Sumsub launches non-document verification solution in UK

With OneID, Sumsub can provide document-free verification for 95% of adults。

Sumsub, a London-based provider of authentication and anti-fraud automation, announced the launch of its non-document verification solution in the UK。

Customers in industries such as fintech, cryptocurrency, e-commerce, online gaming and transport can now securely provide their users with near-instant authentication through official bank records while complying with UK regulations。Currently, non-document validation is also available in Nigeria, Brazil, Argentina, Indonesia, Ghana, Bangladesh, India and the Netherlands。

The solution is achieved through a strategic partnership with OneID, a UK government-certified identity provider。Users are supported by OneID during use to ensure compliance with personal data regulations。Sumsub is the first company in the world to offer document-free verification as part of a holistic compliance solution that spans the entire user journey。The service marks a pioneering approach to full-cycle user verification globally, and local vendors do offer document-free verification services in individual markets.。

With OneID, Sumsub says it can offer document-free verification services to 95 percent of the adult population.。The solution will be facilitated through the identification of major customers such as Barclays, Bank of Scotland, Chase, First Direct, Halifax, HSBC, Lloyds, MBNA, Monzo, Nationwide, West, Royal Bank of Scotland (RBS), Virgin B and Santander, Starling。

With OneID, Sumsub says it can offer document-free verification services to 95 percent of the adult population.。Data-facilitated customer authentication at major institutions such as Direct, Halifax, HSBC, Lloyds, MBNA, Monzo, Nationwide, NatWest, RBS, Santander, Starling, TSB, Ulster and Virgin Money。

Non-document validation solutions bring many benefits to customers, redefining the landscape of user validation。OneID enables Sumsub to provide lightning-fast authentication in five seconds, much faster than the industry average of two minutes on the phone。Users can be verified without having to upload an ID photo。

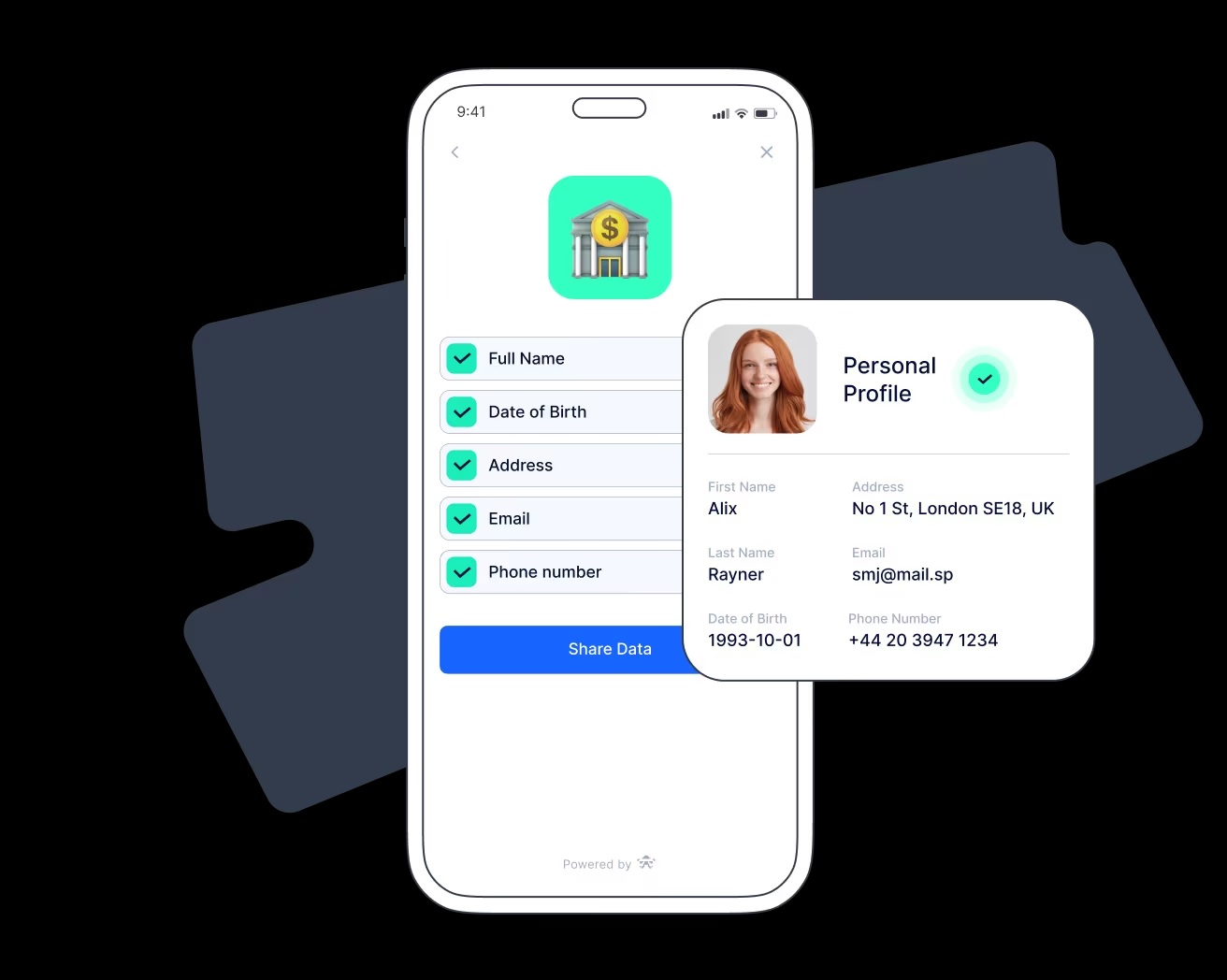

During the login process, the user first selects his bank and is directed to his page or application in the same session window。After logging into the bank account, the user hereby agrees to share personal data, which is necessary for authentication。Finally, Sumsub will immediately retrieve and verify the required data to successfully check in for new customers without providing any documents。

Document-free verification brings low churn and high conversion rates due to a seamless user experience。In addition, Sumsub simplifies the process through a user-friendly no-code approach. Through workflow generator and network software development kit (SDK) integration, customer compliance teams can easily adapt to various regulations and country-specific needs without the need for internal developers。Sumsub enables account teams to build their solutions into their own user processes, while incorporating their enterprise brand into the SDK and end user interface。

Sumsub co-founder and CEO Andrew Sever said:

"We are pleased to offer our UK customers a fast onboarding solution。The UK is one of the first European markets in our non-document verification portfolio, which we believe will take the authenticated user experience to the next level。We will replace UK customers "sophisticated identity verification procedures with a unique way to log in to online banking, eliminating identity fraud, duplicate accounts and bot-based verification attempts.。We are committed to providing users with a secure, efficient and seamless login experience, while enabling enterprises to effortlessly meet regulatory requirements。

Paula Sussex, CEO of OneID, noted:

"We are pleased that Sumsub has chosen us as a partner to provide a document-free identity solution.。We are proud that we have allowed Sumsub to promise their customers a fast and convenient experience, reaching around 50 million people in the UK.。

Sumsub Chief Legal Officer Tony Petrov added:

"Under UK anti-money laundering legislation, no-file solutions can be used, provided they have additional security measures in place.。These measures are essential to establish a link between the user and his or her claimed identity, which has been independently verified by external data sources.。We ensure the security of the no-document verification process to prevent fraud and abuse, and because we use advanced electronic identification technology, we can guarantee that the user who claims a specific identity is indeed the person who owns that identity。

Understanding Sumsub

Sumsub is a full-cycle verification platform that ensures the safety of the entire user journey。With Sumsub's customizable KYC, KYB, transaction monitoring and fraud prevention solutions, you can coordinate your verification process to reach more customers globally, meet compliance requirements, reduce costs and protect your business。Sumsub has more than 2,000 customers in the fintech, cryptocurrency, transportation, trading, e-commerce, and gaming industries, including Binance, Mercury, Bybit, Huobi, Unlimit, DiDi, Poppy, and TransferGo.。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.