What is Exness's jump point history?

Exness jump point history can be used to access historical data for various financial instruments, here is how to use it。

Exness is one of the most trusted brokerage firms offering online trading services for a wide range of instruments, including currencies, commodities, stocks and indices。This multi-regulated broker offers a variety of transparent features, one of which is the "jump point history" feature.。

In financial markets, a scale represents the smallest possible price change for a particular asset。Price data usually includes the price at which the trade was executed (bid and ask prices), the time of the trade (timestamp), and sometimes other information such as the volume of the trade.。

Therefore, the Exness "Spread History" is a file of the spread movement of the selected trading instrument over a specific time period.。Exness customers can use this data for detailed analysis, back-testing trading strategies, and making more informed trading decisions。In addition, comparing the tick mark history with the transaction history ensures that there are no hidden costs and orders are executed at the expected price。

How to download Exness bounce point history?

Exness bounce point history is easily accessible on the official Exness website。Traders can download the beat point history for a specific time period and read it on a personal computer or smartphone。The following steps will guide you on how to download the tool:

1.Make sure you have a live Exness account。

2.Sign in to your Exness account。

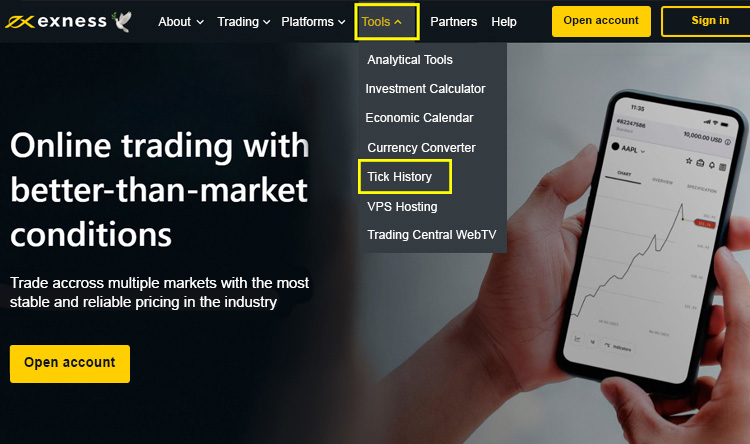

3.Find the "Tools" option in the title section and click "Jump Point History"。

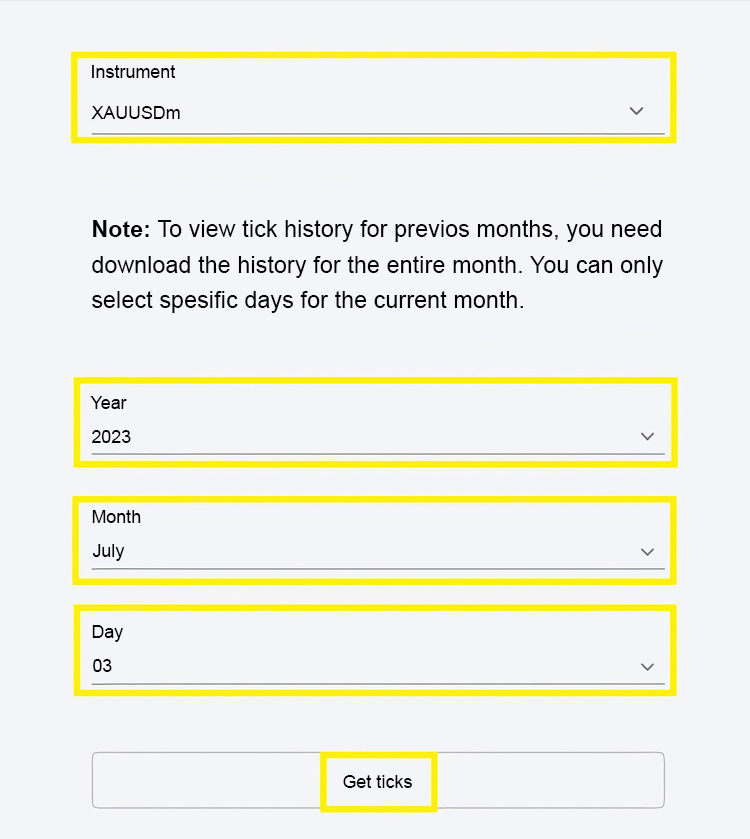

4.Select a specific tool to download beat point history。

5.Set the desired year, month, and day for the data you want to download, and then click the Get tick option。

6.The browser will initiate the download.zip or.Rar format jumping point history file。

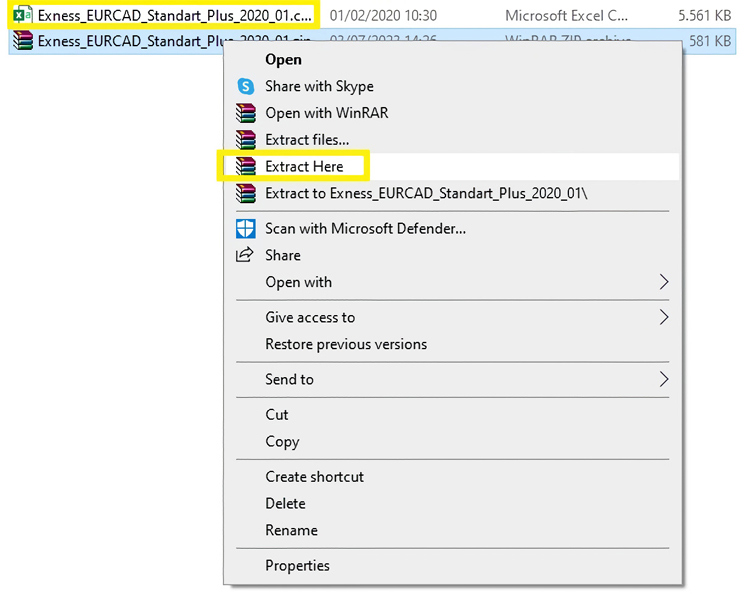

7.To access the tick point history, you need to unzip the file。Right-click the downloaded file and select "Unzip Here"。

8.A CSV file is generated and you can view the beat point history using Microsoft Excel (Windows) or Numbers (Mac)。

How to read Exness bounce point history?

After successfully downloading and opening the file, you can read the data。A quote history file contains all quotes for a specified time period in the formats "Exness," "Symbol," "Timestamp," "Bid," and "Ask"。Here is an explanation of each format:

Exness label indicates the source or platform from which the tick mark data was obtained。

The symbol field indicates the trading instrument or currency pair for which the tick is recorded, such as EUR / USD or GBP / JPY。

The timestamp bar indicates the precise time at which each tick occurs, and you can observe the chronological order of market events。

The buy and sell columns represent the bid and ask prices for each timestamp, respectively.。The bid price represents the maximum price the buyer is willing to pay for the instrument, while the ask price represents the lowest price the seller is willing to sell.。

Who can use Exness Bounce Point History?

This data applies to a variety of individuals and entities involved in financial markets。Here are some examples of who should use Exness bounce point history:

Traders and investors: The report can be used to analyze past price movements, market trends and liquidity conditions。By studying "bounce point" data, they can gain insight into the behavior of specific trading instruments, identify trading patterns, and make more informed trading decisions.。

Algorithmic Traders: Algorithmic or quantitative traders who develop strategies based on historical data can use Exness jump point history to backtrack test and optimize their algorithms, fine-tune parameters, and evaluate the performance of their strategies under various market conditions。

Market researchers: professionals engaged in market research, financial analysis, or academic research can use jump point history to study price dynamics, market microstructure, and the impact of economic events on various instruments。

Regulators: Regulators and compliance officers may require access to trading history data for market surveillance, monitoring and enforcement purposes。Tick data can be used to investigate market manipulation, identify irregularities and ensure fair and transparent trading practices。

Conclusion

Exness Hit Point History is in line with Exness's commitment to transparency as a trusted broker, a feature that enables traders, investors, market researchers and regulators to easily access and analyze comprehensive historical trading data across a wide range of financial instruments。

By using the bounce point history, users can gain valuable insights about price movements, market trends and liquidity conditions within a specified time frame。This information helps them make informed trading decisions, develop effective strategies and conduct comprehensive market research。

Exness is a Forex and CFD broker offering clients cross-market trading services at the most stable and reliable prices in the industry, offering spreads as low as 0 pips and maximum leverage of 1: 000。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.