Malaysia plans to introduce a dividend income tax due to rising spending, and Prime Minister Anwar Ibrahim has proposed raising the 2025 budget to US$98 billion, breaking previous records.

On October 18, Malaysian Prime Minister Anwar Ibrahim announced that the government plans to impose a dividend income tax on individuals starting next year, and has also expanded the target group of sales and services tax, as the government expects spending to hit a record high in 2025.

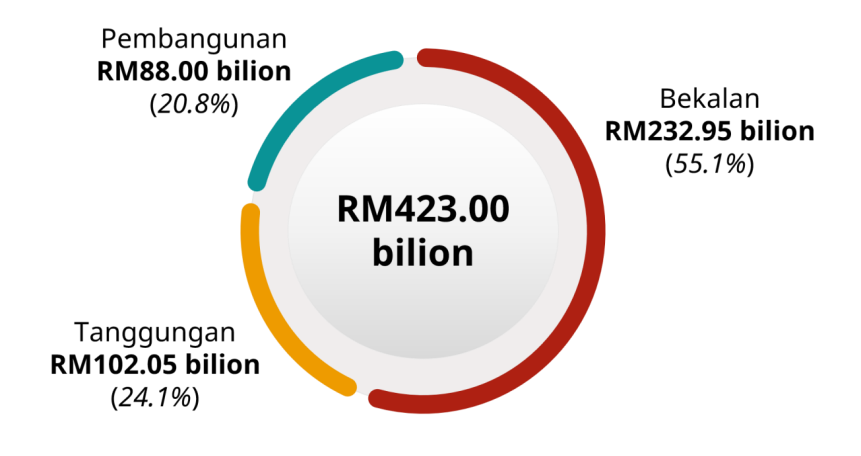

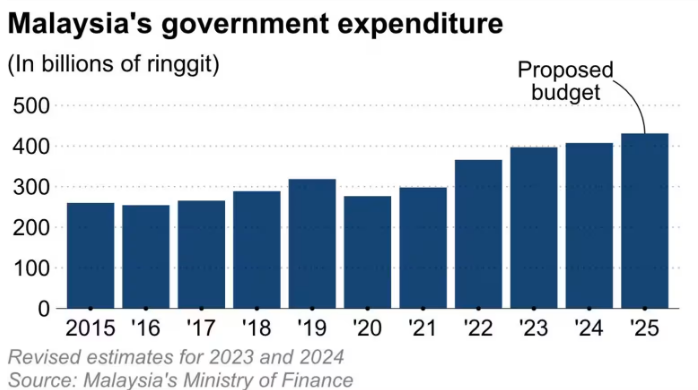

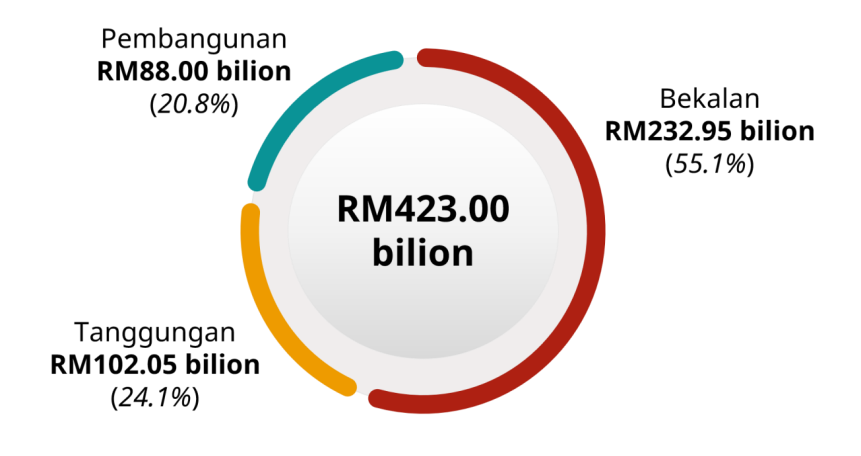

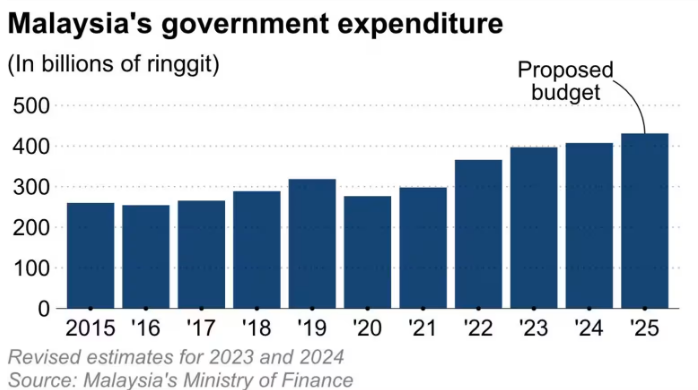

In the draft budget submitted to Parliament that day, the government proposed total expenditure in 2025 to be RM421 billion (approximately US$98 billion), which broke previous records and increased by 7% from the 2024 budget of 393.8 billion, accounting for 20.2% of the country's GDP.The main reasons for the increase in expenses were increases in salary and pensions, as well as increased debt service costs.

In order to increase tax revenue, Malaysia has decided to impose a 2% dividend income tax on individual shareholders whose dividend income exceeds RM100,000 in 2025.Prime Minister Anwar explained: "The move is to make income tax not just dependent on working people, but also include company owners and individual shareholders holding millions of ringgit shares.”

He also said that the country's current Sales and Services Tax (SST) rate is 8%, and starting from May next year, the coverage of this tax will be expanded to include commercial services and fee-for-fee financial services.

Not only that, the government will also impose a carbon emission tax on the steel and energy industries a year later, in 2026, to encourage the adoption of low-carbon technologies. This tax will also be used to fund green technologies and related research projects.

In January 2025, Malaysia will also gradually increase the consumption tax on sugary drinks to RM0.9 per liter.Previously, the tax was launched in 2019, initially at RM0.4 per liter, and was increased to RM0.5 per liter in 2024.

According to the budget document, tax revenue is expected to increase by 5.5% to RM339.7 billion in 2025, which will be driven by continued economic growth and improved corporate profits.

At the same time, due to sluggish investment income, dividends from Malaysia's state-owned energy group (Petronas) in particular may remain at RM32 billion in 2025.As a result, the government expects non-tax revenue to fall slightly to RM80.7 billion next year.

In order to maintain fiscal discipline, Prime Minister Anwar said Malaysia will scale back its gasoline subsidy program and only provide subsidies to certain groups of people starting next May.In other words, people in the top 15% of wealth in the country (including foreigners) will be excluded from the plan.

"The government currently spends about RM20 billion on gasoline subsidies every year. After this adjustment is released, the government will continue to defend the interests of most people. Each subsidy is aimed at correcting the imbalance of the country's 'package subsidy' and is expected to save the government approximately RM4 billion in fiscal expenditure.”

As part of a new plan to stimulate economic growth, the Prime Minister announced a new investment incentive framework that will allocate a total of RM1 billion to cultivate domestic talent and encourage high-value activities.Of this, approximately RM300 million will be used for state funds controlled by the treasury, and RM200 million will be used for pension funds (KWAP) to support investment in start-ups.

Prime Minister Anwar said in Parliament that Malaysia's economic growth rate is expected to be 4.5%-5.5% in 2025.The World Bank predicts that Malaysia's economy will grow by 4.9% in 2024, up from 3.7% in 2023.