Bank of Japan hikes rates by 15 basis points in July, may continue rate hikes in the medium term

After the negative interest rate was lifted, super-large banks and local banks raised the interest rate on demand deposits for the first time in 16 years, which will benefit Japanese household deposits.

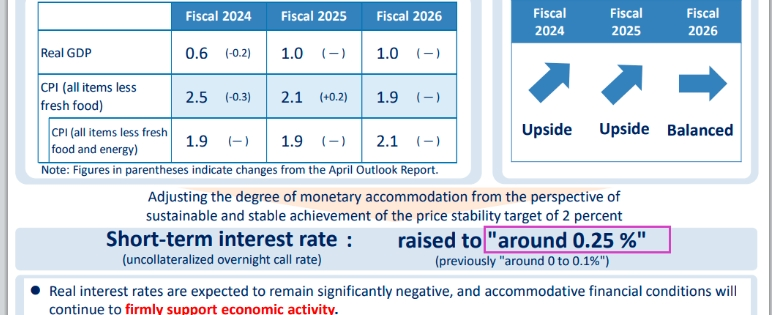

On July 31st, the Bank of Japan unexpectedly raised interest rates by 15 basis points, increasing the policy rate to 0.25%.

The monetary policy committee approved the latest monetary policy adjustment with a 7:2 vote. The Bank of Japan will also gradually reduce the scale of government bond purchases, from the current approximately 57 trillion yen to 31 trillion yen by the first quarter of 2026.

The yen surged in the short term, with the US dollar falling 110 points against the yen, hitting a low of 151.58; the Nikkei 225 index rose sharply at the end of the day, breaking through 39,000 points again. By the close, the index had risen 1.5%, closing at 39,101.82 points.

In the monetary policy decision, the Bank of Japan stated that the development of Japan's economic activity and prices is generally in line with the outlook presented in the "Economic and Price Outlook" ("Outlook Report"); in the corporate sector, corporate fixed investment has been on a moderate growth trend, and corporate profits have improved. In the household sector, despite the rise in prices and other factors, private consumption has remained resilient; in terms of wages, not only have large companies raised wages, but this has also been reflected in various regions, industries, and companies of all sizes.

In terms of prices, the impact of rising import prices leading to increased costs has weakened, but service prices continue to rise moderately, and the measures reflecting wage increases in selling prices have been strengthened. The inflation expectations of enterprises and households have risen slightly. The year-on-year change in import prices has turned positive again, and the risk of price increases is worth paying attention to.

In light of this, the Bank of Japan believes that adjusting the degree of monetary easing is appropriate from the perspective of achieving a sustainable and stable 2% price stability target. After the policy rate change, it is expected that the real interest rate will remain significantly negative, and the loose financial environment will continue to firmly support economic activity.

Following the rate hike in March, the Bank of Japan initiated further rate hikes because the inflation rate is still higher than the 2% target and is on an upward trend. The consumer price index (CPI, excluding fresh food) in June rose by 2.6% compared to the same period last year, exceeding 2% for 27 consecutive months.

The Bank of Japan stated that the expected central value of the core CPI for the fiscal year 2024 is 2.5% (expected to be 2.8% in April); the expected central value of the core CPI for the fiscal year 2025 is 1.9% (expected to be 1.9% in April); the expected central value of the core CPI for the fiscal year 2026 is 1.9%.

For the future economic outlook, the Bank of Japan also continues to give a positive guide. The Bank of Japan stated that the expected central value of the actual GDP growth rate for the fiscal year 2024 is 1.0% (expected to be 0.8% in April); the expected central value of the actual GDP growth rate for the fiscal year 2025 is 1.0% (1.0% in April); the expected central value of the actual GDP growth rate for the fiscal year 2026 is 1.0%.

Bank of Japan Governor Haruhiko Kuroda pointed out at a press conference after the June meeting that if prices continue to rise as predicted by the Bank of Japan, the bank will "raise the benchmark interest rate and adjust the degree of monetary easing." Even after lifting the negative interest rate in March, the Japanese economy still maintains the upward pressure on prices brought by measures such as raising wages. If the inflation rate continues to be around 2%, the Bank of Japan will consider further rate hikes in the medium term.

For this rate hike, HSBC's Chief Economist for Asia, Fred Neumann, said that despite weak consumer spending, the Bank of Japan officials have sent a decisive signal by raising interest rates and allowing a more gradual reduction in the balance sheet. Despite the sluggish consumer spending, the improvement in wage levels makes people optimistic about the recovery of economic growth in the next few quarters. The rise in inflation expectations has also paved the way for the Bank of Japan to continue normalizing monetary policy. If there are no major disturbances, the Bank of Japan will further tighten monetary policy and raise interest rates again early next year.

Marcel Thieliant, Head of Macroeconomics for Asia-Pacific at Capital Economics, said that the Bank of Japan is more confident in the formation of a virtuous cycle between prices and wages because it has noticed that the measures to raise wages are not only present in large enterprises but have also spread across various regions, industries, and enterprises of all sizes. The bank believes that the measures to reflect wage growth in selling prices are strengthening. Marcel said that the Bank of Japan will raise interest rates again at the meeting in October. However, unlike the pricing in the financial market, it is expected that there will be no further rate hikes next year, as the basic inflation rate will be lower than the bank's 2% target due to the decline in import costs.

For Japan, the increase in interest rates has both good and bad aspects. After the negative interest rate was lifted, super-large banks and local banks raised the interest rate on demand deposits for the first time in 16 years, which will benefit Japanese household deposits. On the other hand, for the government departments with huge debts, the rise in interest rates may become an important factor in increasing financial pressure.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.