What is OANDA Currency Converter?

Are you looking for a transparent and reliable tool to exchange currency, OANDA Currency Converter may be the perfect solution for you。

With online foreign currency exchange, customers can transfer money through a bank or company of their choice, which will quote the exchange rate before processing the transaction。Since exchange rates fluctuate frequently, the conversion ratio is not always 1: 1。

OANDA's currency converters can check the latest foreign exchange average buy and sell exchange rates, making foreign exchange faster and cheaper because they use real-time exchange rates and do not have additional fees like banks。Many services are fairly transparent, and customers do not need to sign any agreement to pre-calculate the possible costs.。

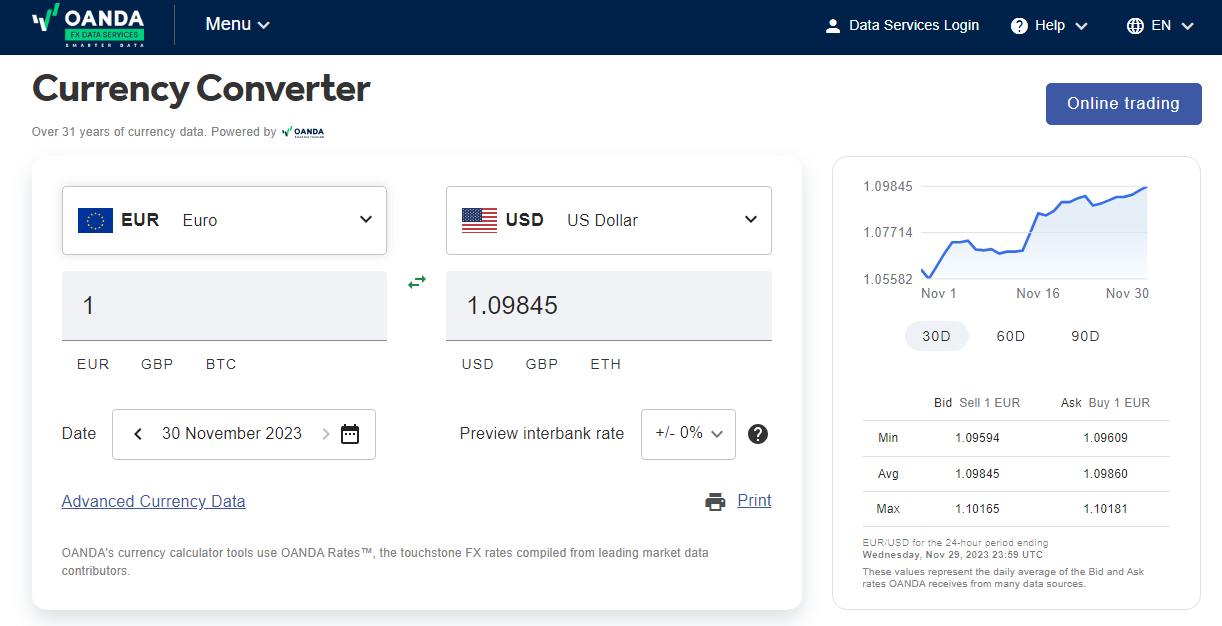

OANDA Currency Converter

OANDA is a well-known brokerage company that provides customers with reliable currency converter services.。By partnering with Shift, OANDA's currency converter allows users to view the latest Forex average bid and ask prices, as well as convert all major currencies in the world.

In OANDA, up to 212 currencies can be used in the currency converter. The service can be used free of charge at any time without registration。In addition, the service is available in 9 languages, including English, French, German, Spanish, Italian, Portuguese, Russian, Chinese and Japanese。

Here are the reasons why OANDA Currency Converter is the best choice for all investors:

- trustworthy。OANDA is a well-known broker that is well known to companies, tax authorities, audit firms and individuals around the world.。The company has been around for more than 20 years and is regulated in a number of countries including the US, Europe, UK, Australia, Japan and Canada.。

- Trusted and transparent。Some brokers may manipulate prices to attract clients, but OANDA has direct access to real-time foreign exchange rates, so the numbers are certainly accurate and reliable。

- Years of historical data。OANDA has over 31 years of historical data covering more than 38,000 currency pairs and exchange rates for no less than 200 currencies, commodities and precious metals.。

- Reasonable price。Users can access the basic functions of the currency converter for free without registration。

How to use currency converter?

OANDA Currency Converter is very easy to use。It can be accessed directly from the broker's website, so there is no need to install and register。Here are the steps you need to follow:

1.Go to the OANDA website and turn on the currency converter。You can access this feature from any device, including desktops and phones。

2.You can enter the name of the currency (3-letter ISO currency symbols such as USD, JPY, GBP, etc.) or the country name of the currency, and you can choose to find the exchange rate for world currencies, precious metals, or obsolete currencies。

3.Enter the value of the currency on both sides of the converter based on the currency you have or want to buy。

4.You can also select the date and percentage from the Interbank Offered Rate list to further specify the data。

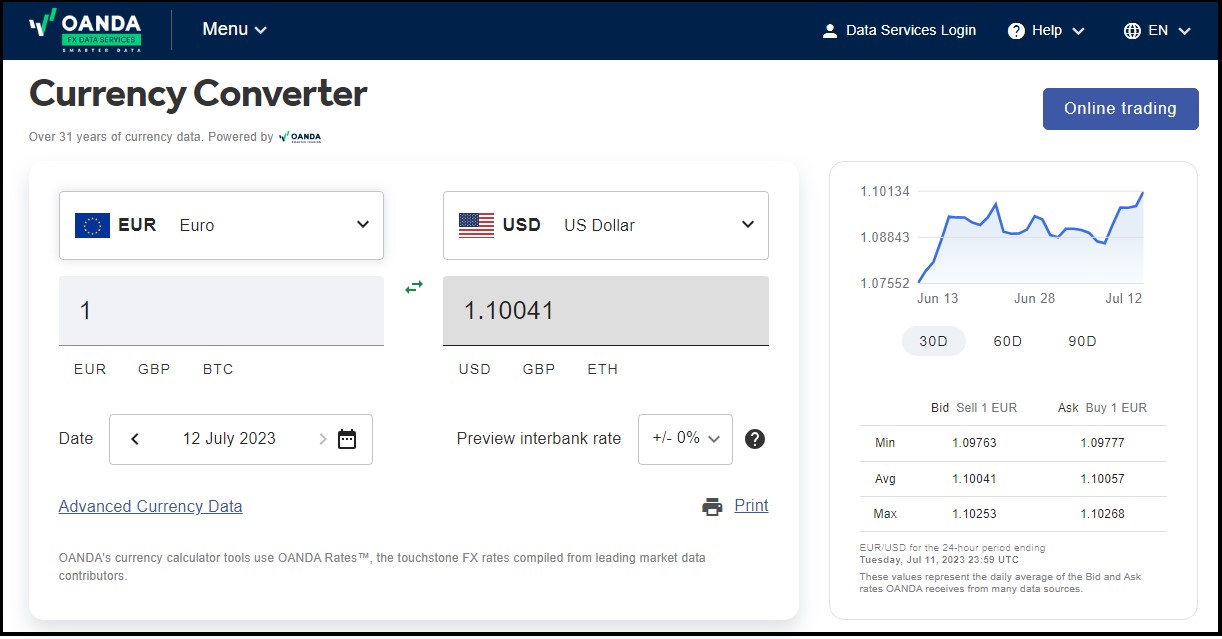

Historical Currency Converter

OANDA's Historical Currency Converter can access authoritative data on 38,000 currency pairs in January 1990 and can compare up to 10 currencies simultaneously。

This is very helpful for auditors, CPAs or tax professionals to spot check, analyze data or produce exchange rate data reports.。You can choose the data frequency, whether it's daily, weekly, monthly, yearly or fully custom。

The OANDA exchange rate is based on a compilation of foreign exchange rates provided by major market data contributors.。Exchange rate data is uploaded every day at 00: 00 UTC, representing the exchange rate for the past 24 hours aligned with midnight UTC。

Here are the steps to use the Historical Currency Converter:

- Open Historical Rates on the platform, select the currency base and the currency to use。

- Select time frame (daily, weekly, monthly, yearly or custom), source of exchange rate (OANDA rate or central bank rate) and price (bid, median or ask price)。

- If you want to compare more than 5 quoted currencies, click the plus sign next to the last quoted currency。

- Finally, you can download the data in CSV format for ease of use。

There are three pricing options for you:

- Free: No fees, no registration required。View historical exchange rates for 180 days and compare quotes in up to 10 currencies。

- Pro License: $75 per month or $750 per year。Includes all the features of a free license, as well as the ability to download historical data to a CSV file, access historical data over 31 years, and access exchange rates from more than 50 central banks。

- Multiple members: 25% off for 5 licenses or seats。Includes all features of free and professional licenses。You can add multiple members to this license。

How are OANDA Rates calculated?

The exchange rates provided by ourCurrency Converterand other tools are averages for the global foreign exchange market gathered from frequently updated sources, including ourOANDA fxTradecurrency trading platform, leading market data vendors, and contributing financial institutions. The data is filtered and stored in a proprietary data repository.

We do not take market closing prices as the "average" price. Instead we take the average from all our collected data over a 24-hour period, reflecting the fact that the foreign exchange market never really "closes" globally. However, the volume of market activity is lower on weekends and holidays, so the number of prices varies from day to day. Our rates are rounded up to five significant digits, with a few exceptions.

How accurate are OANDA Rates?

OANDA Rates are trusted by top accounting firms, international corporate and financial institutions and individuals, and are a recommended resource for tax authorities worldwide.

For major currency pairs, our rates are based on tens of thousands of different price points, collected every few seconds, 24 hours a day, 365 days a year. We collect these rates from live data suppliers, filter them to remove false prices and validate the data, and use the filtered data to compute interbank market rates.

Note: you may see this message in the Currency Converter's details section: "Estimated price based on daily US dollar rates." This message is displayed for currency pairs where relatively little data is available, and means that the exchange rate for the converted currencies was computed from cross rates with the US dollar.

Frequently asked questions

How often are OANDA Rates updated?

The period of time over which the average bid/ask currency price is taken depends on the data available for the particular currency. When possible, we take the average of prices over the last 24 hours and use these averages to update the rate every day at 00:00 UTC (Coordinated Universal Time).

Prices for the currencies of some emerging market countries may be published once per day or even less, resulting in only a few price points each week for these currencies.

Why can't I get interbank rates from a bank?

The prices quoted by theCurrency Converterare based on interbank market rates and generally reflect the exchange rates for transactions of USD1 million or more. These are the "official" rates quoted in the media, such as ‘The Wall Street Journal.’ Retail spreads (the difference between the Bid and Ask prices) for smaller amounts are not reflected in these interbank prices since they vary among payment systems, countries and banks.

If you go to a bank in your home country, you usually have to pay more of your home currency to get foreign currency than you will receive of your home currency, if you return the foreign currency. This results in the two exchange rates shown in the margin result.

Because these retail rates vary so much in every place, we cannot advise you where to go at any given moment to change currencies. You can usually find this information from your local bank, travel guides, or from people who have visited the place you are heading for.

How do I choose the rate that applies to me?

Interbank rates (+/- 0%), with a margin close to zero, are the "official" rates quoted in media such as ‘The Wall Street Journal’. They typically reflect the market rates for large transactions of USD1 million or more when banks trade between themselves or with very large clients.

For the smaller amounts exchanged in a retail setting, banks, credit cards and exchange agencies charge commissions to convert currencies. These retail rates add commissions of 1 to 10 percent or more. For example:

- ATMs typically add 2% (and then add service charges in many parts of the world)

- Credit cards typically add 3% (for the major currencies; more for other currencies)

- Foreign exchange kiosks and banks often add 5% when you convert hard cash (for the major currencies; more for other currencies).

Retail rates vary widely between payment systems, countries and banks, so we encourage you to enquire about the rates your financial institution is actually charging you.

To add a commission to your conversion, you can use the Interbank +/- pull-down on any of our applications. Either choose the commission from our list of typical charges, or type in a value if you know the rate you will be paying:

When you convert currency, you sell one currency to buy another. Your financial institution charges you a different rate if you are selling a currency (the Bid or Sell rate) or buying a currency (the Ask or Buy rate).

You can see these two types of rates in the details section of theCurrency Converter.

The Bid (or Sell) rate is the lower amount. You will receive fewer euros when selling your dollars (this is the number you see in the right field of the converter).

The Ask (or Buy) rate is the higher amount. It will cost you more dollars when buying euros.

Many currency information sites provide the midpoint rate, which is the average of the Bid and Ask rates for a currency pair. At OANDA, we default to the Bid price for our applications, as it more accurately mimics the rate that you would be charged if you were exchanging money. We do provide midpoint rates as a point of reference in ourHistorical Exchange Ratestool.

Conclusion

All in all, OANDA offers a safe and secure currency exchange service for all traders worldwide。Before undertaking any international transaction, it is important to know the currency exchange rate, as exchange fees may be higher than expected if you are not careful。

Many options may have hidden fees, and some brokers will even manipulate prices to deceive clients。Therefore, choosing a reliable exchanger service is also essential to get the best deal。

OANDA can be an option for traders looking for a precision broker。This is because OANDA is a broker that offers 5-digit accuracy quotes and active price movements that follow market developments.。The broker's orders are also executed faster。

It provides benefits for novice traders because they can use a calculation system based on currency value for smaller trading volumes, which is different from other brokers that use lot systems。

OANDA was founded in 1996 by Dr. Michael Stumm, Lecturer in Computer Engineering at the University of Toronto, Canada, and colleagues at TheOlsen Ltd, one of the leading econometric research institutions..Dr. Richard Olsen co-founded the institution。Their headquarters are located in San Francisco, USA。

OANDA Branches Everywhere。Some of these offices are located in the UK, Singapore, Japan and Canada。With the distribution of the number of offices, OANDA increasingly attracts the attention of global customers。

OANDA's companies are registered in several well-known jurisdictions in the field of financial transactions。They are regulated by the US CFTC and NFA, UK FCA, Australian ASIC and others。Traders no longer need to worry about security when trading OANDA。However, these advantages make OANDA's trading rules more stringent than other brokers。

For example, OANDA only allows a maximum leverage of 1: 20 because the rules in the United States and Japan do not allow higher than that leverage。In addition, the registration process is more complicated due to various additional requirements that other forex brokers do not submit。Most importantly, hedging is not allowed in one trading account, as the client must open another account to hedge。

Nevertheless, OANDA is known as a leading broker and offers many advantages。OANDA faces greater market risk during periods of price volatility, such as economic and political news announcements。When market spreads increase or decrease, their pricing engine expands or reduces spreads accordingly。In this way, traders can be more quickly updated on market price movements。

Prices in the market move very quickly, especially when news releases have a large impact on market volatility。Brokers often exploit this situation to take advantage of clients by re-quoting。However, traders do not need to worry about additional fees when trading with OANDA。

Firms never withdraw re-quotes, so traders get maximum profit。When traders cannot monitor open positions, they can set take profit orders to lock in profits and stop loss orders to help prevent further losses。

As an experienced and well-known online forex broker, OANDA is committed to maintaining an efficient trading environment, reducing delays and providing tools to help clients manage acceptable levels of slippage.。

With OANDA's fast and reliable trading platform, customers can trade at 0.Execute within 012 seconds。This is suitable for traders who choose a broker based on execution speed。

Due to this outstanding executive service, it is no surprise that Oanda has won many awards, including the world's best retail forex platform award in the prestigious e-FX awards.。The broker was also rated number one for consistency in executing trades on quote, execution speed and platform reliability.。

There is no minimum deposit or minimum balance requirement to open an OANDA account, both deposits and withdrawals can be done easily。OANDA offers multiple payment method facilities including Paypal, wire transfer, credit and debit cards。Traders can adjust according to the region they live in。

OANDA offers more than 100 trading instruments, including 71 currency pairs, 16 indices, 8 commodities (Brent, copper, corn, natural gas, soybeans, sugar, etc.), 6 bonds and 23 metals.。

fxTrade and MetaTrader platforms available on OANDA。These platforms are available for desktop and mobile devices。Another advantage is that they have OANDA technical analysis in cooperation with Autochartist technical analysis provider。

With these platforms, customers can more easily monitor price movements and automatically identify patterns created on charts and receive alerts when waiting patterns appear。The technology can be used for free。

In summary, OANDA is the ideal broker for traders who need fast execution backed by years of experience.。The firm is also a good choice for those looking for a broker with good regulation and flexible trading and deposit conditions。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.