In addition to the Federal Reserve, the Bank of Canada, the European Central Bank, and the Swiss National Bank may also cut interest rates later this week.

In Asian markets on December 11, gold maintained its gains ahead of key inflation data.Traders believe that if U.S. inflation data is in line with expectations, the Federal Reserve will cut interest rates at its last meeting of the year next week, and gold has maintained its rise for three consecutive days.

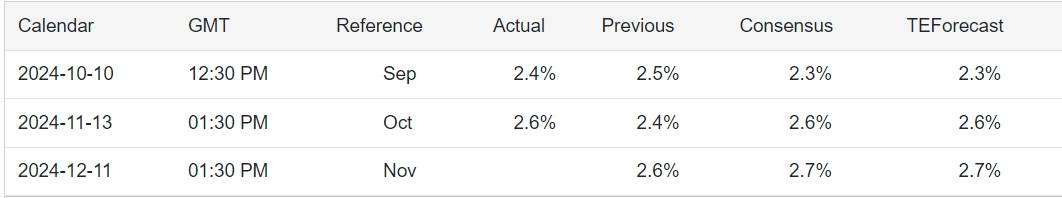

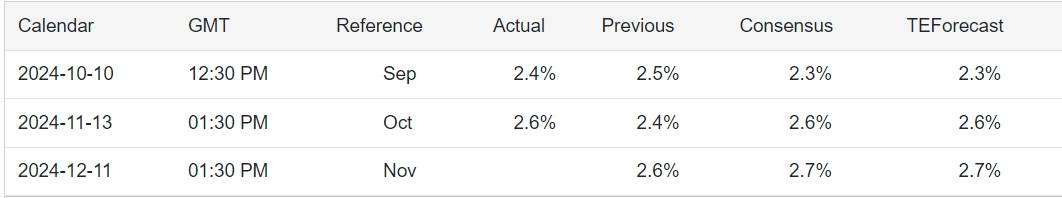

Analysts expect the U.S. consumer price index (CPI) to rise 0.3% in November, with year-on-year increases of 2.7% and 3.3%, respectively.Overall and core producer prices in the United States are expected to increase by 0.2% month-on-month in November, with year-on-year increases of 2.6% and 3.2% respectively.

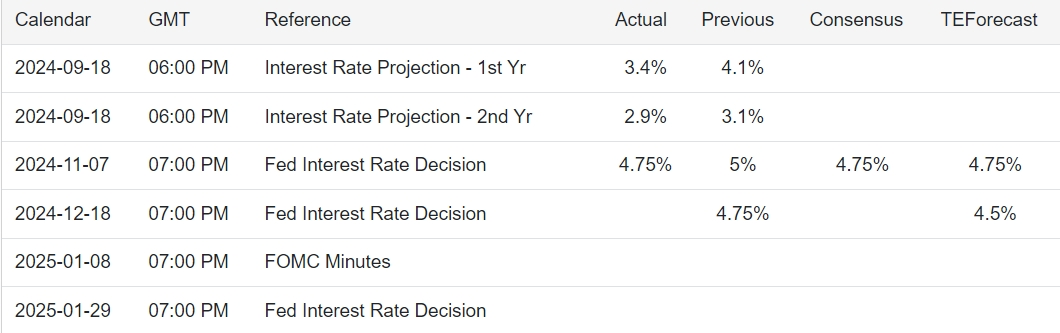

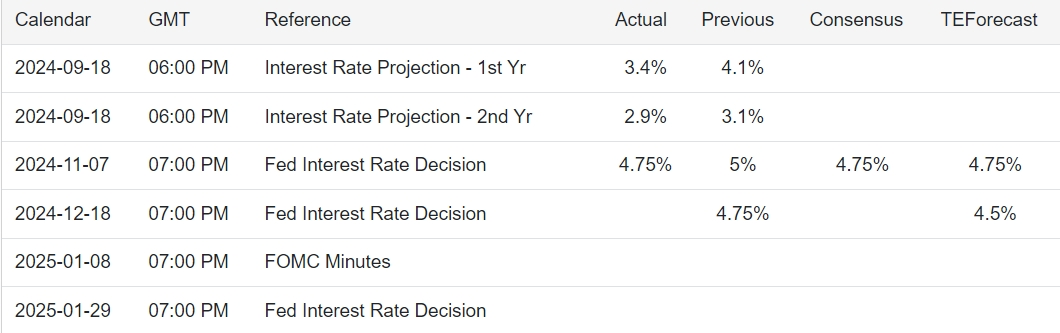

After rising more than 2% in the first three trading days, spot gold and silver briefly traded above $2,700 an ounce.Markets currently believe that the probability of a quarter-point rate cut at the December 17-18 meeting is more than 70%.Lower borrowing costs are usually good for gold and silver because both are zero-coupon assets.

In addition to the Federal Reserve, the Bank of Canada, the European Central Bank, and the Swiss National Bank may also cut interest rates later this week.

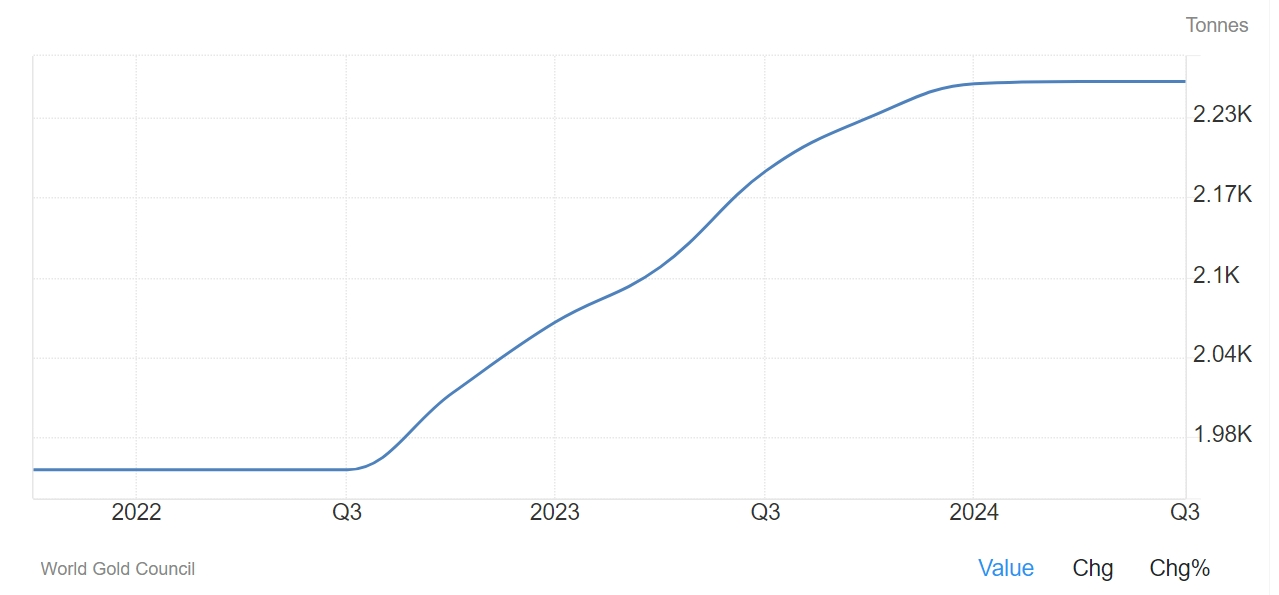

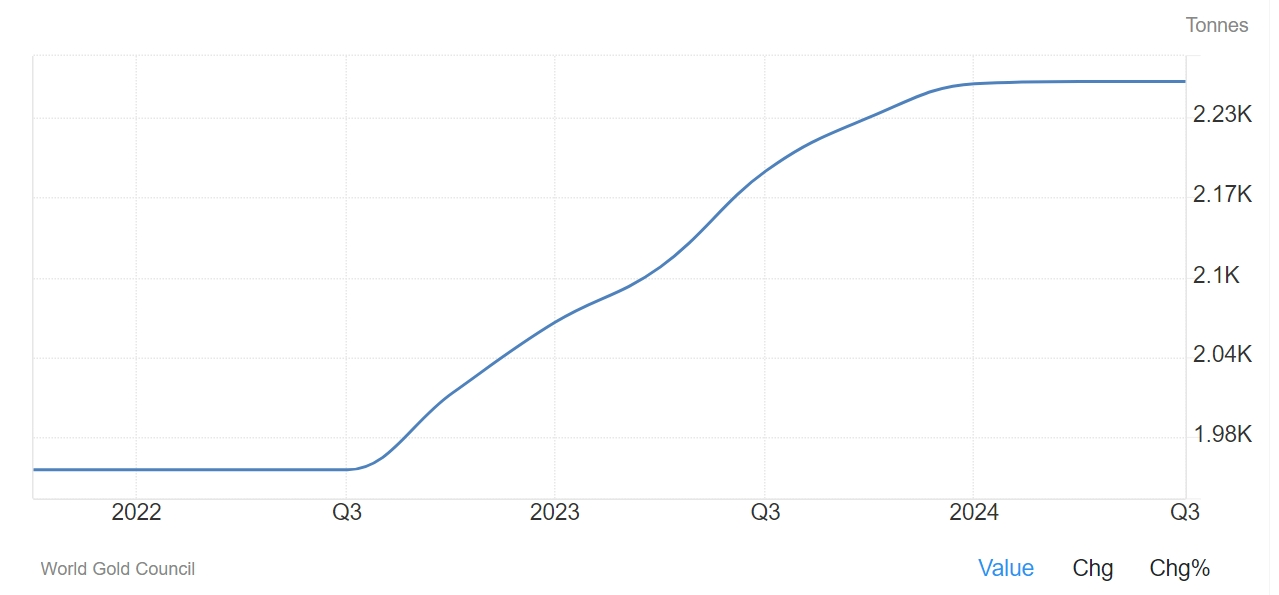

Supported by the Federal Reserve's shift to easing policy, safe haven demand and central bank buying, gold hit a record high of more than $2,790 in October.Gold prices have risen more than 30% this year after resuming gold purchases after the People's Bank of China suspended them for six months.

Chris Weston, director of research at Pepperstone Group Ltd., said technical factors also helped gold and silver, with increased trading volume as futures "convincingly" emerged from the consolidation phase this week.

In addition to support from potential inflation data, the worsening of local conflicts has also increased safe-haven demand for gold.

On December 11, the Israel Defense Forces issued a statement in the early morning saying that so far, the Israeli military has struck 320 strategic targets in Syria and destroyed weapons that may fall into the hands of hostile forces.

According to estimates by the Israeli military, more than 70% of Syria's military forces have been destroyed.The statement said that the Israeli army will continue to deploy troops in the military buffer zone on the Syria border in the Golan Heights.The Israel Defense Forces stressed that depending on developments, the army may eventually be stationed for a long time.Defense Minister Katz said Israel's goal is to establish a security zone in southern Syria.

Peter Grant, vice president and senior metals strategist at Zaner Metals, said: "Concerns about rising tensions in the Middle East are driving safe-haven buying.”

In addition, Syria's new interim leader Al-Bashir announced on Tuesday that he would take charge of the country as a caretaker prime minister and lead the interim government until March 1, with the support of the opposition army that overthrew President Bashar.In the Syria capital, banks reopened for the first time since Bashar was overthrown.The capital is gradually returning to order of life.

As of press time, spot gold rose 0.24% within the day, or rose 6.5 US dollars/ounce to 2,702.5 US dollars/ounce.