How to Choose the Best XM Account Type

XM offers several different account types, which at first glance may confuse novices。

XM offers several different account types, which at first glance may confuse novices。Here's a short guide to choosing the right。

In order to select the best trading account type, it is important to have an in-depth understanding of all available types。It's not just knowing their respective names。Therefore, this article will introduce how to choose the bestXM account type for best results basic information。

XMWhat is the account type??

In general,XM offers its traders the following accounts:

Micro, where 1 Micro-lot represents 1000 units of base currency。

standard, of which1 standard lot is equivalent to 100,000 units of base currency。

Ultra Low Micro, an account that trades on micro-lots with spreads as low as 0.6 o'clock。

stock, an account dedicated to stock trading。

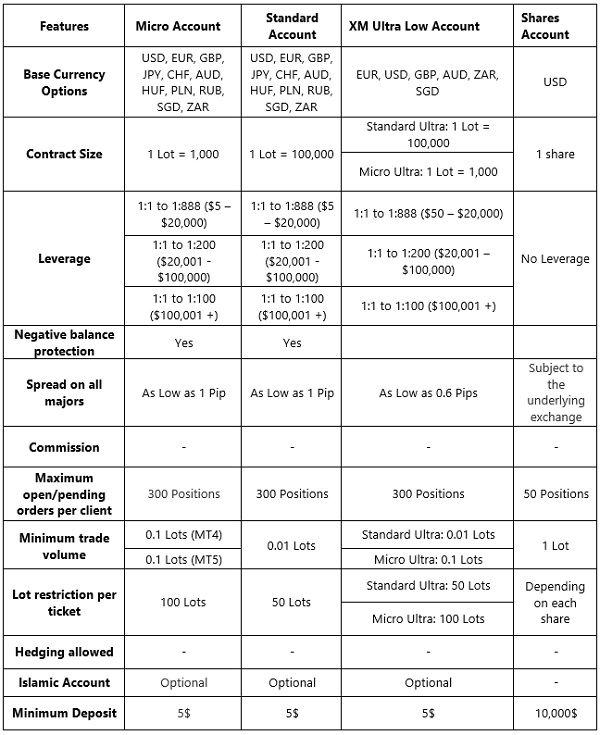

For further reference, a table is provided to describeMore Attributes for XM Account Types。You can customize the solution according to the deposit currency。

In addition to the aboveOther than 4 account types, if you are new to Forex trading, it is highly recommended that you trade with XM demo account as this will help you trade with virtual currency。risk is zero, since gains and losses are only a simulation。

The best account should be a supplement to you.

Based on the above details, you may have recognized that each account has its own unique characteristics that highlight the various needs of traders。For example,XM microaccounts are allowed from 0.01 lots to start trading to eliminate the risk of having to trade with standard lots。At the same time, the ultra-low account compared to other accounts highlights the importance of narrowing spreads。

After understanding these key information, you can adjust as neededSpecification for XM accounts。If you're a beginner, minimizing risk is your top priority,XM micro account is the best choice。If you are experienced and looking for higher opportunities while being aware of the increased risk,XM Standard Account may be right for you。On the other hand, XM ultra-low accounts are for scalpers, day traders or other types of traders who put low spreads at the forefront of their strategies。Finally, if you want to try investing in the stock market, an XM stock account might be a good idea。

In a word, the bestThe XM account type should not have a clear answer for all traders as it is up to the trader himself。XM ultra-low account may be the best choice for scalpers, but not for beginners, and vice versa。

XM was founded in 2009 as a company called Trading Point of Financial Instruments Ltd..A member of an online brokerage firm。In serving customers globally, the company has been split into XM Australia, XM global and XM Cyprus。Each member has a different head office and licence, XM Australia is registered with the Australian Securities and Investments Commission (reference number: 443670), XM Global is registered with the IFSC (60 / 354 / TS / 19), XM Cyprus is registered with the Cyprus Securities and Exchange Commission (reference number: 120 / 10)。

XM is one of today's experienced brokers in the field of online forex trading。Since its inception, the broker has undergone many changes, including the addition of ultra-low account and webinar features, which are available in 19 different languages, with 35 local instructors in each language。

In terms of trading instruments,XM is a well-known diversified asset provider, including FX, commodities, CFD equity indices, precious metals, energy and equities。XM prides itself on being the ideal broker for trade execution, offering 99.Statistics for 35% of orders executed in less than 1 second。XM Trading will also offer a strict no-re-quote policy, no virtual trader plug-ins, no reject orders, real-time market execution, and the option for traders to place orders online or over the phone.。

In ultra-low accounts, spreads across all major accounts can be as low as0.6 pips, while spreads on other accounts usually start at 1 pip。XM did not provide maximum leverage in a ratio of 1: 500 or 1: 1000 (whole numbers), but chose to limit its leverage to a ratio of 1: 888, a unique number that is now widely regarded as a trademark of XM。

In order to protect the client's funds in case of extreme volatility,XM provides negative balance protection for each account type。Deposits for small and standard accounts start at $5, while ultra-low accounts require a minimum deposit of $50。Traders who open accounts in XM are enabled with a condition similar to the Cent account environment in small accounts, in which the contract size per lot is only 1,000 units。If it is the smallest batch in the MetaTrader platform (0.01) Applied, which means that traders can trade as few as 10 units per trade。

For deposits,XM applies zero-fee deposits in most of its available payment methods。Traders can choose to use wire transfers, credit cards, andThe best electronic payment methods such as Skrill, Neteller and FasaPay to fund or withdraw money from an account。

XM also has an Islamic account for Islamic law-abiding Muslim traders, which prohibits the use of interest earned on overnight swaps for each currency pair.。In order to provide customers with the best trading experience, XM allows them to access the MT4 and MT5 platforms, each with more than 6 display formats (PC, Mac, Multiterminal, WebTrader, iPad, iPhone, Android and Android tablets).。

All in all, no doubt,XM has gone global and is committed to providing trading services in more than 15 languages worldwide.。In addition to easing the trader's experience with mainstream trading platforms and high-quality trade execution, XM is also open to all types of traders, from small capital traders to more experienced traders ready for large deposits.。Traders can even get a Cent trading environment if they choose to register under a micro account。

for their global approach,XM ensures that traders from different countries can easily access their services。This has resulted in different domain names for traders in some jurisdictions。For example, traders from Indonesia can access XM through this link。

How inXMOpen an account in

You should first visitXM's official website, opens the registration page for new traders。The next steps should be simple as you just have to pay attention to the instructions given and fill out the form accordingly。

Keep in mind that after completing the process, the system will automatically send you an email providing you with access to the members areaYou will be able to easily manage the features of your account, including:

Check your open position

Changing Leverage

Access Support

Access Trading Tools

Deposit or withdrawal of funds

View and apply for unique promotions

Check your loyalty status

As more features are added to enrich yourExperience in XM broker, you will get more autonomous operation in the future。So when you need to change or add some information to your account, you don't always have to contact your personal account manager。

You will make trades on the trading platform that match your trading account login details。Therefore, if you set up a different deposit in the member area/ withdrawals or other options, the trading platform will reset accordingly。

在在MT4和MT5Choose between

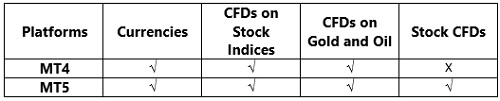

After opening an account and completing the verification process, you may need to select a platform to start trading。XM broker offers trading in all variants of MetaTrader 4 (MT4) and MetaTrader 5 (MT5)。All platforms equally support micro, standard and ultra-low accounts, as shown in the table below。

As shown above, stock CFDs are only available inAvailable on MT5。Otherwise, all assets are equally supported on both platforms。Another factor to consider is technical features, such as time frame, pending order type, integration with Expert Advisors, and other tools to separate MT4 from MT5。After all, MT5 is an upgraded version of MT4。MT5 may still be able to compete with more advanced platforms like cTrader, but MT4 can't say the same。

To further explore the differences, let us enterIs cTrader better than MT4??Here are four things to consider. "?

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.