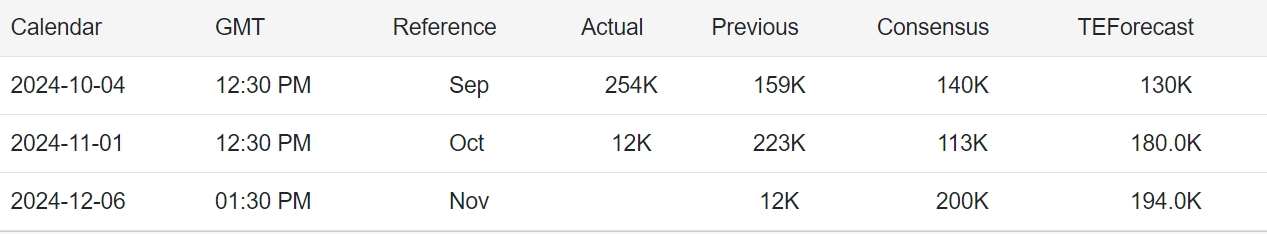

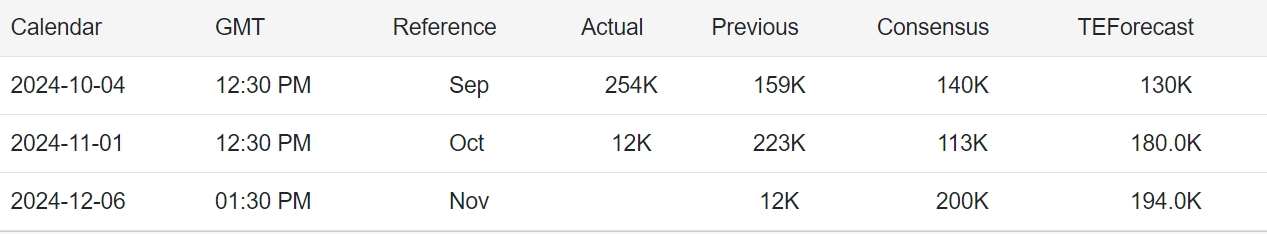

Economists expect that the non-agricultural population in the United States is expected to increase by 200,000 in November, a sharp increase from the previous value of 12,000.

On December 6, gold maintained its decline before the release of the U.S. non-agricultural report for November.

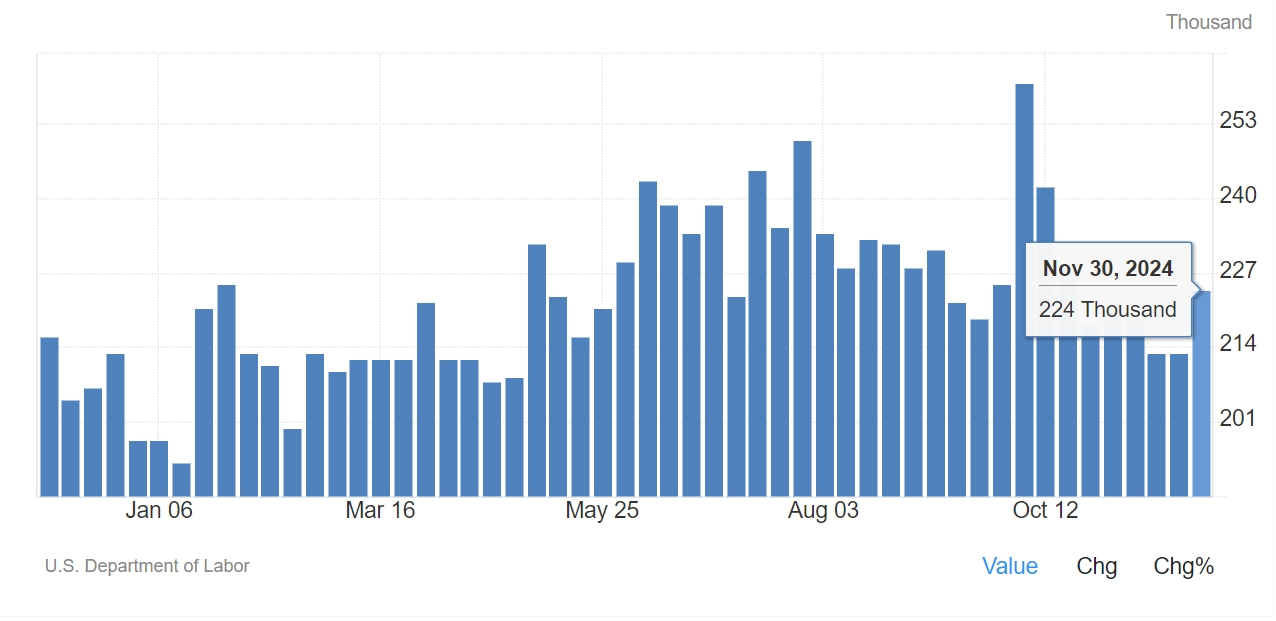

Spot gold fell 0.7% on Thursday, the largest decline since November 25.Since the beginning of last week, gold has been fluctuating within a narrow range.

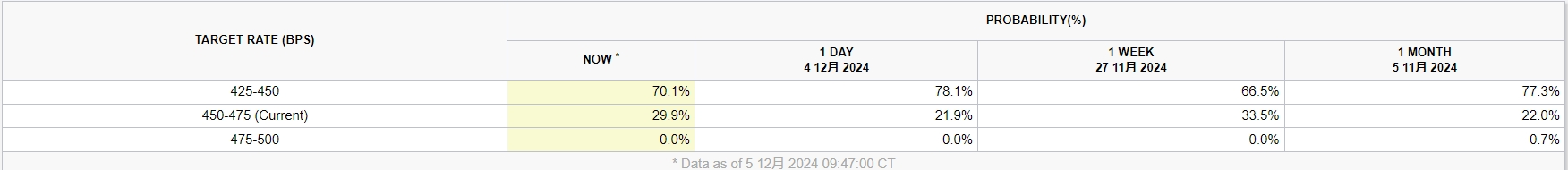

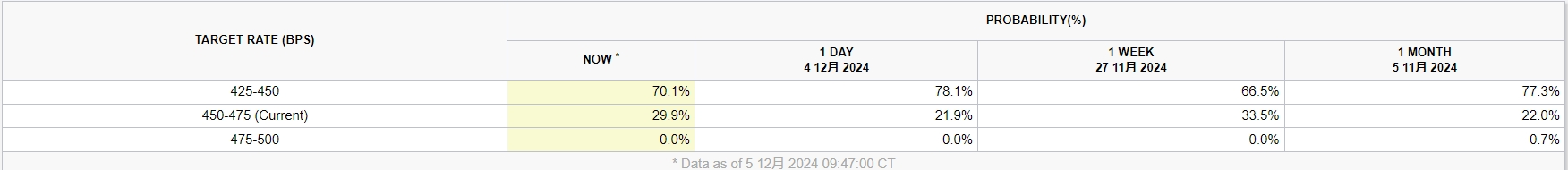

The U.S. non-farm payrolls data released late Friday is the next important data release before policymakers meet in Washington on December 17-18.Although the swap market is priced at a 25 basis point rate cut, strong labor data may prevent the central bank from implementing aggressive monetary easing next year-interest rate cuts are good for interest-free gold.

As Trump won the U.S. election with a "red sweep" approach, the dollar rebounded strongly, tensions in the Middle East eased, and gold and silver prices fell from a record high set at the end of October.However, supported by U.S. interest rate cuts and central bank buying, gold and silver prices have still risen by more than a quarter this year.

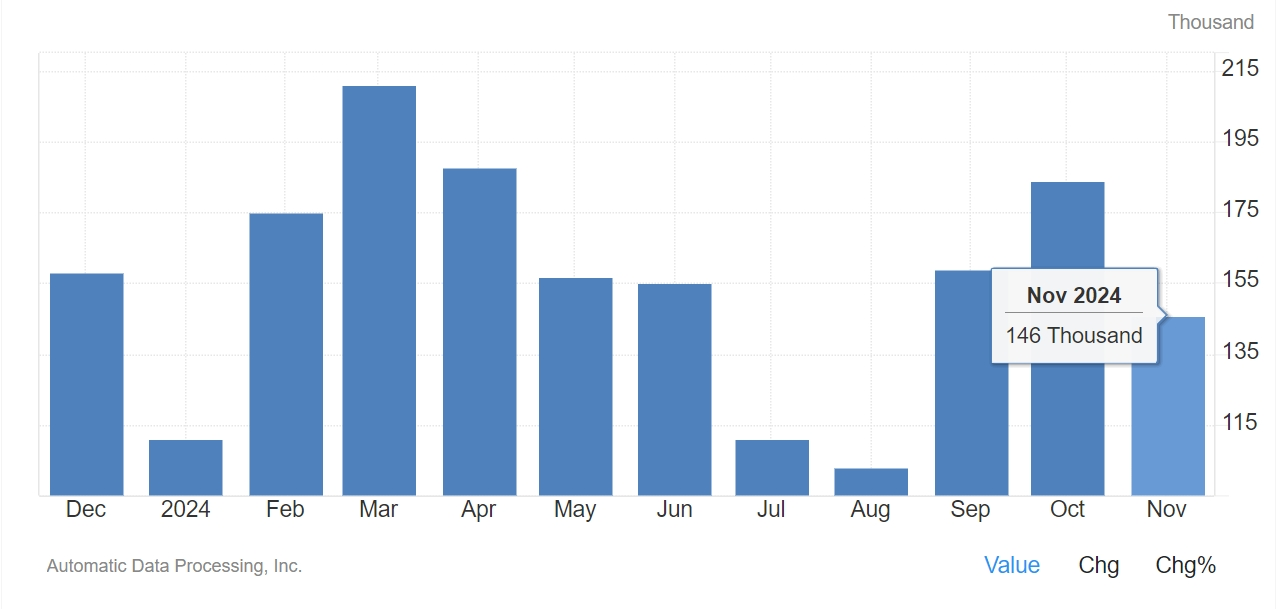

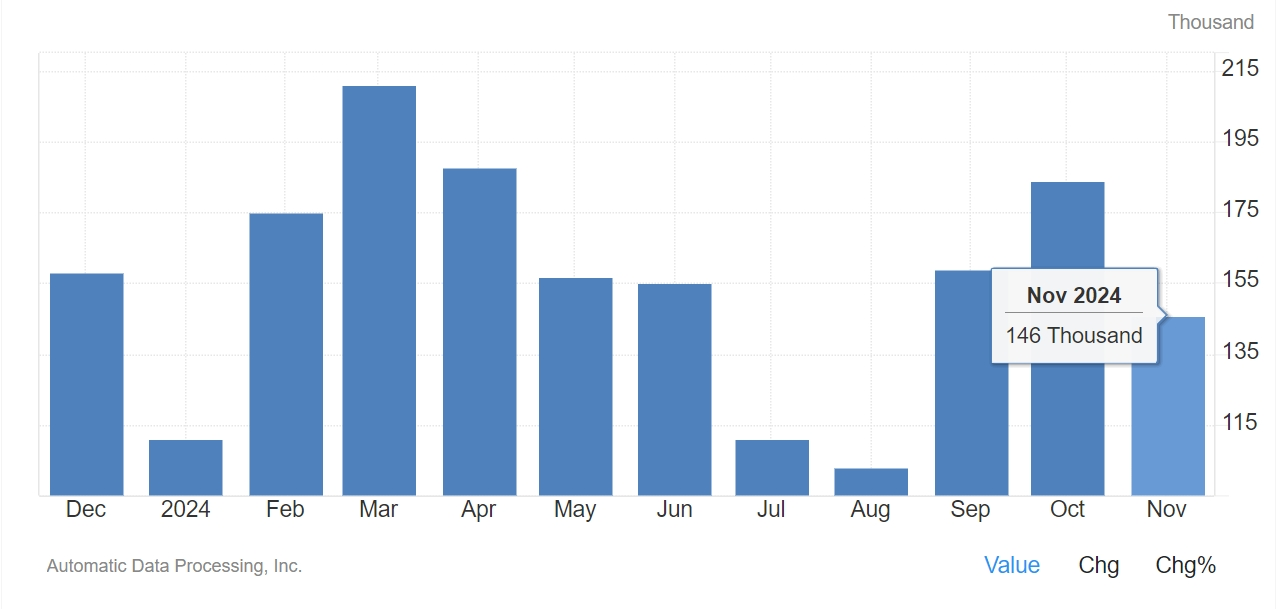

In the latest employment data released, ADP for private employment in the United States has become the key fundamental support for gold prices. The report shows that private enterprises added 146,000 new jobs in November.This number is a significant drop from 233,000 jobs last month and is also lower than MarketWatch's consensus forecast of 163,000 new jobs.

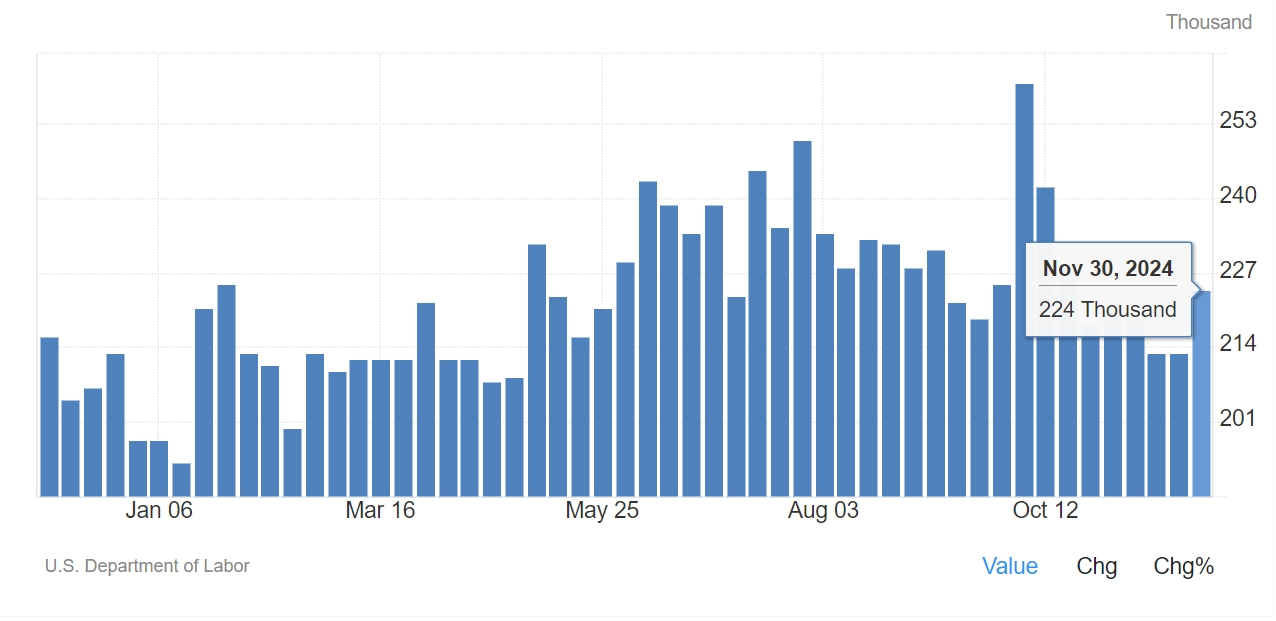

Jason Ware, chief investment officer and chief economist at Albion Financial Group, said: "Unemployment claims are not a big deal; even though applications have increased by 9,000 in the recent week, unemployment claims are still at very low levels.”

Another high-frequency data, the U.S. Weekly Unemployment Benefit Claims Report, shows that in the week ended November 23, the number of people who renewed unemployment benefits, reflecting recruitment, fell by 25,000 to a seasonally adjusted 1.871 million.

Complementing the employment data, U.S. bond yields show a weakening trend.The 2-year Treasury yield fell 6 basis points to 4.218%, while the 10-year Treasury yield fell 3.8 basis points to 4.19%.The moderate decline in yields provides some bullish support for gold prices.

Macquarie Group Ltd. He said that against the background of the Federal Reserve's interest rate cuts and central banks 'further purchases of gold, gold still has room to rise next year and may hit a record high.The company said gold prices will average $2,650 per ounce in the first quarter of 2025.

StoneX is cautious about short-term forecasts for the future gold market.Analyst Fawad Razaqzad said a weaker-than-expected jobs report could reignite hopes for a moderate Fed, which could boost gold prices.Conversely, stronger-than-expected data could prolong current market pressures.

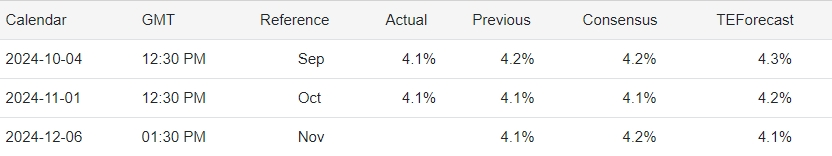

It is understood that due to the damage caused by the hurricane and the impact of strikes, non-agricultural data in October was extremely cold.Economist surveys show that although the unemployment rate may rise further in November, job opportunities are expected to increase, driving a rebound in non-agricultural data and further reducing the urgent need for the Federal Reserve to cut interest rates sharply and quickly.

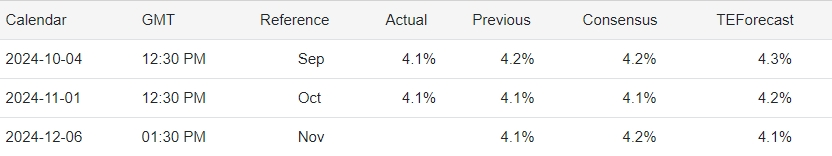

Reuters said economists expect the U.S. non-agricultural population to increase by 200,000 in November, a sharp increase from the previous figure of 12,000.Unemployment is expected to rise slightly to 4.2%, from 4.1%. A sharp rise in unemployment last summer sparked concerns about a recession, but those fears have receded.The average monthly hourly wage and annual rate are expected to record 0.3% and 3.9% respectively.