Kazuo Ueda said Japan's inflation efforts have seen results and that if the economy continues to improve, the bank will raise interest rates.

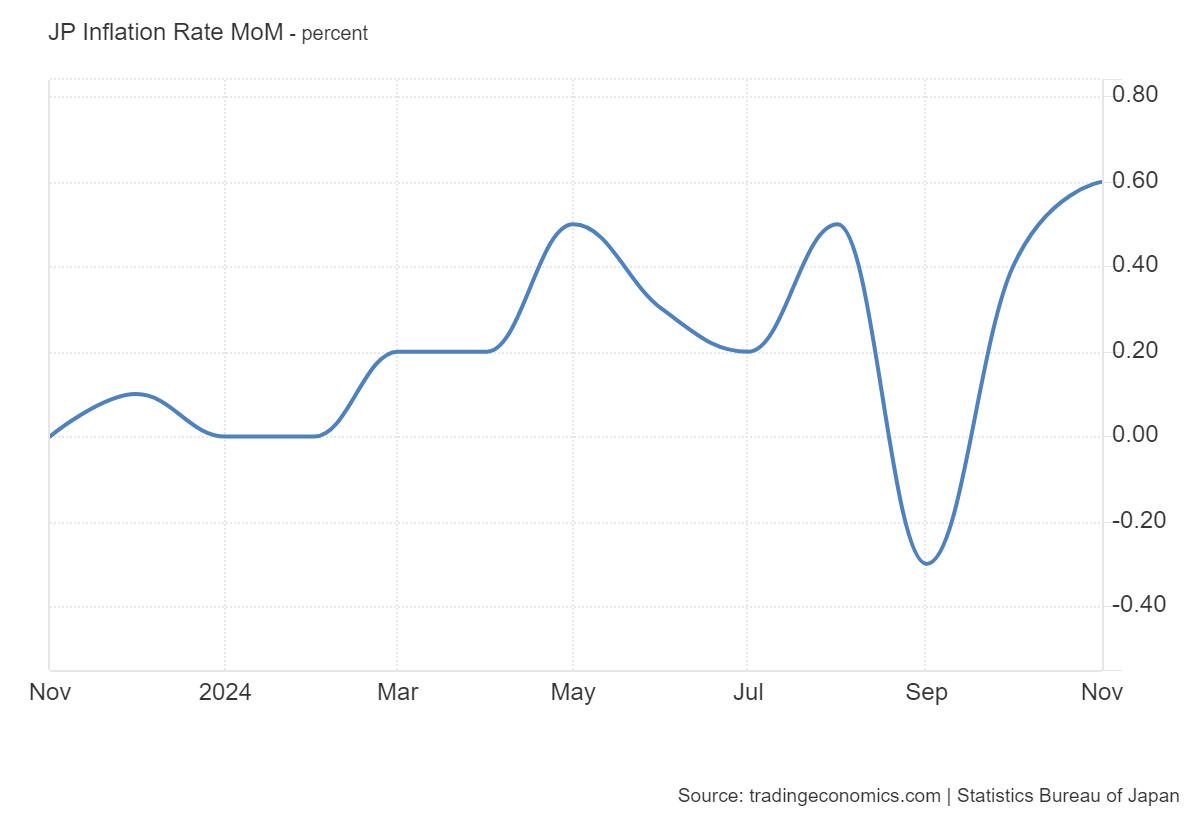

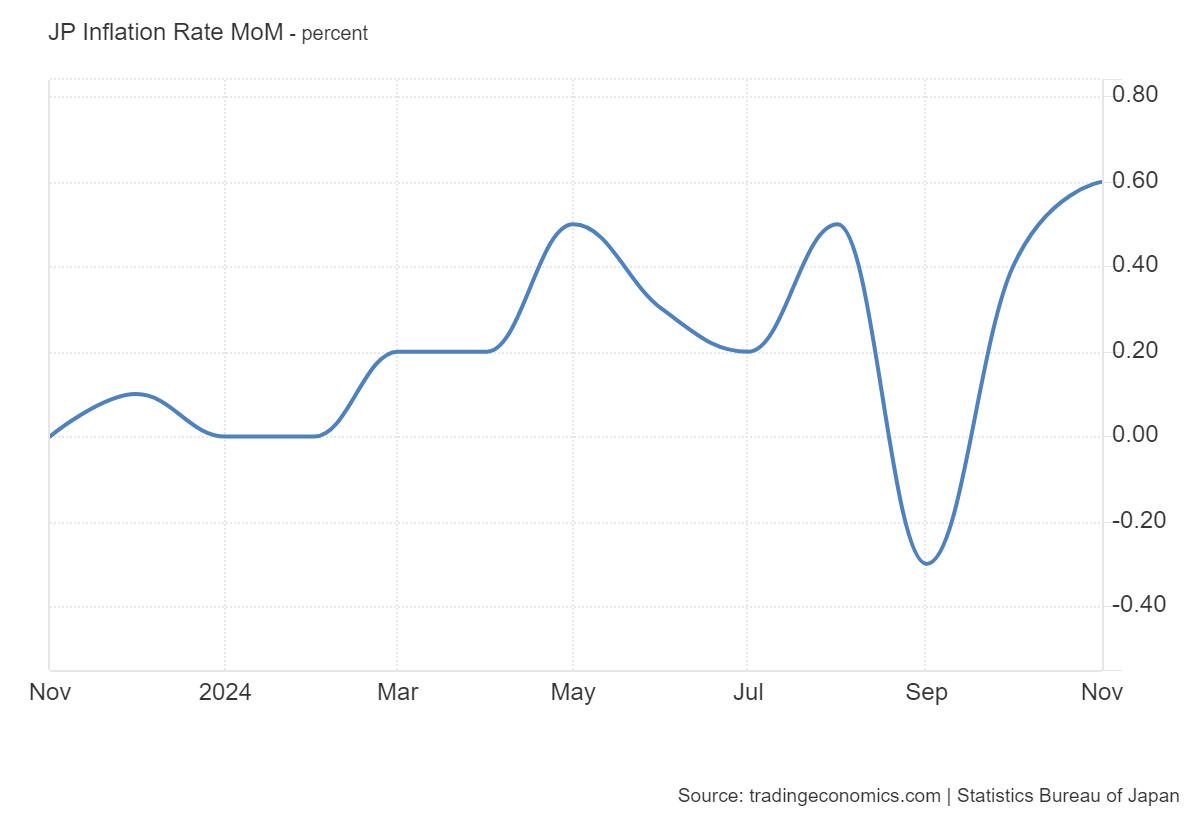

On December 25, Bank of Japan data showed that Japan's service producer price index rose to 3.0% in November, accelerating for the second consecutive month-this data is considered to be the leading indicator of Japan's official inflation data.

Currently, the Bank of Japan is closely monitoring inflation in the services sector, compiling Wednesday's data for clues as to whether demand-driven price increases have widened enough to justify further interest rate hikes.The Bank of Japan believes that the rise in labor prices is gradually being transmitted to enterprises, bringing about a virtuous cycle in the economy.

Data showed that the year-on-year increase in the service industry producer price index, which measures the service prices companies charge each other, accelerated in November from a 2.9% growth rate in October.The index reached 109.1, the highest level since March 1995.Rising prices for services ranging from accommodation and mechanical maintenance to construction have driven this growth.

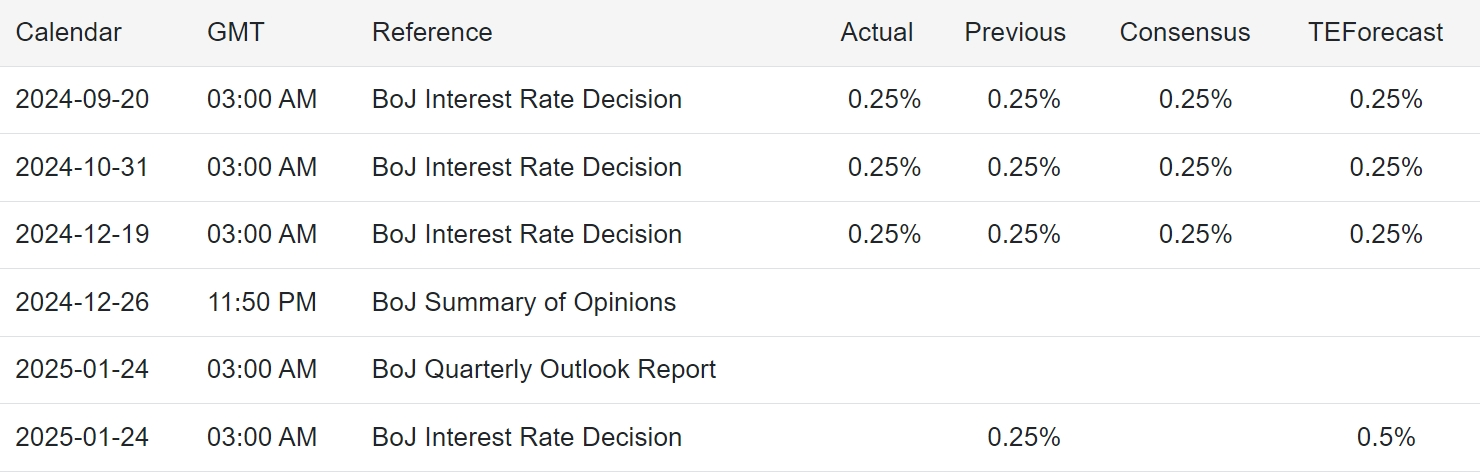

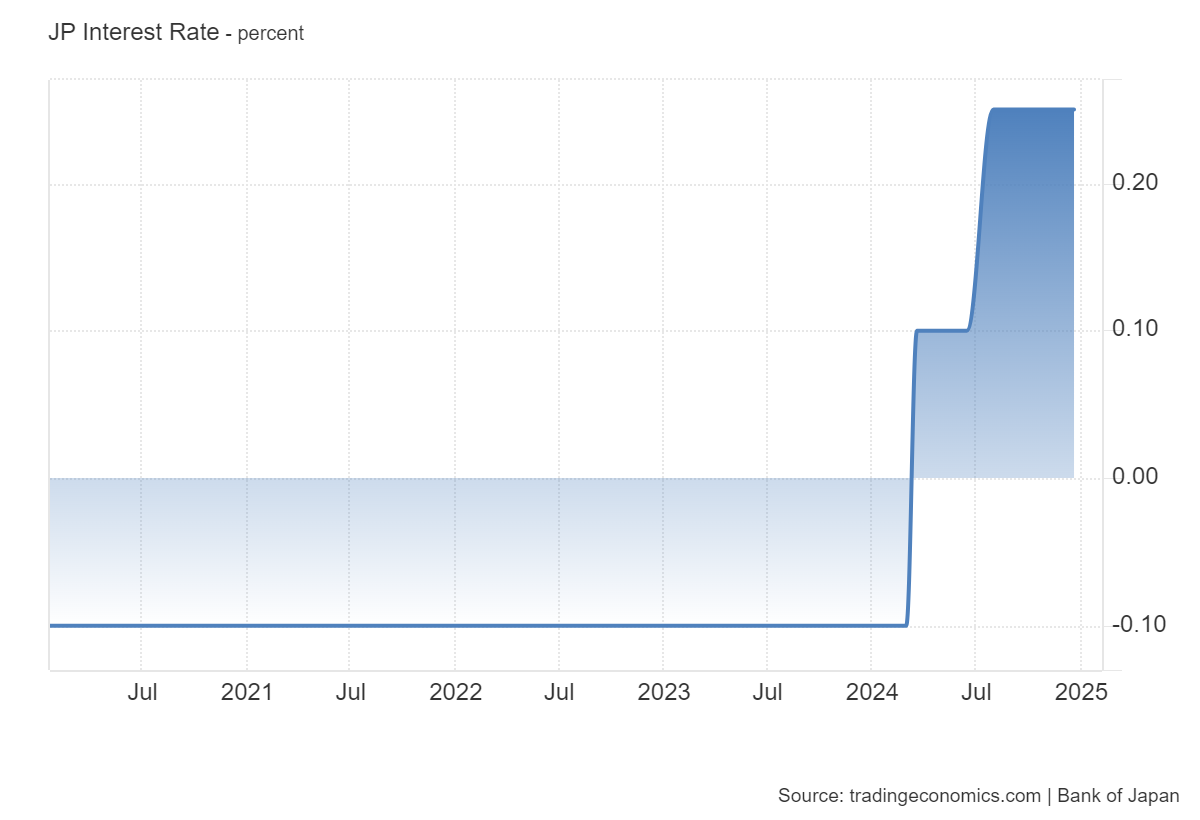

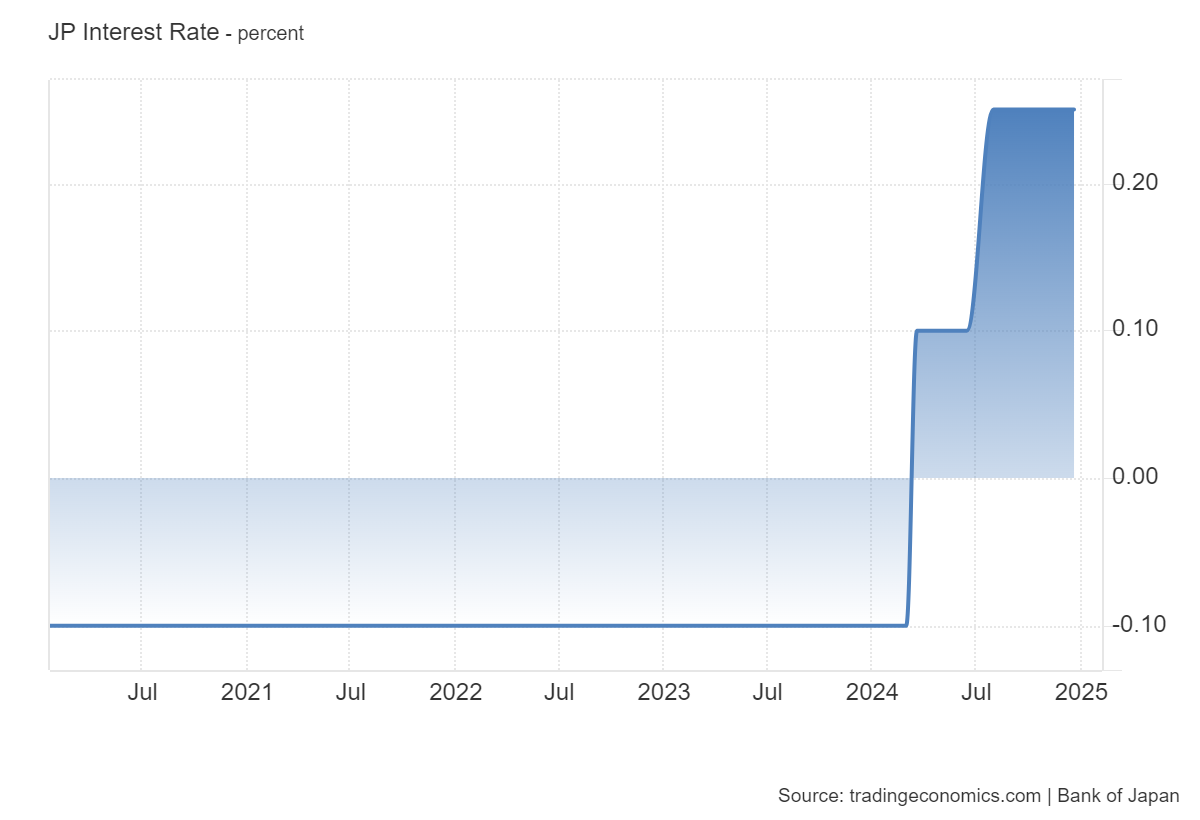

In March this year, the Bank of Japan ended its negative interest rate policy and raised its short-term policy rate to 0.25% in July, believing that Japan is making steady progress towards achieving the 2% inflation target in a sustained manner.The Bank of Japan has said it will continue to raise interest rates if inflation remains stable at 2%.

On the same day, at a business event in Tokyo, Bank of Japan Governor Kazuo Ueda said in a speech that Japan's inflation next year will be closer to the bank's 2% target, laying the groundwork for further interest rate hikes.

Kazuo Ueda said that Japan's inflation efforts have seen results and that if the economy continues to improve, the bank will raise interest rates because maintaining excessive monetary support for a long time may increase inflation risks.

"As intensifying labor shortages push up wages, consumption shows signs of improvement, and after years of aggressive monetary stimulus, Japan has made progress towards achieving its inflation target in the long term.”

He also warned that it was necessary to carefully review the consequences of "high uncertainty" surrounding the overseas economy, especially the economic policies of U.S. President-elect Trump after taking office, saying that before raising interest rates again, more information about Trump's policy stance would be needed.

Kazuo Ueda also said that the prospects for wage negotiations next spring are also key to assessing the path of monetary policy.

In this month's Reuters poll, all respondents expected the Bank of Japan to raise its benchmark interest rate to 0.5% by the end of March, but the outlook for monetary policy in January was unclear.According to the schedule, the Bank of Japan will hold an interest rate review meeting on January 23-24, followed by another meeting on March 18-19.