Hawkinsight Crude Oil Market Daily (12.29) International oil prices closed lower yesterday as Red Sea shipping disruptions eased

From now on, almost all container ships sailing between Asia and Europe will pass through the Suez Canal, with only a few vessels detouring Africa, according to a breakdown of the Danish company Maersk's shipping schedule on Thursday.。

Hawkinsight APP - December 29 (Friday) Asian morning market, due to the global interest rate cut is expected to grow, the international oil prices rose。

Market Review

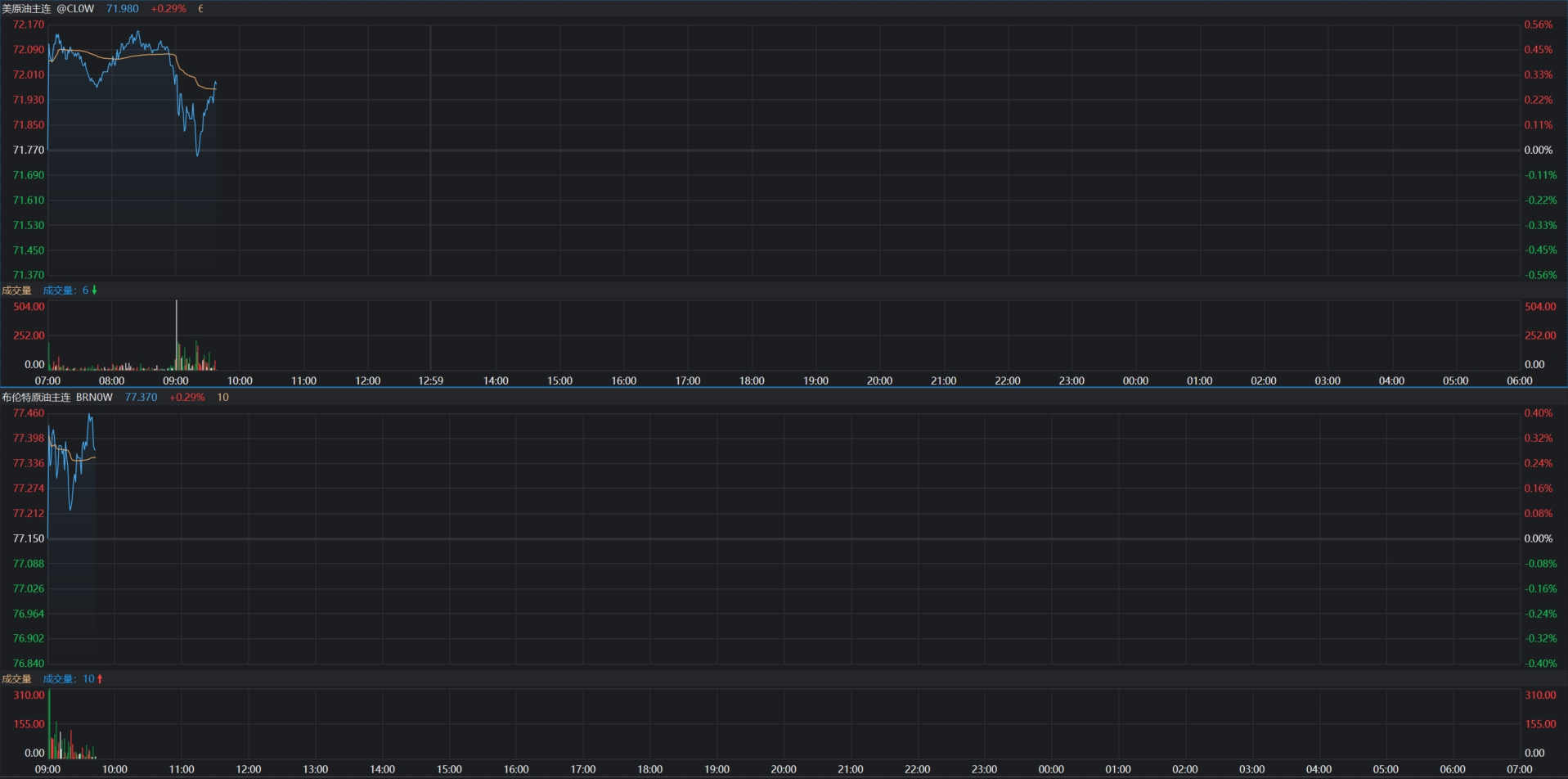

WTI main crude futures close down 2 Thursday as Red Sea shipping disruptions ease.$34, down 3.16%, reported 71.$77 a barrel; Brent main crude futures close down 2.$39, or 3%, at 77.$15 a barrel; INE crude futures close down 3.45%, at 548.5 yuan。

As of press time, WTI's main crude oil futures rose slightly in the day..29% at 71.$98 / bbl; Brent main crude futures edged up 0.29%, reported 77.$37 / barrel。

important news

Red Sea shipping disruptions ease: From now on, almost all container ships sailing between Asia and Europe will pass through the Suez Canal, with only a few ships detouring around Africa, according to a foreign media breakdown of Denmark's Maersk shipping schedule on Thursday.。

U.S. crude oil inventories fell more than expected: EIA data showed that in the week ended December 22, U.S. crude oil inventories fell by 7.1 million barrels, while analysts expected a decrease of 2.7 million barrels。U.S. Gulf Coast crude inventories fell 11.03 million barrels, the biggest drop since August, data show。

l Global interest rate cut expectations are growing: investors expect interest rate cuts in Europe and the United States in 2024, or will stimulate oil demand。

l U.S. domestic crude oil production remains unchanged: U.S. commercial crude oil imports excluding strategic reserves for the week of December 22 627.60,000 barrels per day, down 47 from the previous week.40,000 barrels per day。Crude oil exports decreased by 20.60,000 barrels / day to 39.1.50,000 barrels per day。U.S. domestic crude oil production remained at 1330 for the week of December 22..0 million barrels per day unchanged。

l Russian oil exports fell month-on-month: Russian oil product exports fell month-on-month in the week ending December 24, with diesel, naphtha and fuel oil shipments falling sharply。Analysts expect its exports to remain stable overall next year.。

l Mandara Capital to shut down business: Once one of the largest crude oil and fuel market makers, Mandara Capital is going out of business and the shutdown process is underway。

Technical analysis

Rémy GAUSSENS, director of research at TRADING CENTRAL, said that on the 30-minute line, U.S. crude oil (WTI) futures (G4) are expected to fall restrictively during the day, with a technical review of the downward movement of RSI technical indicators.。

Trading Strategy: At 72.75 below, bearish, target price of 71.15, then 70.65; alternative strategies: at 72.Above 75, bullish, target price set at 73.80, then 74.40。Support level: 70.65, 70.15; resistance level: 74.40, 73.80。

This week's important schedule

Friday, December 29

08: 30 U.S. to December 23 Initial jobless claims (10,000)

10: 00 Monthly Rate of US Existing Home Contract Sales Index for November

10: 30 EIA Natural Gas Inventory for the Week from US to December 22 (100 million cubic feet)

11: 00 US EIA crude oil inventories for the week ending December 22 (10,000 barrels)

11: 00 US to December 22 week EIA Oklahoma Cushing Crude Oil Inventory (10,000 barrels)

11: 00 U.S. EIA Strategic Petroleum Reserve Inventory for the Week to December 22 (10,000 barrels)

Saturday 30th December

09: 45 US December Chicago PMI

13: 00 Total number of oil wells drilled in the week from the United States to December 29 (ports)

* * The above schedule is US Eastern Time (UTC-05: 00) * *

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.