferences。Traders can arrange multiple charts, watch lists and order entry panels to create a personalized trading environment that suits their trading style。

The desktop version also integrates an API that enables traders with programming skills to develop and deploy their own automated trading strategies.。This gives experienced traders advanced algorithmic trading and customization options。

OANDA and intraday trading

First, OANDA offers online brokerage services for retail forex traders, built to meet the needs of day traders.。

It is also heavily regulated by top institutions such as the UK's Financial Conduct Authority (FCA), the US Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA).。

OANDA also provides customers with a first-class and easy-to-use trading platform, as well as powerful research tools, a variety of technical indicators and excellent API products。

The process of opening an account is also very fast and user-friendly, OANDA's online trading platform uses a two-step login method, the user interface is friendly and secure, and traders can also choose to customize the platform。

The minimum deposit requirements are very low and there is no charge for deposits and withdrawals except by bank transfer。

OANDA has a demo account where traders can test their trading strategies to determine the best strategy for day trading purposes。

Since no expiration date is attached, OANDA will not charge any unactivated fees for its demo account, and traders can return to the account after opening a real account in order to test new trading strategies in the future。

OANDA also supports margin trading, where traders can open trading positions larger than the account balance.。Since intra-day trading is biased towards quick returns, traders can make the most of this feature and make good profits。

In general, OANDA has very low transaction fees, charging a spread on each transaction。Day traders tend to open multiple trading positions in a day, which is quite beneficial to them。

OANDA can be an option for traders looking for a precision broker。This is because OANDA is a broker that offers 5-digit accuracy quotes and active price movements that follow market developments.。The broker's orders are also executed faster。

It provides benefits for novice traders because they can use a calculation system based on currency value for smaller trading volumes, which is different from other brokers that use lot systems。

OANDA was founded in 1996 by Dr. Michael Stumm, Lecturer in Computer Engineering at the University of Toronto, Canada, and colleagues at TheOlsen Ltd, one of the leading econometric research institutions..Dr. Richard Olsen co-founded the institution。Their headquarters are located in San Francisco, USA。

OANDA Branches Everywhere。Some of these offices are located in the UK, Singapore, Japan and Canada。With the distribution of the number of offices, OANDA increasingly attracts the attention of global customers。

OANDA's companies are registered in several well-known jurisdictions in the field of financial transactions。They are regulated by the US CFTC and NFA, UK FCA, Australian ASIC and others。Traders no longer need to worry about security when trading OANDA。However, these advantages make OANDA's trading rules more stringent than other brokers。

For example, OANDA only allows a maximum leverage of 1: 20 because the rules in the United States and Japan do not allow higher than that leverage。In addition, the registration process is more complicated due to various additional requirements that other forex brokers do not submit。Most importantly, hedging is not allowed in one trading account, as the client must open another account to hedge。

Nevertheless, OANDA is known as a leading broker and offers many advantages。OANDA faces greater market risk during periods of price volatility, such as economic and political news announcements。When market spreads increase or decrease, their pricing engine expands or reduces spreads accordingly。In this way, traders can be more quickly updated on market price movements。

Prices in the market move very quickly, especially when news releases have a large impact on market volatility。Brokers often exploit this situation to take advantage of clients by re-quoting。However, traders do not need to worry about additional fees when trading with OANDA。

Firms never withdraw re-quotes, so traders get maximum profit。When traders cannot monitor open positions, they can set take profit orders to lock in profits and stop loss orders to help prevent further losses。

As an experienced and well-known online forex broker, OANDA is committed to maintaining an efficient trading environment, reducing delays and providing tools to help clients manage acceptable levels of slippage.。

With OANDA's fast and reliable trading platform, customers can trade at 0.Execute within 012 seconds。This is suitable for traders who choose a broker based on execution speed。

Due to this outstanding executive service, it is no surprise that Oanda has won many awards, including the world's best retail forex platform award in the prestigious e-FX awards.。The broker was also rated number one for consistency in executing trades on quote, execution speed and platform reliability.。

There is no minimum deposit or minimum balance requirement to open an OANDA account, both deposits and withdrawals can be done easily。OANDA offers multiple payment method facilities including Paypal, wire transfer, credit and debit cards。Traders can adjust according to the region they live in。

OANDA offers more than 100 trading instruments, including 71 currency pairs, 16 indices, 8 commodities (Brent, copper, corn, natural gas, soybeans, sugar, etc.), 6 bonds and 23 metals.。

fxTrade and MetaTrader platforms available on OANDA。These platforms are available for desktop and mobile devices。Another advantage is that they have OANDA technical analysis in cooperation with Autochartist technical analysis provider。

With these platforms, customers can more easily monitor price movements and automatically identify patterns created on charts and receive alerts when waiting patterns appear。The technology can be used for free。

In summary, OANDA is the ideal broker for traders who need fast execution backed by years of experience.。The firm is also a good choice for those looking for a broker with good regulation and flexible trading and deposit conditions。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.