Accountability Online Banking Business Disruption: DBS CEO Cuts Pay by Over $3 Million!

In 2023, Singapore's DBS Bank cut its executive pay as a result of repeated major disruptions in its digital banking operations, with the bank's chief executive taking a total of about $3.08 million in variable pay cuts.。

On February 7, Singapore's largest bank by total assets, DBS Bank, cut senior management pay after a series of digital banking disruptions。

The bank's latest earnings data show that DBS, affected by high interest rates, hit a new high in 2023 as central banks raised borrowing costs in response to inflation: net profit rose 26% year-on-year to S $10.3 billion;.S $900 million, up 2% YoY。

At the same time as the results, DBS Bank said that CEO Piyush Gupta's variable compensation, including bonuses, has been cut by 30% in 2023, totaling 4.14 million Singapore dollars ($3.08 million), and that the full salary for the year will be specifically disclosed in March.。In 2022, his annual compensation totaled S $15.4 million (approximately 1,144.$20,000)。

Variable remuneration for other senior management, i.e., those who make up the Company's Group Management Committee, decreased by 21% in 2023。The committee is understood to consist of senior bankers such as Chief Financial Officer Chng Sok Hui and other leaders from business units such as corporate finance, capital markets and auditing.。

DBS, which has previously been named the "world's best digital bank" by business and financial publication Euromoney, suffered at least five major disruptions to its service network last year, leaving digital payment services and cash machines unavailable across the country.。Immediately after the incident, the bank issued a statement apologizing and announcing plans to improve the resilience of the system.。

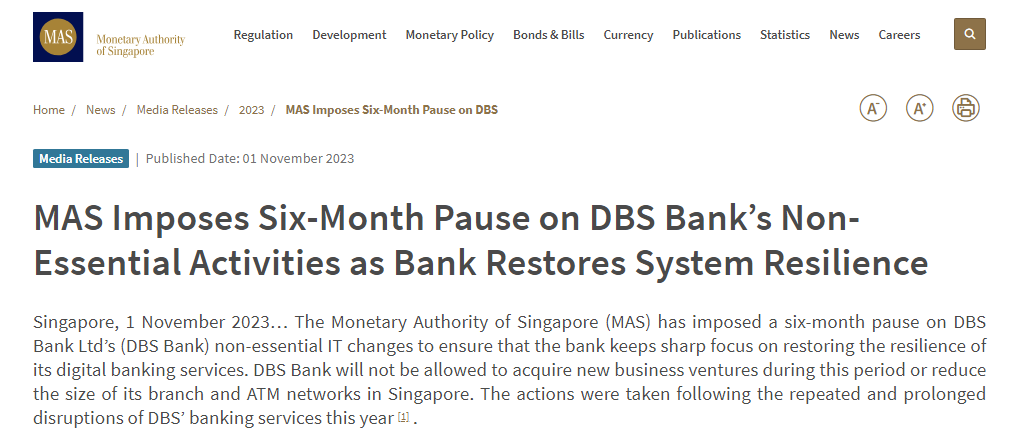

In November 2023, the Monetary Authority of Singapore (MAS) imposed a six-month "moratorium" on DBS's "non-essential information technology changes."。During this period, DBS cannot acquire any new businesses and cannot reduce its branches and ATM network in Singapore.。

DBS has invested S $80 million in technology "upgrades" to better prevent service disruptions, provide customers with alternative payment and account lookup channels during disruptions, and shorten the recovery time from power outages.。"We look forward to further improving the reliability of our services and ensuring that each service has a backup channel that is sufficient to deal with unexpected issues," Gupta said.。

Gupta also revealed that of the S $80 million earmarked, S $25 million has been spent on hiring consultants.。In addition, DBS has hired several senior employees, including a technical risk officer and another professional, to improve the company's risk audit capabilities.。Moreover, the company is also conducting "rigorous training" for 5,000 employees and is paying more attention to reducing human errors.。

Commenting on the drastic pay cuts, company executives said: "Cutting senior management's pay is an important part of establishing accountability so that people can take responsibility for fixing it.。"

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.