The ship is hard to tune! Sequoia Capital announces split red shirt China intends to use the original Chinese brand name.

On June 6, Sequoia Capital, a world-renowned venture capital fund, said on the social platform that as the regional divisions have taken the lead in the market, Redshirt has chosen to completely embrace the localization strategy and divide the global business into three parts, which is planned to be completed by March 31, 2024.。

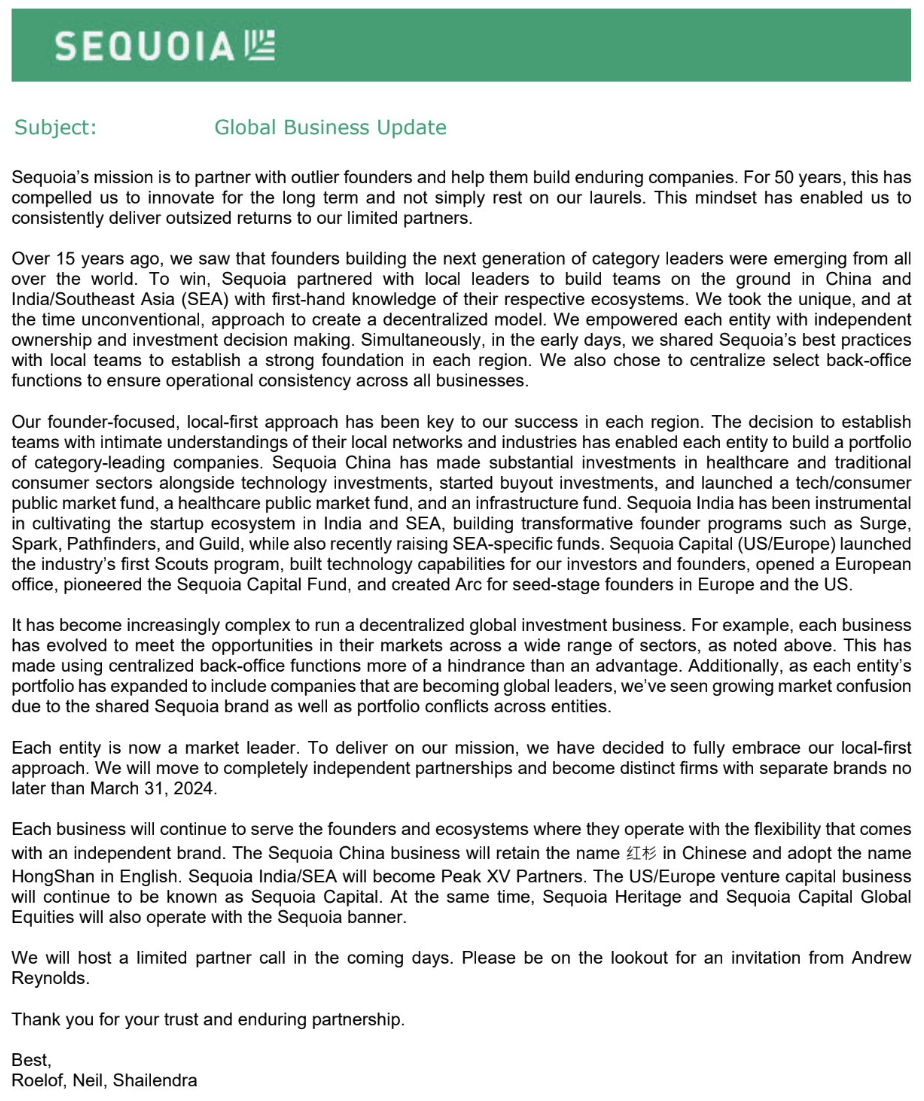

On June 6, Sequoia Capital, a world-renowned venture capital fund, said on the social platform that as the regional divisions have taken the lead in the market, Redshirt has chosen to completely embrace the localization strategy and divide the global business into three parts, which is planned to be completed by March 31, 2024.。The letter was co-signed by Roelof Botha, managing partner of Redshirt US / Europe, Nanpeng Shen, managing partner of Redshirt China, and Shailendra Singh, managing partner of Sequoia India / Southeast Asia.。

In an open letter, Sequoia Capital said that 15 years ago, Sequoia saw entrepreneurs emerge around the world to create a new generation of industry leaders, and in order to create and win opportunities in more emerging markets, Sequoia China, Sequoia India / Southeast Asia came into being.。For a long time, Sequoia has adopted a unique mode of operation, with teams rooted locally and well versed in the local market and ecology in different regions, and each regional entity has independent ownership and investment decision-making power, while selectively centralizing some back-office functions globally to ensure consistency in the operation of these functions across regions.。

Sequoia China: Over 1,000 potential companies invested in the past 20 years raised $9 billion last year against the trend

For Red Shirt China, this investment path can be described as star-studded。

After its establishment in September 2005, Red Shirt China has always adhered to the "entrepreneur behind the entrepreneur" positioning, with a unique business sense to discover a large number of emerging enterprises, in recent years, one of the largest number of IPO head institutions, its assets not only include byte beat, Meituan, Pinduoduo and many other familiar brands, but also include SHEIN, Vision Energy, Canva and other unicorn enterprises.。

According to Zero2IPO statistics, Red Shirt China has a wide range of investments, involving science and technology, health care, corporate services, consumer life, cultural and sports industries, finance, e-commerce and manufacturing, but the focus is still on information technology, with assets under management of about $56 billion.。In the past 20 years, Red Shirt China has invested in more than 1,000 companies with distinctive technical characteristics, innovative business models, high growth and high development potential, of which more than 130 member companies have become listed companies and more than 100 non-listed companies have developed into unicorns.。

According to data provider PitchBook, against the backdrop of a bleak overall situation in 2022, Red Shirt China was still able to raise $9 billion through the issuance of several funds, and successfully attracted investments such as Calpers, the largest public pension fund in the United States, Massachusetts Pension Reserve Investment Trust, Quebec Savings & Investment Group and Canadian Pension CPP Investments.。In addition, according to relevant sources, Red Shirt Capital's U.S. team did not participate in the round of Red Shirt China's fundraising.。

Sequoia Capital: Operating model gradually becomes a burden rather than an advantage Sequoia China continues to use the "Sequoia" Chinese brand name

For this split, Sequoia Capital said that more in-depth localization developments have made the global centralization of some back-office functions a burden rather than an advantage.。Moreover, as Sequoia's companies investing in different regions internationalize and compete for industry leadership on a global scale, there will inevitably be some competition between them, and sharing the same brand across Sequoia regions will cause some distress to these founders and member companies.。The agency further noted that in order to allow entities in each region to better serve entrepreneurs and LPs and maintain a sustained lead, Sequoia Capital has decided to completely embrace the localization strategy and will fully realize the independent operation and development of each market.。

According to Sequoia Capital, after the regions are fully independent, Sequoia America / Europe will continue to use the "Sequoia Capital" brand name, Sequoia China will continue to use the "Sequoia" Chinese brand name and adopt the new English brand name "HongShan," while Sequoia India / Southeast Asia will launch the new brand name "Peak XV Partners."。Sequoia Capital is understood to be holding an LP limited partner conference call in the coming days, when more details about the split may be discussed。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.