Nvidia's shareholder meeting only lasted for 30 minutes! Take a look and see what was said?

Chip giant Nvidia held its annual shareholder meeting on Wednesday, which was not long and lasted only about 30 minutes. The meeting was chaired by Nvidia's CEO, Jensen Huang.

Chip giant Nvidia held its annual shareholder meeting on Wednesday (June 26th), which was not long and lasted only about 30 minutes.

● Emphasize market position

The annual shareholder meeting was chaired by Jensen Huang, CEO of Nvidia. During the meeting, Jensen Huang answered some questions raised by shareholders.

Despite Nvidia's significant market share in the field of artificial intelligence chips, several traditional chip manufacturers and startups have clearly stated that they will develop and launch similar chip products. Therefore, shareholders are very concerned about Nvidia's market competition issues.

Jensen Huang elaborated on the overall strategy of the company to maintain a leading position. In addition to its current core data center business, the company also hopes to explore new markets such as industrial robots and plans to collaborate with every computer manufacturer and cloud provider.

Jensen Huang said, "From chips to systems, to software and algorithms, Nvidia's platform has been widely provided to users through all major cloud service providers and computer manufacturers, building a huge and highly attractive installation foundation for developers and customers. This not only enhances the attractiveness of our platform to customers, but also marks Nvidia's formation of a self reinforcing virtuous cycle."

When asked how Nvidia can cope with the tight semiconductor manufacturing capacity, Jensen Huang stated that the company "has the expertise and scale to develop flexible supply chains."

Jensen Huang added that Nvidia has established strong relationships with suppliers and can meet customer needs by signing long-term supply agreements or prepaying manufacturing capacity costs.

Citigroup research analyst Atif Malik raised Nvidia's target price from $126 to $150 in a research report on Wednesday and maintained a "buy" rating on the stock. The new target price is based on a 35 times P/E ratio for Nvidia's 2025 earnings forecast. Malik pointed out that artificial intelligence agents (models that can not only respond to requests, but also make decisions and act autonomously) may drive a new round of demand for company chips.

According to FactSet data, analysts predict that Nvidia's sales this year will reach approximately $115 billion.

As of Tuesday's close, Nvidia's stock price has risen 155% so far this year. In contrast, the S&P 500 index rose 15% and the Nasdaq Composite Index rose 18% during the same period.

● Blackwell or become "the company's most successful product"

In March of this year, Nvidia announced the launch of the new generation Blackwell GPU architecture at the annual GTC conference. The Blackwell architecture GPU has 208 billion transistors and is manufactured using TSMC's 4nm process. Through 10TB/s inter chip interconnection, the GPU's bare chips are connected into a unified GPU.

According to the official introduction, Blackwell is able to achieve AI training and real-time LLM inference on models with up to 10 trillion parameters, reducing its cost and energy consumption by up to 25 times compared to the previous generation products. Nvidia stated that these technologies will help achieve breakthroughs in fields such as data processing, engineering simulation, electronic design automation, computer-aided drug design, quantum computing, and generative AI.

At the annual shareholder meeting, Jensen Huang stated that "the Blackwell architecture platform is likely to become our most successful product in history," and added that it may also be the most successful product in computer history.

Jensen Huang emphasized that Blackwell will be adopted by all major cloud service provider server manufacturers and leading artificial intelligence companies, including Amazon, Alphabet's Google, Meta, Microsoft, OpenAI, and Musk's Tesla and xAI.

Citigroup stated that large cloud service providers accounted for about 40% of Nvidia's data center sales in the April quarter, as these companies have all expanded their AI infrastructure on a large scale. Citigroup believes that corporate AI agents will become the next wave of AI demand.

● Approval of executive compensation and other proposals

At this shareholders' meeting, the shareholders approved multiple proposals.

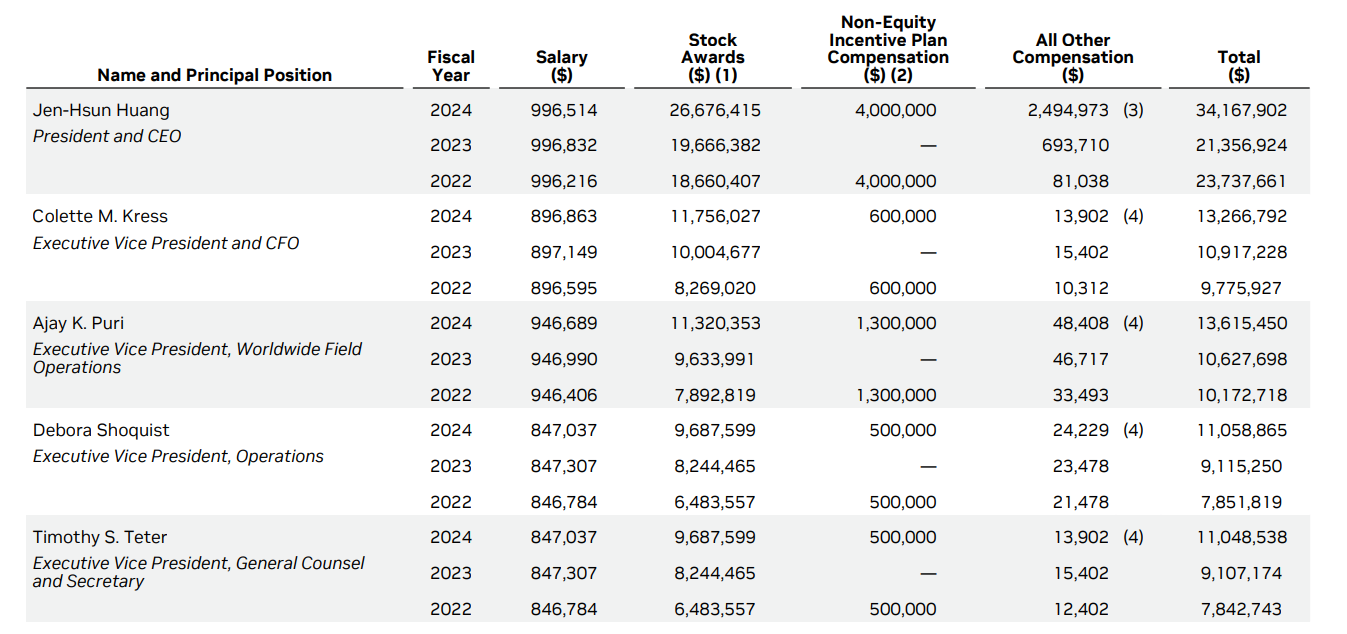

Firstly, there is executive compensation. Nvidia stated that CEO Jensen Huang's total salary for the 2024 fiscal year was approximately $34.2 million, an increase of nearly 60% from the previous fiscal year. Due to Nvidia's executive compensation structure being largely linked to performance, the rapid rise in the stock has increased his salary.

Compared horizontally with executives from other large American companies, Jensen Huang's salary is not particularly high. Especially compared to Musk's sky high salary of $56 billion, it is even less. This is mainly related to their level of control over the company. At present, Jensen Huang's shareholding in Nvidia is less than 4%, while Musk's shareholding in Tesla is over 20%.

Except for Jensen Huang, the total annual compensation of other executives at Nvidia is generally between $11 million and $14 million.

Shareholders also voted to re elect 12 current directors to join the company's board of directors and approve PwC as the independent registered accounting firm for the company's fiscal year 2025.

In addition, shareholders also approved a consulting proposal proposed by investor John Chevedden, which requires the board of directors to replace the super majority voting clause with a simple majority voting standard.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.