Google (GOOGL) Financial Report Interpretation 2023

Summarize Google's fiscal 2023 quarterly results for your reference。

As one of the world's tech giants, Google's (GOOG) earnings numbers are important to investors and analysts, as they reveal the company's performance in various business areas and the company's overall financial health.。By reading this data in depth, we can better understand Google's business model, competitive advantages and future development potential。The following will provide a brief analysis of Google's latest earnings report in order to provide readers with valuable reference information。

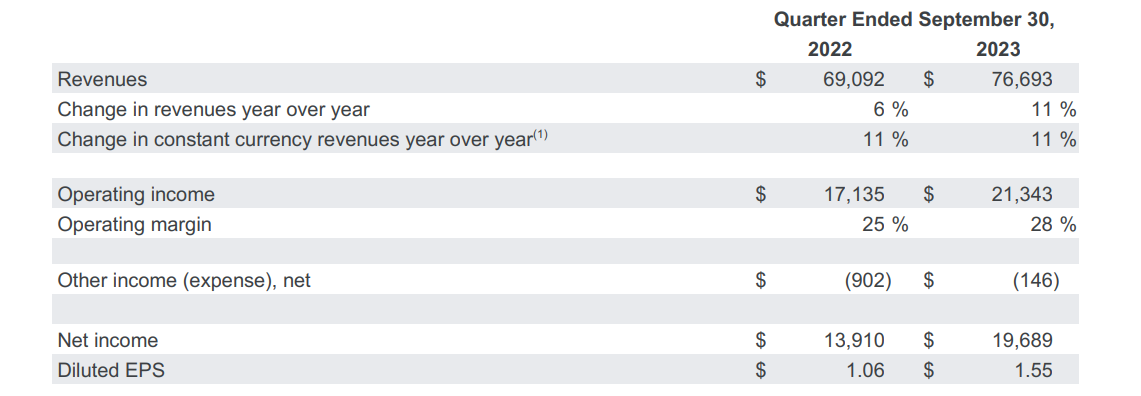

Google Third Quarter Results Report 2023

GoogleQ3Performance data

On October 24, local time, Google's parent company Alphabet released its third-quarter 2023 results.。

Performance data shows that Alphabet's revenue in the third quarter was 766.$9.3 billion, up 11% YoY, better than expected 759.700 million dollars。Operating profit was 213.$400 million, up 24% year-over-year, slightly lower than the expected $21.4 billion。Net profit is 196.$8.9 billion, an increase of about 41.5%, diluted EPS 1.55, above Wall Street expectations of 1.45美元。

Google Q3 Business Performance

● Google Cloud: According to earnings, Alphabet's cloud revenue in the third quarter was 84.$100 million, below market expectations of 86.$0 billion。Cloud business grew 22% year-over-year in the third quarter, falling to its lowest level since the first quarter of 2021。In contrast, year-on-year growth was 28 per cent in both quarters of the first half of the year and 32 per cent in the fourth quarter of last year.。

In terms of earnings, Alphabet's cloud business had an operating profit of 2 in the third quarter..$6.6 billion, significantly below market expectations of 4.$3.4 billion。The business was profitable for the first time in the first quarter of this year, and while it continued to be profitable in the second and third quarters, the slowdown in growth has left the market concerned that Google will lag behind its competitors such as Microsoft in this area.。

Ruth Porat, chief financial officer of Alphabet and Google, said in an interview that sales in the cloud business unit had been affected by cost-cutting by some customers.。Porat did not disclose any further information.。

"Cloud computing is a more volatile business than advertising, and Google faces stiff competition.。According to Max Willens, an analyst at market research firm Insider Intelligence, "While its appeal among AI startups may bear fruit in the long run, it's not helping Google Cloud enough to please investors at the moment."。"

● Google Services: Although the cloud business underperformed expectations in the third quarter, Alphabet's other businesses performed well.。

In terms of advertising revenue, Alphabet recorded advertising revenue in the third quarter 596.$500 million, slightly above analysts' expectations of $59.1 billion, compared with $544 million in the same period last year..$800 million growth of about 9.5%。In the advertising business, the main source of revenue - Google search business advertising revenue of 440.$300 million, higher than market expectations of $43.2 billion。YouTube ads also did well in the third quarter, with revenue of 79.$500 million, up 12.45%, better than 78.$200 million market expectation。

Porat said on a conference call after the results that it was pleased with the growth in its advertising revenue after a period of "historic volatility."。

● Other Bets: Alphabet's Other Bets side, third quarter revenue of 2.$9.7 billion, compared with 2.$9 billion increase。The business is the only remaining loss-making unit of Alphabet, which lost $1.2 billion in the third quarter, roughly in line with analysts' forecasts.。The company's Other Bet business includes self-driving car project Waymo and life sciences division Verily.。

Reference article: Google Q3 earnings release: revenue net profit exceeded expectations cloud business growth slowdown "spooked" market

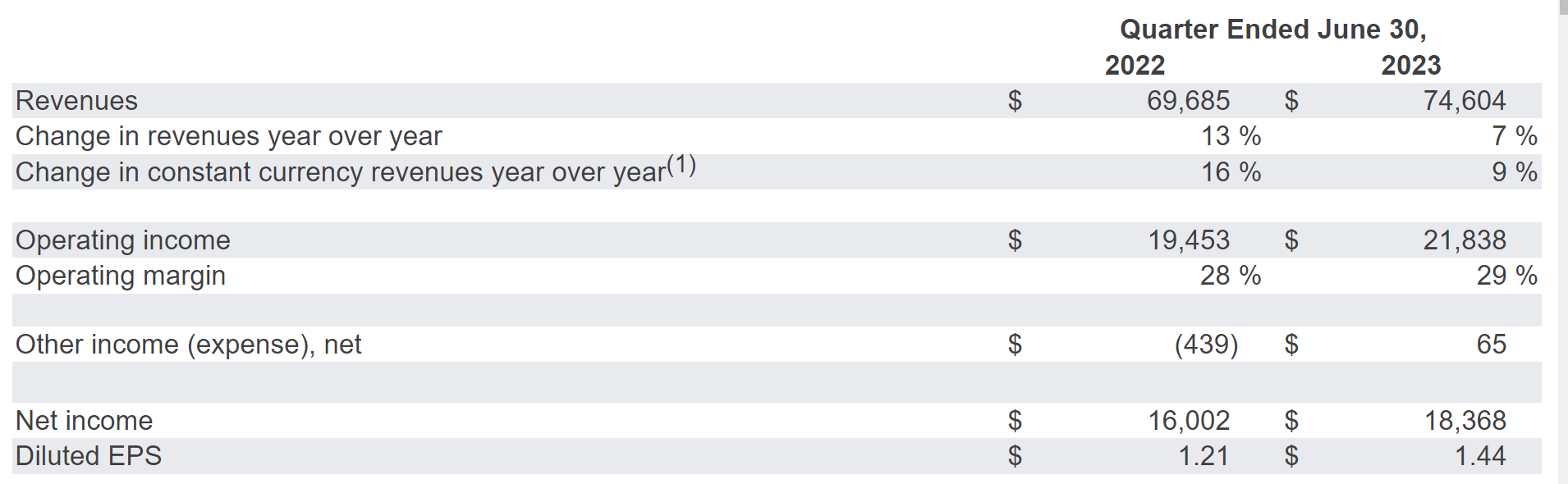

Google Q2 Results Report 2023

Google Q2 Performance Data

On July 25, local time, Google's parent company Alphabet released its second-quarter 2023 earnings report.。

Performance data shows that Alphabet's revenue in the second quarter was 746.$04 billion, up 7% year-over-year, more than double the 3% growth rate in the first quarter and exceeding analysts' estimates of 4.4% growth rate。Operating profit was 218.$3.8 billion, up 12.3%, a year-over-year increase of 2.6%, down 13% year-on-year in the first quarter of this year..3%。Net profit was 183.$6.8 billion, up about 14.8%, diluted EPS 1.44, higher than expected 1.32 美元。

Google Q2 Business Performance

● Google Services: This segment includes products and services such as advertising, Android, Chrome, hardware, Google Maps, Google Pay, search, and YouTube。Revenue from Google services comes primarily from sales of ads, apps and in-app purchases, as well as fees for hardware and subscription-based products such as YouTube Premium and YouTube TV.。

Revenue from this business in the second quarter was 662.$8.5 billion, up 5.5%。Among them, advertising revenue totaled 581.400 million US dollars, achieving a year-on-year growth of 3%。This figure is better than the expected $57.5 billion and the $56.3 billion reported in the same period last year.。YouTube's ad revenue also beat expectations, reaching 76.$600 million, compared to 73.$400 million。Previously, YouTube's advertising revenue fell for three consecutive quarters due to the increase in Tik Tok audience.。

● Google Cloud: This segment includes infrastructure and platform services, collaboration tools, and other services for enterprise customers。Revenue from Google Cloud comes from fees charged for Google Cloud Platform services, Google Workspace and collaboration tools, and other enterprise services。The second quarter revenue of this part of the business was 80..$3.1 billion, up 2.8%。The business made its first profit in the first quarter of this year and continued its earnings trend in the second quarter, reaching 3.$9.5 billion, compared with a loss of 5.900 million dollars。

Other Bets: This revenue comes mainly from sales of health technology and Internet services.。The division's second quarter operating loss 8..$1.3 billion, up from $1.3 billion in the same period last year..$400 million loss narrows。

Sundar Pichai, CEO of Alphabet and Google, said: "Our products and company showed exciting momentum, driving strong results in the quarter.。Our continued leadership in artificial intelligence, along with engineering and innovation excellence, is driving the next evolution of search and improving all of our services.。We have 15 products, each serving 500 million people, and 6 products, each serving more than 2 billion people, so we have many opportunities to achieve our mission。"

Google's overall growth in advertising and cloud revenue is related to its cost-cutting measures.。Alphabet announced 12,000 job cuts in January and reported that it recorded up to $2 billion in employee severance payments and related expenses for the six months ended June 30.。In addition, the company is taking action to optimize its global office space, recording a total cost of 6 for the six months ended June 30..$3.3 billion。

Ruth Porat, Chief Financial Officer of Alphabet and Google, said: "Our financial results reflect the continued resilience of the search business, accelerated revenue growth in the search business and YouTube, and momentum in the cloud business.。We continue to invest in growth while prioritizing a lasting company-wide redesign of our cost base and creating the ability to deliver sustainable value over the long term.。"

Reference article: Google Q2 revenue net profit exceeded expectations Founder "out of the mountain" to help build the next generation of AI model

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.