Documents Required for Opening an Account in Interflow Securities (IB) & FAQs

This article introduces the complete process of opening an account, account preparation matters, common questions, and the author's account opening experience.。

As the leader of U.S. stock brokerages, Interactive Brokers has been named the best Internet broker by Barron's Weekly for four consecutive years and has been repeatedly named StockBrokers..Com, BrokerChooser, Benzinga and other selected as the best Internet brokerage, favored by many investors.。

Interactive Brokers features its global trading accounts, allowing users to participate in trading in up to 150 international markets.。Its tradable financial commodities include stocks, ETFs, REITs, options, futures, foreign exchange, bonds, indices, CFD, funds, cryptocurrencies, etc.。In July 2023, Interactive Brokers also added a new Taiwan stock trading service.。

In this article, we will share the complete process of Interactive Brokers account opening, through multi-graphic form, hand-in-hand to lead you to easily complete the Interactive Brokers personal account opening, the whole process takes only 10 minutes。Content covers:

1.Interactive Brokers Account Opening Preparation

2.Interactive Brokers Account Opening Considerations

3.Account opening process (multi-graphic)

4.Time required to open an account

5.Common account opening problems

Interactive Brokers Account Opening Preparation

Before opening an account with Interactive Brokers, make sure to prepare the following documents and information。It is recommended to open an account in a stable network environment to ensure smooth progress:

◇ Identity documents, optional: ID card, passport, driver's license

◇ Proof of current residential address, optional: house lease or title deed, water and electricity bill, driver's license, bank statement, credit card statement, brokerage statement (U.S. registered brokerage), letter from insurance company, local government letter (e.g., tax bill, voter registration notice)

◇ Tax Number (Nombor Cukai Pendapatan / Income Tax Number)

◇ Details of assets and income

Investment experience and purpose

◇ Bank account information

Interactive Brokers Account Opening Considerations

Securities account type

Interactive Brokers offers more than 10 types of securities accounts, including personal accounts, joint accounts, IRA accounts, small business accounts, investment advisory accounts, and more.。In the personal account, users can choose cash account (Cash Account), Regular T margin account or Portfolio Margin margin account (account net value of $100,000 can apply)。

It is worth mentioning that opening an account is free and there is no minimum deposit threshold.。

commission fee scheme

Interactive Brokers by StockBrokers.com rated as the lowest cost broker with two commission pricing options - IBKR LITE and IBKR PRO。

IBKR LITE users are able to trade US stocks and ETFs with zero commission, no account minimum and account idle fees。High interest rates on idle cash in your account and free access to U.S. exchange-listed stock data。Currently, IBKR LITE is only open to retail investors in the US and India.。

IBKR PRO is a professional version of IBKR, PRO users can enjoy Interactive Brokers Smart Routing order intelligent delivery technology to get the best price to execute orders。Commissions for trading U.S. stocks and ETFs are 0 per share.$005, minimum $1 per transaction。Malaysia, Singapore, Taiwan and other users need to choose IBKR PRO program。

Account Opening Qualification

The minimum age required for Interactive Brokers to open an account is 18 years old, and only cash accounts can be opened.

Users over the age of 21 can apply to open a margin account (Margin trading)。

Interactive Brokers Account Opening Complete Process Teaching (Multiple Graphic)

◇ Estimate Cost: zero

◇ Account opening verification duration Time Needed: 1 working day

Interactive Brokers' account opening process is simple and straightforward, with nine steps:

1.Click the exclusive account opening link to enter the official website

2.Register a new account and email address

3.Verify account to mailbox

4.Log in to your account and select the account type

5.Fill in personal data

6.Verify phone number

7.Declare compliance information

8.Read and confirm agreement to open an account and related disclosures

9.Upload address and identification documents, submit application for account opening

We recommend using the official website to open an account, easy to fill in information and upload documents。The following is a detailed description of how to open a personal account on the Interactive Brokers website, the entire process is completed in about 10 minutes。

Step 1: Enter the official website

Go to the homepage of the website, find "Open Account" in the upper right corner and register a new account。

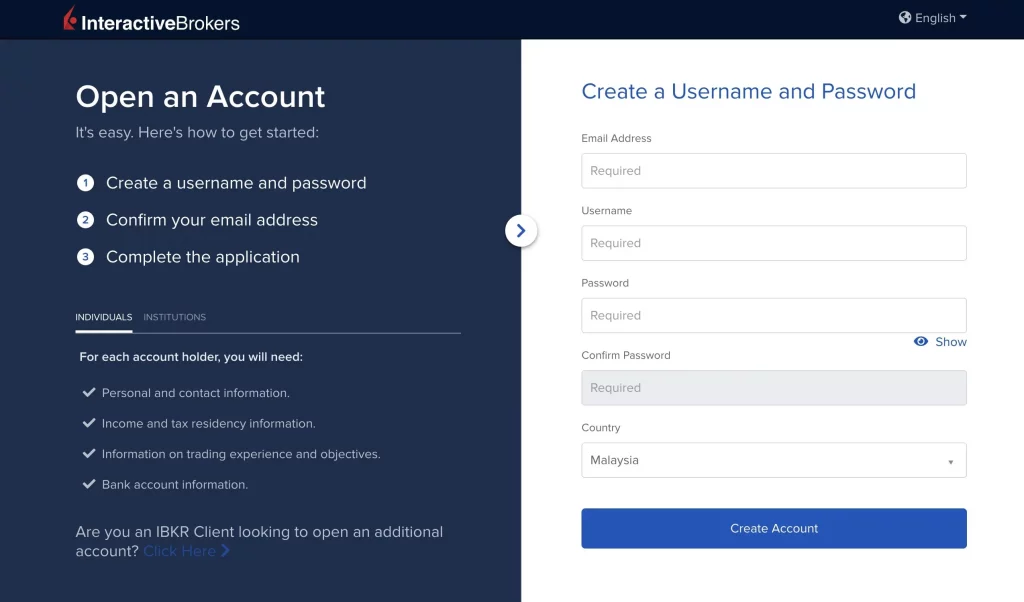

Step 2: Register a new account and email

Complete the registration of the new account by filling in the email address, username and login password on the registration page。It is recommended to choose a frequently used email box to ensure that you do not miss any important messages sent by Interactive Brokers in the future。

After clicking "Create Account," the system will send a verification email to the designated mailbox to ensure the authenticity of the applicant's identity。

If you need to switch the interface language to Simplified Chinese or Traditional Chinese, you can change the language option in the upper right corner of the page。

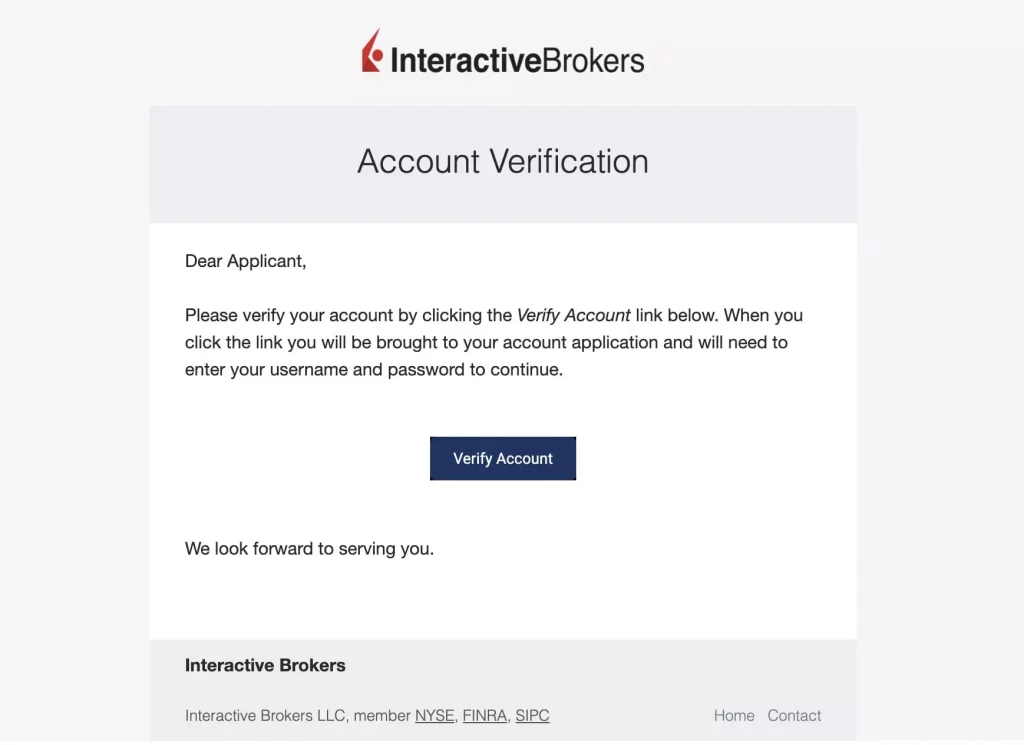

Step 3: Verify account via email

Log in to your personal email, open the "Account Verification" email sent by Interactive Brokers, click "Verify Account" to complete the account verification, and the system will automatically jump to the Interactive Brokers login page。

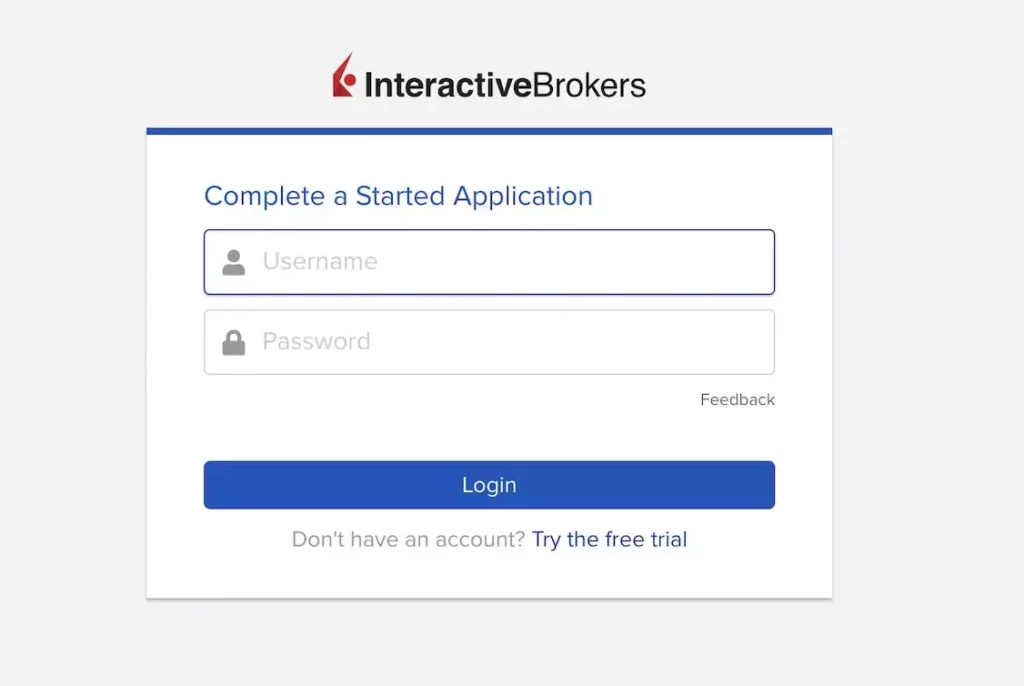

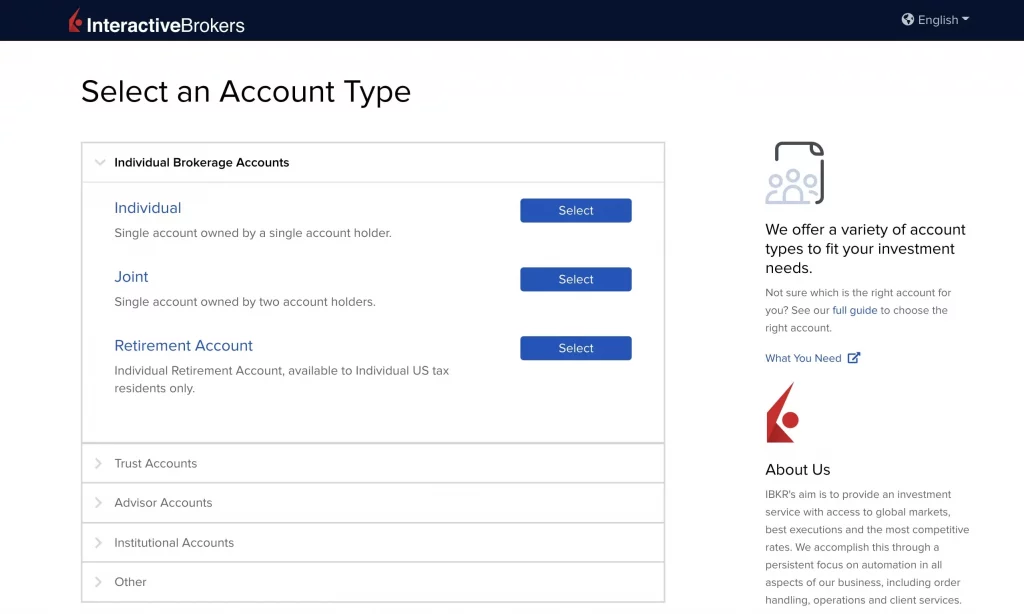

Step 4: Log in to your account and select the account type

On the Interactive Brokers login page, enter your username and password to log into your account。Subsequently, select the type of securities account for this account opening application。Select "Individual" here and click "Start Application"。

Married people can choose to open a "joint account" (Joint), open an account with the other half, so that in the event of an unfortunate event, the other half can continue to manage the investment account。

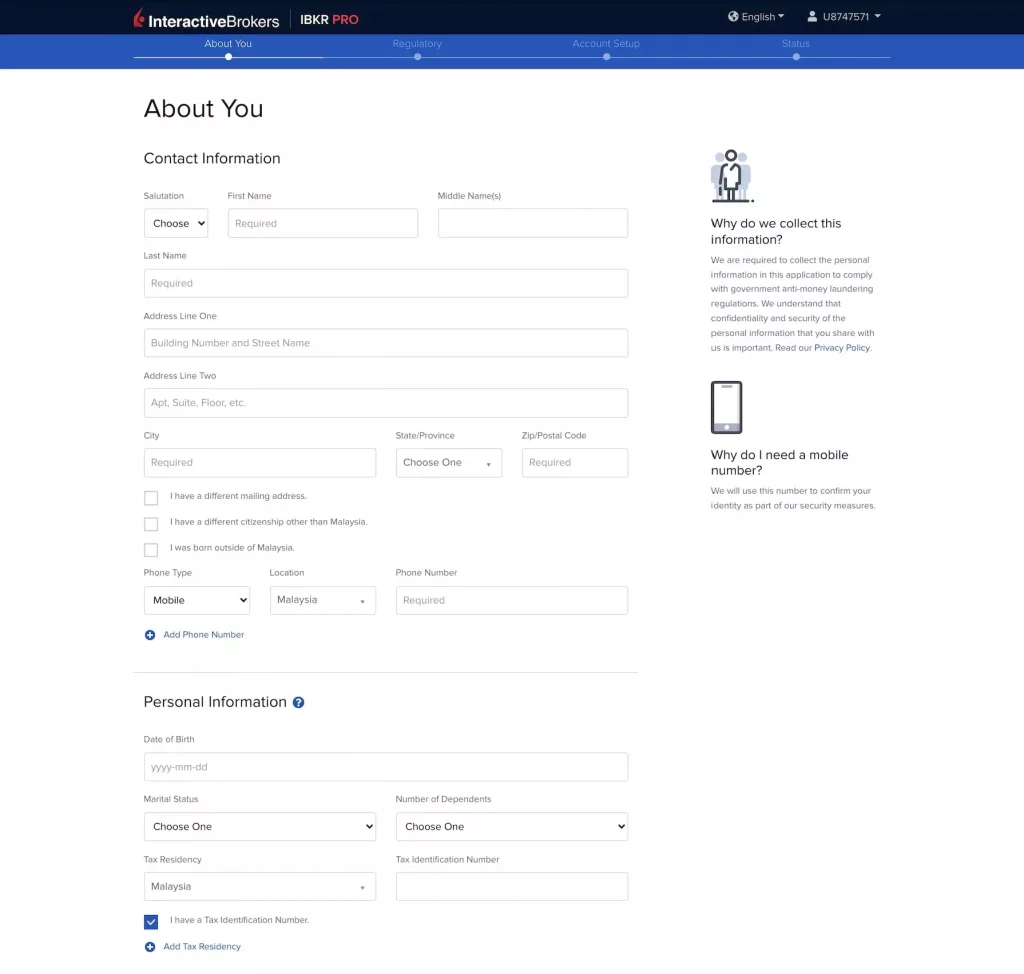

Step 5: Fill in your personal data

Next, fill in personal and occupational information。

Be sure to provide true and accurate personal information and ensure that the address is consistent with the information on the identification document to avoid problems with subsequent account verification。

Tax Identification Number is the number of income tax。In Malaysia, the tax number is an 11-digit number, such as SG12345678901, which can be found in the tax return document (such as Borang BE or Borang B) or in an enquiry with the Inland Revenue Department (LHDN).。

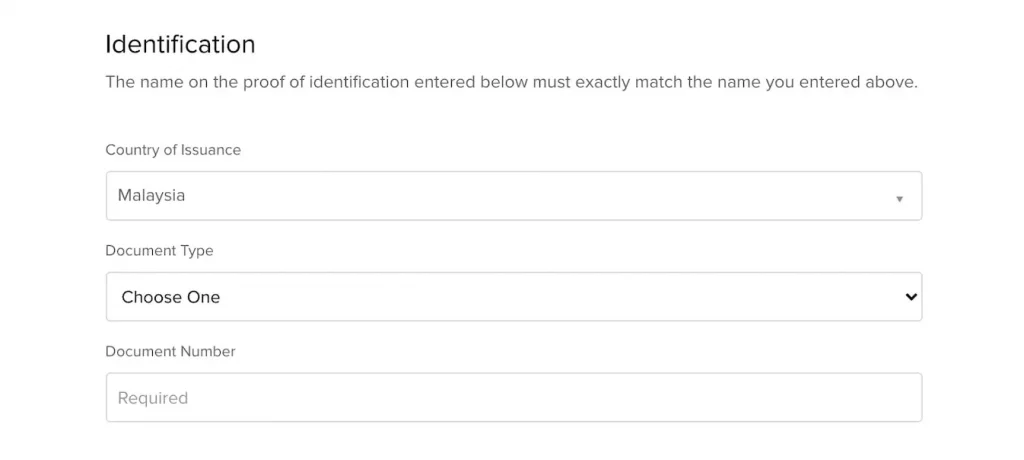

Identification document information (Identification) is recommended to use the identity card (NRIC) for registration, followed by a passport (Passport)。

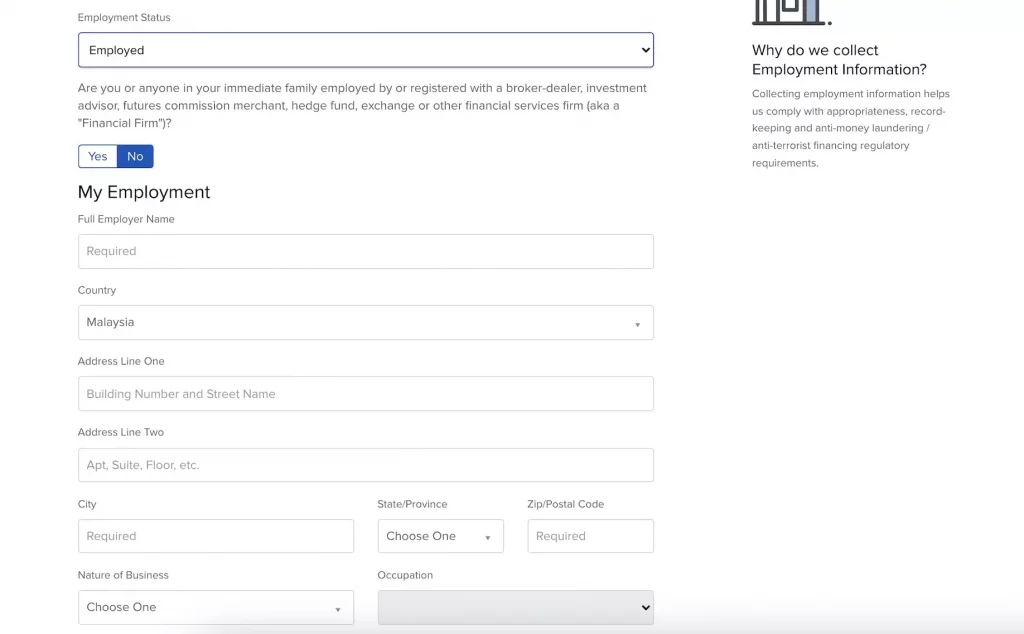

In Employment, select Employment Status. If you are an office worker, select "Employed" and fill in the industry, position, company full name and address.。

If you or your immediate family work for a securities brokerage, futures, hedge fund or any financial institution, be sure to select "Yes"。

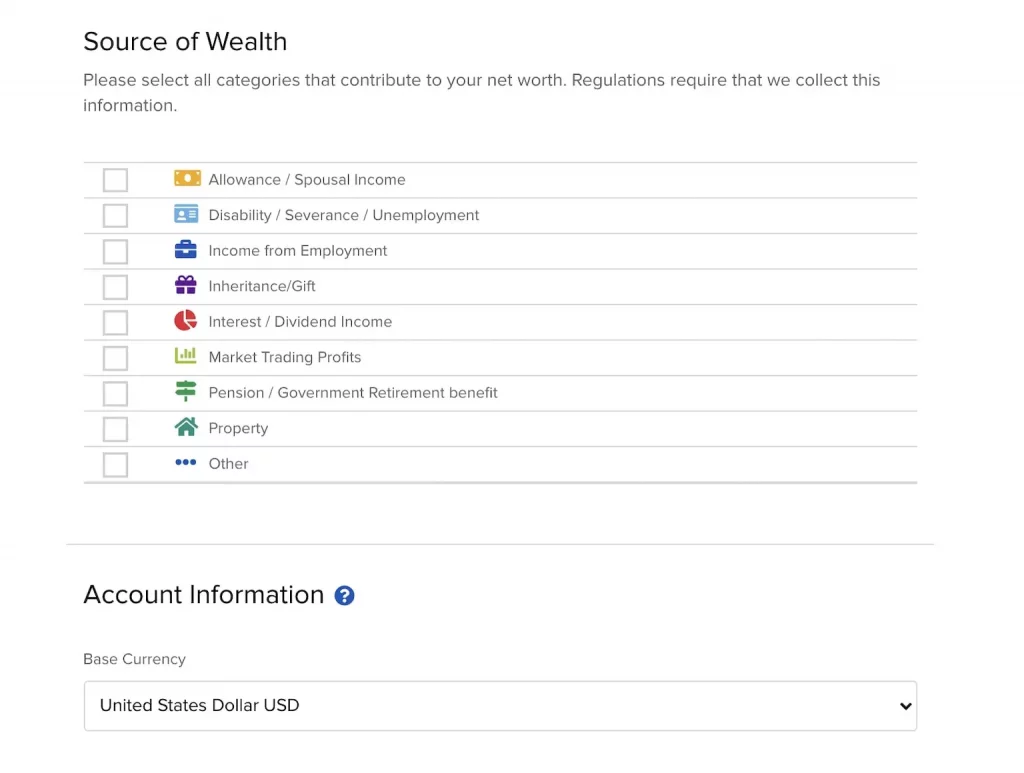

In Source of Wealth, check the source of assets, such as Income from Employment, Inheritance / Gift, and Market Trading Profits.。

The account default currency (Base Currency) is the settlement currency unit of the account, it is recommended to select the United States dollar (USD)。

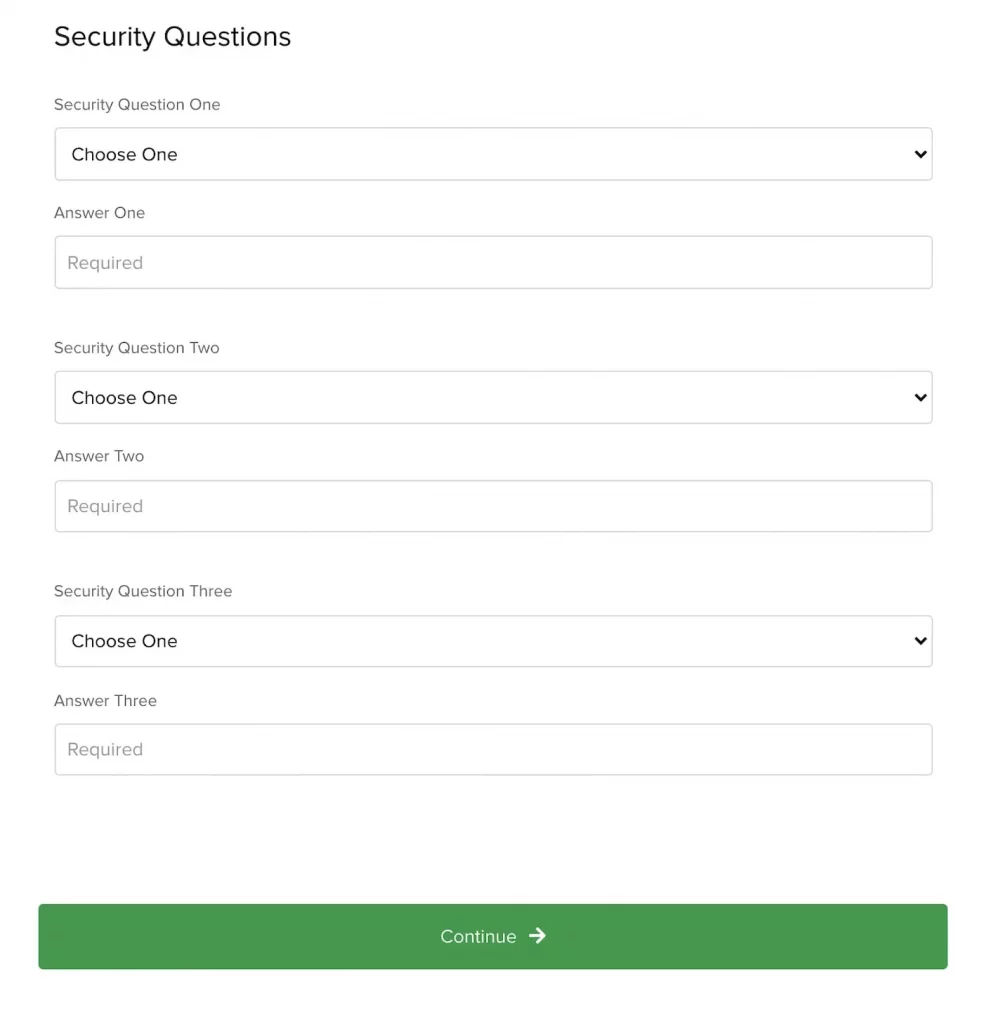

In Security Questions, select three questions and set the answers。In the future, if there are security concerns (such as incorrect login password), the system will use security questions to confirm identity to ensure account security。

After completing, click "Continue" to continue to the next step。

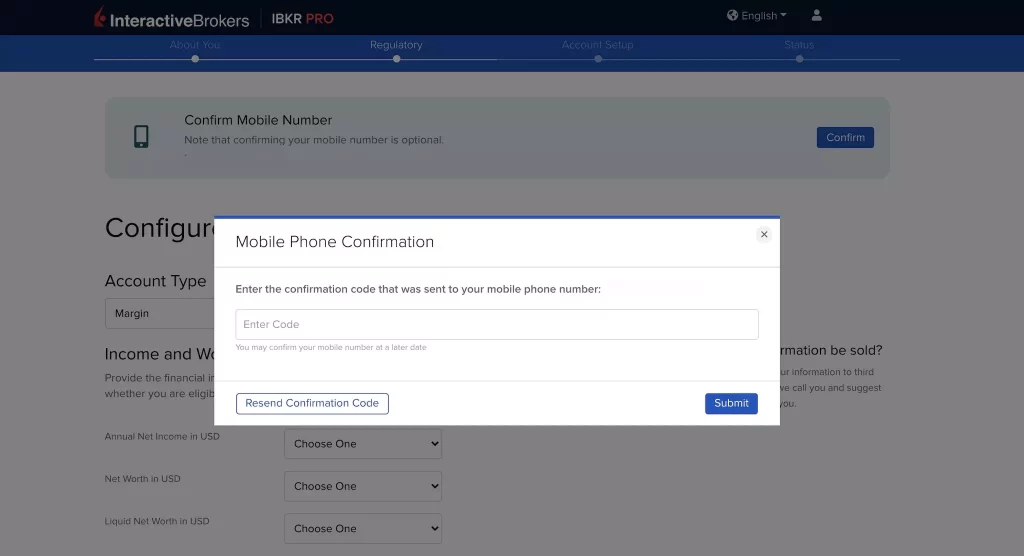

Step 6: Verify the phone number

Please click Confirm Mobile Number above to confirm and associate your personal mobile number。The system will send a text message (SMS) containing a confirmation code, enter this SMS verification code (Confirmation Code) to complete the association, for your investment account to add an additional layer of security.。

Step 7: Declare compliance information

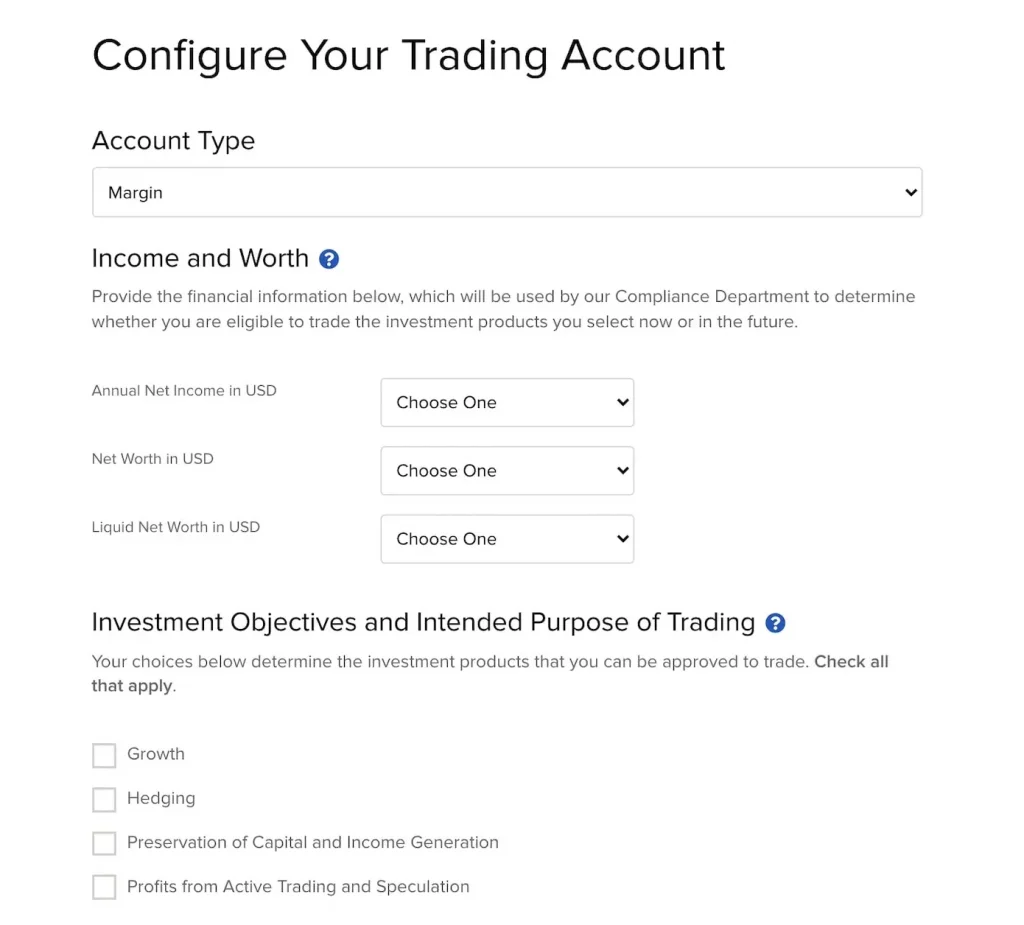

You will then need to fill in the compliance information。

In this section, when you select an account type, you can choose whether to use a Margin account.。Even if you currently select a cash account, you can still upgrade to a margin account later。Margin accounts allow users to trade through brokerage financing, providing flexible ways to use funds, but each financing will bring a corresponding interest rate.。

Fill in income and net asset value (Income and Worth) information to give the broker an idea of your financial situation in order to assess your eligibility for specific financial commodity investments through Interactive Brokers。Please be sure to fill in this section truthfully。

In Investment Objectives and Intended Purpose of Trading, choose your investment objectives, including options such as Growth, Hedging, Preservation of Capital and Income Generation, and Profits from Active Trading and Speculation。

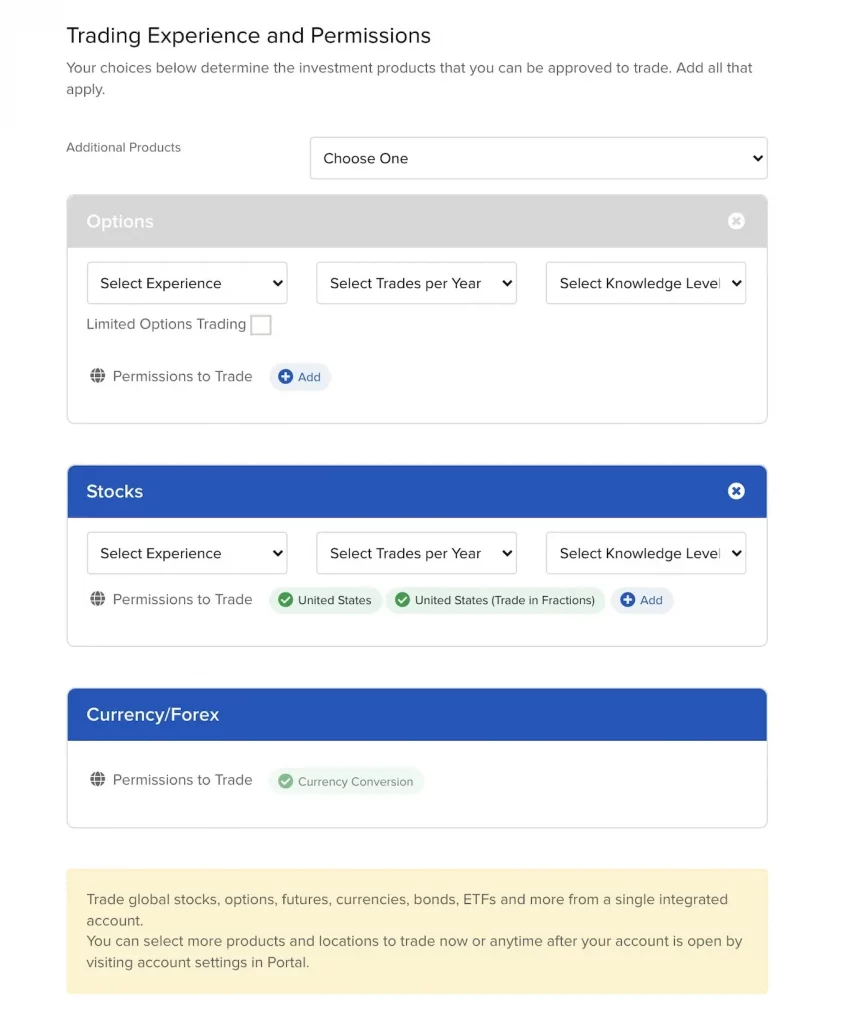

Next, continue to fill in the investment experience and permissions (Trading Experience and Permissions), including stock (Stock), options (Options), foreign exchange (Currency / Forex) investment life, number of investments and professional level.。

Interactive Brokers will determine whether you are eligible to trade a particular financial commodity based on your experience。

The Additional Product section allows users to choose whether to activate investment permissions for other financial products, such as Bonds, Warrants, Futures, Futures Options, Mutual Funds, NextShares, and Complex or Leveraged Exchanged Traded Products.。

If you do not currently choose to apply for trading permissions for other financial products at this stage, you can apply later in the account management background (Portal)。

Before trading any financial product, make sure you have the relevant investment knowledge。Beginner's advice to focus on stocks and ETFs。

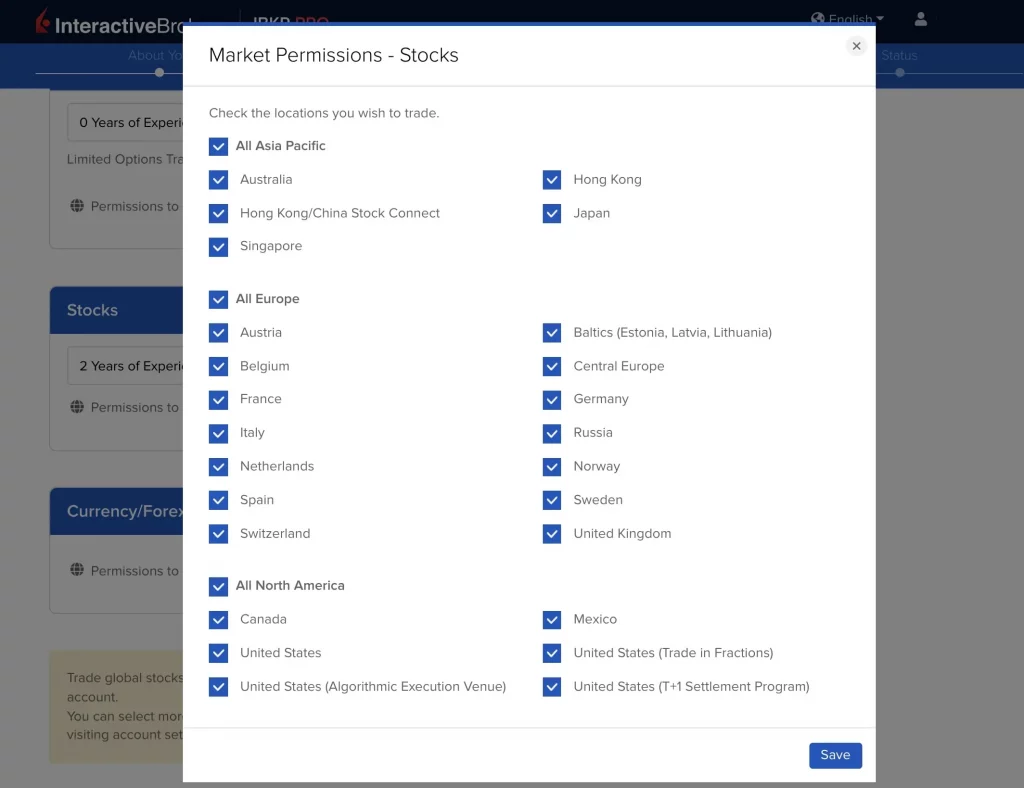

Click "+ Add" next to Permissions to Trade to expand and select all investable markets, which users can select on demand or select other markets later in the background.。

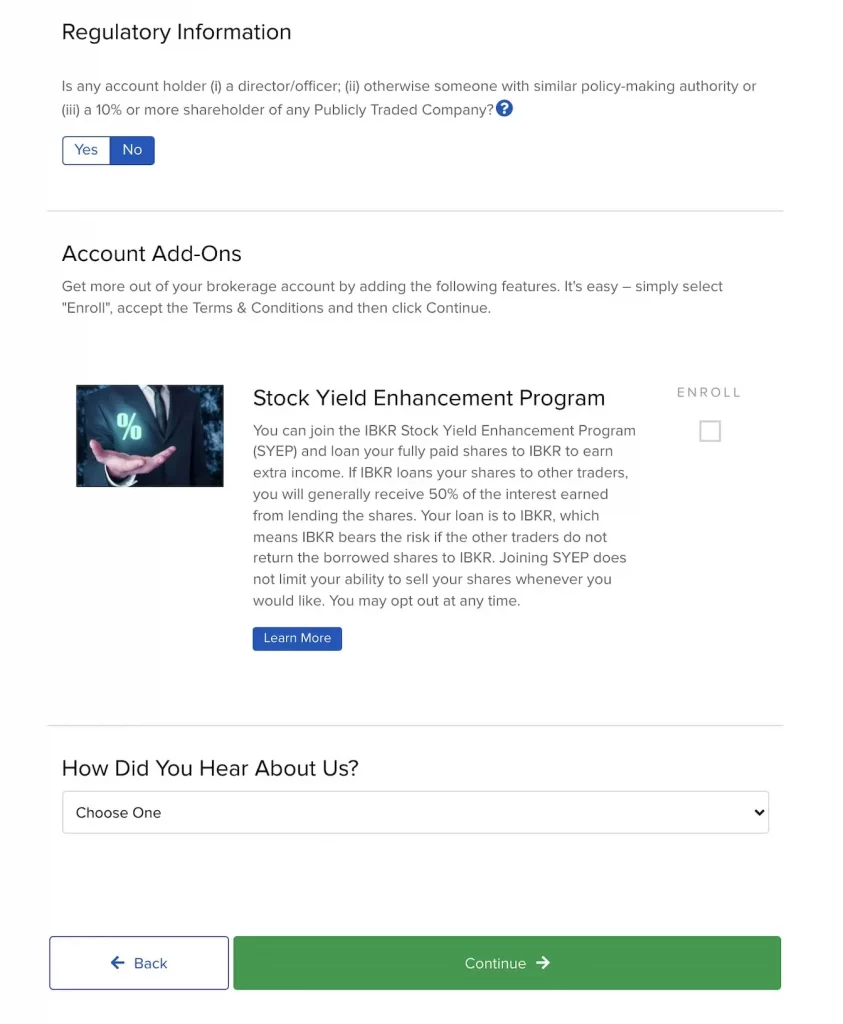

In Regulatory Information, if you are not a director or chief executive of a listed company, do not participate in policy development, and do not hold 10% or more of the shares of a listed company, please select "No."。

The Account Add-Ons section allows users to choose whether to activate the Stock Yield Enhancement Program offered by Interactive Brokers.。If you choose to open (️ ENROLL), you agree that Interactive Brokers will lend your shares to other users for short selling, and Interactive Brokers will share half of the resulting interest to you as additional income.。Interactive Brokers will assume the risk of lending shares, even if the lending user fails to return the shares, it will not affect your position and you can sell the shares normally。

Users can decide whether to activate this service according to their personal needs and change the settings in the background at any time in the future。

How Did You Hear About Us?), choose how you learned about Interactive Brokers。

When finished, please click "Continue" to proceed to the next step。

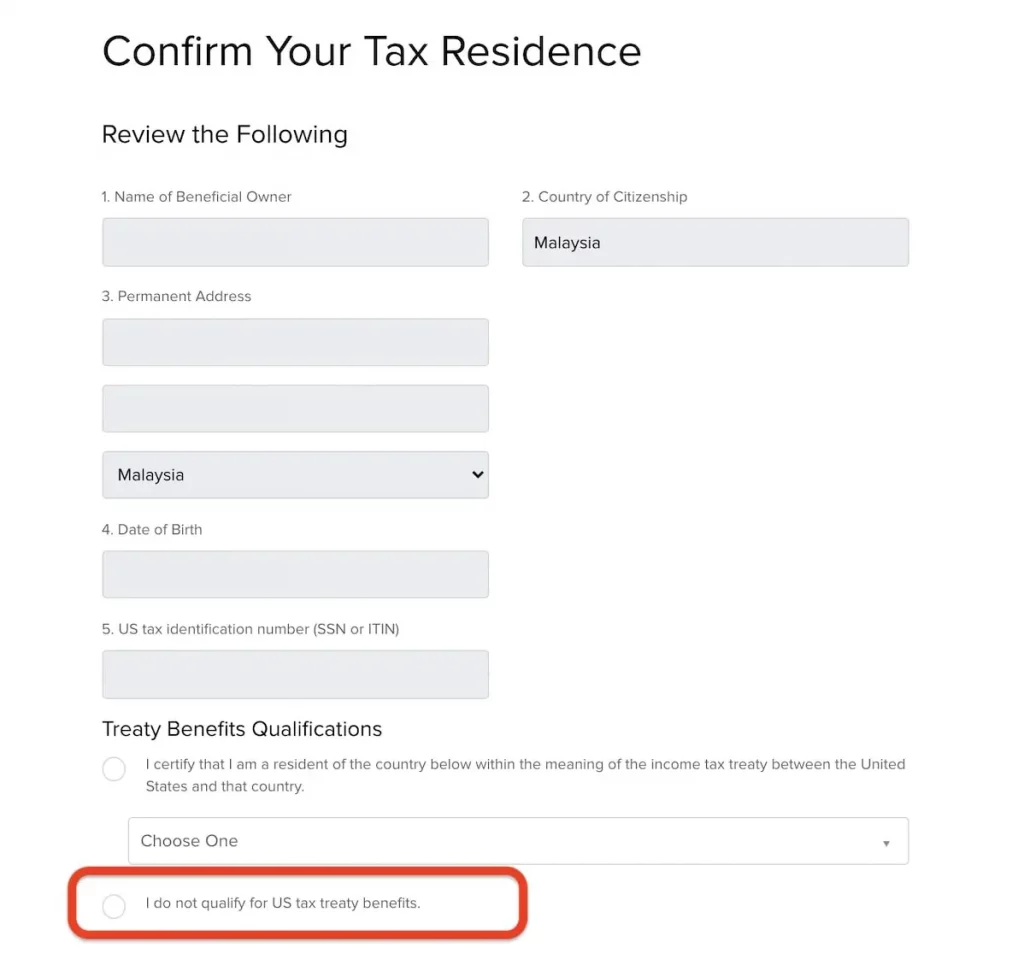

The last is to confirm the individual's tax residence (Confirm Your Tax Residence), please check and confirm the personal information is correct。

"I do not qualify for US tax treaty benefits" means that you are a Malaysian citizen and are not in compliance with the Tax Preference Agreement with the United States.。

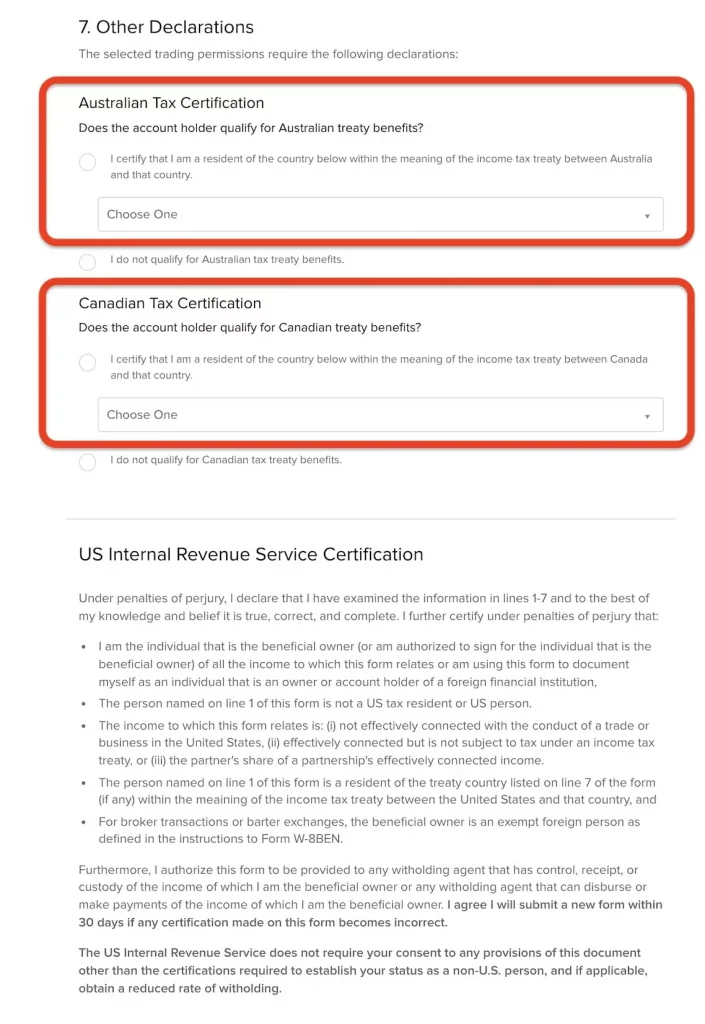

In the Other Declarations section, the system will declare tax benefits based on the trading market requirements previously selected by the user。

Malaysia has tax preference agreements with Australia and Canada, so please select Malaysia in the first column, "I certify that I am a resident of the country below within the meaning of the income tax treatment between XXX (country) and that country."。

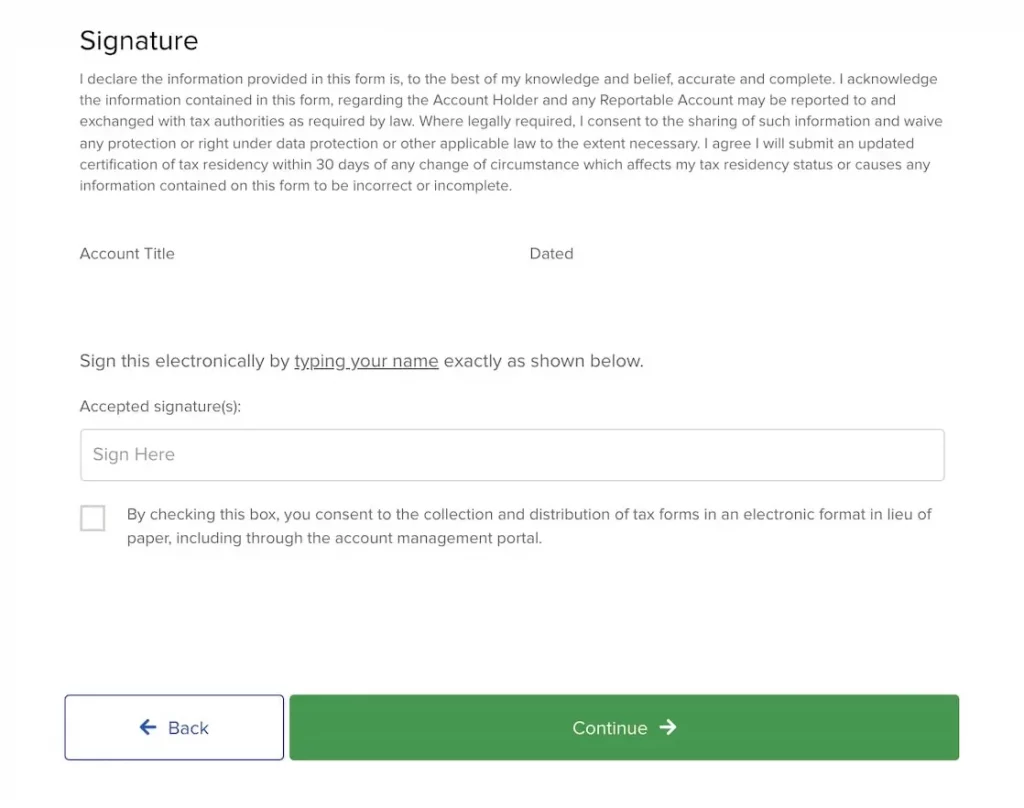

Sign your full English name at the bottom and give your consent to the collection and filing of tax forms by Interactive Brokers。

When finished, please click "Continue" to proceed to the next step。

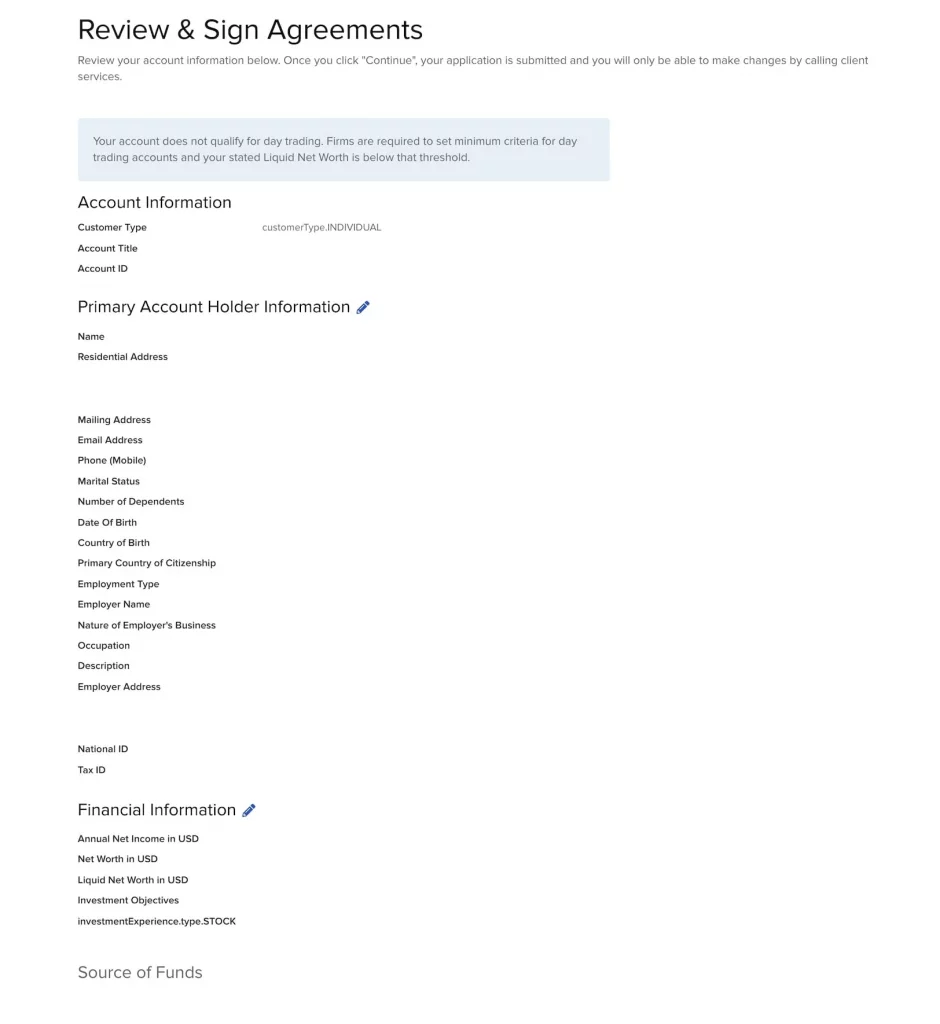

Step 8: Read and agree to the account opening agreement and related disclosures

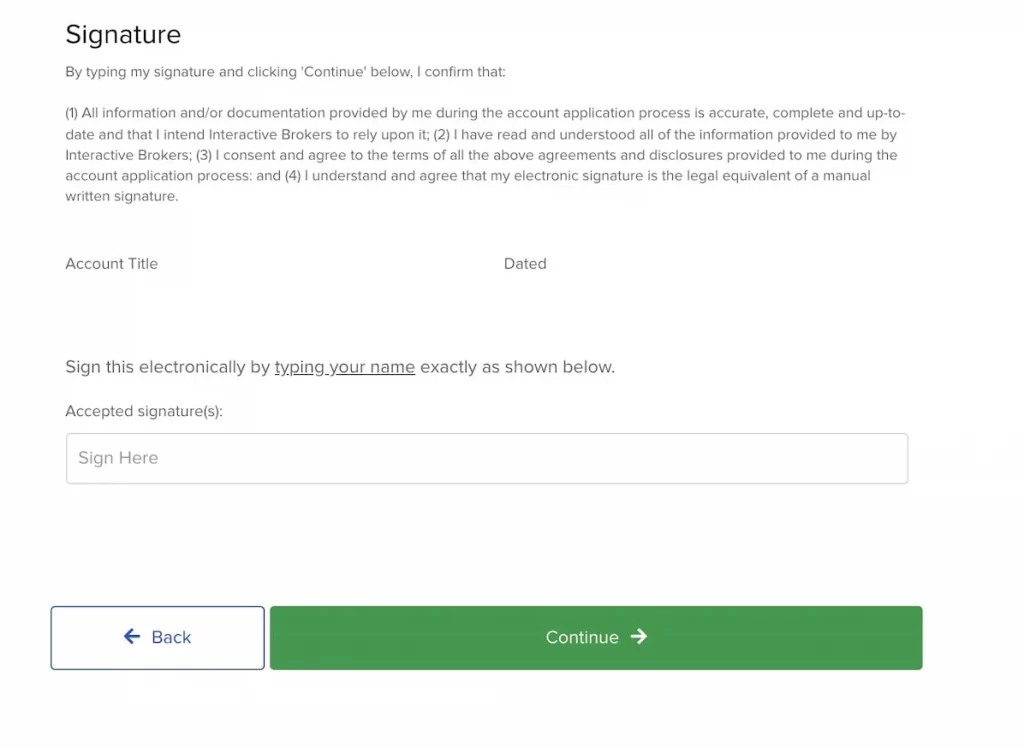

Please review the personal information carefully and read all agreements and related disclosures (Agreements & Disclosures), such as Essential Legal Terms for your IB Account, Privacy Statement, etc.。

Sign your full English name at the bottom to agree to all agreements and related disclosures, then click "Continue" to proceed。

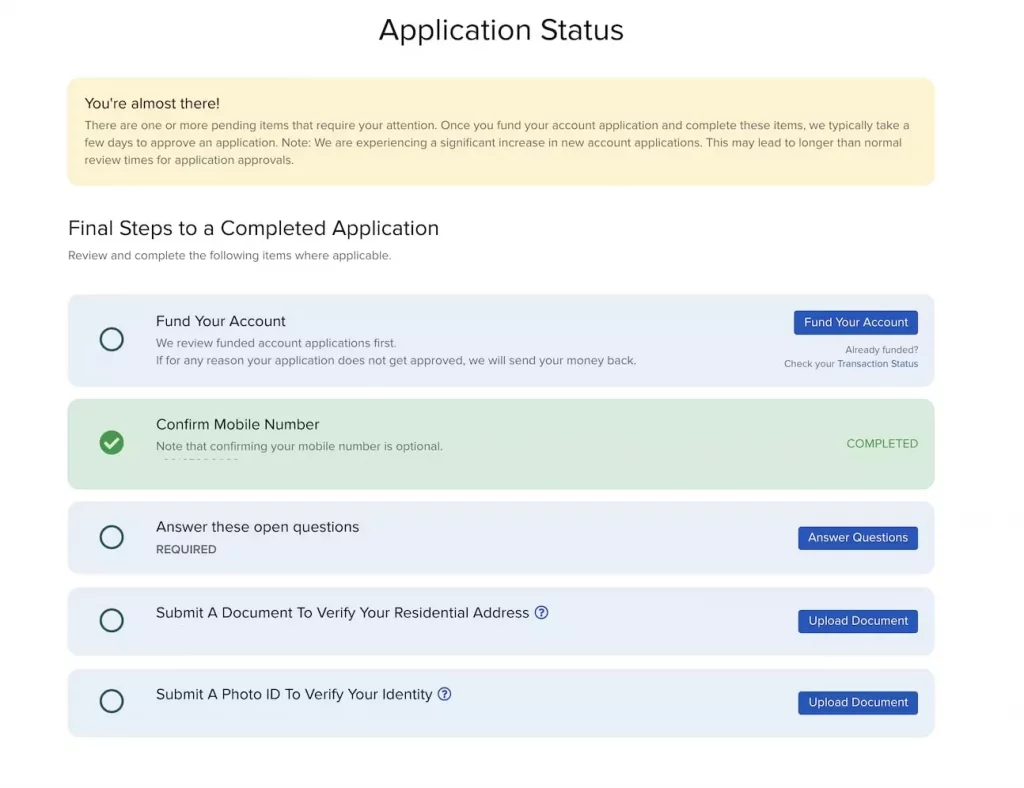

Step 9: Upload address and identification documents

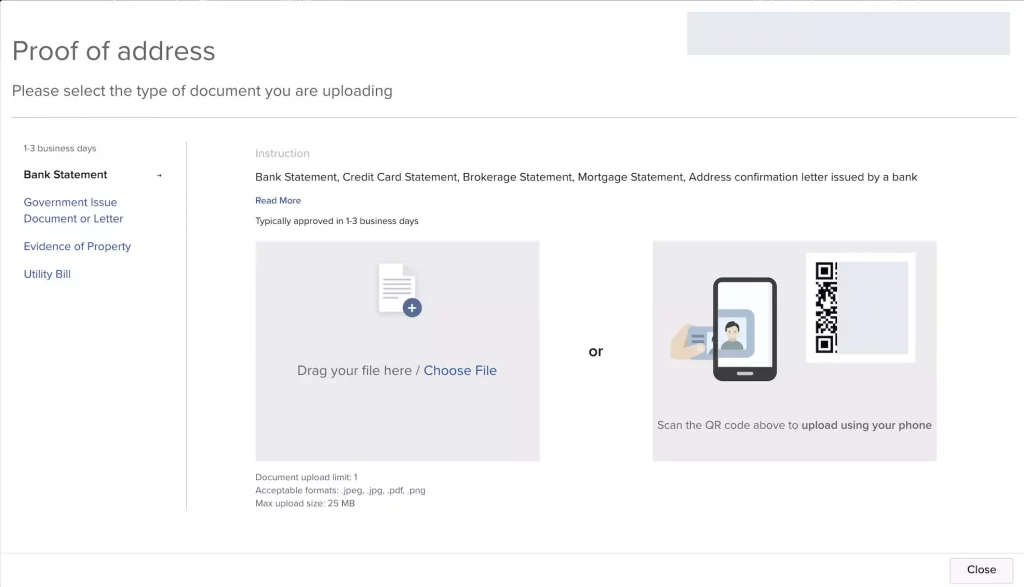

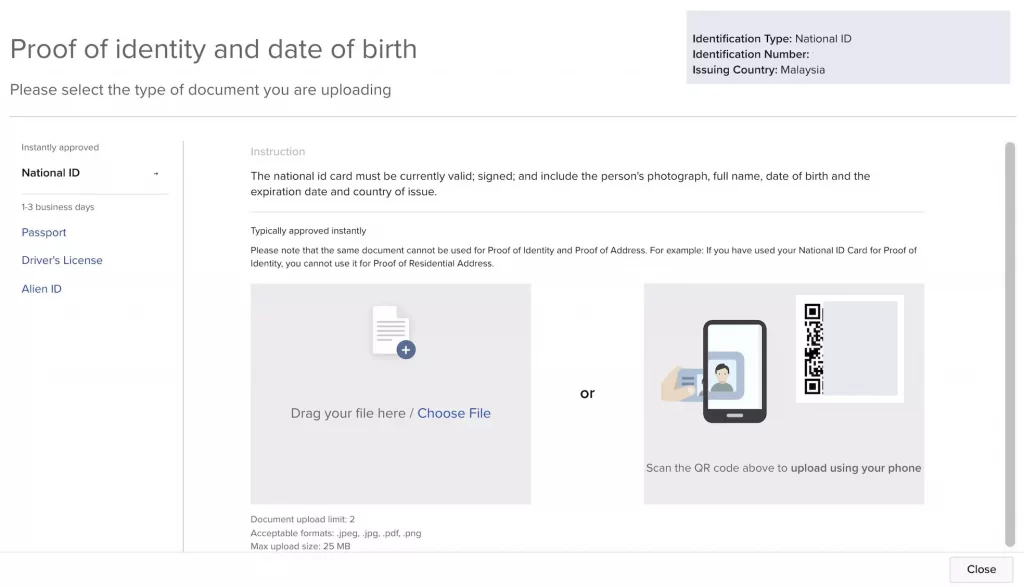

Go to the final step of uploading the address and identification documents。You can choose to upload directly from your computer, or use your phone to scan the QR code displayed on the web page to upload。

In terms of proof of address documents, you can choose to upload a house lease or title deed, a water and electricity bill, a driver's license, a bank statement, a credit card statement, a brokerage statement (U.S. registered brokerage), an insurance company letter, a local government letter (e.g., tax bill, voter registration notice)。

For identification documents, you can choose ID card (recommended), passport, driver's license。

When taking an identity document, make sure that the image is clearly visible, does not reflect light, and must be taken or scanned with the original (original)。The above name must be the same as the personal name previously filled in。

After uploading the file, it means that your account opening application has been completed。Interactive Brokers will review your application, usually within 1 to 3 business days, and your account will be opened。

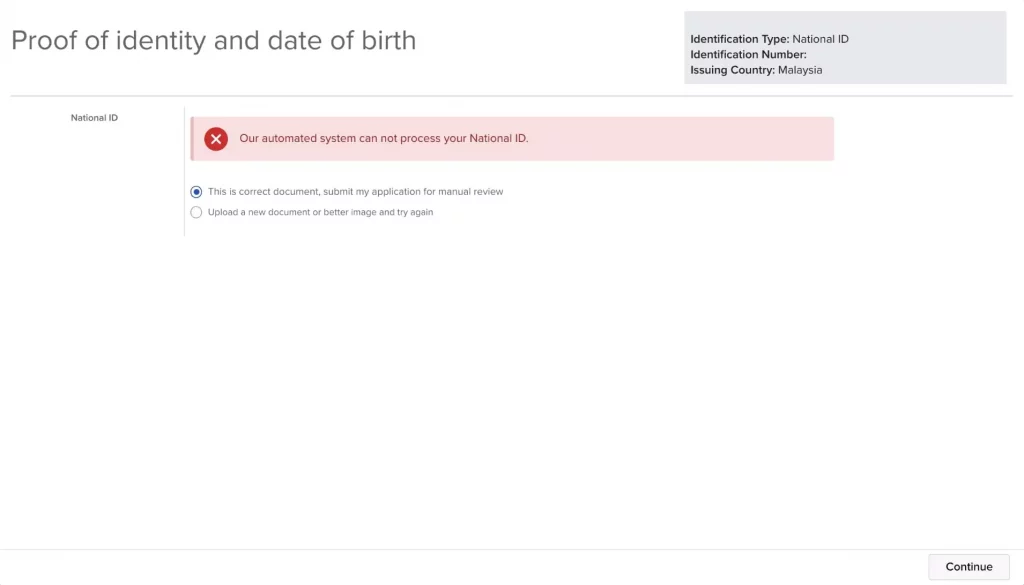

If after uploading a file, the page displays a warning window that the file cannot be recognized, which means that the system cannot recognize the file content。You can choose to click "This is correct document" to submit the document to Interactive Brokers for manual review, or select "Upload a new document" to upload the document again。

Time and experience sharing required to open an account

Although Interactive Brokers has relatively many steps to open an account, the review is quite fast, usually within 1 to 3 business days to complete the review and complete the account opening。The team conducted an account opening test on Sunday afternoon and received an email notification of a successful account opening at noon on Monday the next day。After completing the deposit, you can start trading。

Account Opening FAQ

How long does it take to open an account??

The official said 1 to 3 working days, as long as the documents and information are complete and meet the requirements, the audit time is usually not too long。The results of the author's measurement are within 1 working day through the application for opening an account and receiving an email notification。

If you have not received a notification for more than 1 week, it is recommended to contact Interactive Brokers customer service for information。

Is there a minimum deposit threshold for opening an account??

No minimum deposit requirement。

Will the account remain valid if you do not deposit money after opening the account??

Yes, the account will remain valid。

Do not use after opening an account, do you need to pay any fees?

Interactive Brokers has eliminated the account idle fee and therefore will not incur any charges。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.