Oil prices fall below 7-month low as Middle East conflict intensifies

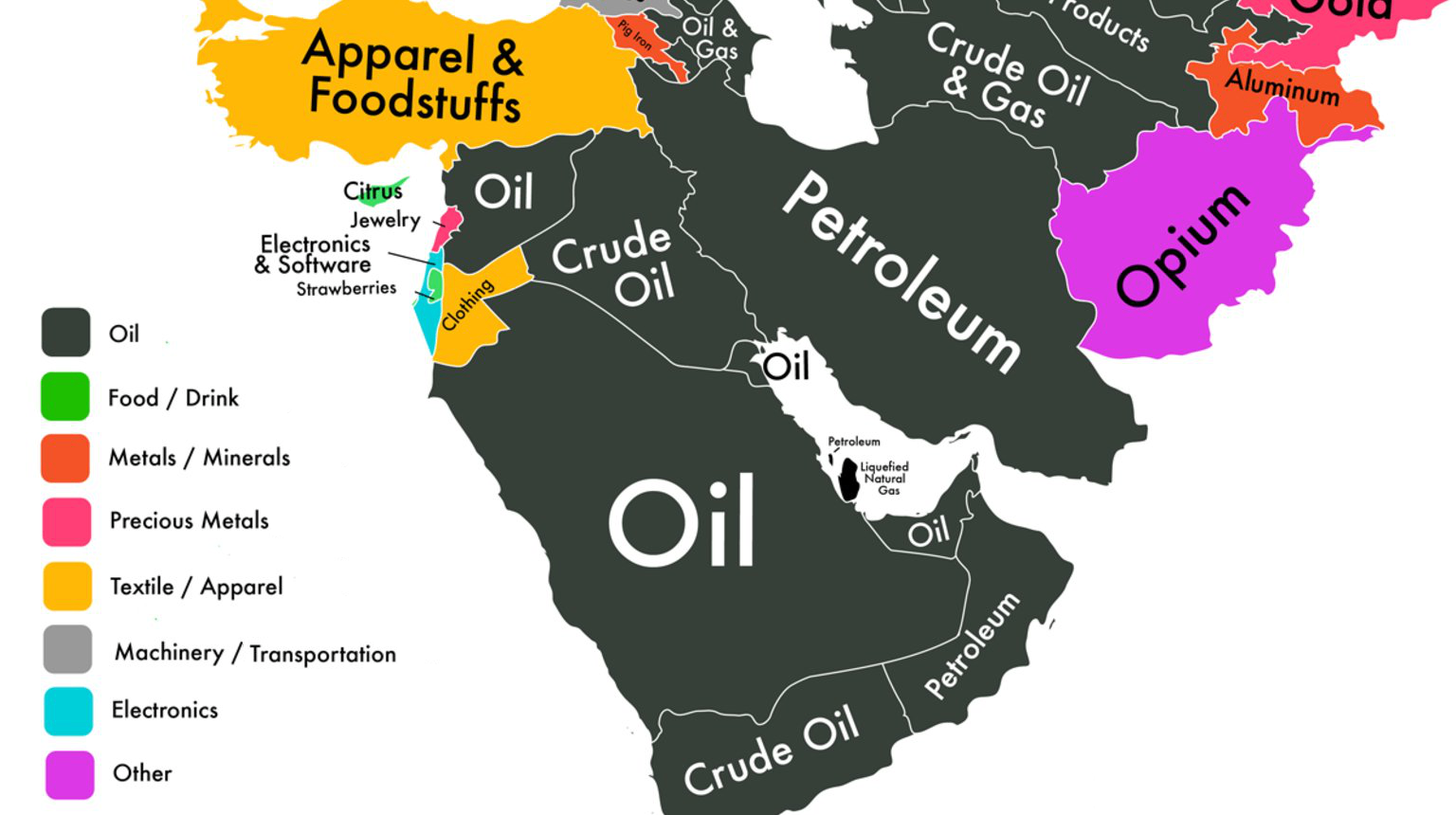

If it were not for the continued supply cuts by OPEC+ and the intensification of conflicts in the Middle East, the decline in oil prices could be more severe.

On August 5th in the Asian market, international oil prices continued to fall to their lowest point in nearly seven months due to the intensification of potential conflicts in the Middle East and the expansion of financial market sell-offs to the global arena.

Last Friday, the global crude oil benchmark, Brent crude oil futures, closed at its lowest point since the beginning of January ($76 per barrel), completely erasing the gains made so far this year. On the same day, the US Department of Labor released employment data that was far from expectations, with official new employment in the United States in July increasing by only 114,000 people, and the unemployment rate rising to 4.1%, causing the market to panic about the economic outlook.

The market also has to guard against Iran launching an attack on Israel in retaliation for the assassination of high-level figures from Hezbollah and Hamas. According to an open-source intelligence report, six countries are preparing to launch a coordinated attack on Israel within the next 72 hours, and the geopolitical situation in the Middle East is on the brink of a catastrophic conflict.

On July 31st, Hamas political bureau leader Haniya was killed in an attack in Tehran, the capital of Iran. The Speaker of the Iranian Parliament stated on August 4th that Iran would respond forcefully to this matter, and Israel and the United States would pay the price for Haniya's death. On the same day, the Israeli Defense Minister said that Israel was ready to respond to the attack.

At present, the United States has dispatched defensive reinforcements to the region.

In terms of Asian demand, due to China's continuous signals of weak demand, coupled with the stimulus plan to boost domestic consumption launched after the Third Plenary Session, highlighting weak consumption, international oil prices are under pressure. In the past two weeks, as the operating rate of China's main refineries has increased, the overall processing volume has also increased, but the operating rate of private refineries remains low due to the pressure of low profits and weak domestic consumption, and the motivation to resume production is insufficient.

In terms of US demand, the weekly EIA data shows that there is not much pressure on the oil market supply and demand. The last report stated that the EIA crude oil inventory in the United States decreased by 3.436 million barrels to 1.088 million barrels, gasoline inventory decreased by 3.665 million barrels, and refined oil inventory increased by 1.534 million barrels. The data shows that US gasoline consumption has fallen on a month-on-month basis, while diesel consumption is not much different from the same period last year.

Analysts say that if it were not for OPEC+ continuing to cut supply and the intensification of conflicts in the Middle East, the decline in oil prices might be more severe.

In terms of speculation, according to data from the US Commodity Futures Trading Commission (CFTC), as of the week ending July 30th, the net long position of WTI crude oil speculative holdings decreased by 31,294 to 176,245. The Intercontinental Exchange (ICE) data last week showed that the net long position of Brent crude oil futures speculative positions decreased by 68,359 to 77,990. In this round of adjustments, funds have withdrawn most of the speculative net long positions in Brent crude oil, and the decline is faster than the speculative positions in WTI crude oil.

Warren Patterson, head of commodity strategy at ING Groep NV in Singapore, said that although concerns about demand are increasing day by day, geopolitical risks still loom over the oil market. He also said that an escalation of the situation in the Middle East may lead to short-term fluctuations, but the price needs an actual supply interruption to continue to strengthen.

Haitong Futures said that under the impact of panic, crude oil, as the king of commodities, is under the greatest selling pressure. However, the current supply and demand structure of the crude oil market is still relatively healthy, and geopolitical risks will continue to cause disturbances. At this stage, under the game of various factors such as macro, geopolitical, and supply and demand, crude oil will maintain a high state of volatility. Although the trend of oil prices is weak, the decline is obviously beyond expectations, but considering that the price of oil is at a low point in the range of the past two years, it is still a high probability event for the market to fluctuate.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.