How about Futu Securities (Singapore)?

Founded in 2012, Fortis Securities is a wholly owned subsidiary of Fortis Holdings. For users in Singapore, the broker supports one-stop trading for a single account, catering to the investment needs of most traders.

Introduction to Futu Securities (Singapore)

Futu Securities was established in 2012 as a wholly-owned subsidiary of Futu Holdings. For users in Singapore, this brokerage firm supports one-stop trading with a single account, meeting the investment needs of most traders.

It is understood that Futu Holdings was listed on the NASDAQ Stock Exchange in 2019. To date, the group and its subsidiaries hold 35 financial business licenses and qualifications in various mainstream financial markets worldwide, with trading products spanning from Hong Kong and U.S. stocks to A-shares, funds, futures, bonds, and more.

Is Futu Securities (Singapore) Safe?

Futu Securities (Singapore) is regulated by multiple top-tier regulatory agencies and always prioritizes the safety of customer funds. Users trading with this brokerage firm can always feel secure and confident.

The brokerage firm is a licensed entity registered with the Monetary Authority of Singapore (MAS) (License No. CMS101000) and holds a Capital Markets Services license (CMS). Futu Securities (Singapore) also has a local office, facilitating smooth business operations.

Additionally, the Securities Investor Protection Corporation (SIPC) is responsible for protecting the U.S. stock accounts of Futu Securities (Singapore) users, with coverage up to $500,000 (including $250,000 in cash). This means that if the brokerage firm were to collapse, SIPC would return assets to investors up to this limit in the shortest possible time.

Three Key Features of Futu Securities (Singapore)

Single-Account Trading in U.S./Hong Kong/Singapore Stocks

Futu Securities supports single-account trading in the U.S., Hong Kong, and Singapore stock markets. In addition, products such as ADRs, ETFs, and Real Estate Investment Trusts (REITs) are also available for selection.

Moreover, a range of financial products is set to be launched soon, allowing investors to choose according to their needs or interests.

Highly Competitive Trading Fees

Compared to local brokers in Singapore, Futu Securities (Singapore) offers highly competitive trading fees, providing favorable conditions for a wide range of traders.

- U.S. Stocks: $0 commission, $0 platform fee.

- Hong Kong Stocks: Commission as low as 3 HKD per trade or 0.03% of the trading principal (whichever is higher); platform fee of 15 HKD per trade.

- Singapore Stocks: Unlike most local brokers in Singapore, which charge a minimum commission of 25 SGD per trade for stocks, ETFs, or REITs, even for using a prepaid account, Futu Securities (Singapore) charges commissions and platform fees as low as 0.99 SGD per trade or 0.03% of the trading principal (whichever is higher).

However, it is important to note that Singapore stocks purchased through Futu Securities (Singapore) do not enter the Central Depository (CDP) account but are automatically stored in the custody account provided by the brokerage firm.

Comprehensive Analysis Tools

For experienced investors, the investment analysis tools provided by the platform are their key focus, as both long-term and short-term investments require the assistance of investment analysis tools to find suitable investment targets.

The moomoo APP provides traders with candlestick charts, line charts, bar charts, and other charts for technical analysis, making it particularly useful for investors who enjoy chart analysis.

Furthermore, the moomoo APP also provides more comprehensive and detailed annual financial reports (10-K reports) of U.S. listed companies than shareholder annual reports, recording key financial statements such as balance sheets and income statements.

Moreover, the moomoo APP offers Paper Trade simulation trading, making it convenient for beginners to practice operations and become familiar with the market.

What are the Advantages of Futu Securities?

In addition to the above three key features, Futu Securities offers many user-friendly functionalities:

- Quick Registration and Account Opening: Register and fill out personal information to open an account. The system indicates that the account opening process takes 1-3 days, but the actual processing time may be shorter. Upon successful account opening, traders will receive relevant notifications.

- Convenient and Free Deposits and Withdrawals: Deposits can be made via direct transfer from Singapore banks for instant processing, which is simple and convenient, with funds arriving immediately. Additionally, no fees are charged for deposits and withdrawals, saving on investment costs. Furthermore, Futu Securities (Singapore) also supports wire transfers or deposits via third-party Wise, with overseas users recommended to use Wise or open a Singapore bank account themselves, as the cost is slightly lower than bank wire transfers.

- Convenient Dollar-Cost Averaging: The minimum commission for many brokers is as high as S$25/0.28%, which is disadvantageous for traders who want to use dollar-cost averaging to gradually buy the same stock. It is generally recommended to keep commissions below 0.5% of the investment amount. However, Futu Securities (Singapore)'s preferential policies allow traders to completely avoid this issue.

- Favorable Exchange Rates: It is understood that the exchange rates for Futu Securities (Singapore) accounts are slightly better than those provided by other brokers, so there is no need to worry too much about exchange rate issues.

- Language-Friendly: The moomoo APP has a Chinese interface and Chinese customer service, available to answer questions from Chinese traders at any time. Moreover, the bilingual communication groups provided by the brokerage firm allow everyone to communicate with people from around the world, making the investment journey less lonely.

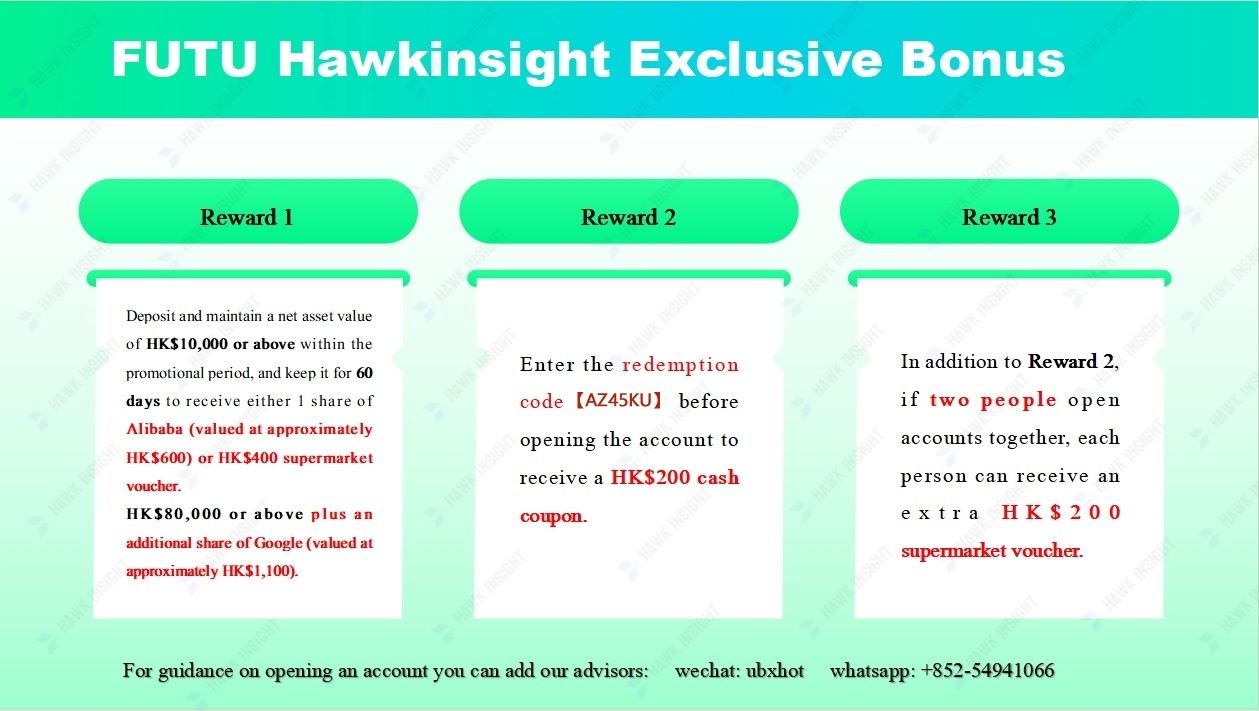

- Account Opening Bonus: Futu Securities offers account opening bonuses to each new user, providing generous rewards for users who open an account with the brokerage firm for the first time.

Conclusion

In summary, Futu Securities (Singapore) brings many benefits to both local and overseas traders: single-account trading for various products, extremely low trading fees, and comprehensive analysis tools, ensuring full support for users throughout the trading process.

Additionally, Futu Securities (Singapore) offers various bonuses and user-friendly operating systems for users.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.