Hawkinsight Gold Market Daily (1.9) Federal Reserve officials put pigeons spot gold sub-market slightly higher.

On Monday, local time, Fed Governor Bowman said he had adjusted his position slightly and hinted that the rate hike might be over。However, Bowman said she's not ready to start cutting rates。She

January 9 (Tuesday) Asian morning market, spot gold slightly higher。

Market Review

On Monday, January 8, the price of gold fell to a three-week low of 2,028 per ounce..$03, down 0.9%, which initially fell below the $2020 mark and hit its lowest level since December 18, 2016..69美元。

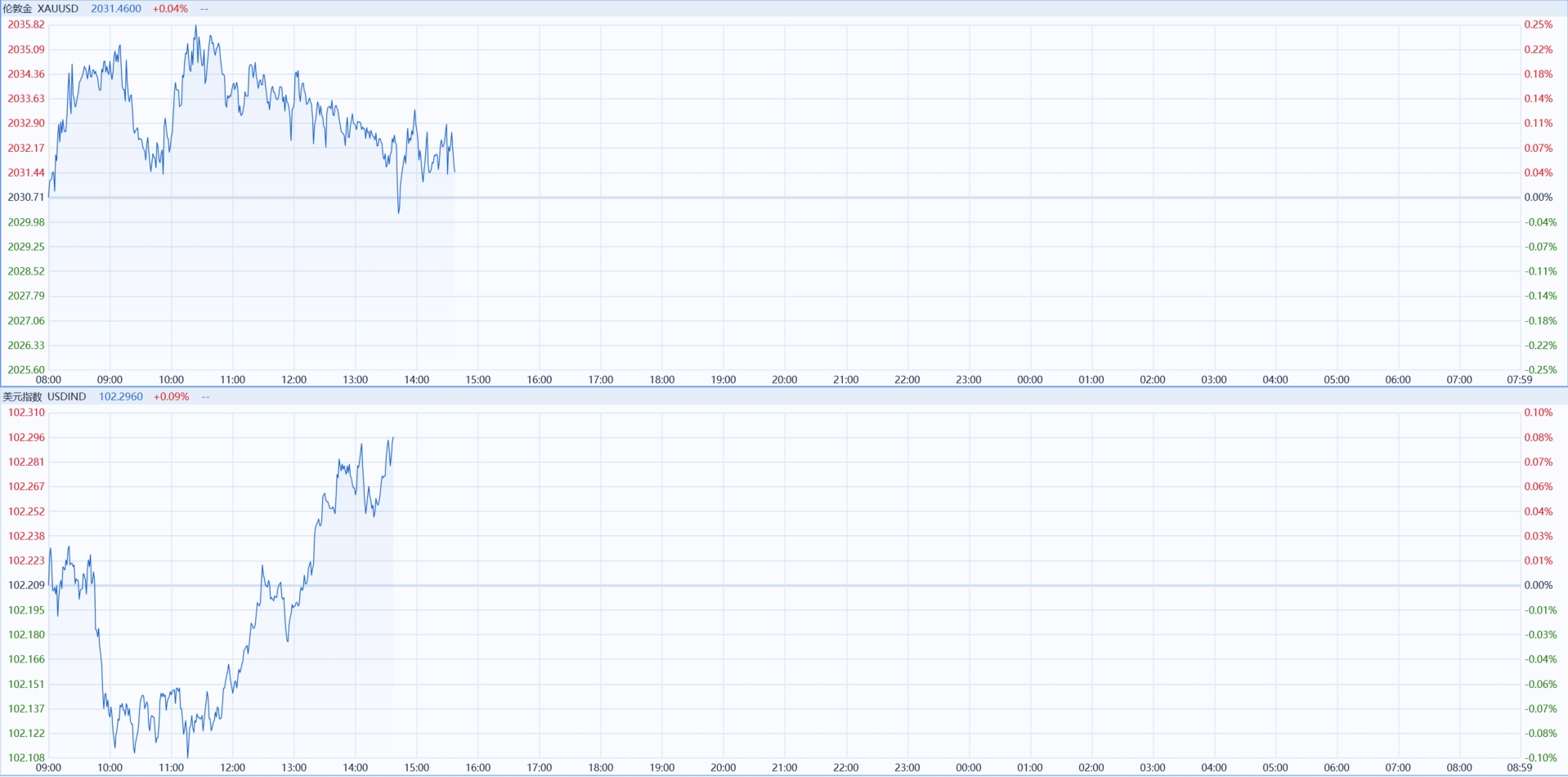

Spot gold prices up 0 today as of press time.04%, reported 2031.$46 / oz; dollar index up 0 on day.09% at 102.30。

important news

l Fed governor hints that rate hikes may be over: On Monday, local time, Fed Governor Bowman said he had adjusted his position slightly and hinted that rate hikes may be over。However, Bowman said she's not ready to start cutting rates。She said short-term interest rates should remain at current levels and important inflation upside risks remain。

l Atlanta Fed chairman says it's too early to declare victory: On Monday, local time, Atlanta Fed President Bostic said inflation fell more than he expected and was moving towards the Fed's 2% target, but it's too early to declare victory。He said: "Today we are moving towards 2%.。The goal is to stay on this path。

l Market attention to Thursday's U.S. December CPI data: analysis said that the core CPI in December, excluding food and fuel, is expected to increase by 3.8%, which would be the smallest annual gain since May 2021。Overall CPI is expected to rise 3.3%, compared with a gain of 3% in the November report..1%。If the data is strong, it could boost the dollar and weigh on dollar-denominated gold。

l CME "Fed Watch": Fed keeps rates at 5 in February.25% -5.The probability of the 50% interval being constant is 95.3%, the probability of a 25 basis point rate cut is 4.7%。The probability of keeping interest rates unchanged by March is 38.1%, with a cumulative probability of a 25 basis point cut of 59.1%, with a cumulative probability of a 50 basis point rate cut of 2.8%。

Technical analysis

Rémy GAUSSENS, director of research at TRADING CENTRAL, said that on the 30-minute line, spot gold is expected to rise restrictively during the day, and the technical review is that RSI technical indicators run complex trends and tend to rise。

Trading Strategy: In 2026.00 above, bullish, target price 2042.00, then 2050.00; alternative strategy: in 2026.00, bearish, target price set at 2017.00, then for 2011.00。Support level: 2017.00, 2011.00; resistance level: 2042.00, 2050.00。

This week's important schedule

Tuesday, January 9

06: 00 US December NFIB Small Business Confidence Index

08: 30 US November Trade Account

Wednesday, January 10

10: 00 Monthly Wholesale Sales Rate in November

10: 00 US to January 5 week EIA crude oil inventories

10: 30 U.S. to January 5 Week EIA Oklahoma Cushing Crude Oil Inventory

13: 00 U.S. to January 10 10 10-year Treasury auction - bid rate.

13: 00 U.S. to January 10 10 10-year Treasury bid - bid multiple.

Thursday 11th January

08: 30 U.S. December not quarterly CPI annual rate

08: 30 US monthly CPI rate after December quarter adjustment

08: 30 Initial jobless claims for the week from the United States to January 6

08: 30 U.S. Core CPI Annual Rate Not Quarterly in December

08: 30 U.S. December Core CPI Monthly Rate

10: 30 US to January 5 week EIA natural gas stocks

Friday, January 12

08: 30 US December PPI Annual Rate

08: 30 US December PPI Monthly Rate

13: 00 Total number of oil wells drilled in the United States for the week ending January 12

* * The above schedule is US Eastern Time (UTC-05: 00) * *

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.