Singtel Anchors Data Center & IT Business, Preparing for New Breakthrough

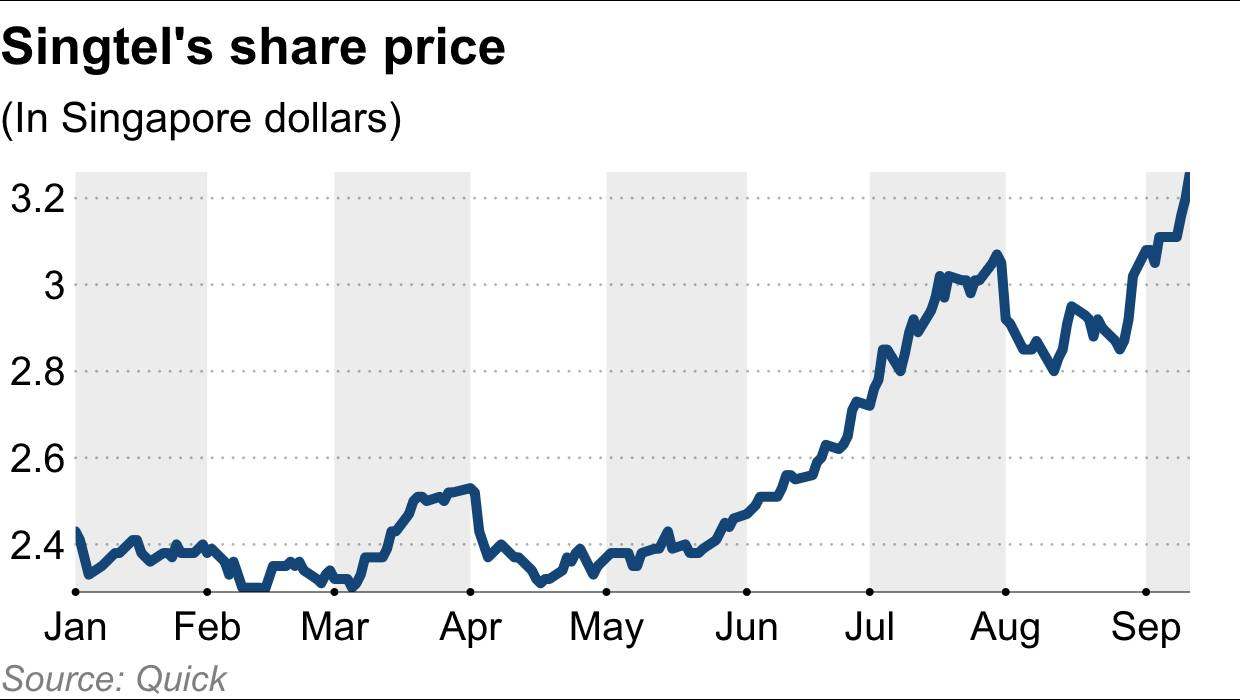

After its mobile business matured, Singtel turned to data center and IT businesses to seek new growth points, and its share price has hit a four-year high.

After its main telecommunications business matured, Singapore Telecommunications (Singtel) is committed to developing its data center and IT business into a new growth pillar for the group. The company's share price has risen by more than 30% this year, hitting a four-year high, reflecting investors' optimism about the group's development strategy.

At the end of last month, Singtel announced a partnership with Hitachi to develop data centers in Japan and other Asian markets with the help of the company's power and cooling technology. The move is part of Singtel's promotion of its Asian data center business after completing its corporate restructuring last year and setting up a new infrastructure department. In addition, Singtel has also cooperated with Nvidia to deploy AI technology to its infrastructure, with the goal of tripling the total pipeline capacity to more than 200 megawatts in three years.

This year, Singtel has opened a new stage of cooperation with global investors.

In June, Singtel announced a joint investment of S$1.75 billion with US private equity firm KKR in its data center business (ST Telemedia Global Data Centres), and last year KKR had already spent S$1.1 billion to acquire a 20% stake in the business.

The new measures are part of Singtel's growth plan, called Singtel28, announced in May, which promised to improve the group's financial performance over the next three years. The plan also includes the sale of S$6 billion worth of monetizable assets to fund its new businesses, including capital-intensive data centers.

"The company is about to move from a transformation phase to a growth phase and hopes to build on the difficult decisions of the past three years and create more growth momentum," Singtel CEO Yuen Kuan Moon said in a May statement.

Over the past two decades, Singtel has grown into Southeast Asia's largest telecom operator by investing in some of the region's leading businesses, such as Thailand's Advanced Info Service (AIS), Indonesia's Telkomsel, the Philippines' Globe Telecom and India's Bharti Airtel.

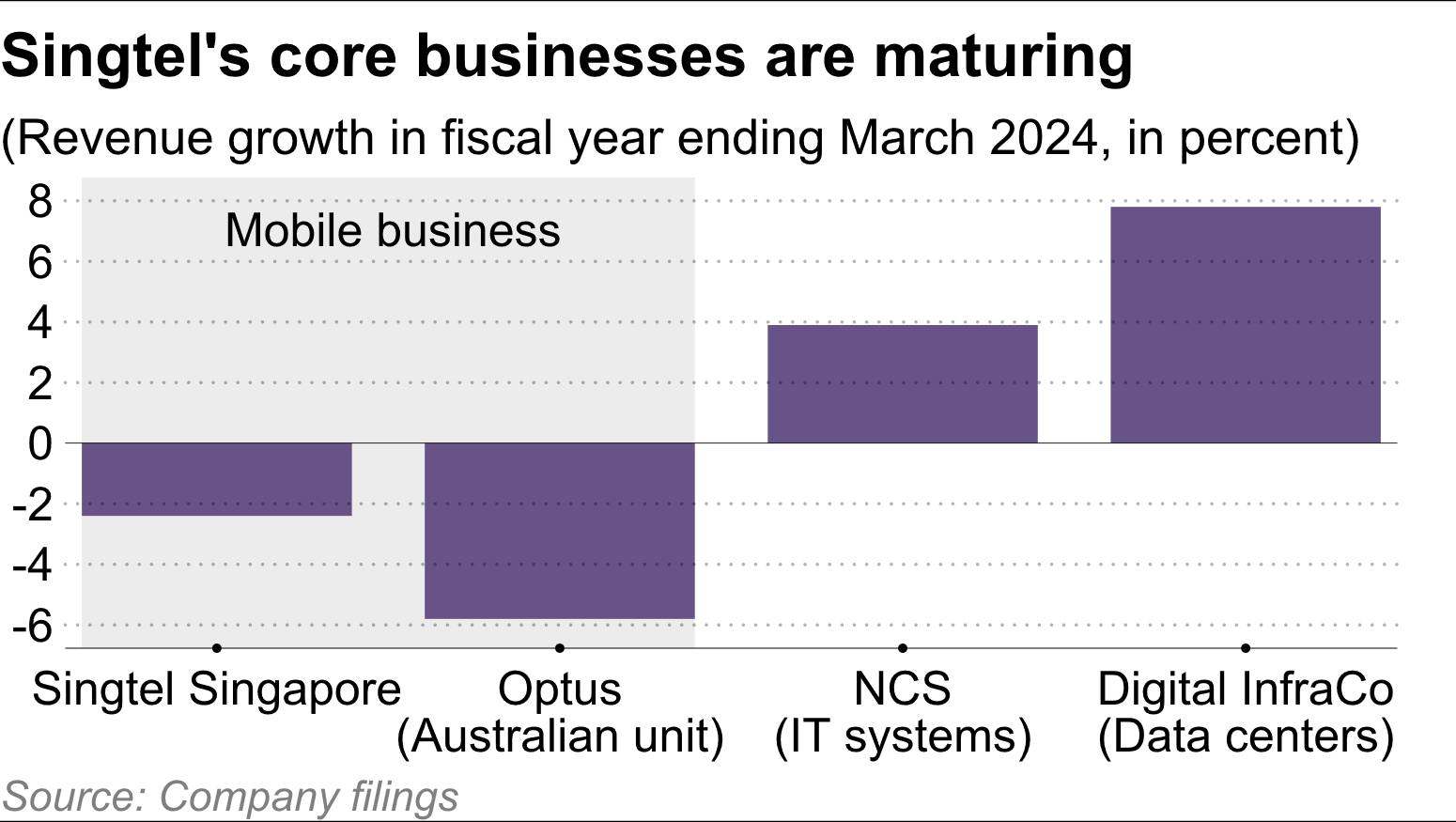

However, as the key markets of Singapore and Australia mature, accounting for nearly 80% of the company's total revenue, Singtel has begun to shift its focus to new growth areas such as technology businesses. Singtel's operating revenue in the two markets fell 2.4% and 5.8% to S$3.89 billion and S$7.13 billion, respectively, in the fiscal year to March this year.

To improve operational efficiency, Singtel has streamlined its operations over the past three years by merging its consumer and enterprise businesses in the local market and setting up a separate infrastructure unit, Digital InfraCo. It has also divested non-core assets and subsidiaries worth about $8 billion and invested in emerging growth areas such as data centers and IT systems.

Today, Singtel's key growth engines are showing potential. In terms of business units, revenue from its data center and other businesses reached S$413 million in the last fiscal year, an increase of 8% year-on-year, making it the fastest growing unit in the company.

NCS was established in 1981 as a government entity and was acquired by Singtel in 1997. The company's main business is developing critical infrastructure for the government public sector, such as network defense and surveillance systems. Since then, NCS has expanded into the private sector by acquiring local companies and has successfully entered the Hong Kong and Australian markets.

Among them, the revenue of Singtel's digital service department NCS increased by 3.9 percentage points year-on-year to S$2.83 billion, accounting for nearly 20% of the group's total revenue, narrowing the gap with the local telecommunications business. Yuan Kunman said: "NCS will improve profit margins by expanding the global delivery network and investing in AI and technological resilience."

Sam Liew, CEO of NCS's government business unit, said that large markets like Japan "cannot be ignored", but did not specify plans to enter the Japanese market. "We must anchor the market that best suits our service type, and the company will give priority to markets with large IT spending and investment. As for the Southeast Asian market, we will continue to wait and see when the time comes." He added.

However, not all of Singtel's digital plans have been successful.

Last October, the company announced the sale of its stake in cybersecurity company Trustwave for US$205 million because the business had generated a loss of S$336 million in fiscal 2021. In 2022, Singtel also sold its digital media and advertising division Amobee, which had a loss of S$589 million.

Dan Baker, senior analyst at Morningstar, said Singtel's latest investment is still in the early stages. He pointed out: "The data center industry is booming due to the demand for AI. Although the current investment value has increased, it is too early to judge the long-term development."

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.