NVIDIA CEO to Reveal Blackwell’s Future at Goldman Conference

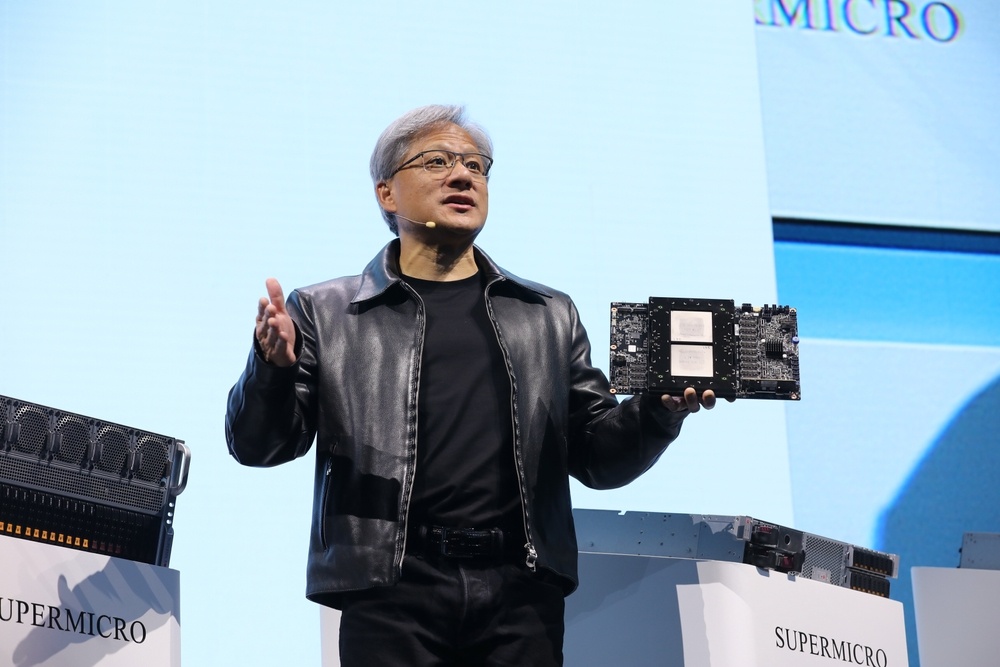

Nvidia CEO Jensen Huang plans to speak at the Goldman Sachs conference in San Francisco to provide more information on the latest progress of the next-generation AI processor Blackwell.

Nvidia (NVDA) CEO Jensen Huang plans to speak at a Goldman Sachs conference in San Francisco to provide more information on the latest progress of Blackwell, a new generation of AI processors.

Although Blackwell was announced six months ago, its mass production progress has been delayed due to engineering problems. Huang promised in August that revenue was coming, but failed to completely allay market concerns. Investors hope that Blackwell's progress will stimulate stock prices and reverse the 15% decline in stock prices after the earnings report was released.

Blackwell's delay has caused investors' concerns, especially in the absence of other market catalysts. Zacks Investment Management analyst Mulberry pointed out that Nvidia's stock price fluctuations are mainly due to market concerns about the rapid development of the AI boom and dissatisfaction with delays.

Bank of America (BAC) believes that Blackwell's shipment progress will be the key to Nvidia's stock recovery. This next-generation AI chip is seen as a major driver of Nvidia's future growth. The company acknowledged challenges in the production process and said that some manufacturing processes need to be improved, but it is expected to begin contributing billions of dollars in revenue in early 2024.

Mulberry said that if Nvidia can deliver Blackwell chips as planned, stock price volatility will be reduced. However, if the chip faces more delays or technical difficulties, the stock price may continue to fall, and the risk of antitrust investigation by the US Department of Justice also weighs on market sentiment.

Hare, an investment manager at Huntington Bank, pointed out that although there may be pressure in the short term, it is a good time for investors who believe in the long-term potential of AI to increase their holdings of Nvidia. He believes that the market will gradually realize the growth potential in the field of AI, and Nvidia will still be one of the high-quality investment targets in this field.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.