On October 23, U.S. Eastern Time, the three major U.S. stock indexes collectively closed down, and Tesla also fell nearly 2%.Surprisingly, Tesla delivered a better-than-expected third-quarter report card after hours, causing it to rise more than 12% after hours.

Tesla's share price has been under pressure in the near future after the Robotaxi launch fell short of expectations.On the other hand, the success of starship recycling and the news of Musk's "big coin drop" have recently continued to grab headlines in the United States, which has also strengthened Musk's attitude towards Tesla's "improper work".All in all, the market did not have expectations for this financial report.

But that's the market. There are often surprises when there are no expectations.

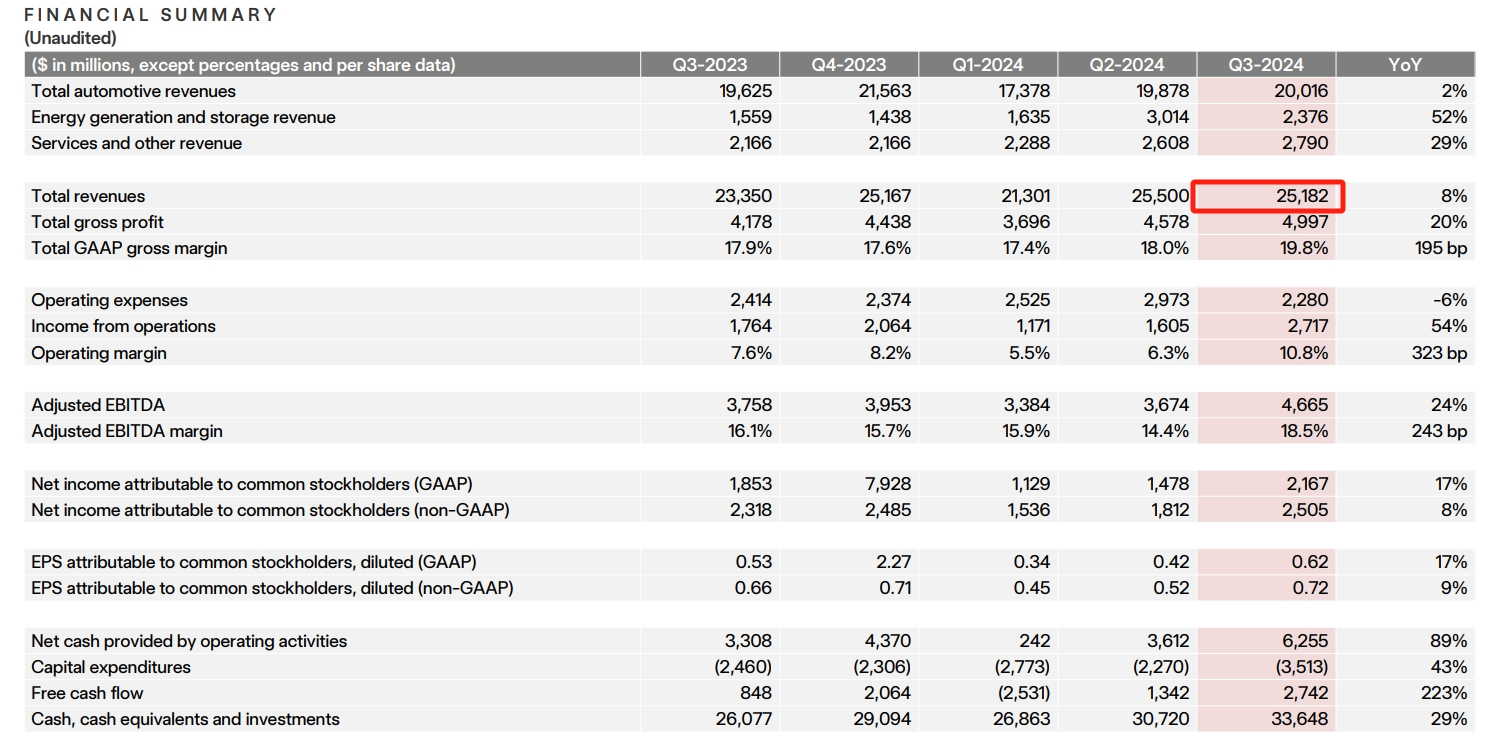

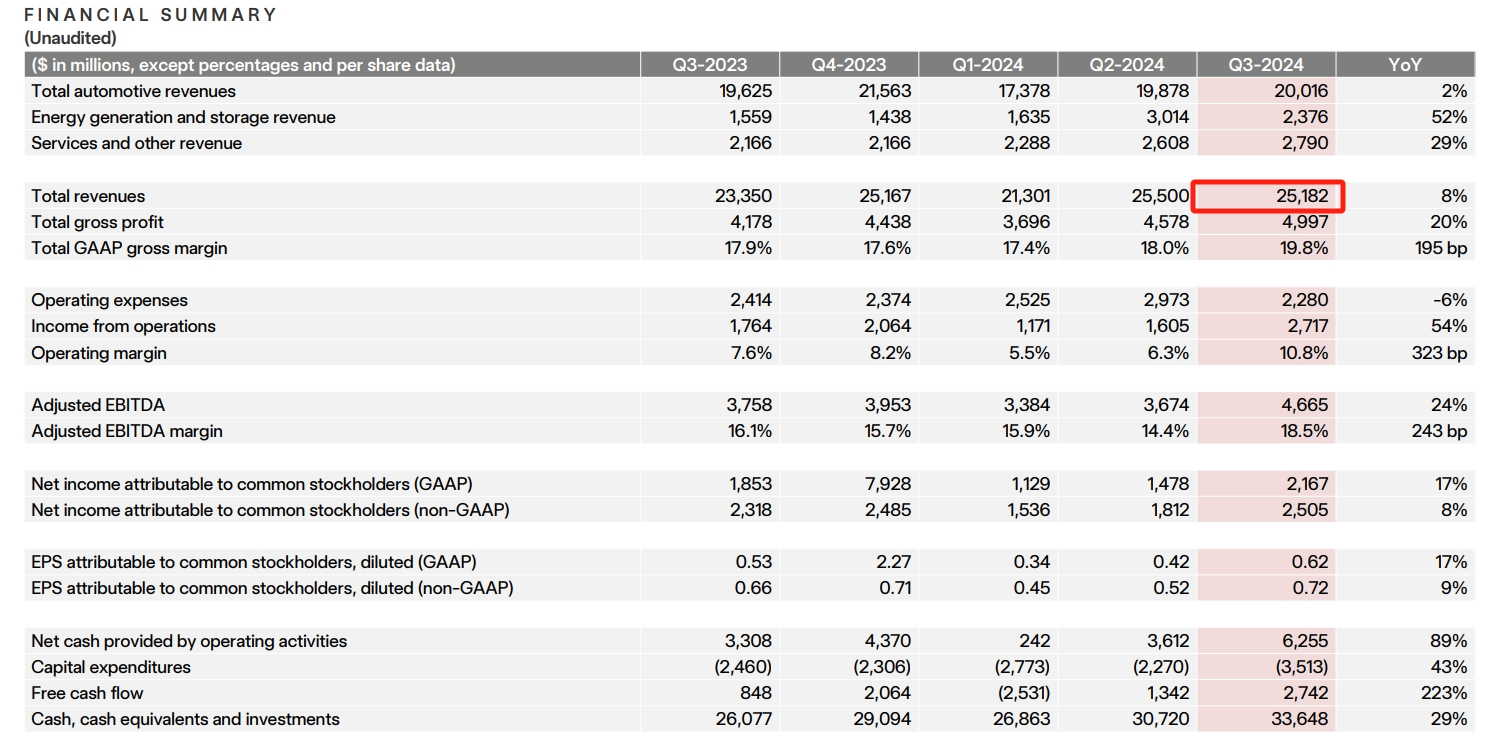

The financial report showed that Tesla's fiscal third-quarter revenue was US$25.18 billion, slightly lower than analysts 'expectations of US$25.43 billion and basically the same as US$23.35 billion in the same period last year.However, Tesla's adjusted earnings per share in the third quarter reached US$0.72, better than analysts 'expectations of US$0.60; the gross profit margin in the third quarter reached 19.8%, better than analysts' expectations of 16.8%; Tesla's operating profit in the third quarter reached US$2.72 billion, which was also better than analysts 'expectations of US$1.96 billion.

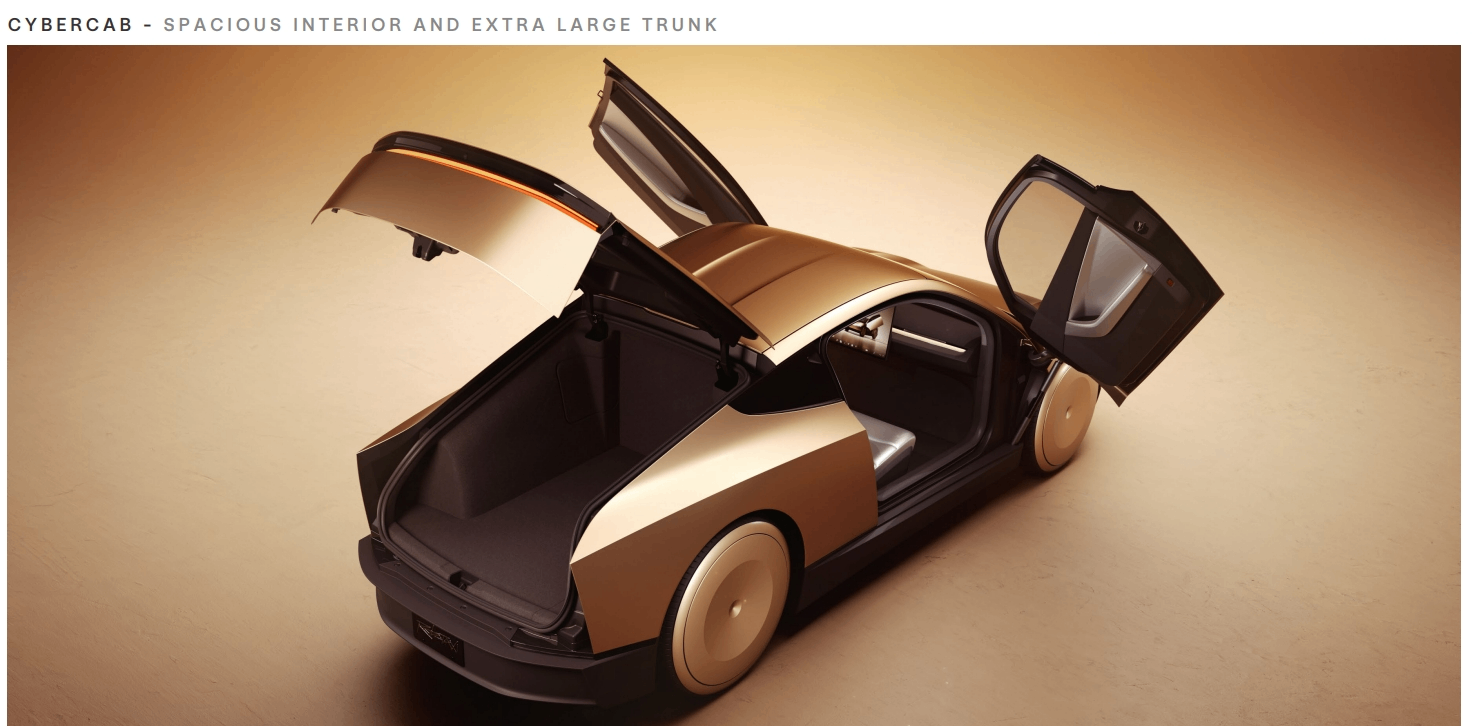

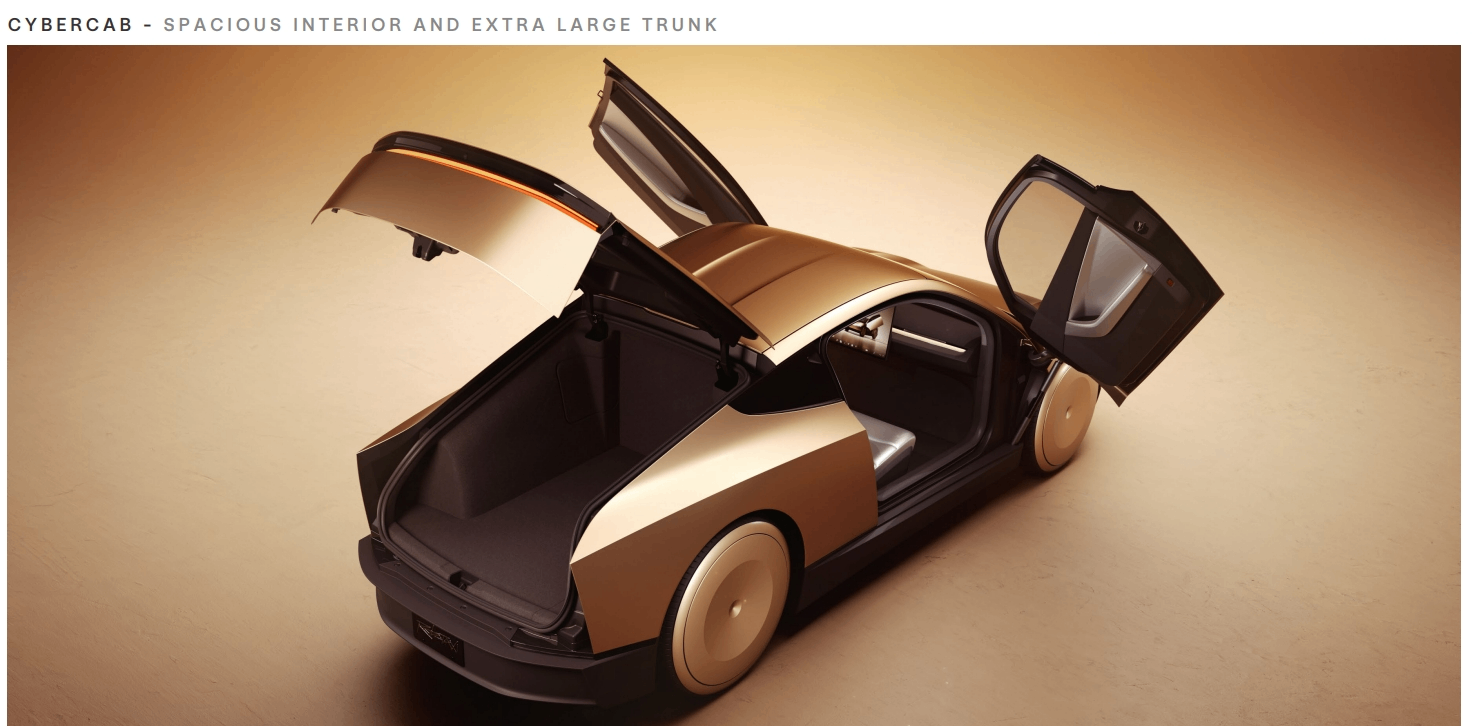

What surprised the market even more was that Cybertruck, which was no longer optimistic about the market and had repeatedly reported production cuts, actually achieved a positive gross profit margin for the first time.Musk even gave strong performance guidance. He predicted that Tesla car sales will increase by 20%-30% next year. Cybercab will achieve mass production in 2026, with the goal of producing at least 2 million units every year.

Faced with an environment in which the overall automobile market is exhausted and industry turmoil is intensifying, Tesla was able to make a profit in the third quarter, mainly due to the record high profit of the energy storage business and the decline in automobile production costs.

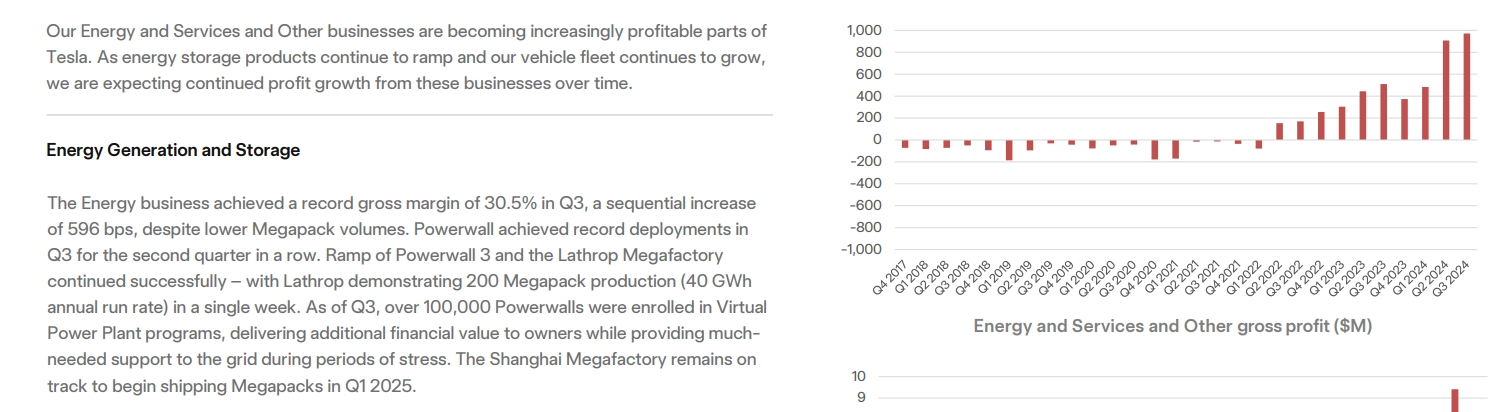

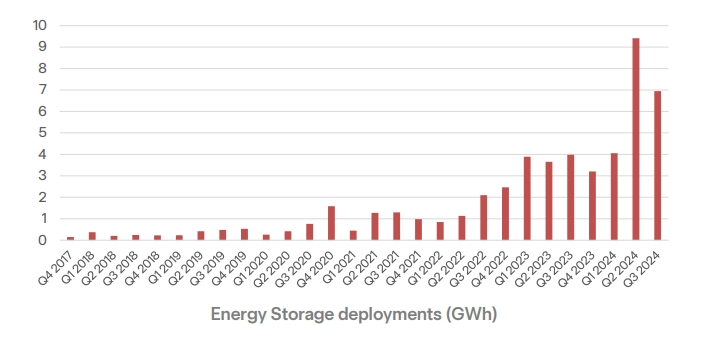

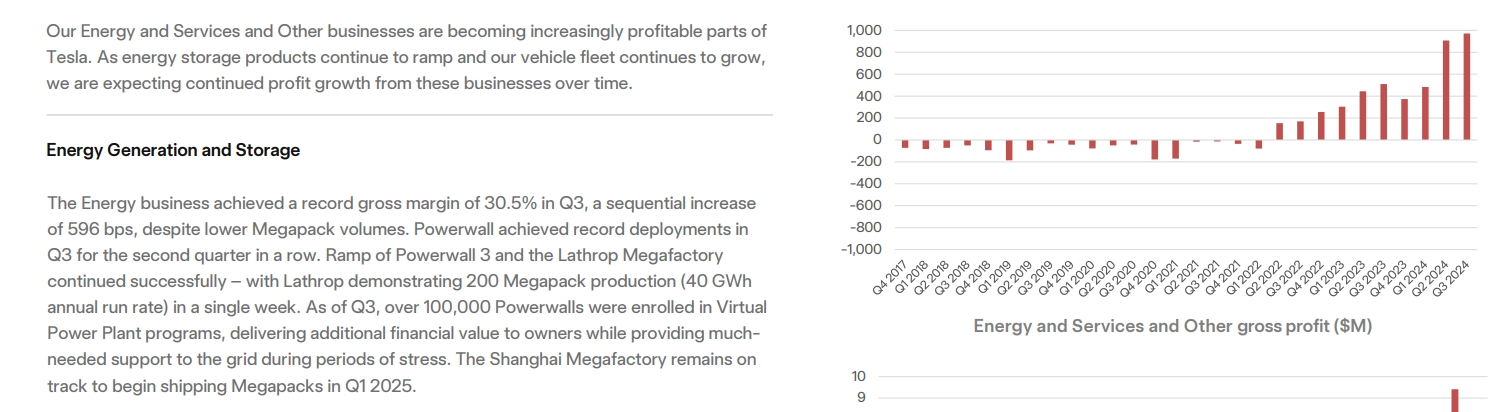

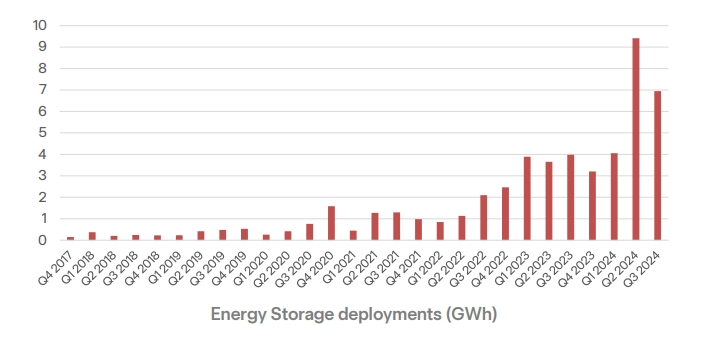

The energy storage business has become a star growth sector for Tesla.Data shows that Tesla's energy power generation and energy storage business revenue in the third quarter was US$2.376 billion, a year-on-year increase of 52.4%, and a year-on-year increase of 100% in the second quarter.In the third quarter, the gross profit margin of the energy storage business reached 30.5%, setting a record for the highest gross profit margin of the business in a single quarter.

It is understood that Tesla's energy storage business mainly includes Powerwall and Megapack products.Powerwall is a household energy storage system that stores electricity generated by solar panels for use at night or during power outages.Megapack is a very large commercial energy storage system suitable for large commercial and industrial customers such as data centers, hospitals and schools.

As a car manufacturer, Tesla's energy storage business was initially not attracted by the market.However, as AI data centers are built across the United States, these "power-swallowing behemoths" are putting huge loads on the U.S. power grid, and Tesla's energy storage business is beginning to have the opportunity to show its muscles.

As one of the first investment banks to discover the advantages of Tesla's energy storage business, Morgan Stanley said that the power demand brought about by the AI boom will make Tesla a key player in the U.S. energy market.According to a Morgan Stanley report, by 2030, the electricity consumption of U.S. data centers may be equivalent to the electricity consumption of 150 million electric vehicles.

In other words, from 2023 to 2027, the projected growth in U.S. data center power is equivalent to adding 59 million electric vehicles on U.S. roads, or a 21% increase in the total number of vehicles in service.There is no doubt that whether it is a car company or an ordinary company, Tesla's layout of energy storage can be regarded as far-sighted, and this business, which is growing at an alarming rate, has gradually entered a dividend period of redemption.

In terms of the automotive business that the market is concerned about, Tesla's automotive business revenue in the third quarter was US$20.016 billion, a year-on-year increase of approximately 2%, an increase from the 6.5% year-on-year decline in the second quarter.

To be fair, in terms of the performance of the auto sector alone, such data does not satisfy investors.Although at the beginning of this month, Tesla announced the first positive year-on-year increase in car deliveries in the third quarter (6.4%) in the year, if we stretch the time, we will find that Tesla's sales in the first three quarters fell by 2.3% compared with last year.This shows that if Tesla's sales are to achieve positive growth for the whole year this year, sales pressure in the fourth quarter will be very high.

Tesla is clear about the stage it is in.The financial report shows that Tesla believes that the company is currently between two major growth waves. The first wave is the global expansion of the Model 3/Y platform, and the next wave of growth will be triggered by advances in autonomous driving technology and the launch of new products, including products based on Tesla's next-generation automotive platform.

If we have to use a relevant term to summarize Tesla's node, it should be "connecting the past and the next."

During the car-building phase, Tesla once again confirmed its plan to produce new models, including ultra-low-cost models, starting in the first half of next year.In addition, Tesla also announced a milestone when the business gross profit margin of Cybertruck, an electric truck that began delivering since November last year, reached positive for the first time.

During the smart driving phase, Musk also reiterated his determination to do a good job in Robotaxi.He reiterated that Cybercab will be mass-produced in 2026, with the goal of producing 2 million vehicles per year.In terms of FSD, Tesla released version 12.5 of supervised FSD (supervised) v 12.5 in the third quarter, which improves safety and comfort due to increased adoption of data and training calculations, a five-fold increase in training parameters, and other architectural options, and plans to continue to expand these options in the fourth quarter.

If Tesla sales can stabilize this year, Musk said he predicts Tesla sales will increase by 20% to 30% next year.Tesla CFO said that considering the current economic environment, maintaining car profit margins in the fourth quarter will face "challenges". Although Tesla's all-electric semi-trailer truck Semi is still in pilot production, demand is also quite strong.

We will wait and see.