Market Bets on September Fed Rate Cut: Is Yen at a Turning Point?

On Thursday morning, the US dollar rose to around 155.5 against the Japanese yen, setting a six week high. The market speculated that authorities may intervene again to support the yen.

On Thursday morning (July 18th), the US dollar rose to around 155.5 against the Japanese yen, setting a six week high. The market speculated that authorities may intervene again to support the yen.

Subsequently, the Japanese yen weakened slightly. As of press time, the US dollar is trading at 156.38 against the Japanese yen. Since the beginning of this year, the Japanese yen has been the worst performing currency against the US dollar in the G10, with a decline of over 9%.

Since last Thursday, the Japanese yen has surged by about 4%. According to data from the Bank of Japan's money market, authorities may have purchased nearly 6 trillion yen last week. Traders believe that this week's trend shows signs of further intervention, at least the market has been influenced by this speculation.

After the intervention, many traders and Japanese investors hope to increase trading volume again, "said Rodrigo Catril, a strategist at the National Australia Bank.

The weakness of the Japanese yen is mainly due to the huge interest rate difference between Japan and the United States, which has led many investors to flock to Japan, borrowing yen at low interest rates and investing in asset markets denominated in US dollars to earn interest rate spreads. Last week, net short positions in the Japanese yen reached their highest level in 17 years.

Analysts generally expect that as long as the interest rate differential between Japan and the US dollar does not reverse, the fundamentals of the yen's weakening will not change. And now, it seems that the Japanese yen has finally reached a turning point.

Firstly, the expectation of a US interest rate cut in September has significantly increased.

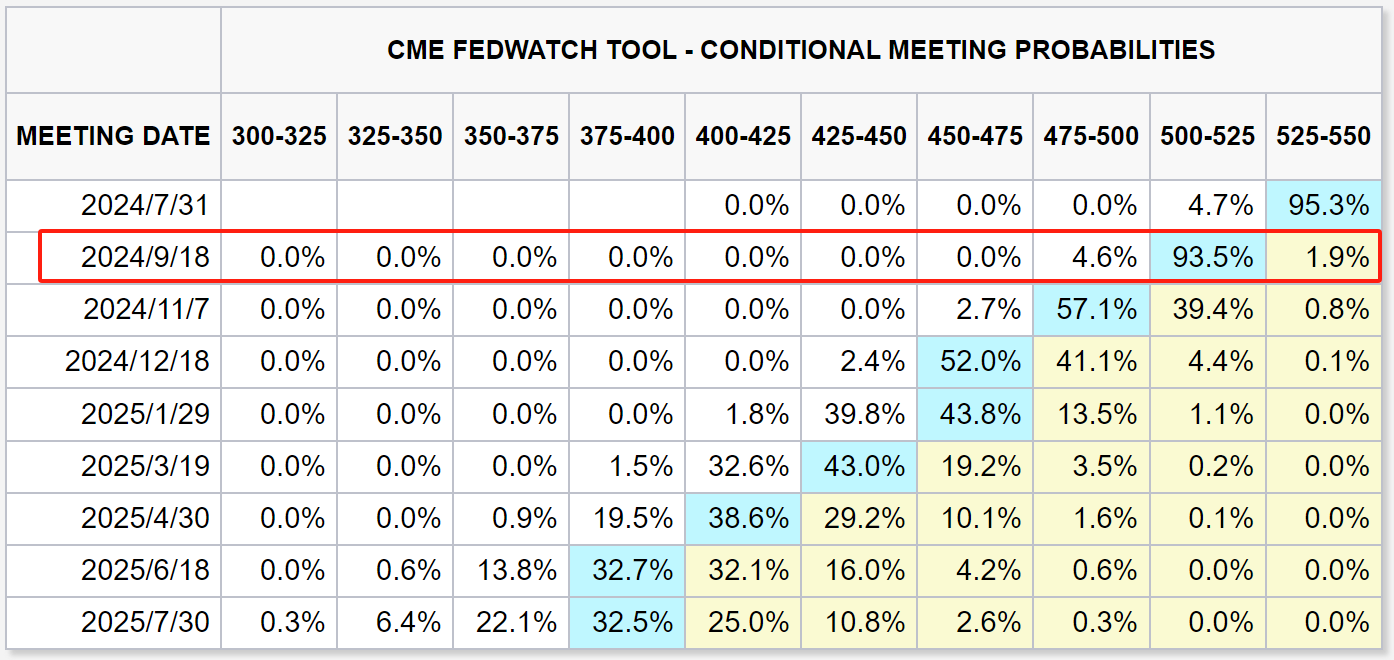

With better than expected CPI data in June and further cooling of the labor market, the probability of the market betting on the Federal Reserve cutting interest rates in September has further increased. According to data from CME FedWatch, the probability of a 25 basis point rate cut in September has exceeded 93%, compared to only 70% a month ago.

Federal Reserve officials have also begun to collectively release doves. On Monday of this week, Federal Reserve Chairman Powell stated that recent data has increased the central bank's confidence that inflation will fall to the target level.

Christopher Waller, a hawkish Federal Reserve governor, also said on Wednesday, "I believe the current data is in line with expectations of a soft landing, and I will look for data in the coming months to support this view. Therefore, although I don't believe we have reached our ultimate goal, I do think we are getting closer and closer to the time when we need to cut interest rates.

Once the Federal Reserve initiates a rate cut, there will be less pressure on the yen. At present, the interest rate market expects that the United States will cumulatively cut interest rates by more than 60 basis points this year, while Japan will raise interest rates by 20 basis points, and the spread between the two will narrow accordingly.

Jun Kato, Chief Market Analyst at Shinkin Asset Management, said, "The weakness of the yen has ended." He believes that as US inflation slows down, the labor market cools, and the economy slows down, the real interest rate gap between Japan and the US is significantly narrowing.

Jonas Goltermann, Deputy Chief Market Economist at Capital Economics, wrote that interest rate differentials may continue to shift in favor of the yen. He expects the yen to continue to rebound and is expected to rise to 145 by the end of the year.

Secondly, the market is also paying attention to signals from Trump's plan to devalue the US dollar.

As the presidential candidate of the Republican Party in the United States, Trump believes that the strength of the US dollar and the weakness of the Japanese yen and yuan are major issues. In the interview, he stated that the strengthening of the US dollar has damaged the competitiveness of US exports. At the same time, the weakness of the Japanese yen and the Chinese yuan has also raised concerns that if he wins the election this year, he may take action to devalue the US dollar.

"We are facing a serious currency problem, "Trump said." I have noticed that they always do their best to keep their currency at a low level."

Although Trump is currently leading Biden in polls, the winner of the US election in four months is still uncertain.

Yujiro Goto, head of currency strategy at Nomura Securities, said, "Regardless of whether the trend in the yen market has changed or not, the answer is in the coming months, but in the long run, it is too early to draw conclusions now." He believes that it is too early to predict a trend reversal based solely on current developments.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.