Why Wal-Mart grocery prices are as stable as a tiger of inflation in the United States?

Walmart has kept grocery prices lower than its competitors while raising prices at a rate much lower than U.S. inflation, according to analysis data。

On May 3, local time, the Fed raised interest rates by 25 basis points, raising the federal rate to 5% to 5%..25% range, so far, the Fed has achieved a "ten-plus"。It is stubborn and abnormal inflation in the United States that prompted the Federal Reserve to raise interest rates so violently.。Latest data show US core CPI at 5 in March.6%, an increase of 0.1 percentage point。

Inflation affects U.S. retailers, Wal-Mart shines in Q4 last year

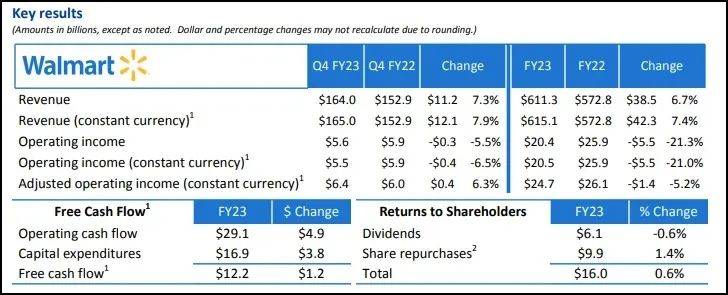

U.S. inflation affects more than just the general public, and times are also tough for U.S. retailers。Earlier, U.S. retailer Kroger announced that sales in the fourth quarter of 2022 were 348.$2.3 billion, up 5.37%; net profit attributable to parent 4.$500 million, down 20.49%。Target, another retailer, reported revenue of $31.4 billion in the fourth quarter of 2022, up 1.3%; net profit attributable to parent was 8.$7.6 billion, down 43.3%。By contrast, Wal-Mart's numbers look much better。For the fiscal fourth quarter ended January 31, 2023, Wal-Mart's revenue was $164 billion, up 7.3%; net profit attributable to the parent company was $6.3 billion, up 76.2%。

Wal-Mart has become the platform of choice for consumers to buy household groceries online, with low prices as its killer

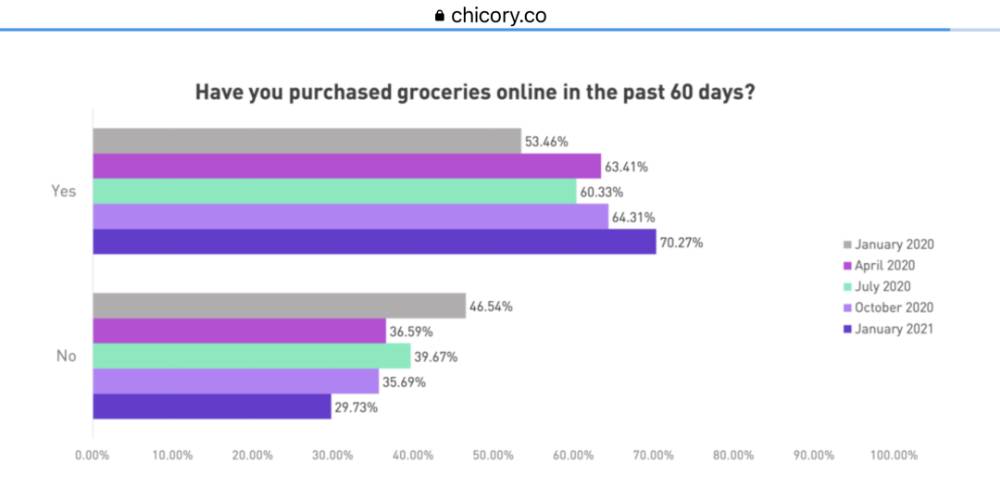

Wal-Mart's revenue growth is naturally inseparable from consumer preferences。According to a new study by Chicory, a digital commerce platform owned by CPG / Grocery, Walmart's current popularity has overtaken Amazon as the shopping platform of choice for consumers to buy household groceries online。The study also shows that the main reason consumers shop at Walmart is because of its relatively low price, followed by familiarity with the product and proximity to Walmart stores。

According to media sources, a new analysis of Wal-Mart's pricing strategy shows that Wal-Mart has kept grocery prices lower than its competitors while raising prices at a rate much lower than U.S. inflation.。

In recent years, global food prices have hit record highs, with domestic food prices in the United States rising wildly at a double-digit rate.。Household food prices, the price of food purchased at grocery stores and supermarkets, are expected to rise further this year, according to the U.S. Department of Agriculture..6%。

In the face of soaring food prices, Wal-Mart still maintains relatively affordable prices for external sales。Some media said that in a sample basket of 10 foods, including Kellogg's Pringles potato chips, Kraft Heinz's Miracle Whip Mayo and Del Monte's Green Beans, Wal-Mart's prices were 4 times cheaper than Target's..6%, 14 cheaper than Kroger.8%, 17% cheaper than Amazon。

Parul Jain, professor of finance and economics at Rutgers, said: "These figures show Walmart's influence over suppliers and the company's potential to take market share from competitors such as Amazon.。"

In addition, data analytics firm Dataweave also compared the prices of 589 brand-name products in 34 categories, including coffee, soup, cereals, baked goods, batteries, personal care products and pet food.。The company collected and checked prices from online and offline stores at Walmart, Kroger, Target and Amazon to arrive at an average daily price for these items over the months of January 2022 to February 2023.。

Analysis of the data shows that during this period, although the average inflation rate in the United States was 7.5%, but Wal-Mart kept prices steady。Krishnan Thyagarajan, chief operating officer of Dataweave, said that in the 14 months to February 2023, the overall price of goods in Wal-Mart's online and offline stores rose by an average of 3%, compared with 7% for the same products sold by Amazon..5%, while Kroger and Target are up 9%。

One in every four dollars of grocery spending comes from Walmart, which has been a bright spot for the world's largest retailer.。Wal-Mart's relatively low retail price has naturally gained a lot of market share for it.。According to data from market research companies, Wal-Mart accounts for a total of 42% of U.S. brick-and-mortar retailers, and Wal-Mart's overseas market share is equally strong, with operations in Latin America and Asia and a current market capitalization of more than $400 billion.。However, the online retail share of this piece still needs to be improved, the current Wal-Mart online market share of only 6.3%, compared to 37 for Amazon.8%。

Walmart sued by consumers and retailers for allegedly "pressuring" suppliers to get low prices

The company is currently facing allegations of using its influence to gain an unfair advantage over its competitors.。Last week, consumers and retailers sued Walmart and battery maker Energizer, accusing it of conspiring to raise the price of disposable batteries in a project inside Energizer called Atlas.。According to the lawsuit, Energizer "under pressure from Wal-Mart" agreed to expand its wholesale battery business from other retailers starting around January 2018 and required those retailers not to lower prices below Wal-Mart.。

In response, Walmart said in an email on Thursday: "The company takes such allegations seriously and will respond in court in due course."。Walmart sells Energizer batteries at bigger discounts than competitors, data shows。For example, a pack of two alkaline A23 batteries sells for 4 at Wal-Mart.$49, while Amazon and Target sell for 4 each.$64 and 5.22 USD。At the same time, at least two different types of Energizer coin batteries sold by Walmart were found to be 30% to 35% cheaper than the second-lowest-priced competitor.。

The National Grocers' Association and the Wholesale Grocers Association, which represent independent and regional grocery chains in the United States, have been urging federal lawmakers and regulators in recent years to crack down on the influence of grocery giants, including Wal-Mart, over suppliers and to more strictly enforce the Robinson-Patman Act, which prohibits manufacturers from engaging in retailer price discrimination.。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.