Tencent 2023 earnings report: this year will buy back more than 100 billion shares of the mixed model will be power Wensheng video

For the whole year, Tencent generated 6,090 revenue.1.5 billion yuan, up 10% year-on-year。Adjusted net profit was 1,576.8.8 billion yuan, up 36% year-on-year。The company also plans to at least double the size of its share buybacks, from HK $49 billion in 2023 to over HK $100 billion in 2024.。

On March 20, Tencent's full-year 2023 results finally came out after a thousand calls.。

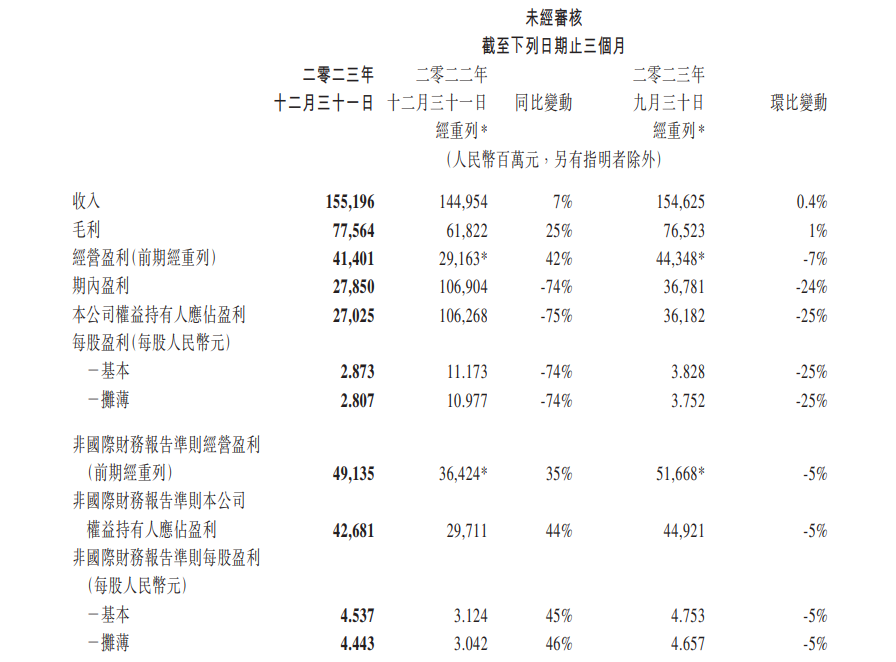

First look at the fourth quarter 2023 results。Tencent's revenue for the quarter was 1,551.9.6 billion yuan (RMB, the same below), up 7% YoY and a slight increase of 0% YoY..4%。Gross profit was 775.6.4 billion yuan, up 25% YoY, up 1% YoY。Adjusted net profit 426.8.1 billion yuan, up 44% year-on-year and down 5% month-on-month。

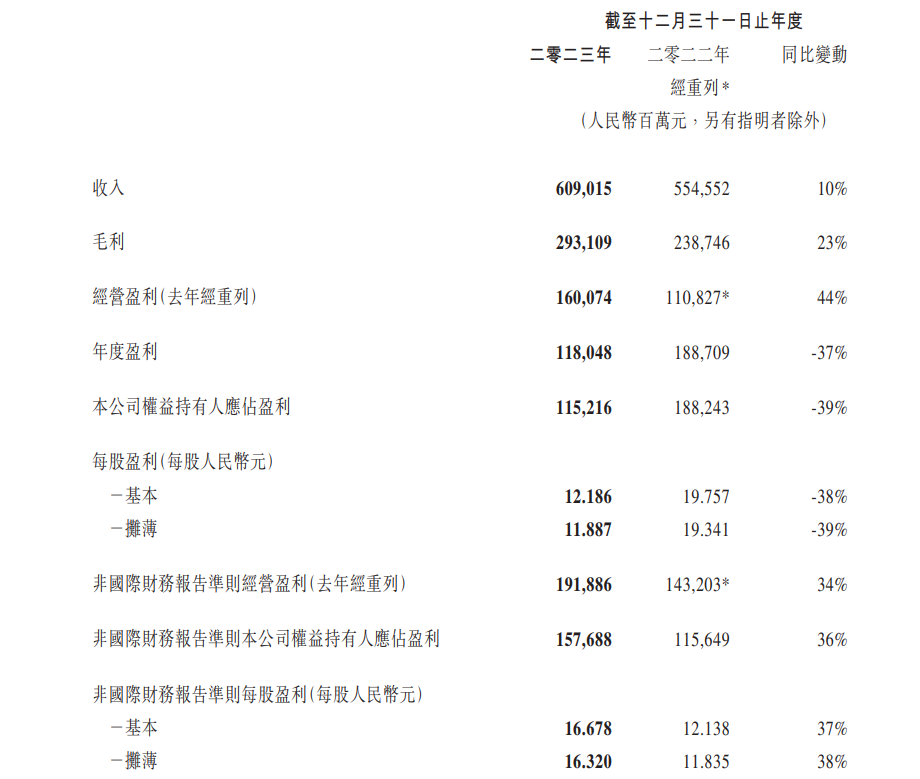

For the whole year, Tencent generated 6,090 revenue.1.5 billion yuan, up 10% year-on-year。Gross profit was 2,931.09 billion yuan, up 23% year-on-year。Adjusted net profit was 1,576.8.8 billion yuan, up 36% year-on-year。

In earnings, Tencent announces dividend and buyback plans for this year。Tencent said that in 2024, the company will pay a dividend of 3 per share for the year ended December 31, 2023..HK $40 (approximately HK $32 billion), up 42% YoY。The company also plans to at least double the size of its share buybacks, from HK $49 billion in 2023 to over HK $100 billion in 2024.。

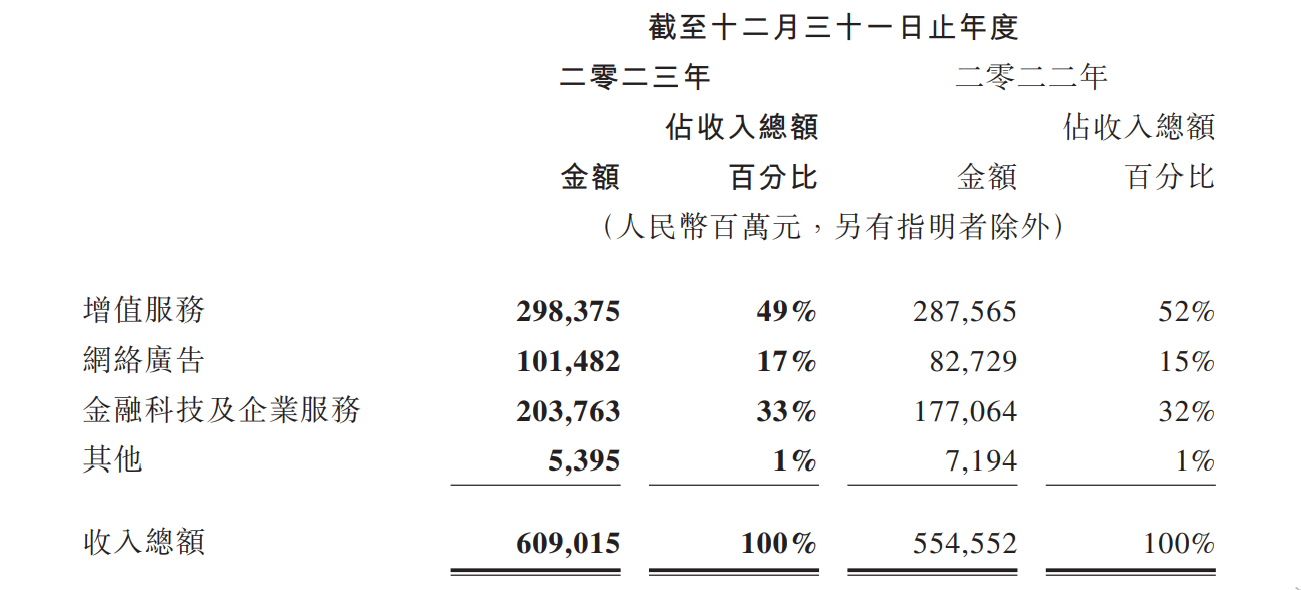

Specifically, the performance of Tencent's various business segments。

Video number performs well, game revenue will improve from Q2

The first is the value-added services that account for "half" of total revenue.。Tencent's value-added services include social networking and gaming。In the fourth quarter of 2023, revenue in this segment fell 9% year-over-year to $69.1 billion.。But for the full year, it grew 4% year-on-year to $298.4 billion; gross profit was $161.9 billion, up 11% year-on-year, and gross margin increased to 54% from 51% last year.。

● Social networks

In 2023, the social network business generated a total of $118.5 billion in revenue, up 1% year-on-year.。The slight increase was due to music paid membership (up to 1.0.7 billion) and small game platform service fee revenue growth (total flow of small games increased by more than 50%), partially offset by a decline in live music and game live service revenue.。

The video number is still performing well, Tencent revealed, thanks to the recommendation algorithm to optimize the number of active accounts and per capita usage time growth next day, the total user usage time of the video number doubled last year。Tencent has also provided more monetization support for video number creators, such as promoting live delivery.。

President Liu Chiping revealed that Tencent's live and video number e-commerce sales in 2023has exceeded 100 billion yuan,achieve substantial growth。

● Game aspects

Full-year gaming revenue in the international market was $53.2 billion, up 14% year-on-year and 8% after excluding the impact of exchange rate fluctuations.。The company said the year-over-year increase was mainly due to the strong performance of "VALORANT," the contribution of the recently released games "Victory Goddess: Nikki" and "Triple Match 3D," and the recovery of "PUBG MOBILE" in the second half of the year.。

In terms of games in the local market, full-year revenue rose 2% year-on-year to $126.7 billion, mainly due to revenue contributions from the recently released Intrepid Pact and Ark of Destiny, as well as strong growth in emerging games such as Dark Zone Breakthrough and The Battle of the Golden Shovel, partially offset by a weaker contribution from Peace Elite.。

In the local market, the number of Tencent's "key popular games" increased from 6 in 2022 to 8 in 2023.。The standard for key popular games is hand games with an average daily active account of more than 5 million or PC games with an annual running water of more than 4 billion yuan.。

In the earnings call, Tencent's chief strategy officer James Michelle (James Michelle) revealed that Tencent has now received a considerable number of version numbers.。He indicated that ,Online games is still a high-growth, high-return industry, despite the fierce competition in the industry, but in fact, the company's challenge is still to "do their own thing."。

Michel mentioned that Tencent currently has three strategies in the game business that are being implemented, including changing the leadership team of existing games, targeting the commercial realization of the game's stock of users, and focusing on launching games with larger budgets.。He revealed that these high-budget game products will be launched later this year, including Dungeons and Warriors Hand Tour, the game has a very successful internal test, "the team has accelerated the release date, will be released in the next three months, that is, the second quarter。"

As a result, Michelle believes that the company's game business revenue will improve from the second quarter of this year.。He said: "The success of these three strategies will also determine our medium-term growth rate.。"

In addition, when talking about the end of last year's "online game management measures (draft for comments)" will have what impact on the company, Liu Chiping said that this is no longer a matter of concern to Tencent。He said the regulator had made it clear that the draft was actually intended to provide a healthy environment for the development of the industry, not to restrict it.。Secondly, after the market expressed concern about the regulatory convenience of the introduction of a series of support measures, including the issuance of a large number of editions, Tencent also benefited from it.。In addition, the focus of the market is on games with high ARPU values, which has little to do with Tencent, as Tencent's game product consumption is actually at a lower level in the industry as a whole。"So, this is no longer one of our concerns.。"

AI Helps Q4 Advertising Business Hit Quarterly High

Revenue from the online advertising business rose 16% year-on-year to 29.8 billion yuan in the fourth quarter of last year, a quarterly high.。Year-over-year revenue up 23% to $101.5 billion。The company said the growth was driven by new advertising inventory from Video Number and WeChat Search, as well as continued upgrades to its advertising platform。

Gross profit was $51.3 billion, up 47% year-on-year, and gross margin increased to 51% from 42% last year.。The increase in gross margin was mainly due to strong growth in high-quality revenue, especially video advertising.。

With the exception of the automotive industry, all key advertiser industries increased their advertising spending on Tencent's advertising platform, with significant increases in spending on consumer goods, Internet services and big health.。

Tencent revealed that in 2023 the company upgraded its AI-driven advertising technology platform, significantly improving the effectiveness of precision delivery, thereby increasing advertising revenue。

The next direction of hybrid power: Wensheng video

Fintech and corporate services,Revenue in the fourth quarter of last year rose 4% year-on-year to 54.4 billion yuan.。Revenue for the year was $203.8 billion, up 15% year-over-year.。The double-digit growth was mainly due to increased payment activity and revenue growth from wealth management services.。In addition, enterprise services revenue also recorded double-digit growth, thanks to the collection of technical service fees for video number delivery and the steady growth of cloud services.。

Gross profit, on the other hand, rose 38 per cent year-on-year to $80.6 billion, and the business segment's gross margin was relatively weak, but also recorded an increase, from 33 per cent last year to 40 per cent.。

On February 29, Alibaba Cloud officially announced that the official website price of all cloud products was lowered, with an average price reduction of more than 20% and a maximum drop of 55%.。Last year, Alibaba Cloud, Tencent Cloud, Huawei Cloud and other cloud service providers set off a wave of price cuts。

Regarding the trend of price cuts in the cloud service industry, Michelle said that price cuts have always existed, and as long as Moore's Law continues to be effective, reducing computing costs will always be the trend in the cloud service industry。"But we have not seen a dramatic change in the competitive landscape, as in the high-profile but low-impact round of price cuts for SMEs initiated by the industry a year ago.。"

Michelle believes that the most important thing for cloud services is to be cost-competitive。In order to be cost-competitive, the first step is to have sufficient scale and optimize the supply chain.。And there are several cloud services companies in China that are comparable in size, including Tencent。Tencent has been actively promoting supply chain optimization in the past few quarters and has achieved good results.。In addition, the ability to convince customers to purchase services other than infrastructure services。This is the real focus of Tencent。

In addition to cloud services, in the conference call, Tencent also responded to the outside world's concern about the hybrid model.。

Tencent said the hybrid is among the top levels in the Chinese language model, both in China and globally.。

President Liu Chiping said that the hybrid is currently mainly focused on text technology, as this is the basis of the model.。But he also revealed that the next important development direction of the hybrid will be Wensheng video。"As we have seen from Sora, Sora has done a great job in converting text to long videos, which is what we will develop next.。We will continue to improve the text-based capabilities of the hybrid, as well as develop text-to-video capabilities, which are highly relevant to our core business.。He believes that Tencent's main businesses, such as short video, long video and games, will be the areas where mixed yuan will promote research and development in the future.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.