The market has begun to judge the new market narrative in advance.

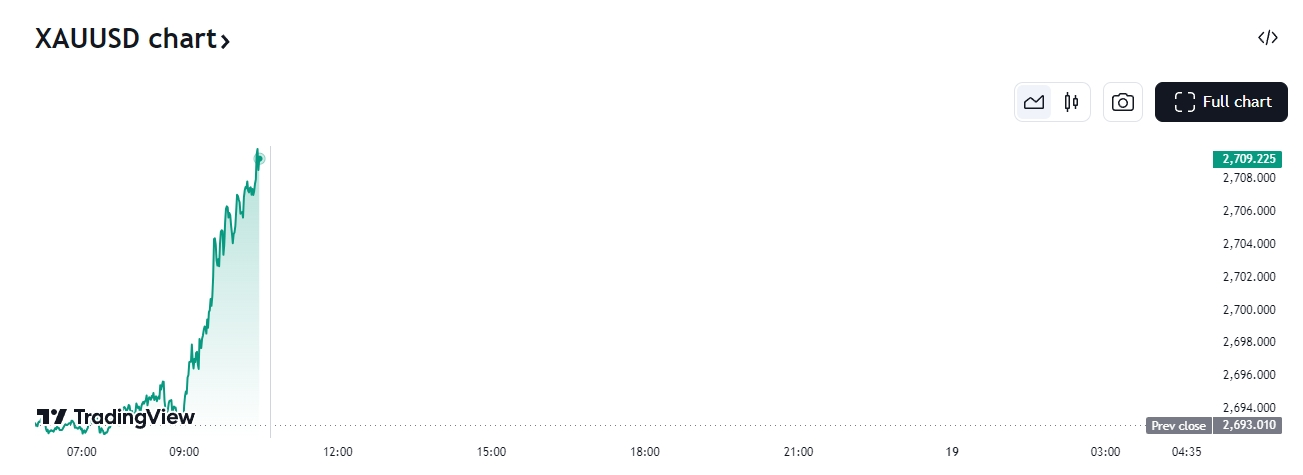

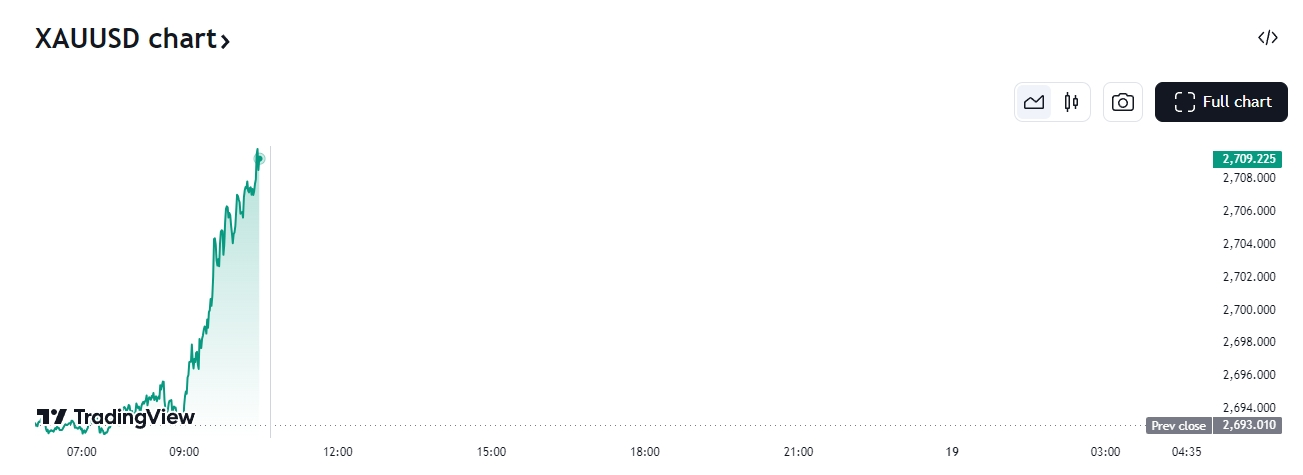

On October 17, U.S. Eastern Time, spot gold hit a record high of US$2,696.63 per ounce, closing at US$2,692.75 per ounce. Advance trading around the U.S. election, uncertainty about the Middle East conflict, and loose monetary policies around the world jointly pushed the price of gold to nearly US$2,700 per ounce.

As gold continues to rise, strategists at Bank of America say gold is becoming increasingly attractive as the risks of other traditional "safe-haven" assets are rising-investors, including central banks, should turn to gold, where bulls can use this asset as a tool for debt depreciation caused by inflation and increased government borrowing.

The US election is approaching, and the market has begun to judge the new market narrative in advance.

Predictably, whether Trump or Harris are elected, they will not make fiscal discipline and spending cuts a priority.Market analysis said that the proportion of U.S. Treasury bonds to GDP may hit a record high in the next three years. Once this becomes a reality, the proportion of interest to GDP will also rise simultaneously. Under concerns that the market will not be able to absorb new debt, investors may turn to gold.

In the eyes of Bank of America strategists, gold "seems to be the last 'safe haven' asset that stands firm."They expect spot gold prices to exceed US$3,000 per ounce by the end of next year.

Since spot gold is denominated in U.S. dollars, investors pay special attention to U.S. macro policies. In terms of the external environment, easing policies around the world have been beneficial to gold in the past.

Since the Federal Reserve cut interest rates by 50 basis points on September 18, central banks around the world have set off a wave of interest rate cuts in a short period of time.Many important financial institutions such as the Monetary Authority of China Hong Kong, the Central Bank of Kuwait, the Central Bank of Bahrain, the Central Bank of United Arab Emirates, and the Central Bank of Qatar announced their decision to cut interest rates at almost the same time. This collective action not only demonstrates the synergy of global central banks in responding to downward pressure on the economy, but also indicates that the valve for economic stimulus is slowly being opened.

The collective interest rate cut by central banks around the world has driven gold prices. As the Federal Reserve's easing cycle begins, gold prices have risen by about 4.3% in the past month.

On Thursday, the European Central Bank cut interest rates for the third time this year, saying inflation in the euro zone is becoming increasingly contained and the regional economic outlook is deteriorating.

It is worth noting that the euro zone's economy has lagged behind the United States for two consecutive years.Although ECB President Christine Lagarde did not give any hints on the path of future interest rate cuts, in terms of market pricing, unless economic or inflation data reverses in the next few weeks, the ECB is likely to cut interest rates for the fourth time in December.

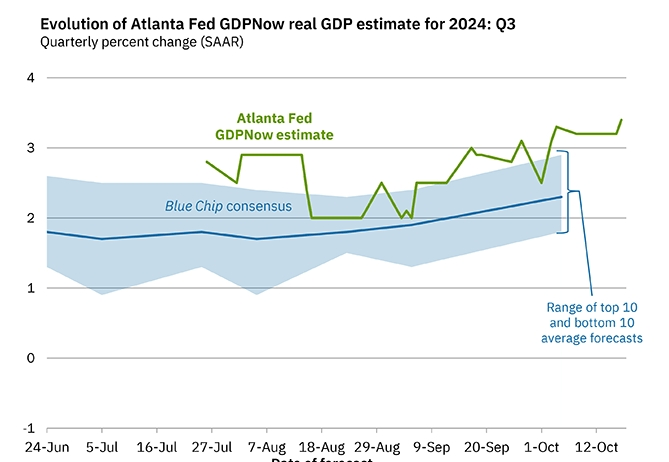

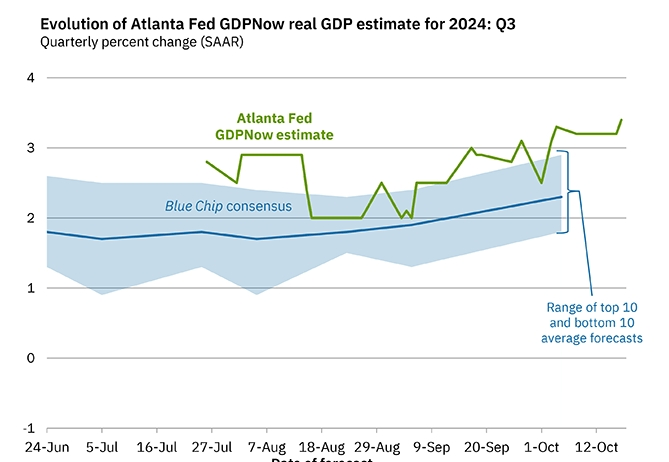

As for the United States, the Atlanta Federal Reserve raised its forecast for the month-on-month annual GDP growth in the third quarter to 3.4% from the previous 3.2% after yesterday's "retail sales data" was higher than expected; the economic growth rate in the second quarter was 3.0%.

Economic data is better than expected, the Federal Reserve's policy space is loosened, and the bank will definitely continue to cut interest rates, but it may slow down.Currently, the market is pricing the Federal Reserve to cut interest rates by 25 basis points next month, which is half of the 50 basis points in September.

At the same time, the world's central bank's gold buying wave continues.Over the past period, central banks around the world have increased the share of gold in their total reserves.Analysts at Bank of America note that gold now accounts for 10% of central bank reserves, up from just 3% a decade ago.