Tesla Shares Plunge After Q2 Net Profit Decline of Nearly 50%

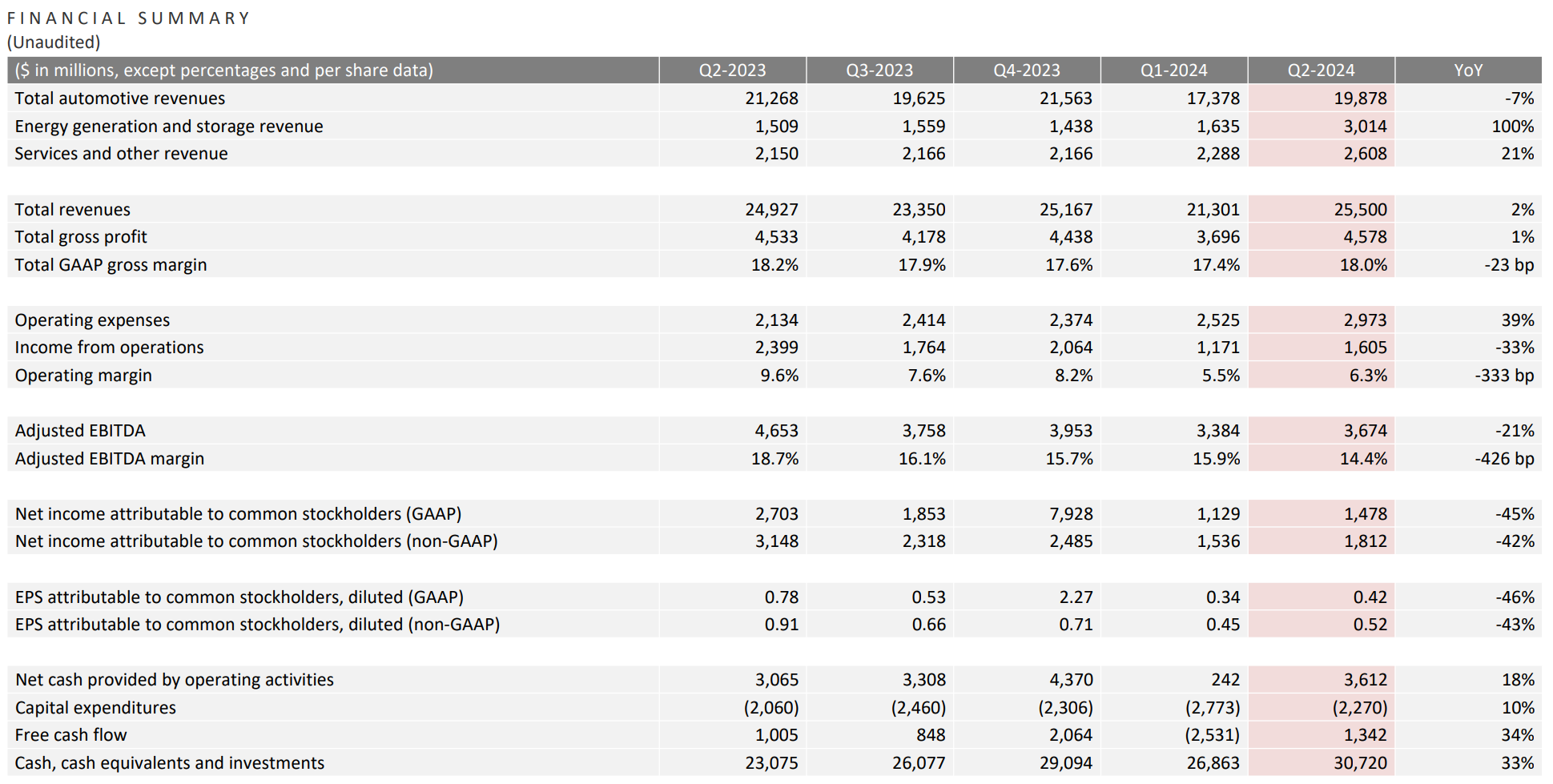

Tesla's revenue for the second quarter was $25.5 billion, a slight increase of 2% year-on-year, and adjusted net profit was $1.812 billion, a decrease of 42% year-on-year.

After the stock market closed on July 23rd, Tesla released its Q2 financial report for this year. Due to the nearly halving of net profit in the financial report, Tesla experienced a sharp decline after hours.

According to financial report data, Tesla's revenue in the second quarter was $25.5 billion, a slight increase of 2% year-on-year, better than analysts' expectations of $24.72 billion. Among them, the revenue of the electric vehicle business was 19.878 billion US dollars, a year-on-year decrease of 7%. The revenue of the power generation and energy storage business was 3.014 billion US dollars, a year-on-year increase of 100%. The revenue from services and other businesses was 2.608 billion US dollars, a year-on-year increase of 21%.

In terms of profitability, Tesla's adjusted net profit for the first quarter was $1.812 billion, a year-on-year decrease of 42%. Adjusted earnings per share were $0.52, a year-on-year decrease of 43%, lower than analysts' expectations of $0.62.

The good news is that Tesla's gross profit margin data is not bad. The gross profit margin for the second quarter was 18%, which was lower than the same period last year's 18.2%, but better than analysts' expectations of 17.4%. The gross profit margin of the automotive business was 14.6%, lower than market expectations.

The free cash flow (FCF) for the second quarter was $1.342 billion, a year-on-year increase of 34%, lower than analysts' expectations of $1.92 billion.

In addition to operating performance indicators, the progress of Tesla's various businesses is also of interest to the market.。

● Electric vehicles

In terms of electric vehicles, Tesla's global car production in the second quarter of this year was 410,813 units, a year-on-year decrease of 14.3% and a month on month decrease of 5.2%. The delivery volume was 443,956 vehicles, a year-on-year decrease of 4.7% and a month on month increase of 14.7%. In the first half of 2024, Tesla's cumulative sales were approximately 831000 vehicles, a year-on-year decrease of approximately 7%.

In its financial report, Tesla stated that its car production growth rate in 2024 may be significantly lower than the growth rate in 2023. However, the company has also responded to the decline in sales, stating that it is currently in between two waves of growth: the first wave began with the global expansion of the Model 3/Y platform, and the next wave will be triggered by advances in autonomous driving technology and the launch of new products, including those based on next-generation automotive platforms.

For the next generation of more affordable models, Tesla has stated that production will still begin as planned in the first half of 2025.

Tesla stated that the new generation of cars may be produced on the same production line as the existing car series, which will help reduce costs. Although the cost reduction effect is not as expected, it can enable the company to cautiously increase car sales in a more capital expenditure efficient manner during uncertain periods. At present, Tesla's maximum annual car production capacity is about 3 million vehicles.

● Energy storage business

In the second quarter, Tesla's energy business performed exceptionally well. According to financial reports, in the second quarter, Tesla's deployment of Megapack and Powerwall energy storage products reached a record high of 9.4 GWh per quarter.

The company stated that the promotion of Powerwall 3 is currently progressing smoothly. Except for the United States, Powerwall 3 is now available in countries such as Canada, the United Kingdom, and Germany.

Tesla stated that its energy storage deployment and revenue growth rate for its energy generation and storage business should exceed that of its automotive business by 2024.

Our non automotive business is becoming an increasingly lucrative part of Tesla's profits. With the continued growth of energy storage products and the expansion of our fleet, we expect non automotive profits to continue to grow over time, "the company wrote in its financial report.

According to analysts' previous predictions, Tesla Energy's revenue in the 2024 fiscal year may exceed $7 billion, and the profit margin of this business is expected to surpass that of the automotive business by 2025.

● 4680 battery

In the second quarter, Tesla's 4680 battery production increased by 50% compared to the first quarter, while achieving significant cost reductions.

This month, Tesla successfully equipped its first Cybertruck prototype with 4680 batteries produced using cathode dry coating technology, and has entered the vehicle testing and verification phase. Tesla sees the application of this technology as an important milestone in reducing battery costs. In the future, the company will continue to prioritize reducing the cost of the entire product line.

Tesla's Vice President of Automotive Engineering, Lars Moravy, stated during a conference call that currently, the weekly production capacity of Cybertrucks equipped with 4680 batteries is over 1,400 units. In the future, with further cost reduction and gradually achieving the cost parity target set at the end of the year, we believe that production capacity will further increase.

He also stated that he plans to use the cathode dry coating process for production in the fourth quarter of this year. This move will significantly reduce battery costs and also meet the initial goals of the 4680 battery plan.

● Automated driving

During the conference call, Tesla executives revealed that the Robotaxi, originally scheduled to be released on August 8th, will be postponed to October 10th. Musk stated that the reason for the delayed release of the car is his request for changes to the vehicle design.

When asked when the first batch of Robotaxis can be put on the road, Musk said, "Based on current trends, it is necessary to accumulate enough mileage before achieving completely unregulated autonomous driving to ensure that autonomous driving is superior to human drivers. As for the specific time point, I think it will be around the end of this year, no later than next year. I think achieving it next year will definitely not be a problem.

Musk also revealed during the conference call that Robotaxi will be produced at Tesla's Texas Gigafactory.

Regarding the latest progress of Tesla's full auto drive system FSD, Musk said that FSD is in rapid iteration, and the parameters of FSD version 12.5 have reached five times of that of version 12.4.

Apart from North America, Tesla is planning to apply for regulatory approval in Europe and China, and is expected to receive approval by the end of this year. In addition, Musk also claimed that several mainstream OEMs have expressed interest in Tesla FSD authorization, and he believes there will be more in the future.

● Robot Optimus

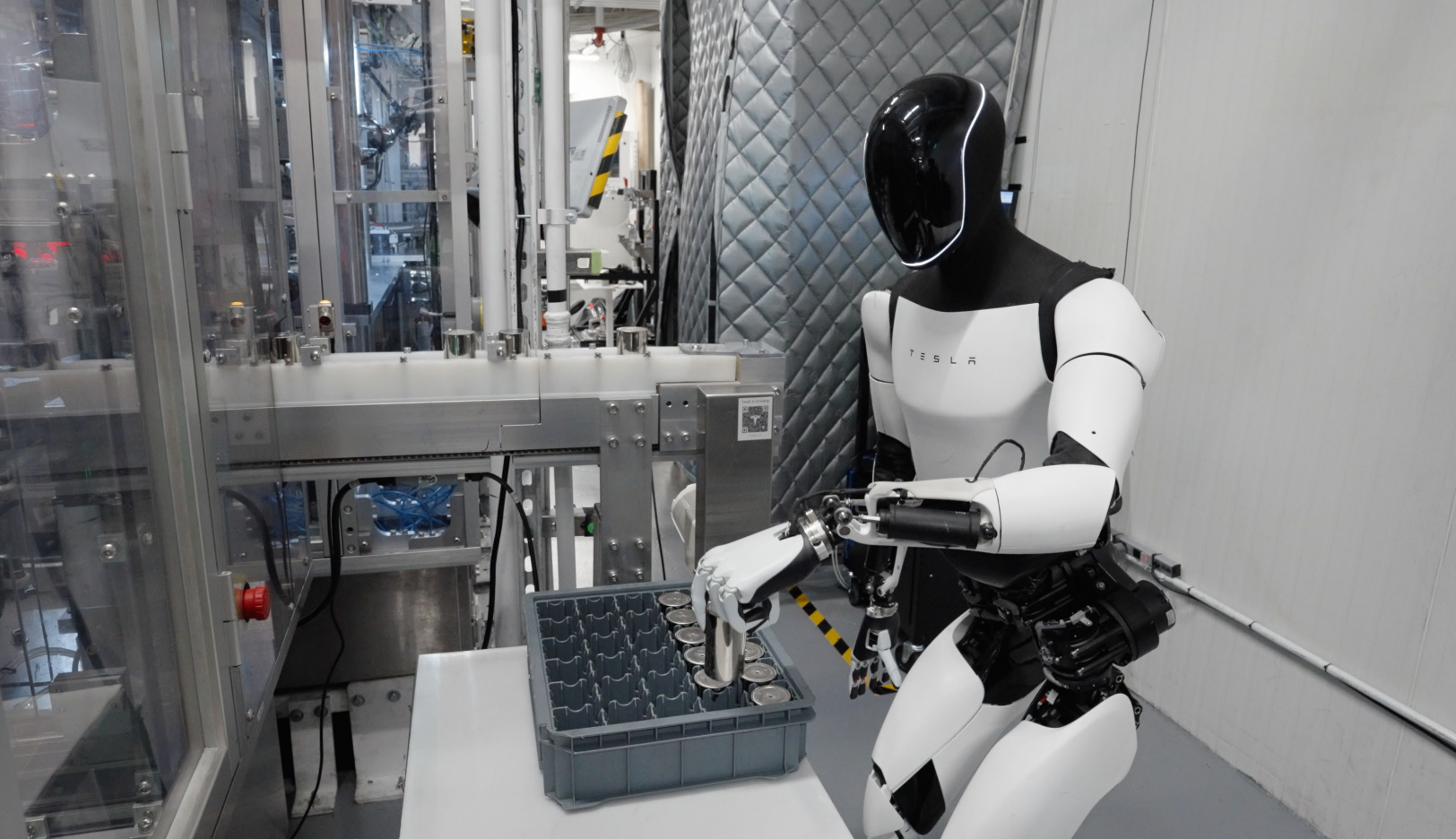

Regarding the humanoid robot Optimus, Tesla has revealed that Optimus is already performing battery related tasks at Tesla factories.

The company stated that it expects to have thousands of Optimus on duty at Tesla factories by the end of 2025 and is expected to begin delivering Optimus to external customers in 2026.

Musk is very optimistic about the potential of Optimus. He believes that Optimus' contribution to the company's revenue in the future may exceed the sum of all other business departments. Because in his view, the demand for humanoid robots from global customers will reach 22 million units, and Optimus will be in a leading position.

Regarding the production location of Optimus, Musk stated that all robots will be manufactured at the Texas Gigafactory, including future higher versions of Optimus robots.

● Mexico Gigafactory

It is worth noting that during the conference call, Musk also revealed that the construction of Tesla's Mexico Gigafactory is currently in a "suspended state".

Regarding the suspension, Musk explained that Trump had previously stated that if elected, he would impose high tariffs on cars produced in Mexico. If the situation is true, then making large investments in Mexico is meaningless. Therefore, the construction of the Mexican Gigafactory still needs to wait for the election results before making a decision.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.