On Wednesday, January 7, U.S. Eastern Time, the Federal Reserve announced the minutes of its December 2024 monetary policy meeting.

In the minutes of the meeting, Fed officials expressed concerns about higher-than-expected inflation and the possible inflationary impact of Trump's policies after taking office, suggesting that they would slow down interest rates due to future uncertainty.After the report was released, Nick Timiraos, a senior Federal Reserve reporter known as the "New Federal Reserve News Agency", bluntly stated that the Federal Reserve would not continue to cut interest rates for the time being.His report directly titled: "Federal Reserve Meeting Minutes Mean Officials Ready to Keep Interest Rates Hold for the Temporarily."

The meeting took into account the impact of Trump's additional tariffs

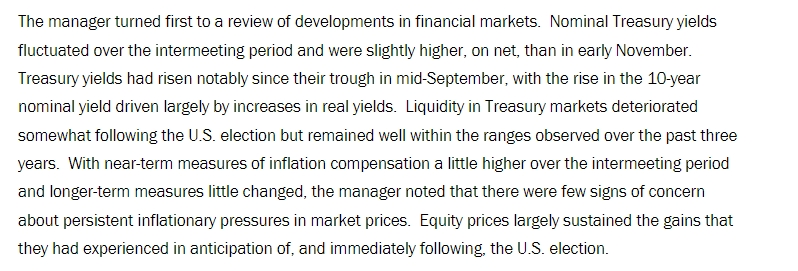

Minutes of the meeting showed that Fed officials made a "carefully weighed" decision to cut interest rates in December when they expected the risk of higher-than-expected inflation, in part due to Trump's possible tariff increases.According to the minutes of the meeting, when considering the extent of future interest rate cuts, Fed officials were confused about two situations: one was uncertain whether the slight strengthening of inflation data last fall meant more potential upward pressure on prices; the other was uncertain whether Trump's commitment to impose tariffs would make the inflation outlook more complicated.

When discussing the inflation outlook, the minutes wrote that officials attending the meeting expected inflation to continue to fall back towards the Fed's 2% target,"but they pointed out that recent higher-than-expected inflation data, as well as the impact of potential changes in trade and immigration policies, indicate that this (downward inflation) process may take longer than previously expected."Several people believe that the downward trend in inflation may have temporarily stalled, or pointed to the risk of such a possibility.”

Immediately following the above two sentences, the minutes wrote that some participants believed that positive sentiment in financial markets and the momentum of economic activity could continue to constitute upward pressure on inflation, and then mentioned trade policy: "All participants agreed that the scope, timing and economic impact of possible changes in policies affecting foreign trade and immigration have become more uncertain.”

In assessing the risks and uncertainties associated with the economic outlook, the minutes read: "Almost all participants agreed that the upside risks to the inflation outlook have increased.Participants cited the reasons for this judgment as recent stronger-than-expected inflation data and the impact of possible changes in trade and immigration policies.

Other reasons include geopolitical changes that could disrupt global supply chains, a looser financial environment than expected, stronger-than-expected household spending, and a more protracted rise in housing prices.Some participants pointed out that for some time to come, it may be difficult to distinguish between more lasting effects on inflation and potentially temporary effects, such as changes in trade policies that may lead to changes in price levels.”

In the future, the pace of interest rate hikes may be slowed down

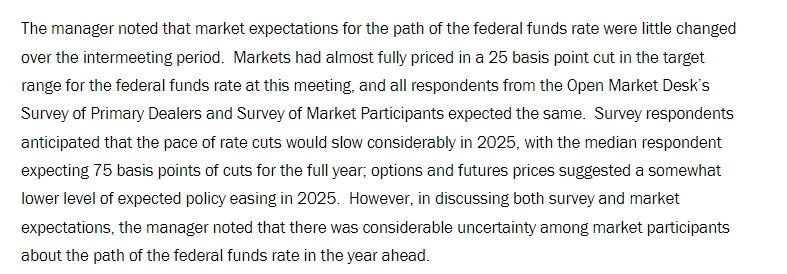

In a resolution statement released after the FOMC meeting of the Federal Reserve's Monetary Policy Committee in December, the Federal Reserve hinted that it would slow down interest rate cuts in the future.The minutes of this meeting directly mentioned that interest rate cuts will be slowed down.

When discussing the outlook for monetary policy, the minutes read: "Participants stated that the (FOMC) committee is at or close to being appropriate to slow the pace of policy easing.They also suggested that if the data is broadly in line with expectations, inflation continues to slide steadily towards 2%, and the economy remains close to full employment, a gradual shift to a more neutral monetary stance over time would be appropriate.

Some participants pointed out that the three meetings from September to December 2024, including the December decision, cut interest rates by a total of 100 basis points, and the Federal Reserve's policy interest rate is now significantly closer to neutral levels than when the interest rate cut was launched in September."In addition, many participants said that various factors highlighted the need for prudent monetary policy decisions in the coming quarters.”

In its statement at the December meeting, the Federal Reserve announced that it had decided to cut interest rates by another 25 basis points, as at the previous meeting, which was in line with market expectations.Unexpectedly, a voting committee member opposed it and advocated keeping interest rates unchanged, that is, suspending interest rates, exposing a rift in the united front within the Fed.

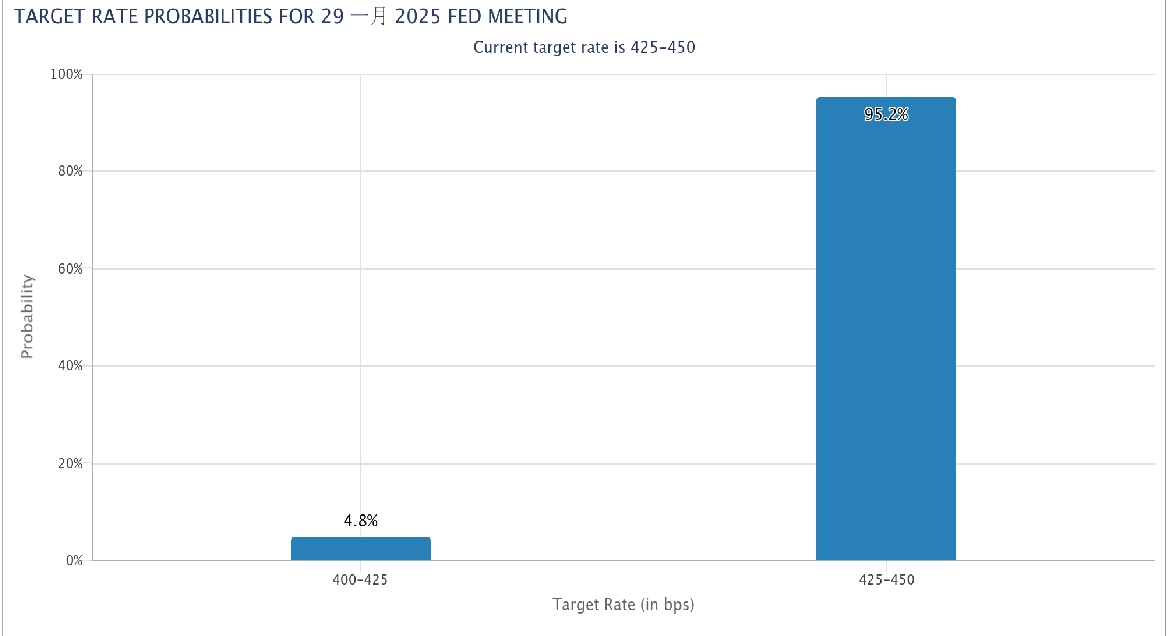

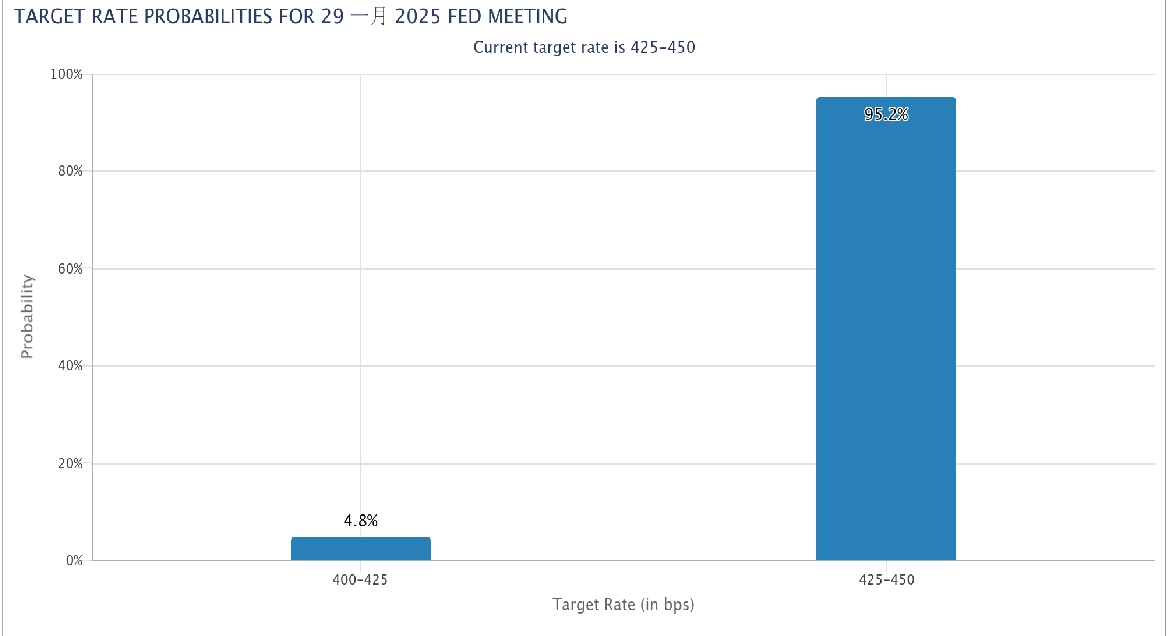

According to CME's "Federal Reserve Observation": The probability that the Fed will keep interest rates unchanged in January is 93.1%, and the probability of cutting interest rates by 25 basis points is 6.9%.The probability of keeping current interest rates unchanged by March is 61.4%, the probability of a cumulative interest rate cut of 25 basis points is 36.2%, and the probability of a cumulative interest rate cut of 50 basis points is 2.4%.

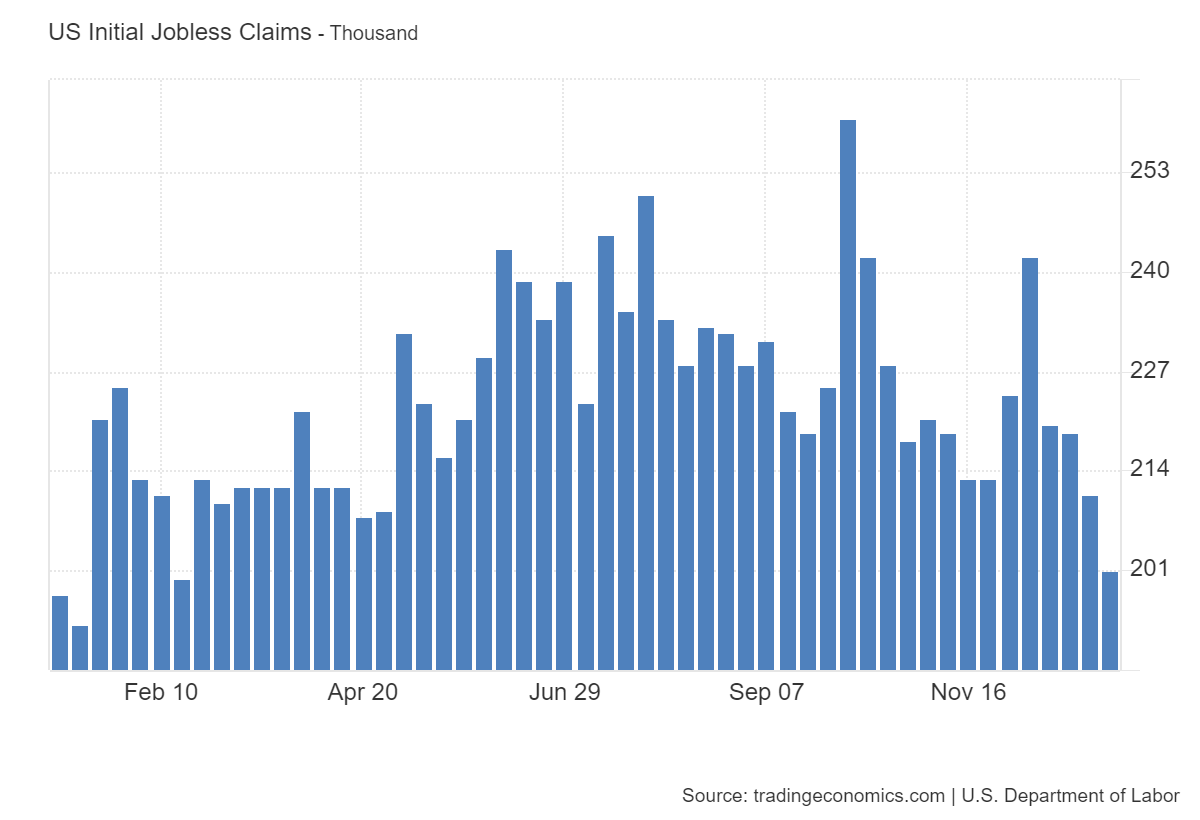

Initial claims for unemployment benefits dropped unexpectedly

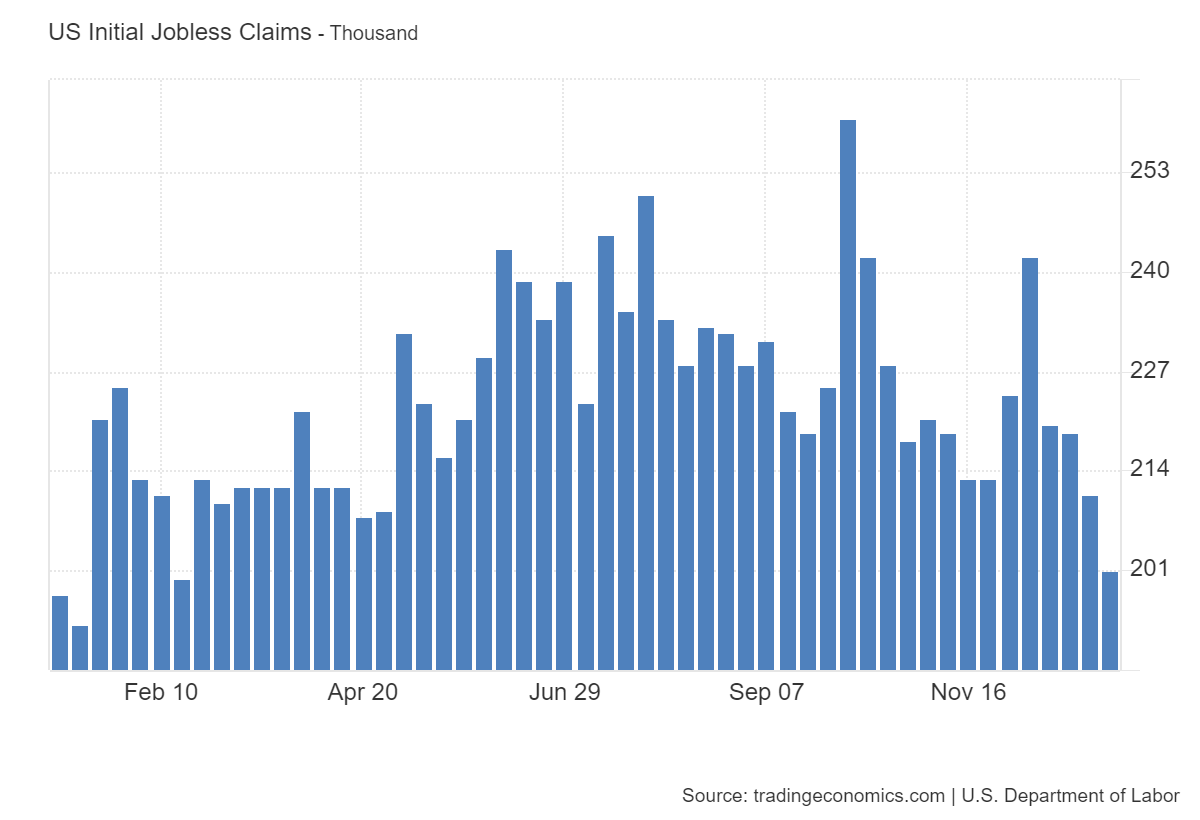

U.S. government data showed Wednesday that weekly applications for unemployment insurance fell unexpectedly last week, while the number of renewed applications rose.

According to data from the Ministry of Labor, the seasonally adjusted number of first-time applications fell by 10,000 to 201,000 for the week ending January 4.According to a Bloomberg survey, the former figure is expected to be 215,000.Last week's figure remained unchanged at 211,000 without revision.

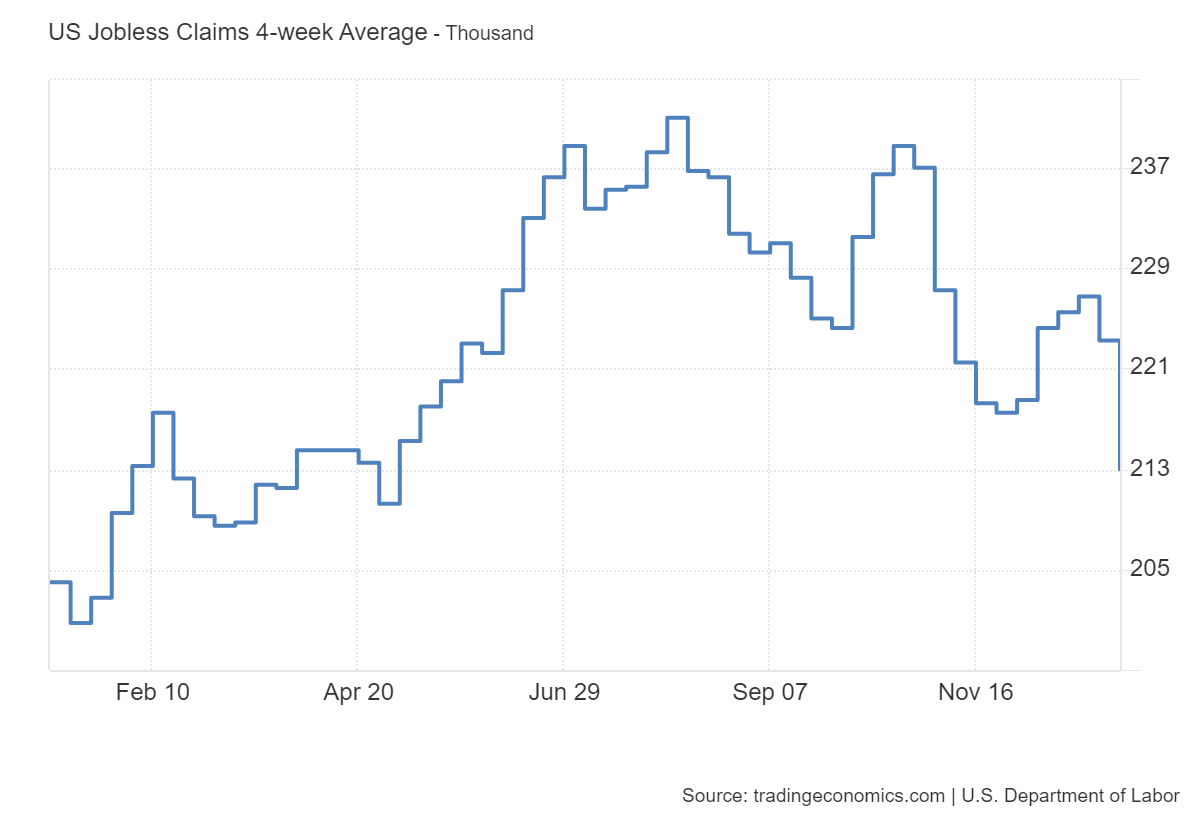

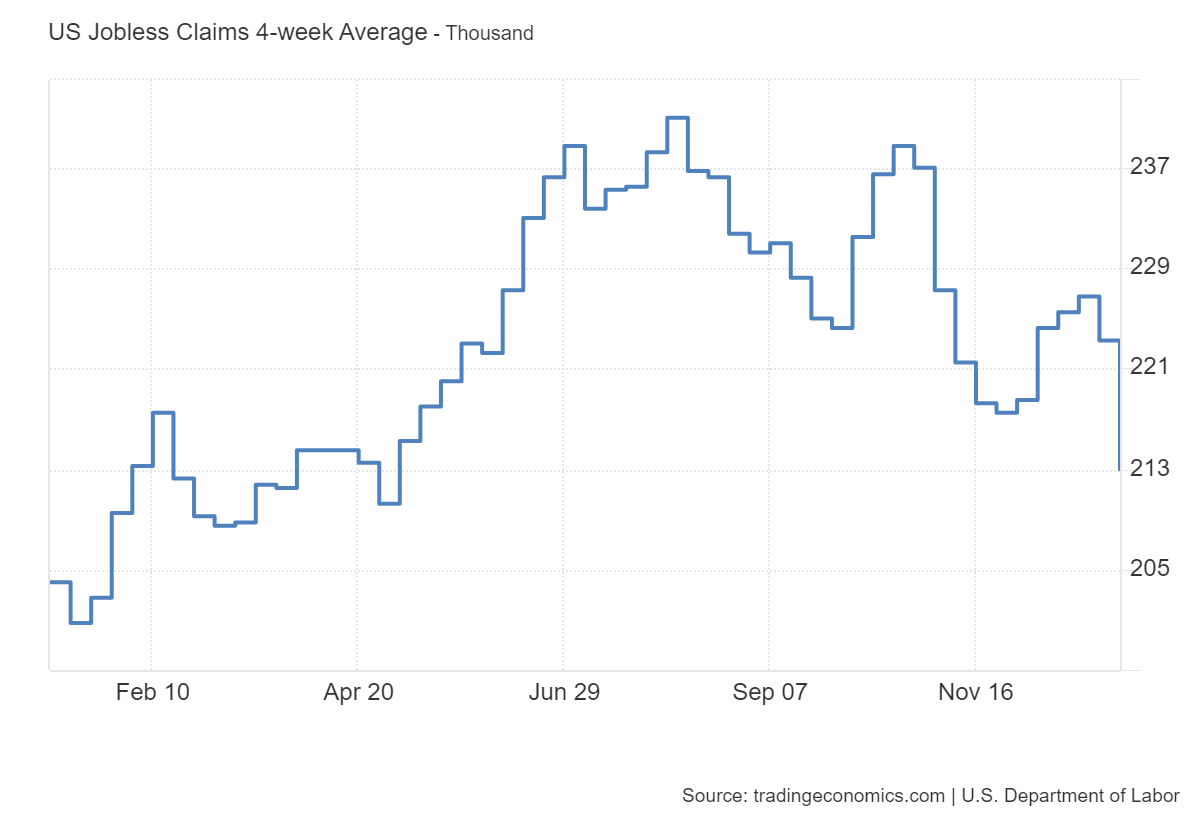

The four-week moving average was 213,000, a decrease of 10,250 from last week's unrevised average.The number of unadjusted weekly applications increased by 21,253 to 304,741.

As of December 28, the seasonally adjusted total number of continuing applications was 1.87 million, compared with the Bloomberg consensus of 1.86 million.Continuing applications increased by 33,000 from last week's level, which was lowered by 10,000.According to data from the Ministry of Labor, the four-week moving average was 1.87 million, a decrease of 3,000 from last week's revised average.

On the non-farm side, released on Friday, the U.S. economy was expected to add 163,000 jobs last month, which will be down from the 227,000 new jobs created in the previous month.Jefferies expects total wages to increase by 140,000 in December.