Hawkinsight Crude Oil Market Daily (1.2) Red Sea Renewed Conflict Disturbs Supply Chain International Oil Prices Open Jump

Oil prices jump 1 in the first trading day of 2024 due to possible supply disruptions in the Middle East following clashes in the Red Sea.5%。

On Thursday, January 2, oil prices jumped by 1 in the first trading day of 2024 due to possible supply disruptions in the Middle East after clashes in the Red Sea..5%。

Market Review

December 29 (last Friday) global crude oil closed, futures market trading is relatively sparse。Specifically, the settlement price of international crude oil futures fell slightly last week, and the price of the February contract for WTI crude oil futures fell by 0.17%, compared with a cumulative decline of about 10% for the full year 2023..7%; Brent crude futures contract price for March fell 0.22%, with a cumulative decline of about 10% for the full year 2023..3%。

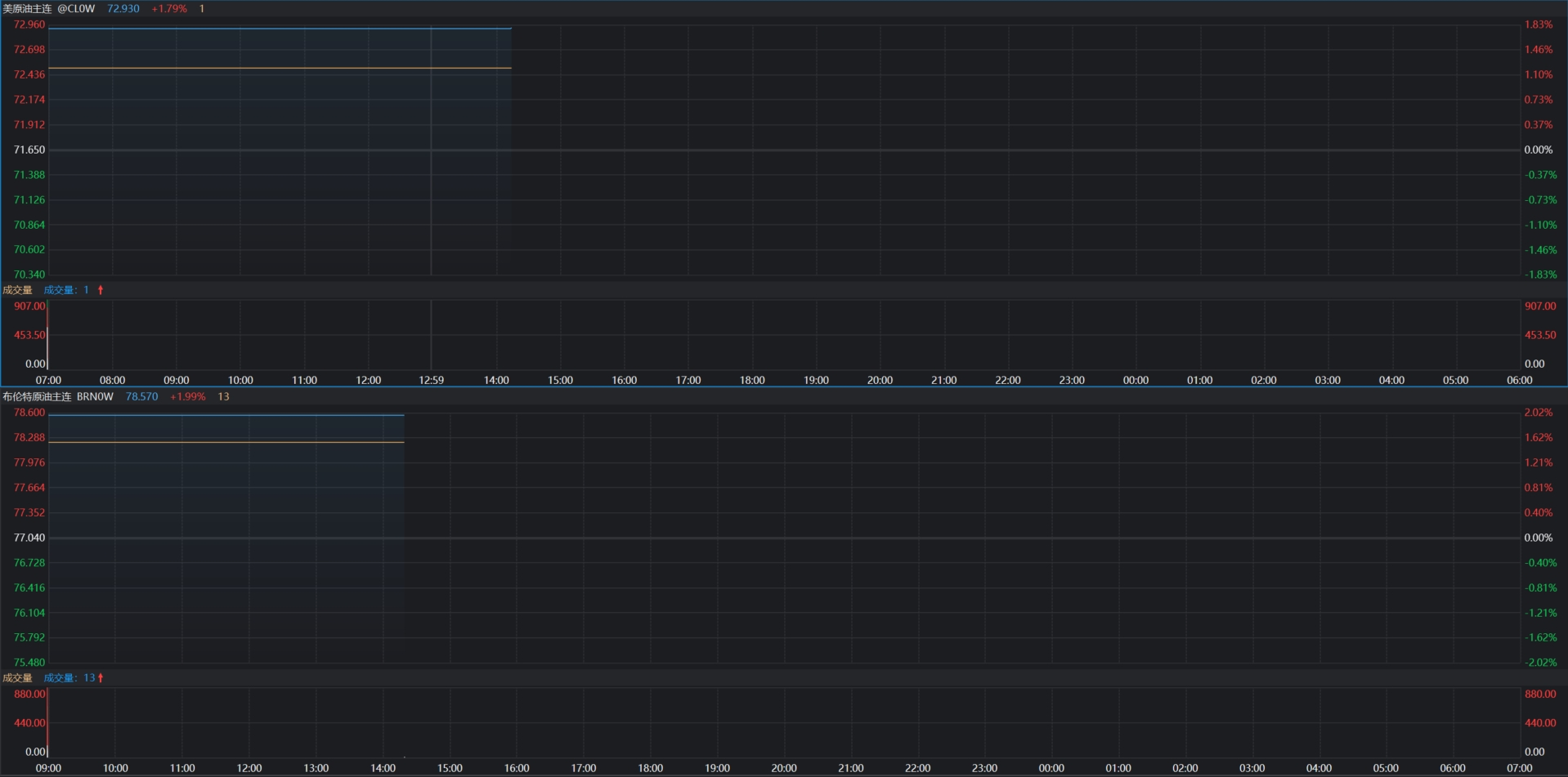

As of press time, WTI's main crude oil futures prices rose 1.79%, at 72.$93 / bbl; Brent main crude futures up 1 today.99%, reported 78.$57 / barrel。

important news

l Renewed clashes in the Red Sea as crude supply disruptions return to view: U.S. helicopters repelled an attack on a Maersk container ship by Iranian-backed Houthi militants in the Red Sea on Sunday, sinking three Houthi vessels and killing 10 militants。The wider conflict could shut down vital waterways for oil supply shipments such as the Red Sea and the Strait of Hormuz in the Gulf, reports said: An Iranian warship sailed into the Red Sea after the naval battle ended。

l China's manufacturing sector shrank for the third consecutive month, as investors bet on government stimulus measures: December 31, the National Bureau of Statistics released data, December, the manufacturing purchasing managers' index (PMI) was 49.0%, down 0 from the previous month.4 percentage points, the manufacturing boom level has fallen。As a result, investor expectations of new stimulus measures from the Chinese government have risen。

l India raises domestic windfall profits tax on crude oil: India raises windfall profits tax on domestic crude oil to Rs 2,300 per tonne (27.$63)。

India's crude imports from Russia fell: Kpler data show that after rising to an all-time high of 2.15 million bpd in May last year, India's oil imports from Russia began a volatile decline, falling sharply between November and December, falling to 1.48 million bpd last month。

Technical analysis

Rémy GAUSSENS, director of research at TRADING CENTRAL, said that on the 30-minute line, U.S. crude oil (WTI) futures (G4) are expected to continue to rise during the day, with technical analysis being bullish on RSI technical indicators。

Trading Strategies:: At 71.Above 70, bullish, target price 73.70, then 74.30; alternative strategies: at 71.70 under, bearish, target price set at 71.20, then 70.45。Support level: 71.20, 70.45; resistance level: 73.70, 74.30。

This week's important schedule

Tuesday, January 2

04: 00 Eurozone December Manufacturing PMI Final Value

04: 30 UK December Manufacturing PMI

09: 45 US December Markit Manufacturing PMI Final Value

10: 00 Monthly Rate of US Construction Expenditure in November

Wednesday, January 3

10: 00 US December ISM Manufacturing PMI

10: 00 US November JOLTs Job Vacancies

16: 30 US API Crude Oil Inventory for Week to December 29

20: 45 China's December Caixin Services PMI.

Thursday 4th January

04: 00 Eurozone December Services PMI Final Value

04: 30 UK November Central Bank Mortgage Permit.

04: 30 UK December Services PMI

07: 30 U.S. December Challenger Corporate Layoffs

08: 15 U.S. ADP Employment in December

08: 30 U.S. to December 30 Initial jobless claims for the week

09: 45 US December Markit Services PMI Final Value

11: 00 US to December 29 week EIA crude oil inventories

11: 00 U.S. to December 29 Week EIA Oklahoma Cushing Crude Oil Inventories

11: 00 U.S. to December 29 Week EIA Strategic Petroleum Reserve Inventory

Friday, January 5

05: 00 Eurozone December CPI Initial Annual Rate

05: 00 Eurozone December CPI Monthly Rate

05: 00 Eurozone November PPI Monthly Rate

08: 30 U.S. Unemployment Rate in December

08: 30 US non-farm payrolls after December quarter adjustment

10: 00 US December ISM Non-Manufacturing PMI

10: 00 U.S. November Factory Orders Monthly Rate

13: 00 Total number of oil rigs for the week from the United States to January 5

* * The above schedule is US Eastern Time (UTC-05: 00) * *

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.