Hawkinsight Crude Oil Market Daily (1.8) | Saudi Arabia's Sharp Price Cut Overlays OPEC's Increase in Production and International Oil Prices Fall

Rising supplies and competition from rival producers prompted Saudi Arabia on Sunday to cut the official selling price (OSP) of its flagship Arab Light crude to Asia in February to its lowest level in 27 months.。

International oil prices fell in early Asian markets on Monday, January 8, as sharp price cuts by top exporter Saudi Arabia and increased OPEC production offset concerns about escalating geopolitical tensions in the Middle East.。

Market Review

Oil prices close higher in first week of 2024, WTI crude closes at 73.$81 / barrel, up more than 3.01%; Brent up 1.$17 a barrel, up 1.51%; SC crude oil also rose more than 3% in the week after Friday night trading to close at 561.2 yuan / barrel。

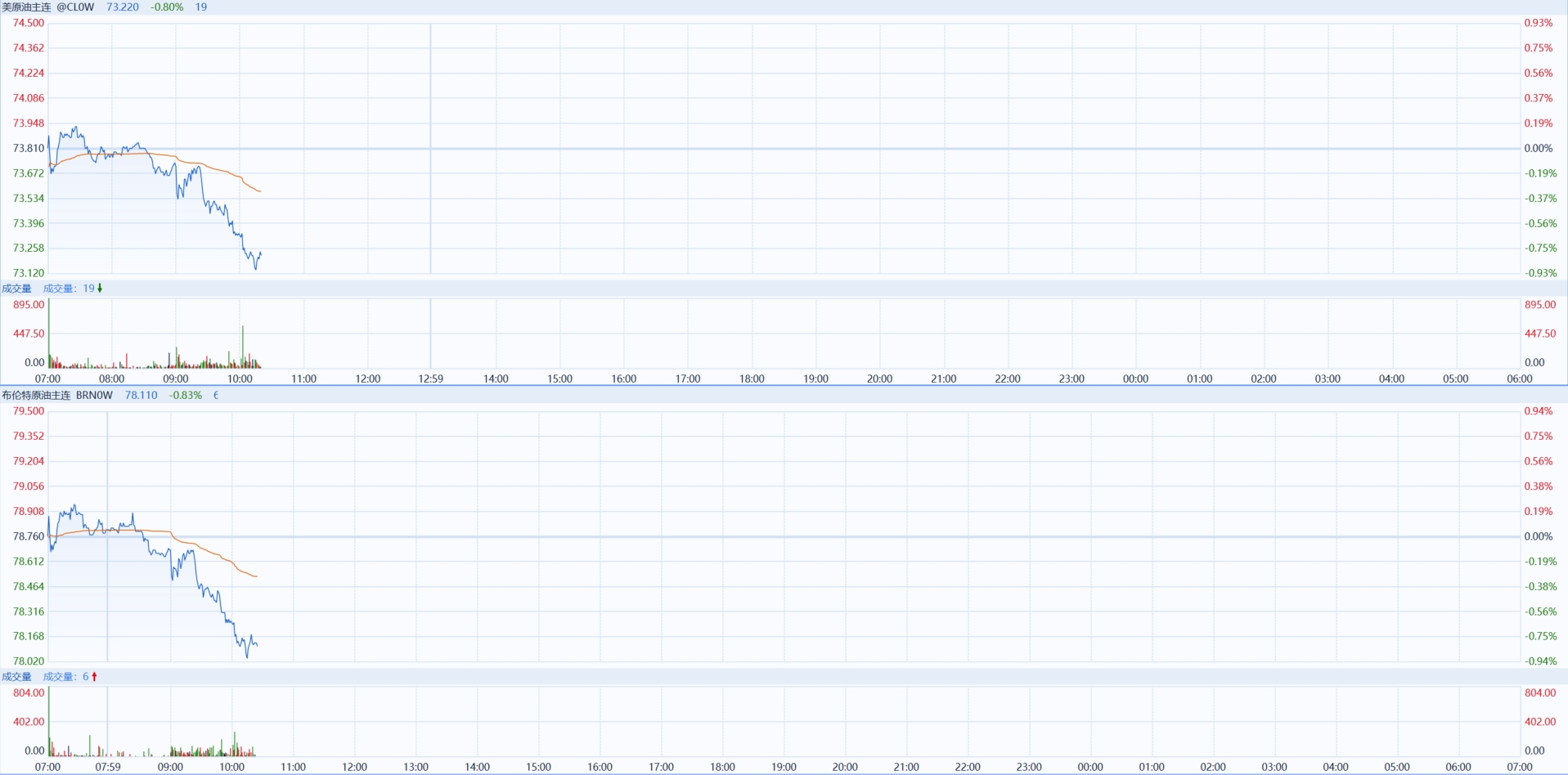

As of press time, WTI's main crude oil futures prices fell 0 today.8% at 73.$22 / bbl; Brent main crude futures down 0 today.83%, reported 78.$11 / barrel。

important news

l OPEC crude oil production increased by 70,000 barrels per day in December: foreign media surveys show that OPEC oil production increased by 70,000 barrels per day to 27.88 million barrels per day in December, offsetting the upward pressure on prices caused by geopolitical concerns。Rising supplies and competition from rival producers prompted Saudi Arabia on Sunday to cut the official selling price (OSP) of its flagship Arab Light crude to Asia in February to its lowest level in 27 months.。

l US seeks to avert bigger war in Middle East: US Secretary of State Anthony Blinken, who was visiting the Middle East this week, warned that without a coordinated peace effort, the Gaza conflict could spread to the entire region。

l U.S. oil rigs increased last week: Baker Hughes (Baker Hughes), a well-known oil service, said in a weekly report that U.S. oil rigs increased by one last week to 501。JPMorgan has forecast 26 more oil rigs will be added this year, most of them in the Permian, in the first half of the year.。

l U.S. non-farm payrolls grew more than expected in December, prompting financial markets to fall back on expectations of a March rate cut by Wachovia: according to CME "Fed Watch," the Fed kept interest rates at 5 in February..25% -5.The probability of the 50% interval being constant is 93.3%, the probability of a 25 basis point rate cut is 6.7%。The probability of keeping interest rates unchanged by March is 30.8%, with a cumulative probability of a 25 basis point cut of 64.7%, with a cumulative probability of a 50 basis point rate cut of 4.5%。

Technical analysis

Rémy GAUSSENS, director of research at TRADING CENTRAL, said that on the 30-minute line, U.S. crude oil (WTI) and futures (G4) are expected to rise restrictively during the day, with technical analysis showing that RSI technical indicators run complex trends and tend to rise。

Trading Strategy: At 73.15 above, bullish, with a target price of 74.75, then 75.20; alternative strategies: at 73.15 down, bearish, target price set at 72.40, then 71.90。Support level: 72.40, 71.90; resistance level: 74.75, 75.20。

Tuesday, January 9

06: 00 US December NFIB Small Business Confidence Index

08: 30 US November Trade Account

Wednesday, January 10

10: 00 Monthly Wholesale Sales Rate in November

10: 00 US to January 5 week EIA crude oil inventories

10: 30 U.S. to January 5 Week EIA Oklahoma Cushing Crude Oil Inventory

13: 00 U.S. to January 10 10 10-year Treasury auction - bid rate.

13: 00 U.S. to January 10 10 10-year Treasury bid - bid multiple.

Thursday 11th January

08: 30 U.S. December not quarterly CPI annual rate

08: 30 US monthly CPI rate after December quarter adjustment

08: 30 Initial jobless claims for the week from the United States to January 6

08: 30 U.S. Core CPI Annual Rate Not Quarterly in December

08: 30 U.S. December Core CPI Monthly Rate

10: 30 US to January 5 week EIA natural gas stocks

Friday, January 12

08: 30 US December PPI Annual Rate

08: 30 US December PPI Monthly Rate

13: 00 Total number of oil wells drilled in the United States for the week ending January 12

* * The above schedule is US Eastern Time (UTC-05: 00) * *

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.