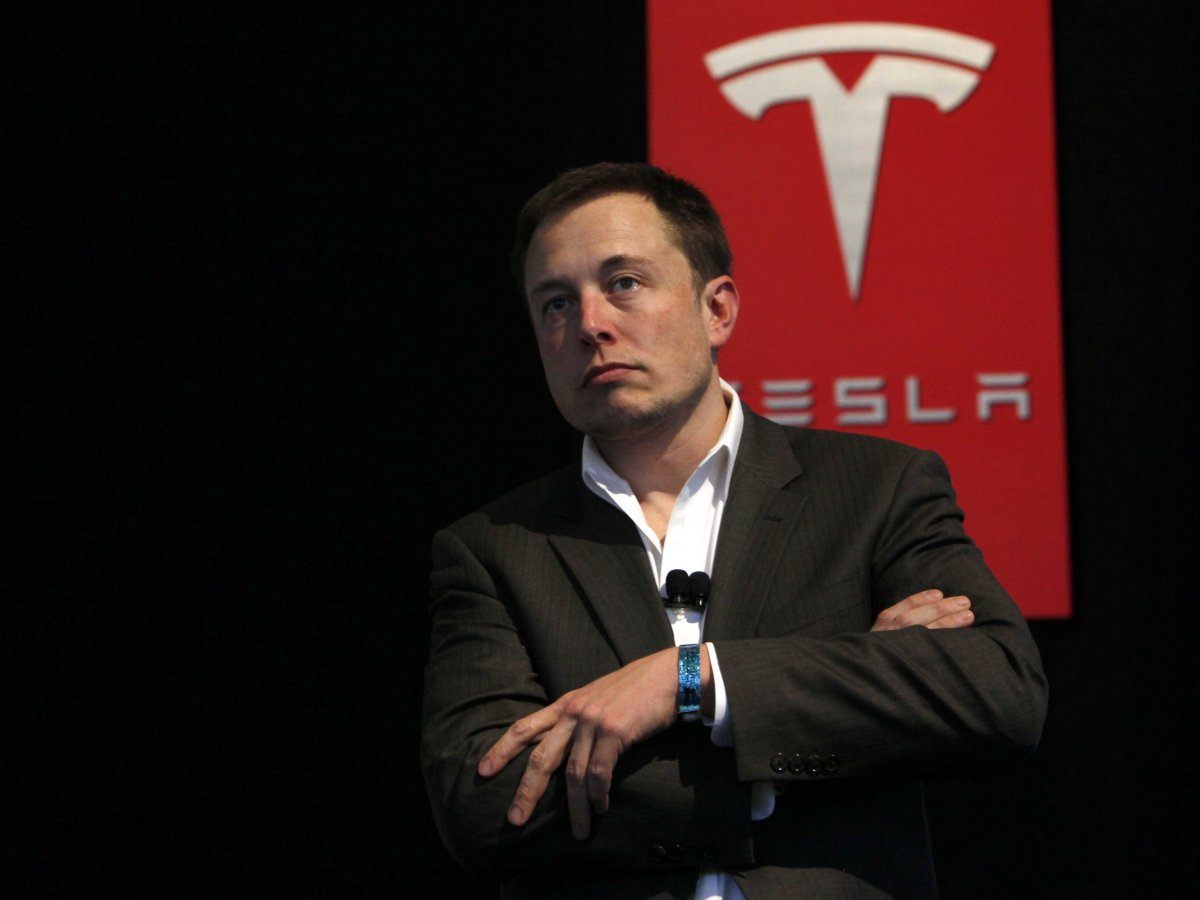

Tesla Robotaxi To Be Unveiled On Thursday As Analysts Offer Early Insights

Previously, Musk had said on social media platform X that Robotaxi would be the biggest event since the Model 3 program was launched in 2014, describing it as “an event for the history books.”

Tesla will hold a Robotaxi launch event on Thursday (October 10th).

Tesla is expected to unveil its first prototype robot cab, called Cybercab, which will be guided by an AI-trained camera and the company's Autopilot software. It has been suggested that the Cybercab unveiled could be the model or basis for Tesla's “next generation” of cars, known as the “Model 2”.

Previously, Musk said on social media platform X that Robotaxi would be the biggest event since the launch of the Model 3 program in 2014, describing it as “an event that will go down in history”.

The Robotaxi hasn't even been officially unveiled, and some Wall Street analysts have already been the first to update their ratings on Tesla.

Some analysts are strongly bullish on Robotaxi

The upcoming Robotaxi event is expected to be a catalyst for Tesla's stock price, according to Royal Bank of Canada Capital Markets analyst Tom Narayan in a report released Tuesday.

Narayan raised his price target on Tesla stock by $12 to $236 per share. He said the event will “highlight a Tesla business that generates $153 billion in revenue for the company,” a figure that represents about 63% of his current valuation.

Narayan believes the emerging self-driving cab market could generate $1.7 trillion in global revenue by 2040, when it will be joined by a wide range of players including app providers, fleet operators and automakers.

In a report released late last week, Wedbush analyst Dan Ives argued that Thursday's Robotaxi event will be a good showcase for Tesla's long-term vision.

Like other analysts, Ives believes Tesla will showcase its self-driving cabs, next-generation operating platform, and FSD updates, and predicts that Musk will address the current “pain points” of Autopilot and explain how the company will overcome them.

Ives added that Tesla is undergoing another transformation not seen since the company mass-produced the Model 3 and Model Y, and that the company's next phase will focus on artificial intelligence, fully autonomous driving, and supercomputing.

Wedbush has an Outperform rating and a $300 price target on Tesla.

We firmly believe that Tesla will remain a robotics/artificial intelligence company in the future, not just an electric car supplier,” Ives said. We believe this is a pivotal moment for Tesla as the company prepares to unveil its Robotaxi development, which it has been working on in secret for years, and Musk and his team lay out the company's vision for the future.”

Some analysts are cautious

However, CFRA analyst Garrett Nelson has a different view. He warns that earlier predictions of the size of the robot cab market, particularly by Musk himself, proved to be overly optimistic. He also believes that true driverless cabs are still a few years away, as “there are still many technical hurdles, safety tests, and regulatory approvals standing in the way.”

According to Nelson, “We believe the company is still far from reaching Level 4 autonomous driving as recognized by the Society of Automotive Engineers.” Level 4 autonomous driving is highly automated driving, where the vehicle performs all safety-critical driving functions and monitors road conditions throughout the trip.

Musk told investors last month that Tesla's “Autopilot” advanced driver-assistance software will be available in Europe and China next year, subject to final regulatory approval and a series of regulatory and technical delays.

Nelson has a Hold rating and a $240 price target on Tesla. He believes the key question for Tesla bulls is whether investors will let go of the company's near- and medium-term issues, such as weak electric vehicle sales, and continue to focus on longer-term opportunities such as self-driving and robot cab deployments.

Musk told investors on the second-quarter earnings call, “If you believe Tesla can solve the Autopilot problem, you should buy Tesla stock. And all the other problems are hidden in the noise.”

Nelson added: “We see a growing disconnect between the high valuation of Tesla stock and the reality that its earnings growth is hitting a bottleneck and the medium-term growth drivers are unclear.”

Deutsche Bank's Edison Yu is also cautious about Tesla's Robotaxi Day. In a report, Yu advised clients to adopt a “cautious strategy” on Tesla's event because of the high bar for wowing Wall Street and the potential for a “news sell-off” type of stock market reaction.

Edison Yu has a “buy” rating and a $295 price target on Tesla.

At Tuesday's close, Tesla closed at $224.50 per share, up 1.52%, and the stock has risen nearly 41% over the past six months.

Tesla is scheduled to report third-quarter earnings on Oct. 16 after the close. Preliminary estimates put the company's earnings at 60 cents per share, down 9% from a year ago, on revenue of about $25.57 billion.

Currently, Musk has been working to shift the focus of investor attention on Tesla to the potential of related technologies such as self-driving, robotics and artificial intelligence. So, Tesla needs a well-planned launch to convince investors to put up with declining profits and slowing sales in its core auto business.

Whether or not Tesla's Robotaxi Day can surprise everyone depends on Thursday night.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.